SOC as a Service Market Overview

The global soc as a service market size was valued at USD 4.6 billion in 2021 and is projected to reach USD 9.9 billion by 2031, growing at a CAGR of 8.2% from 2022 to 2031.

The rise in demand for work-from-home and remote working policies during the period of the COVID-19 pandemic aided in propelling the demand for better security and endpoint management policies, hence empowering the growth of the SOC as a service industry. In addition, the increase in the need for continuous monitoring and proactive threat detection drives the adoption of SOC as a Service. Furthermore, the government stringent regulations pertaining to maintain security standards across industries, further supports in the expansion of SOC as a service market.

Key Market Insights

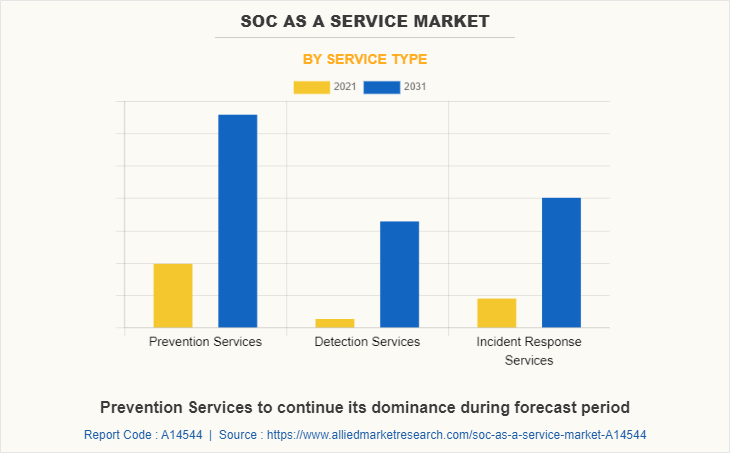

- By service type, the detection services segment is expected to witness the highest growth in the upcoming years.

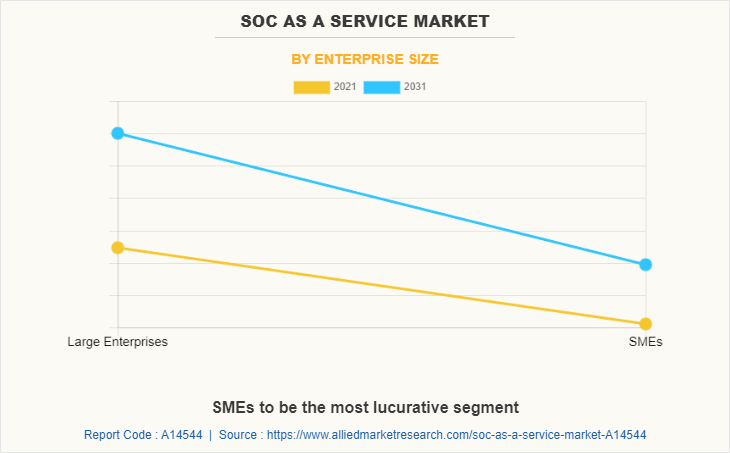

- By enterprise size, the SMEs segment is expected to witness the highest growth during the forecast period.

- By region, LAMEA is expected to witness significant growth during the forecast period.

Market Size & Forecast

- 2031 Projected Market Size: USD 9.9 Billion

- 2021 Market Size: USD 4.6 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 8.2%

How to Describe Security Operations Center (SOC)

A security operations center (SOC) is a team of IT security experts who monitor an organization's complete IT infrastructure around-the-clock in order to identify cybersecurity incidents as they happen and take appropriate action. Security operations center as service offerings is intended for organizations that do not have an advanced IT security and response team.

However, data privacy and customization challenges of SOC as service platforms can hamper the SOC as a service market during the forecast period. In addition, integrating SOC as a Service with existing IT infrastructure, security tools, and processes can be challenging, which may deter organizations from adopting this solution, impeding the growth of the SOC as a service market.

Conversely, the SOC as a service market demand is expected to witness significant growth offering several opportunities for new players in the market. Rise in adoption of SOC as a Service (SOCaaS) by small and medium-sized enterprises (SMBs) is driven by its cost-effectiveness and scalability. By offering tailored services, including lower-cost entry points or packages, SOCaaS providers can tap into new revenue streams and expand their market impact.

In addition, the surge in cybersecurity has led SOC as a Service (SOCaaS) providers to have the opportunity to expand their offerings into emerging. By targeting regions such as Asia Pacific, Latin America, and the Middle East, SOCaaS providers can tap into a growing market and significantly enhance their market impact. Furthermore, the increase in the adoption of SOC as a Service (SOCaaS) presents an attractive outsourcing option for organizations, helping them overcome challenges in recruiting skilled cybersecurity professionals, thereby expanding their market reach. These factors are expected to offer remunerative SOC as a service market opportunities for growth during the forecast period.

Moreover, the upsurge in the integration of managed detection and response (MDR) capabilities into SOC as a Service (SOCaaS) offers real-time threat detection and response, using managed security systems. By providing a combined solution of SOCaaS and MDR, providers can attract organizations seeking proactive threat detection and faster incident response, thereby expanding their market reach and impact. In addition, with the increase in the use of SOC as a Service (SOCaaS), providers can include compliance monitoring in their services, making them attractive to companies in regulated sectors. By ensuring compliance, SOCaaS providers can gain a competitive edge and attract more clients.

In addition, the rise in adoption of SOC as a Service (SOCaaS) by businesses which rely more on third-party vendors, managing the security risks, SOC as a Service (SOCaaS) providers offers third-party risk monitoring and assessment as part of their services. By helping organizations track and manage security risks within their vendor ecosystems, SOCaaS providers can appeal to large enterprises with complex supply chains, broadening their market reach and influence. These factors are expected to provide lucrative opportunities for the SOC as a service market growth during the forecast period.

SOC as a Service Market Segment Review:

The report focuses on growth prospects, restraints, and analysis of the global SOC as a service market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and bargaining power of buyers on the global SOC as a service market share.

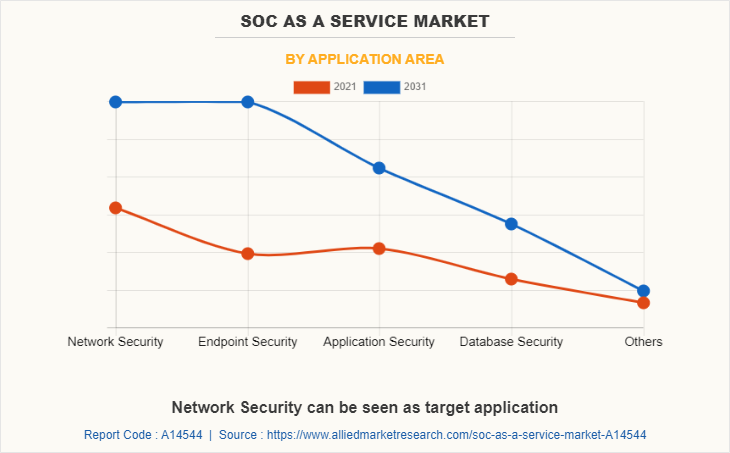

The SOC as a service market is segmented on the basis of service type, enterprise size, application area, industry vertical, and region. Depending on the service type, the market is classified into prevention services, detection services, and incident response services. Based on enterprise size, the market is bifurcated into large enterprises and SMEs. The application area covered in the study includes network security, endpoint security, application security, database security, and others. On the basis of industry vertical, the market is classified into, BFSI, healthcare, government and public sector, IT and telecom, retail, manufacturing, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on the service type, the prevention services segment dominated the SOC as a service with largest market share in 2021 and is expected to continue this trend during the forecast period owing to the various government and industry standards that are put in place to ensure the safety of customer and user data. However, the detection services segment is expected to witness the highest growth in the upcoming years, owing to the rising number of cyber-attacks on business enterprises and public sector organizations.

The global security operations center as a service market trends has witnessed stable growth during the COVID-19 pandemic, owing to the rapid increase in remote working trends during the period. Moreover, business organizations were distracted trying to handle the global impact of the COVID-19 virus and additional security and risk management considerations that arose during the period, which further fueled the demand for building an advanced security operations center by combining AI/ML and user behavior analytics to monitor the spectrum of an organization’s IT infrastructure, including network, endpoints, and cloud, as a foundation to developing proactive protection, detection and response capabilities enforcing zero trust.

In addition, many key players have enhanced their platforms to build greater cyber resiliency and maximize the value of their existing security policies. For instance, in October 2022, Trellix, the cyber security company, announced the expansion of its XDR platform. The upgraded XDR engine provides security operations teams with enhanced playbooks for guided investigations, upgraded threat intelligence through the integration of McAfee and FireEye assets, and the launch of Trellix Event Fabric. Such factors propelled the growth of the global security operations center as a service market during the period of the pandemic.

Region wise, the SOC as a service market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to high concentration of security services vendors in the region, which is expected to drive the market for SOC as a service within the region during the forecast period. However, LAMEA is expected to witness significant growth during the forecast period, owing to rapid economic and technological developments in the region, which is expected to fuel the growth of the SOC as a service industry in the region in the coming few years.

What are the Top Impacting Factors in Market

Market Driver

Demand for Network Security and Privacy is on the Rise

With the growing number of cyber-attack and threats on modern business enterprises, security operation centers are proving to be essential for safeguarding client data & information, maintaining the security of shared data, assuring dependable network performance, and defending against cyber-attacks. Moreover, access control, antivirus software, application security, network analytics, various types of network-security firewalls, VPN encryption, and others are being used to monitor the spectrum of an organization's IT infrastructure, including network, endpoints, and cloud based solutions, as a foundation for developing proactive protection, detection, and response measures. As a result, the demand for security operation services and privacy has increased in modern enterprise environments.

In addition, many key players have enhanced their platforms to build greater cyber resiliency and maximize the value of their existing security. For instance, in October 2022 Trellix, the cyber security company delivering the future of extended detection and response (XDR), announced the expansion of its XDR platform. The upgraded XDR engine provides security operations teams with enhanced playbooks for guided investigations, upgraded threat intelligence through the integration of McAfee and FireEye assets, and the launch of Trellix Event Fabric. Such factors propelled the growth of the global security operations center-as-a-service market during the period.

Restraint

The Increasing Number of Cyber-attacks and Fraud Cases

Post the outbreak of the COVID-19 pandemic, the world has witnessed a significant increase in the number of cyber threats on business enterprises in the form of ransomware attacks, data breaches, and others. However, with the help of managed security systems, operations centers that can monitor, prevent, detects, investigate, and responds to cyber threats around the clock, enterprises are optimizing their IT operations with ease. According to a study published in Cybercrime Magazine, in February 2022, total damages and ransoms collected by hackers and cybercriminals around the globe amounted to more than $6 trillion in 2021. The study also claims that these costs could grow every year and reach up to $10.5 trillion in the coming 5 years, growing at the rate of 15% each year.

In the aftermath of a cyber-attack, a SOC works to restore systems and recover any lost or compromised data. This may include wiping and restarting endpoints, reconfiguring systems, or, in the case of ransomware attacks, deploying viable backups in order to circumvent the ransom-ware. Such capabilities of a security operations center are boosting the demand for security operations center services.

Opportunity

Advanced communication technologies such as 5G communication networks and cloud technology

The development of advanced communication technologies such as 5G communication networks and cloud technology presents significant opportunities in the System on Chip (SoC) as a Service (SoCaaS) market. SoCaaS, which involves providing integrated chip solutions as a service, is revolutionizing industries by offering highly efficient, scalable, and customizable solutions that enhance device performance and connectivity. The integration of 5G and cloud technologies into this ecosystem opens up new avenues for growth and innovation.

5G communication networks, known for their high-speed data transmission, low latency, and ability to support massive device connectivity, are poised to drive significant demand for SoCaaS. These networks require highly optimized, energy-efficient chips capable of handling complex operations, making SoCaaS an ideal solution. As 5G accelerates the growth of IoT, autonomous vehicles, smart cities, and augmented reality (AR), there is a rising need for chips that can seamlessly handle data processing and connectivity while reducing energy consumption. SoCaaS providers are capitalizing on this trend by offering specialized chip solutions tailored for 5G networks, enabling businesses to optimize their operations and stay competitive.

Furthermore, cloud technology offers a scalable infrastructure for managing data and services, making it an ideal complement to SoCaaS. With the increase in the adoption of edge computing and data-intensive applications, cloud platforms enable remote management and deployment of SoC devices, providing flexibility and reducing costs. SoCaaS solutions are well-positioned to benefit from the expanding cloud market, as businesses look to offload their hardware demands and access high-performance chips without needing to invest in extensive infrastructure.

Which are the Leading Companies SOC as a Service

The following are the leading companies in the market. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the SOC as a service market.

Atos SE

Verizon

AT&T

Arctic Wolf Networks

IBM CORPORATION

NTT

Thales

Cloudflare, Inc.

Fortinet Inc.

Check Point Software Technologies.

What are the Current Market Trends Shaping the Industry

The SOC as a service market is expected to witness several noteworthy trends. One of the key SOC as a service market trends is the increase in the adoption of cloud-based security as businesses are migrating to the cloud. SOCaaS providers can seize this opportunity by offering specialized monitoring and security services for cloud infrastructures like AWS, Microsoft Azure, and Google Cloud. By developing SOCaaS platforms tailored to cloud security, providers can capture a significant market share among cloud-first businesses.

In addition, there in a shift in preference toward the integration of AI and machine learning for threat detection, behavioral analytics, and anomaly detection, enhancing the effectiveness of SOCaaS. Companies that incorporate advanced analytics into their SOCaaS offerings enable them to deliver more accurate and faster threat identification, attracting sophisticated clients seeking cutting-edge protection. Furthermore, there is a growing trend toward incorporating automation as SOCaaS providers can reduce response times, enhance operational efficiency, and make their offerings more appealing to larger enterprises. These factors are expected to drive the growth of market in the upcoming years.

For instance, on July 3, 2024 ,SonicWall launched its EMEA managed security services, backed by a 24x7 European Security Operations Center (SOC). This new service suite is designed for European Managed Service Providers (MSPs), Managed Security Service Providers (MSSPs), and other partners. It includes Managed Detection and Response (MDR), SOC as a Service (SOCaaS), and other managed security services, all aimed at enhancing threat detection and response capabilities.

Another notable trend in the market is the surge in the emergence of IoT devices and OT systems has led to the development of enhanced SOCaaS solutions for IoT and OT, tapping into new industries such as manufacturing, healthcare, and transportation. In addition, there is growing trend toward collaborating with other cybersecurity service providers, such as threat intelligence vendors, enhancing the capabilities of SOCaaS platforms. These partnerships enhance the reputation of SOCaaS providers by offering access to a broader range of tools and expertise, making their services more robust and appealing to clients. Furthermore, integrating threat intelligence feeds and services into SOCaaS platforms provides real-time data on emerging threats, enabling proactive defense measures. Offering cutting-edge threat intelligence as part of SOCaaS services in high-risk sectors like finance and healthcare. These factors are expected to accelerate the growth of SOC as a service market trends in the upcoming years.

For instance, on May 23, 2024, Zeronsec partnered with Web Werks Data Centers to offer advanced Security Operations Center (SOC) as a Service. This collaboration aims to enhance security infrastructure and operational efficiency for businesses relying on Web Werks' extensive network of data centers. The SOC service includes real-time threat monitoring, rapid incident response, and advanced threat intelligence, leveraging AI and machine learning technologies.

What are the Key Developments Currently Shaping the Industry

In April 10, 2024, Johnson Controls has announced the launch of its Security Operations Centers (SOC) service offering in North America. This new service aims to enhance business continuity and reduce risk through flexible, bundled service packages tailored to meet the specific needs of each facility. The SOC offering includes standardized protocols, thorough assessments, 24/7/365 staffing support, and comprehensive auditing and reporting.

In May 7, 2024, CrowdStrike announced partnerships and alliances with global system integrators (GSIs), managed service providers (MSPs), and managed security service providers (MSSPs) to drive SOC transformation with its Falcon Next-Gen SIEM. This initiative aims to unify Falcon and third-party data, threat intelligence, AI, and workflow automation to deliver an AI-native SOC, enhancing speed and efficiency in stopping breaches.

In February 27, 2025, Kyndryl partnered with Malaysia's LifeTech Group to transform its Security Operations Center (SOC). This collaboration aims to enhance threat protection and operational efficiency while keeping data within Malaysia. The new SOC, hosted on Amazon Web Services (AWS), will help organizations reduce cybersecurity costs by up to 40% and meet compliance requirements.

What are the Key Benefits for Stakeholders:

The study provides an in-depth analysis of the global SOC as a service market forecast along with current & future trends to explain the imminent investment pockets coupled with SOC as a service market analysis.

Information about key drivers, restraints, & opportunities and their impact analysis on global SOC as a service market trends provided in the report.

Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry and SOC as a service market size is provided in the report.

A quantitative analysis of the market from 2022 to 2031 is provided to determine the market potential as well as market Growth.

SOC as a Service Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 9.9 billion |

| Growth Rate | CAGR of 8.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Service Type |

|

| By Enterprise Size |

|

| By Application Area |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Fortinet Inc., Cloudflare, Inc., Thales, Verizon, IBM CORPORATION, Check Point Software Technologies, NTT, Atos SE, AT&T, Arctic Wolf Networks |

Analyst Review

Demand for SOC as a service has been on a rise for the past few years and the market is expected to continue this trend in the coming years as well, due to the growing number of cyber-attacks and threats, such as ransomware attacks, data breaches, identity thefts, and DoS attacks that encourage enterprises to adopt managed security operation centers to effectively monitor, control, and manage their security policies. In addition, the growing demand for higher communication flexibility in many regions around the globe promising new opportunities for the growth of the SOC as a service market.

Key providers of the SOC as a service market such as IBM Corporation, Check Point Software Technologies, and Fortinet Inc. account for a significant share of the market. With larger requirements for scalability and security, various companies have optimized and enhanced their products and services to provide greater security and management. For instance, in September 2022, Check Point Software Technologies Ltd. announced the launch of Check Point Horizon – a industry-leading prevention-focused suite of security operations solutions and services that combines proactive management solutions for Managed Prevention and Response (MDR/MPR), Extended Prevention and Response (XDR/XPR), and Events. All of them are powered at the click of a button and supported by the industry’s top analysts, research experts, and innovative AI technology.

In addition, with increase in demand for security services, various companies are expanding their current service range with increasing diversification among customers. For instance, in April 2021, IBM Corporation announced collaboration with HCL Technologies (HCL) to help unify and streamline threat management for clients via a modernized security operation center (SOC) platform. HCL’s Cybersecurity Fusion Centers are anticipated to be designed to take advantage of IBM’s Cloud Pak for Security, to help create a unified security platform to connect security teams, tools, and processes across the threat lifecycle. This collaboration builds on HCL and IBM’s recent alliance expansion to help organizations with digital transformation.

Moreover, market players are expanding their business operations and customers by increasing their product range. For instance, in March 2022, Atos, a leading managed security services provider in Europe, announced the launch of a new next-gen Security Operations Center (SOC) in Sofia, Bulgaria, as part of the continuous expansion of its cybersecurity activities. The new center is Atos’ 16th next-gen SOC worldwide. It is designed to rapidly identify and limit the impact of security incidents for large organizations globally via 24/7/365 threat monitoring, detection, and targeted response supported by state-of-the-art technology with Artificial Intelligence (AI) and Machine Learning (ML) – ultimately strengthening Atos’ powerful global SOC network.

The global SOC as a service market size was valued at $4.56 billion in 2021

North America is the largest regional market for SOC as a Service

Network Security is the leading application of SOC as a Service Market

The increasing number of cyber-attacks and fraud cases

The key players profiled in the SOC as a service market analysis are Atos SE, AT&T, Arctic Wolf Networks, Check Point Software Technologies, Cloudflare, Inc., Fortinet Inc., IBM CORPORATION, NTT, THALES Group, and Verizon.

Loading Table Of Content...