Stevia Market Research, 2034

Market Introduction and Definition

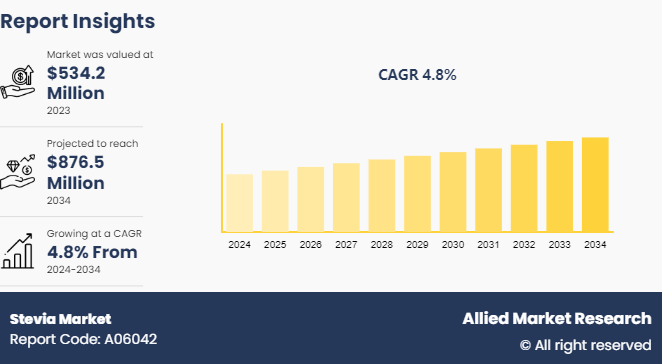

The global stevia market size was valued at $534.2 million in 2023, and is projected to reach $876.5 million by 2034, growing at a CAGR of 4.8% from 2024 to 2034.

Stevia is a natural sweetener derived from the leaves of the Stevia rebaudiana plant and is a popular alternative to sugar due to its intensely sweet taste with minimal caloric impact. The two main types of stevia compounds responsible for its sweetness are stevioside and rebaudioside. Stevia finds widespread application across various industries, including food and & beverage, pharmaceuticals, and personal care products. Its uses range from sweetening beverages, desserts, and snacks to serving as a sugar substitute in dietary supplements and oral care products. With its natural origin and low-calorie profile, stevia continues to gain popularity as consumers seek healthier alternatives to sugar without compromising on taste.

Key Takeaways

The stevia market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Millionmillion) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global stevia markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The surge in demand for natural ingredients is anticipated to drive the growth of the stevia market share. With increasing increase in consumer awareness about the potential health risks associated with artificial additives and synthetic sweeteners, there has been a shift towards natural alternatives. Stevia is derived from the leaves of the Stevia rebaudiana plant and has gained immense popularity due to its natural origin and minimal processing, aligning perfectly with the preferences of health-conscious consumers. Stevia sugar, a natural sweetener derived from the Stevia rebaudiana plant, offers a zero-calorie alternative to traditional sugar, catering to health-conscious consumers and expanding its market reach globally.Its perceived health benefits, including zero calories and a low glycemic index, further contribute to its demand as a natural sweetener option. Moreover, the clean label movement, where consumers prioritize products with transparent and easily recognizable ingredients, has driven the demand for stevia in various food and beverage categories. As manufacturers seek to cater to this growing consumer preference, they are increasingly seeking stevia into their product formulations which drive the stevia market growth.

Taste perception acts as a restraint on in the stevia market demand. Despite its natural origin and low-calorie profile, some consumers perceive stevia as having a bitter aftertaste, which leads to less adoption. This taste discrepancy poses a challenge for manufacturers aiming to replicate the taste of sugar in their products while using stevia as a substitute. Furthermore, consumer preferences vary widely, and the subjective nature of taste perception means that even small differences in flavor impact purchasing decisions and limits the demand of for stevia-based products among certain demographic groups and market segments.

Health and wellness trends create significant opportunities for the stevia market by aligning with consumer preferences for natural, low-calorie sweeteners. As individuals become increasingly health-conscious and seek to reduce their sugar intake, there is a growing rise in demand for alternatives like such as stevia that offer sweetness without the caloric burden. Stevia's natural origin and minimal impact on blood sugar levels make it an attractive option for consumers looking to make healthier dietary choices without sacrificing taste. Furthermore, the rising rise in prevalence of health conditions such as obesity and diabetes are driving the adoption of stevia-based products among individuals seeking to manage these conditions.

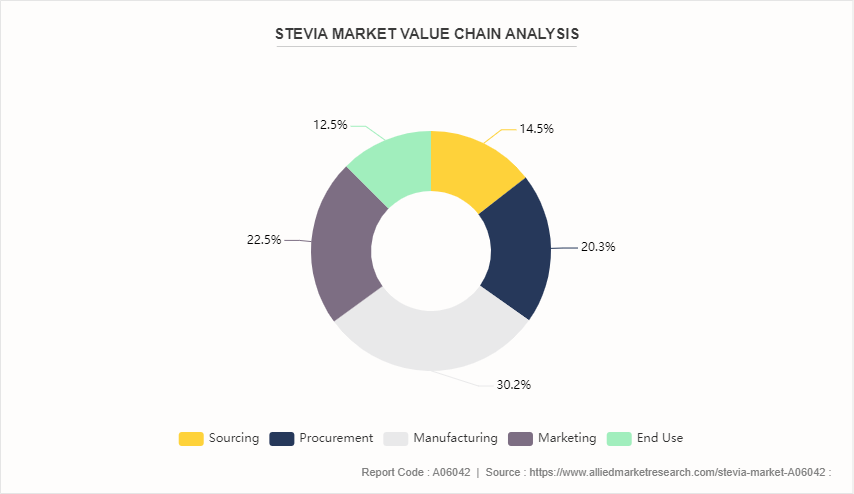

Value Chain of Global Stevia Market

The stevia industry value chain begins with the cultivation and harvesting of the stevia leaf. This primarily takes place in regions of Asia-Pacific likesuch as China, India, and Thailand as well as South America, especially Brazil, Paraguay, and Argentina, along with certain parts of Africa. Major activities involve planting of stevia crops, crop management, and the harvesting of the leaves. Moreover, the stevia leaves undergo processing steps like such as drying and curing. The dried stevia leaves are then typically exported in bulk quantities to stevia extract manufacturers globally. The next major stage is stevia extraction and purification. Manufacturers use water or solvents like such as ethanol to extract the stevia leaves and isolate the desirable steviol glycosides like such as Rebaudioside A. Furthermore, the extracts then go through purification processes such as precipitation, filtration, and ion exchange chromatography to obtain high-purity stevia extract powders containing 80-99% steviol glycosides. Ultimately, consumers purchase products containing stevia, driven by health consciousness and sustainability concerns.

Market Segmentation

The stevia market share is segmented into form, application, source, end-use and region. On the basis of form, the market is divided into powder and liquid extracts. As per application, the market is segregated into bakery & confectionery, beverages, sweeteners, and others. On the basis of source, the market is bifurcated into conventional and organic. As per end use, the market is classified into food & beverages and pharmaceuticals. Region wise, the stevia market size is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/ Country Market Outlook

Asia-Pacific remains a significant player in the global stevia market. Numerous factors are propelling the growth of the stevia market in the Asia-Pacific region, including increasing demand from the beverage industry, rising concerns regarding diabetes and obesity, and regulatory limitations on certain artificial sweeteners. With mounting consumer interest in low-calorie alternatives to sugary beverages, given their association with surging rates of obesity and diabetes, manufacturers are increasingly turning to stevia as a natural, calorie-free sweetening agent in various drink offerings such as soft drinks, juices, and teas.

Moreover, there's a notable uptick in demand for clean-label ingredients, driven by consumers' increased awareness of their dietary choices and preference for quality ingredients over quantity. The growing recognition of the health advantages offered by natural sugar substitutes like stevia, coupled with a positive regulatory landscape supporting their usage. Consumers are gravitating towards authentic, plant-based alternatives to artificial sweeteners, a trend reinforced by regulatory agencies' approvals of stevia as a safe and efficient food additive. However, despite these advancements, Japan faces challenges in achieving its diet-related non-communicable disease targets, with estimates indicating significant obesity rates among adult populations.

Stevia Industry Trends:

According to the International Diabetes Federation (IDF) , the number of adults aged 20 to 79 with diabetes reached approximately 537 million in 2021, with projections estimating a rise to 643 million by 2030 and 783 million by 2045. Diabetes-related deaths totaled 6.7 million in the same year. This surge in chronic conditions has intensified concerns about the health consequences of excessive sugar consumption, prompting a shift towards sugar alternatives. Moreover, artificial sweeteners have been popular for decades, but concerns have been around their safety and potential side effects. As a result, many health-conscious consumers have been turning to natural or plant-based sugar substitutes, such as stevia. These sweeteners are derived from natural sources and are often perceived as healthier alternatives to artificial sweeteners. Furthermore, the development of novel sweeteners with intense sweetness and taste-modifying properties, extracted from plants, offers further promise as viable sugar substitutes with minimal to no caloric content.

Competitive Landscape

The major players operating in the stevia market include Ingredion Incorporated, Tate & Lyle PLC, Archer Daniels Midland Company, Cargill Incorporated, Zhucheng Haotian Pharma Co. Ltd, Sunwin Stevia International, Daepyung, GLG Life Tech, Evolva and Jhuingda Phytoextract.

Recent Key Strategies and Developments

In October 2022, Ingredion Incorporated collaborated?with HowGood which is a SaaS data platform with the largest food and personal care product sustainability database. This partnership will provide data transparency on Ingredion's top products and new product innovations, which, combined with Ingredion's aim of sourcing 99% of its global crop supply sustainably by 2025.

In March 2022, Cargill announced its strategy of sweetening stevia products with the commercial availability of its EverSweet + ClearFlo technology. According to the company, combining Cargill's stevia sweetener with a natural flavor, the new sweetener system provides multiple benefits, including flavor modification, faster dissolution, and improved solubility and stability in formulations.

Key Sources Referred

Organic Trade Association (OTA)

The Soil Association

FiBL (Research Institute of Organic Agriculture)

International Diabetes Federation (IDF)

The Organic Center

Euromonitor International

USDA Economic Research Service (ERS)

Food and Agriculture Organization of the United Nations (FAO)

Agricultural & Processed Food Products Export Development Authority (APEDA)

National Retail Federation

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the stevia market analysis from 2024 to 2033 to identify the prevailing stevia market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the stevia market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global stevia market trends, key players, market segments, application areas, and market growth strategies.

Stevia Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 876.5 Million |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2034 |

| Report Pages | 288 |

| By Form |

|

| By Application |

|

| By Source |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Archer Daniels Midland Company, Daepyung, Ingredion Incorporated, Sunwin Stevia International, Tate & Lyle PLC, Evolva, GLG Life Tech, Zhucheng Haotian Pharma Co. Ltd, Jhuingda Phytoextract, Cargill Incorporated |

The global stevia market size was valued at $534.2 million in 2023, and is projected to reach $876.5 million by 2034

The global Stevia market is projected to grow at a compound annual growth rate of 4.8% from 2024 to 2034 $876.5 million by 2034

The major players operating in the stevia market include Ingredion Incorporated, Tate & Lyle PLC, Archer Daniels Midland Company, Cargill Incorporated, Zhucheng Haotian Pharma Co. Ltd, Sunwin Stevia International, Daepyung, GLG Life Tech, Evolva and Jhuingda Phytoextract.

Asia-Pacific remains a significant player in the global stevia market. Numerous factors are propelling the growth of the stevia market in the Asia-Pacific region

Demand For Natural Ingredients, Increasing Health Awareness, Rising Diabetic Population

Loading Table Of Content...