Surfactants Market Size & Insights:

The global surfactants market size was valued at $37.7 billion in 2022, and is projected to reach $59.5 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Introduction:

Surfactants, or surface-active agents, are a diverse group of chemical compounds that reduce the surface tension between two substances, such as two liquids, a gas and a liquid, or a liquid and a solid. They achieve this by concentrating on the interface of these substances, altering the interfacial properties and enabling better interaction. The word “surfactant” is derived from "surface active agent", which hints at their key role in surface chemistry. Structurally, surfactants are amphiphilic molecules, meaning they contain both hydrophilic (water-attracting) and hydrophobic (water-repelling or oil-attracting) parts. This unique structure allows them to interact with both polar and non-polar substances, making them indispensable in many applications where emulsification, dispersion, foaming, or wetting is required.

One of the most prominent applications of surfactants is in household and industrial cleaning products. In laundry detergents, dishwashing liquids, surface cleaners, and personal care products like shampoos and body washes, surfactants serve as primary cleaning agents. Anionic surfactants such as linear alkylbenzene sulfonates (LAS) are commonly used for their excellent detergency and foaming properties. These compounds work by surrounding dirt and oil particles, breaking them away from fabrics or surfaces, and suspending them in water so they can be rinsed away.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The surfactants market is fragmented in nature among prominent companies such as Clariant AG., Evonik Industries AG, Huntsman International LLC, Nouryon, Stepan Company, Lonza Group AG, BASF SE, Croda International Plc, Kao Corporation, and Dow Inc.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions. Moreover, the report covers sub-segments that is studied across all the regions.

- Latest trends in global surfactants market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,500 surfactants-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global surfactants market.

Market Dynamics:

Rising demand in personal care & household products is expected to drive the growth of the surfactants market. Surfactants serve as essential components in a wide range of consumer products such as shampoos, soaps, body washes, detergents, conditioners, and facial cleansers. Their ability to lower surface tension makes them highly effective in cleaning, emulsifying, foaming, and conditioning, which are critical functions in both personal care and household applications. In August 2024, Kao Corporation launched the 'KANEBO FUSION-ING SOLUTION,' a new serum designed to enhance skin texture and promote a sense of well-being. The serum employs advanced technologies to create a flexible, seamless veil that adheres to the skin. This technology enhances the absorption of key ingredients, such as ceramides, while also trapping moisture to combat skin roughness. One of the key factors contributing to this demand is the growing awareness of hygiene and personal wellness across the globe. In both developed and emerging economies, consumers are increasingly prioritizing cleanliness and grooming as integral aspects of their lifestyle. In October 2023, Europe implemented a ban on intentionally adding microplastics in cosmetics, including microbeads and glitter, with phased compliance deadlines extending up to 12 years for complex products.

However, environmental and health concerns are expected to restrain the growth of the surfactants market. High concentrations of surfactants from industrial and domestic wastewater often end up in municipal wastewater treatment plants or are directly discharged into the environment. While treatment plants reduce surfactant levels, residual amounts and their degraded by-products can still enter water bodies, posing risks to aquatic and terrestrial organisms. For instance, anionic surfactants such as linear alkylbenzene sulfonates (LAS) have been shown to cause biochemical, physiological, and reproductive harm to aquatic life, as well as skin and respiratory irritation in humans. Some surfactants and their transformation products, like nonylphenol ethoxylates, are even more toxic than their precursors and can disrupt endocrine systems in both wildlife and humans.

Moreover, shift toward green and sustainable surfactants is expected to provide lucrative opportunities in the surfactants market. Increasing consumer awareness about environmental issues, coupled with growing concerns over the ecological impact of traditional synthetic surfactants, is driving demand for eco-friendly alternatives. Bio-based surfactants, derived from natural raw materials such as plant oils, sugars, and amino acids, are gaining significant traction as a sustainable alternative to petrochemical-based surfactants. In January 2023, Holiferm and Sasol announced a partnership to manufacture and market rhamnolipids and mannosyl erythritol lipids (MELs), thereby expanding their collaboration to develop and commercialize biosurfactants. Moreover, in May 2023, SurfactGreen, a French startup, announced an approximately $10.8 million (€10 million) expansion project supported by Bpifrance and the French government. The company specializes in eco-responsible alternatives to petroleum-based cationic surfactants and has partnered with over 100 customers across 26 countries.

Segments Overview:

The surfactants market is segmented on the basis of feedstock, type, end use, and region. On the basis of feedstock, the market is categorized into bio-based surfactants, biosurfactants, synthetic surfactants, and others. On the basis of type, it is divided into cationic surfactants, anionic surfactants, non-ionic surfactants, and amphoteric surfactants. By end use, the market is categorized into household detergents, personal care, institutional and industrial cleaners, food processing, oilfield chemicals, textiles, plastics, paints and coatings, adhesives, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

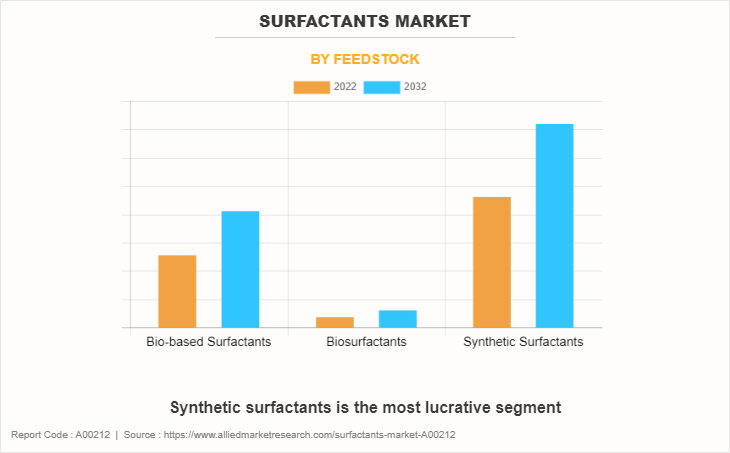

Surfactants Market By Feedstock:

On the basis of feedstock, the synthetic surfactants segment was the largest revenue generator in 2022 and is anticipated to grow at a CAGR of 4.6% during the forecast period. Synthetic surfactants are engineered to meet specific performance criteria such as biodegradability, foaming capacity, and mildness to skin. Synthetic surfactants are integral components of many cleaning products, including laundry detergents, dishwashing liquids, surface cleaners, and personal care items like shampoos and body washes. As household and personal hygiene practices continue to evolve and expand, the demand for such products rises. Moreover, the industrial and institutional cleaning sector, including cleaning services, healthcare facilities, and food processing industries, relies heavily on synthetic surfactants to maintain cleanliness and hygiene. In May 2023, India imposed countervailing duties ranging from 3% to 30% on imports of fatty alcohols from Indonesia, Malaysia, and Thailand. This decision was made to protect domestic producers from subsidized imports, potentially impacting the cost structure for synthetic surfactant manufacturers in India.

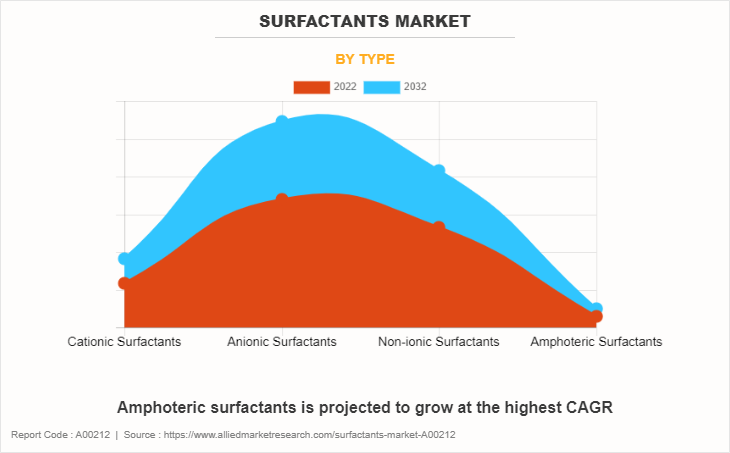

Surfactants Market By Type:

By type, the anionic surfactants segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 4.9% during forecast period. Anionic surfactants are commonly found in household and industrial detergents, shampoos, and personal care products. Their strong cleansing ability makes them essential in formulations designed for heavy-duty cleaning, such as laundry detergents and dishwashing liquids. Sodium lauryl sulfate (SLS) and sodium laureth sulfate (SLES) are among the most widely used anionic surfactants, favored for their ability to generate abundant foam and provide a pleasant tactile experience, which appeals to consumers. In March 2023, Stepan Company partnered with BASF to develop sustainable anionic surfactants for personal care, household care, and industrial cleaning applications. Similarly, Solvay S.A. and AkzoNobel N.V. explored using sustainable raw materials in surfactant production to reduce environmental impact.

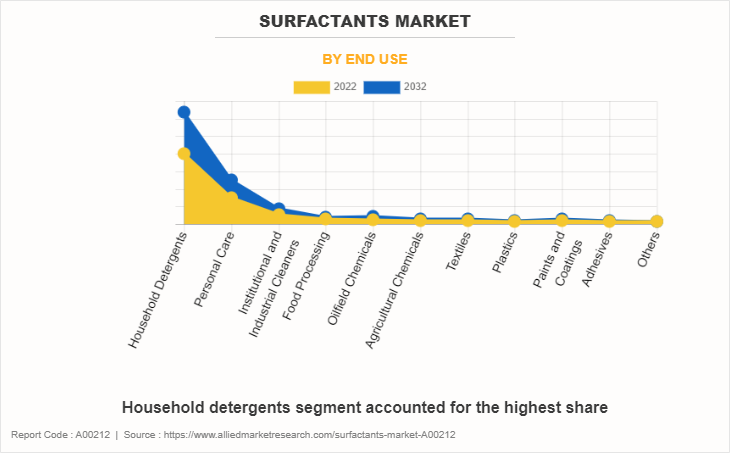

Surfactants Market By End Use:

By end use, the household detergents segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 4.8% during forecast period. Surfactants in household detergents serve as cleaning agents and contribute significantly to the sustainability and environmental impact of these products. Modern detergent formulations increasingly rely on biodegradable surfactants derived from renewable resources such as plant-based oils and sugars. These “green” surfactants reduce the ecological footprint by breaking down more easily in wastewater treatment plants, minimizing aquatic toxicity compared to traditional petrochemical-based surfactants. In March 2024, Unilever invested over $162 million (€150 million) to revamp its European homecare supply chain, including brands like Persil and Omo. This initiative focuses on adapting to post-pandemic consumer behaviors, such as shorter wash cycles, and enhancing product offerings.

Surfactants Market By Region:

The Asia-Pacific surfactants market size is projected to grow at the highest CAGR of 5.1% during the forecast period and accounted for 42.7% market share in 2022. Surfactants play a crucial role across various industries in the Asia-Pacific countries, driven by rapid urbanization, growing consumer awareness, and expanding industrial activities. In countries like China, India, Japan, South Korea, and Southeast Asia, surfactants are widely used in household cleaning products, personal care items, agriculture, textiles, and industrial applications. In March 2023, Bureau of Indian Standards (BIS) considered adding 58 chemicals, including surfactants like benzene and formaldehyde, to the BIS mandatory list to strengthen chemical safety regulations. Moreover, Galaxy Surfactants based in Mumbai, exports over 200 products to more than 100 countries, with clients including Unilever and L'Oréal.

Competitive Analysis:

The global surfactants market profiles leading players that include Clariant AG., Evonik Industries AG, Huntsman International LLC, Nouryon, Stepan Company, Lonza Group AG, BASF SE, Croda International Plc, Kao Corporation, and Dow Inc. The global surfactants market report provides in-depth competitive analysis as well as profiles of these major players.

- In February 2022, Clariant AG launched the 100% bio-based Vita surfactant range contributing to a reduction of up to 85% in CO₂ emissions compared to fossil-based counterparts.

- In January 2024, Evonik Industries AG opened the world's first industrial scale rhamnolipid biosurfactant plant, marking a significant step in sustainable surfactant production.

- In April 2024, Nouryon introduced the Structure® M3 co-surfactant, a biodegradable, waterless powder with 85% natural origin content, designed to enhance personal care formulations.

Recent Key Developments in the Surfactants Market:

In April 2024, Nouryon announced the launch of Structure M3 co-surfactant, featuring innovative biodegradable personal care technology. This product effectively minimizes the irritation associated with commonly used surfactant systems, offering gentleness, cleansing efficacy, and foaming performance in formulations such as shampoos, facial cleansers, and body washes.

In January 2023, Holiferm and Sasol announced a collaboration to develop and commercialize rhamnolipids and mannosylerythritol lipids (MELs), advancing the biosurfactant market.

In October 2023, Ashland introduced silicone-free, high-performance wetting agents for premium industrial coating applications, demonstrating innovation in surfactant formulations.

Trump’s Tariff Impact on Surfactant Market

The surfactant industry, which relies heavily on imported raw materials and intermediate chemicals, has been particularly affected. The imposition of a 25% tariff on imports from Canada and Mexico, along with a 10% tariff on imports from China, has increased the cost of essential feedstocks. This has led to higher production costs for surfactants, which are widely used in detergents, personal care products, and industrial applications.

The Society of Chemical Manufacturers and Affiliates (SOCMA) highlighted the potential for supply chain disruptions and increased operational costs. Similarly, the American Chemistry Council (ACC) emphasized the importance of trade with Canada and Mexico for the U.S. chemical industry and advocated for collaborative solutions to address underlying issues without compromising the benefits of existing trade agreements.

However, the tariffs have also presented opportunities for domestic producers. Locus Fermentation Solutions, an Ohio-based company producing bio-based surfactants, sees potential in the market's shift toward U.S.-sourced materials. The company anticipates increased demand for its glycolipid products, which are approved under the Toxic Substances Control Act (TSCA) and produced on a commercial scale domestically.

Government Initiatives for Promoting the Utilization of Surfactants:

In U.S.:

Toxic Substances Control Act (TSCA, managed by the Environmental Protection Agency (EPA), requires the evaluation and registration of chemical substances, including surfactants. The TSCA Inventory lists chemicals allowed for commercial use. Manufacturers must comply with EPA guidelines for the production, use, and disposal of surfactants.

Clean Water Act (CWA) Section 311 of the CWA addresses the discharge of hazardous substances into U.S. waters, which includes specific regulations for surfactants that may affect water quality and aquatic life.

Code of Federal Regulations (CFR) Title 40, Part 721 includes requirements for specific chemical substances that might restrict the use of certain non-biodegradable surfactants.

In Canada:

Canadian Environmental Protection Act (CEPA) regulate the utilization of surfactants. New surfactants not on the DSL are subject to a New Substances Notification (NSN) under the New Substances Program.

Environmental Emergency Regulations (E2 Regulations): Part of CEPA, these regulations (SOR/2019-51) list surfactants that, if spilled, pose an environmental risk. Manufacturers must follow safety guidelines for handling and disposal.

Volatile Organic Compounds (VOC) Concentration Limits for Certain Products Regulations (SOR/2008-177): These limit VOC concentrations in products like household cleaners containing surfactants, aiming to reduce air pollution.

In Europe:

REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) – Regulation (EC) No. 1907/2006: Managed by the European Chemicals Agency (ECHA), requires surfactant manufacturers and importers to register chemical substances. It includes evaluation, authorization, and restriction of chemicals, including surfactants, to ensure safety for human health and the environment.

Biocidal Products Regulation (BPR) Regulation (EU) No. 528/2012 governs the market placement and use of biocidal products containing surfactants. Manufacturers must obtain product authorization before placing biocidal surfactants on the market.

Detergents Regulation (EC) No. 648/2004 requires the biodegradability of surfactants in detergents. It mandates labeling of product contents and provides guidelines on testing the biodegradability of surfactants.

In Asia-Pacific

In China, measures for the Environmental Management of New Chemical Substances (MEP Order No. 12): This regulation, enforced by the Chinese Ministry of Ecology and Environment (MEE), requires registration of new chemical substances, including surfactants, before they are manufactured or imported.

In Japan, Chemical Substances Control Law (CSCL): Regulates the manufacturing and importation of chemical substances. Surfactants must be evaluated and classified, particularly for their biodegradability and potential environmental impact.

In India, manufacture, storage and import of Hazardous Chemical Rules (1989) classify and regulate the handling of hazardous chemicals, including surfactants, specifying requirements for storage, handling, and disposal to protect environmental and public health.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the surfactants market analysis from 2022 to 2032 to identify the prevailing surfactants market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the surfactants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global surfactants market trends, key players, market segments, application areas, and market growth strategies.

Surfactants Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 59.5 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 752 |

| By Feedstock |

|

| By Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Kao Corporation, Lonza Group AG, Nouryon, Huntsman International LLC, Evonik Industries AG, Croda International Plc, Clariant AG., Dow Inc., BASF SE, Stepan Company |

Analyst Review

According to the perspective of CXOs of the leading companies in the global surfactants market, development of end-user industries, changes in lifestyle in the developing economies, and easy availability of surfactants drive the growth of the market across the globe. However, volatility in raw material prices and environmental concerns of surfactants such as their toxic effects on aquatic organisms are expected to hamper the growth of surfactants market in the near future.

Moreover, CXOs in the surfactants market will place a strong emphasis on understanding the evolving needs and preferences of customers. They are to ensure that product development, marketing, and service strategies are aligned with these customer insights.

Furthermore, CXOs are expected to focus on innovation, ensuring the development of new, sustainable, and effective surfactant solutions. Innovations such as bio-based surfactants, specialty surfactants, or multifunctional surfactants are expected to cater to diverse industry needs.

In addition, to tap into emerging markets and meet the growing demand for surfactants, CXOs may lead efforts to expand the company's global presence through partnerships, acquisitions, or establishing new facilities. CXOs further added that sustained economic development coupled with rise in demand for household detergents is expected to augment the growth of the surfactants market.

Rise in demand from end-use industries, rise in demand for eco-friendly surfactants, extensive use of surfactants in household detergents, low prices and easy availability of surfactants, and low prices and easy availability of surfactants are the upcoming trends of surfactants market in the world.

Household detergents is the leading application of surfactants market.

Asia-Pacific is the largest regional market for Surfactants.

The surfactants market was valued at $37.6 billion in 2022 and is estimated to reach $59.5 billion by 2032, exhibiting a CAGR of 4.7% from 2023 to 2032

Clariant AG., Evonik Industries AG, Huntsman International LLC, Nouryon, Stepan Company, Lonza Group AG, BASF SE, Croda International Plc, Kao Corporation, and Dow Inc are the top companies to hold the market share in the surfactants market.

Loading Table Of Content...

Loading Research Methodology...