Surgical Imaging Market Outlook - 2026

The global surgical imaging market generated $1,063 million in 2018, and is projected to reach $ 1,496 million by 2026, growing at a CAGR of 4.3% from 2019 to 2026. Surgical imaging systems are intra-operative imaging systems that are based on X-ray technology and can be used flexibly in various operating rooms. C-arms system is 2D or 3D medical imaging system used during numerous intraoperative procedures such as spine, cranial, orthopedics, cardiovascular surgery. It is estimated that surgical imaging market will show significant market growth over the forecast period owing to growth in number of minimally invasive surgical procedures across geographies with increasing popularity of flat panel detector (FPD), increase in number of hybrid operating rooms will significantly boost the growth of the surgical imaging market during the forecast period.

Furthermore, increase in demand for integrated imaging systems and technological advancement in surgical imaging systems such as new launch of O-arms n G-arms further contribute the market growth. However, higher cost of surgical imaging systems can impede the market growth.

Surgical Imaging Market Segment Review

The global surgical imaging market is segmented based on modality type, technology, application, and region. Based on modality type, the market is classified as mobile c-arms, mini c-arms, and others. According to technology, the market is categorized as image intensifier and flat panel detector (FPD). Based on application, market is divided into neurosurgery, orthopedic & trauma surgery, cardiovascular, general surgery, and other surgeries. Based on region, the market is studied across North America (U.S., Canada, and Mexico), Europe (Germany, France, the UK, and rest of Europe), Asia-Pacific (China, Japan, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa and rest of LAMEA).

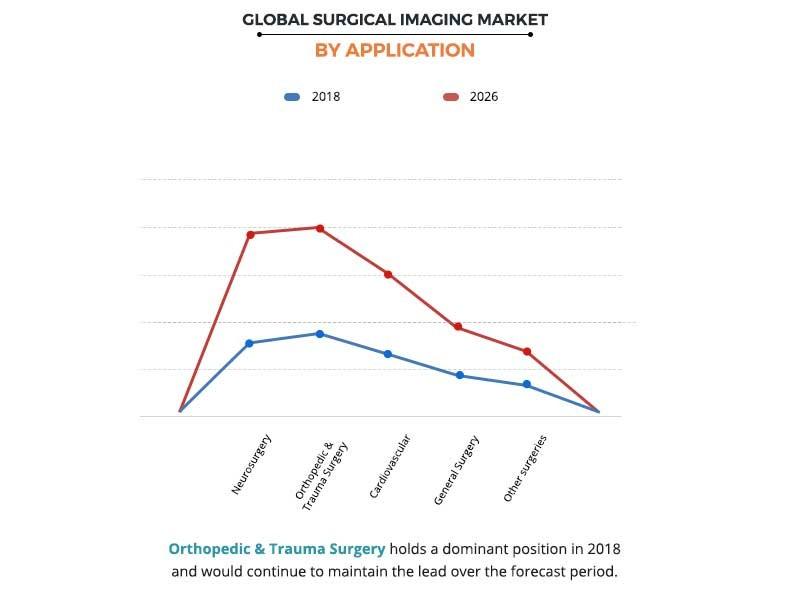

By Application

According to application, the global surgical imaging market is categorized as neurosurgery, orthopedic & trauma surgery, cardiovascular, general surgery, and other surgeries. Presently, the orthopedic & trauma surgery segment dominates the global market, and is estimated to remain dominant during the forecast period owing to rise in adoption of intraoperative surgical imaging during orthopedic surgery, wide availability of surgical imaging systems for orthopedic surgery, and rise in adoption of c-arm during orthopedic implantation.

Neurosurgery or neurological surgery is anticipated to show fastest market growth during the forecast period due to growth in adoption of c-arm during neurosurgeries, rise in number of neurosurgical hybrid operating rooms, and increase in number of target population are majorly driving the market growth of this segment. Furthermore, neurosurgery includes a variety of procedures with very specific imaging requirements for different procedures such as positioning of screws, implants or aneurysm clipping. C-arms offered by GE Healthcare, Ziehm Imaging, Medtronic, Philip, Whale Imaging, and Siemens Healthcare are widely used during neuro surgery procedures.

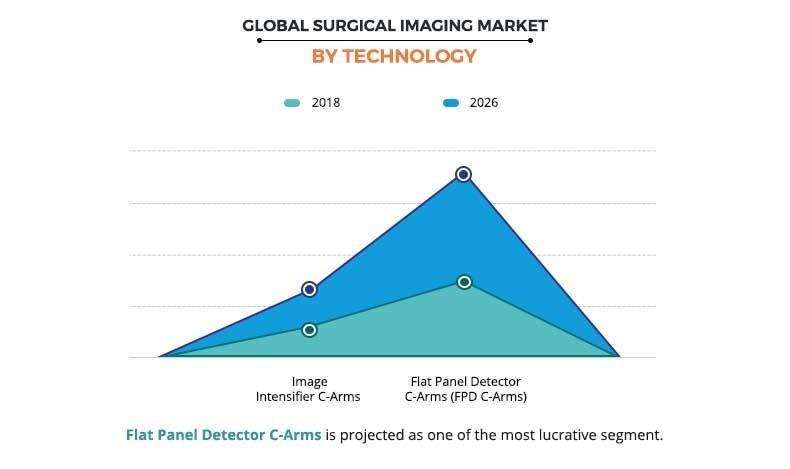

By Technology

Based on technology, the surgical imaging market is categorized as image intensifier and flat panel detector c-arms (FPD). At present, the at panel detector c-arms segment is the major revenue generating segment and is estimated to experience significant growth during the forecast period. Some key factors such as rise in demand for flat panel detector c-arms, technologically advancement in medical devices, and wide availability of FPD c-arm are majorly driving the surgical imaging market growth. Furthermore, advantages offered by flat panel detector c-arms over the image intensifier c-arm such as higher resolution, clarity, contrast, high efficiency further supports the market growth.

Furthermore, FPD image can be displayed and analyzed with the latest software/computer advances, there are no moving parts on FPD, and thus these are simple, and no dust or vibration concerns these factors further contribute the market growth of FPD c-arms.

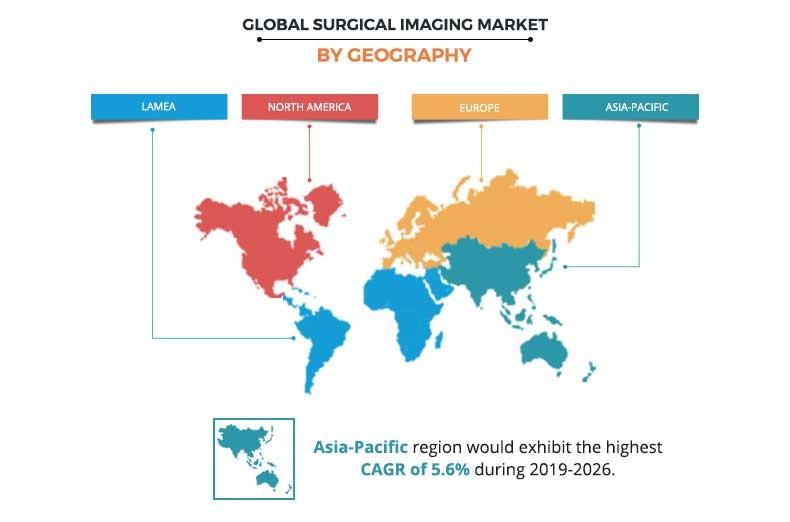

By Region

Snapshot of Asia-Pacific surgical imaging market

Asia-Pacific presents lucrative opportunities for the key players operating in the surgical imaging market, owing to high population base, growth in awareness about surgical imaging, development in healthcare infrastructure, and increase in demand for minimally invasive procedures. However, higher cost of surgical imaging systems and the fact that insurance companies do not cover the entire material expenses of a surgery hamper the market growth in Asia-Pacific.

Competition Analysis

The key players profiled in this report include GE Healthcare (A Subsidiary of General Electric Company), GENORAY Co. Ltd., Hologic, Inc., Koninklijke Philips N.V., Medtronic plc, Shimadzu Corp., Siemens Healthineers AG, Toshiba Medical Systems Corporation, Whale Imaging Inc., and Ziehm Imaging GmbH.

Key Benefits for Surgical Imaging Market

- The study provides an in-depth analysis of the surgical imaging market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers surgical imaging market analysis from 2018 to 2026, which is expected to enable the stakeholders to capitalize on the prevailing opportunities in the market.

- A comprehensive analysis of all the geographical regions is provided to determine the prevailing opportunities.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook and global surgical imaging market growth.

Surgical Imaging Key Market Segments:

By Modality Type

- Mobile c-arms

- Mini c-arms

- Others

Technology Type

Image intensifier

- Flat panel detector (FPD)

Application

Neurosurgery

- Orthopedic & trauma surgery

- Cardiovascular

- General surgery

- Other surgeries

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Rest of LAMEA

Surgical Imaging Market Report Highlights

| Aspects | Details |

| By MODALITY TYPE |

|

| By TECHNOLOGY |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | SHIMADZU Corporation, Siemens, Koninklijke Philips N.V. (Philips), General Electric (GE Healthcare), Canon Medical Systems Corporation (Toshiba Medical Systems Corporation), Whale Imaging Inc., GENORAY Co. Ltd., Medtronic Plc., Hologic Inc., Ziehm Imaging GmbH (Ziehm Imaging Inc.) |

Analyst Review

Surgical imaging systems are intra-operative imaging systems that are based on X-ray technology and can be used flexibly in various operating rooms. C-arms system is 2D or 3D medical imaging system used during numerous intraoperative procedures such as spine, cranial, orthopedics, and cardiovascular surgery. The adoption of surgical imaging is expected to increase due to surge in the number of minimally invasive surgical procedures across geographies.

Increase in popularity of flat panel detector c-arms (FPD c-arms), increase in number of hybrid operating rooms, and technological advancement in surgical systems significantly boost the growth of the surgical imaging market during the forecast period. Major advantages associated with the surgical imaging are better clinical outcomes, cost effectiveness, and greater convenience, further boost the market growth. However, higher cost associated with the surgical imaging system is anticipated to hamper the market growth

North America is expected to remain dominant during the forecast period due to surge in use of surgical imaging owing to presence of advanced healthcare facilities, wide availability of advanced surgical systems, and higher number of minimally surgical procedures. In addition, Asia-Pacific and LAMEA are expected to offer lucrative opportunities to the key players during the forecast period due to developments in healthcare infrastructure with a rise in demand for advanced surgical imaging systems.

Loading Table Of Content...