Tea Market Research, 2031

The global tea market size was valued at $49 billion in 2021, and is projected to reach $93.2 billion by 2031, growing at a CAGR of 6.7% from 2022 to 2031.

Tea is the most commonly consumed drink after water, with several health benefits. The aromatic beverage is made through processing and fermentation of Camellia Sinensis plant leaves. It contains potent antioxidants known as flavonoids, which stabilize harmful free radicals in the body. In addition, tea comprises vitamins C, K, B12, B6, & E; a trace amount of potassium, manganese, magnesium, & calcium minerals; and different amino acids such as L-theanine. Several studies and research on tea suggest that it prevents cancer, lowers cholesterol, facilitates weight loss, and enhances immunity. Primarily, tea can be categorized into black and green tea based on the degree of fermentation or oxidation.

Market Value Projections and Insights

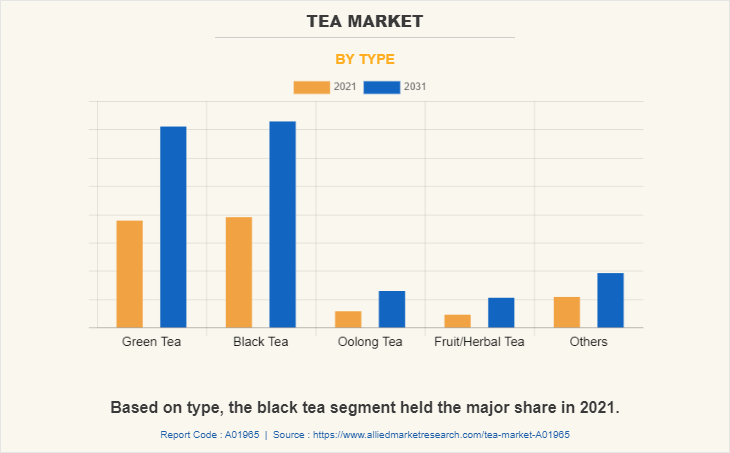

The green tea segment is expected to witness exponential growth during the forecast period. This can be attributed to a rise in awareness about health and fitness and a rise in the number of educated tea consumers.

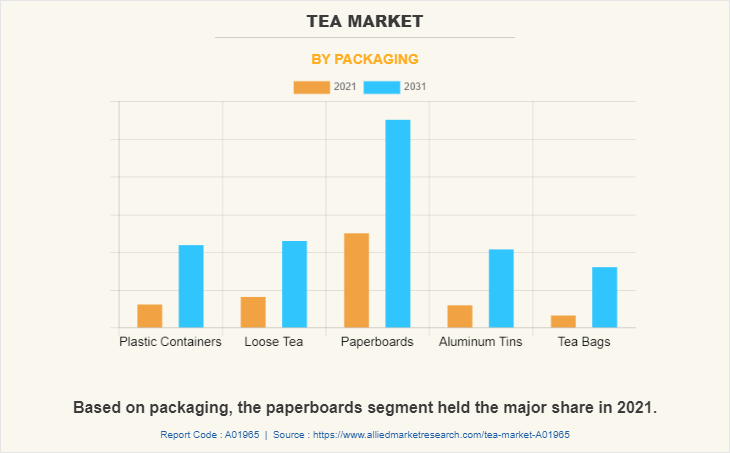

The paperboard segment accounted for a major tea market share in as they are usually treated, coated, laminated, or impregnated with materials such as waxes, resins, or lacquers to improve their functional and protection properties.

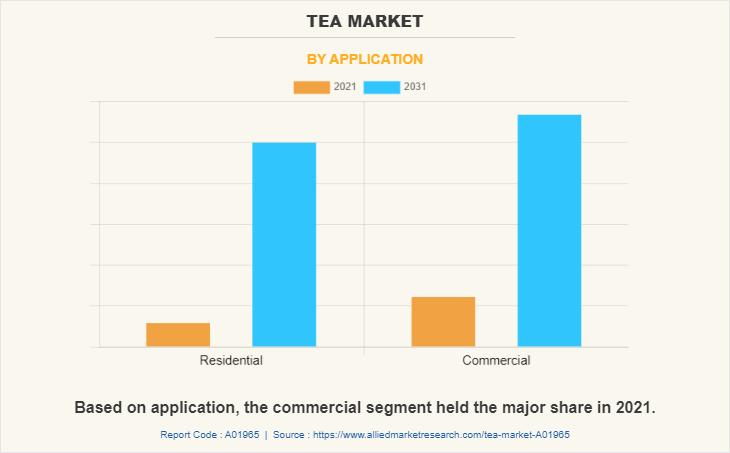

The residential segment accounted for a major share of the market as there is surge in the consumption of caffeine beverages at home boosts the market tea mraket growth in the residential segment.

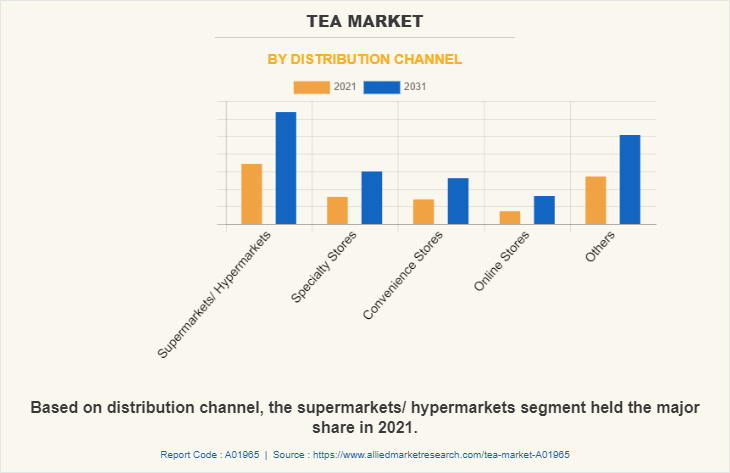

The growth of the supermarket/hypermarket segment in the tea market is attributed to the increase in adoption of supermarket and hypermarket in both the mature and emerging markets.

The increasing consumer awareness regarding the health benefits of tea is a key driver in the global tea market. Consumers are increasingly seeking out teas rich in antioxidants, flavonoids, and other nutrients that are associated with improving heart health, boosting immunity, and reducing stress. This has spurred demand for various tea types, including green tea, herbal teas, and specialty blends, especially in regions like North America and Europe.

The tea market faces a major restraint due to the fluctuating prices of tea leaves and other raw materials. Unpredictable weather conditions, such as droughts or excessive rainfall, can adversely affect tea crop yields, impacting supply chains. Additionally, rising labor costs in tea-producing countries and transportation costs contribute to price volatility, making it challenging for tea producers and distributors to maintain stable pricing.

An emerging opportunity in the tea market lies in the growing demand for premium and organic teas. As consumers become more conscious of their food choices, many are shifting toward sustainably sourced, high-quality tea products. Organic certifications and ethical production practices attract a niche but expanding consumer base, particularly in developed markets. This trend also opens avenues for innovative blends and flavors that cater to sophisticated palates.

Industry Highlights

Tea consumption continues to grow globally, with significant demand in regions such as Asia-Pacific, Europe, and North America. Asia-Pacific, led by countries like China and India, accounts for the majority of global tea consumption, driven by long-standing cultural traditions.

The majority of global tea production is concentrated in a few key regions, including China, India, Sri Lanka, and Kenya. China remains the largest tea producer, followed by India, where both nations are pivotal in the production of green and black teas, respectively.

The premium and wellness tea categories, such as matcha, herbal blends, and detox teas, are driving higher average spending per consumer.

The global tea market is experiencing dynamic growth from both consumption and production perspectives, with evolving spending patterns. Consumption is highest in Asia-Pacific, driven by cultural traditions in countries like China and India, though Europe and North America are seeing a surge in demand for green tea, specialty blends, and ready-to-drink (RTD) tea products. Health-conscious consumers, particularly millennials and Gen Z, are increasingly drawn to wellness-focused tea offerings. On the production side, China and India dominate global output, though climate change poses challenges to yield and quality. To adapt, producers are focusing on innovative cultivation techniques and expanding organic and premium tea production. In terms of spending, consumers in developed markets are increasingly willing to pay more for organic and specialty teas, while price-sensitive regions prioritize traditional teas. Additionally, tea-related experiences, such as cafes and subscription services, are contributing to higher spending in premium markets.

Key Areas Covered in the Report

Tea production is heavily influenced by weather conditions and labor costs. Unpredictable weather patterns, such as droughts or excessive rainfall, disrupt crop yields, causing fluctuations in tea leaf prices.

The growing popularity of coffee, energy drinks, and other health-focused beverages like kombucha and smoothies presents a competitive challenge.

Large-scale tea cultivation, particularly in countries like India and China, faces criticism due to its environmental impact. Issues such as deforestation, pesticide use, and water-intensive farming practices are becoming more prominent concerns.

Political instability, trade tariffs, and logistical disruptions in major tea-exporting countries can lead to inconsistent supply, affecting the availability and pricing of tea in international markets.

The tea market faces several pain points, primarily driven by environmental, competitive, and supply chain challenges. Price volatility due to unpredictable weather patterns, rising labor costs, and transportation expenses makes it difficult for producers to maintain stable pricing. Additionally, growing competition from alternative beverages like coffee, energy drinks, and kombucha is reducing tea’s market share, especially among younger consumers. Environmental concerns related to large-scale tea production, including deforestation, pesticide use, and water consumption, are becoming more pressing as consumers demand more sustainable products. Supply chain disruptions caused by political instability, trade tariffs, and logistical challenges, such as those exacerbated by the COVID-19 pandemic, further complicate the market. Moreover, increasing consumer demand for transparency in sourcing and sustainability is pushing tea brands to adopt ethical practices and certifications, with failure to do so risking loss of market tea market share, particularly among socially conscious buyers.

Topics discussed in the report

Diverse Genres and Storytelling Formats

Challenges from Other Beverages

Rise of Independent Creators

Tea as Collectibles

Differentiation Between Physical and Digital Experiences

Influence of Streaming and Gaming

Role of Sustainability in the Tea Industry

Segment Overview

The tea market forecast is segmented on the basis of type, packaging, application, distribution channel, and region. By type, the market is divided into green tea, black tea, oolong tea, dark tea, and others. By packaging, it is fragmented into plastic containers, loose tea, paperboard, aluminum tins, and tea bags. Applications covered in the study include residential and commercial. By distribution channel, it is categorized into supermarkets/hypermarkets, specialty stores, convenience stores, online stores, and others. By region, the tea market size is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Green tea has become one of the most popular tea varieties globally, known for its distinct flavor and numerous health benefits. Originating in China and Japan, it has now gained widespread appeal across the world due to its rich content of antioxidants, particularly catechins like EGCG (epigallocatechin gallate), which are believed to provide a range of health benefits such as boosting metabolism, improving heart health, and offering anti-inflammatory properties. This health-conscious shift among consumers has driven demand for green tea, especially in regions like North America and Europe, where wellness trends are rapidly growing.

Comparative Matrix of Key Segments

Parameters | Green Tea | Black Tea | Oolong Tea | Dark Tea | Others |

Market Share | Growing, especially in North America and Europe due to health benefits | Largest global market share, especially in Asia-Pacific and Western countries | Niche but growing market, mostly consumed in China and Taiwan | Niche market, mostly consumed in China, limited global awareness | Moderate share; Herbal teas growing in popularity due to wellness trends |

Distribution Channels | Primarily supermarkets, online channels, specialty stores | Dominant in supermarkets, mass retail, tea shops, online | Specialty tea shops, online platforms, niche retailers | Specialty tea shops, limited online presence outside of China | Supermarkets, health stores, tea shops, online platforms |

Challenges | Price volatility due to climate change, competition from alternative wellness beverages (kombucha, etc.) | Intense competition from coffee and other beverages, price volatility in raw material sourcing | Limited global awareness, higher price point, complex preparation process | Low awareness outside China, high price, niche appeal | Increased competition from non-tea beverages like coffee, rising demand for transparency and sustainability |

Key Players | Unilever (Lipton), Tata Tea, Celestial Seasonings, Bigelow Tea, Organic India | Unilever (Lipton), Twinings, Tata Tea, Dilmah, Tetley | Ten Ren Tea, Republic of Tea, TeaVivre | Menghai Tea Factory, Xiaguan Tuocha | Pukka Herbs (herbal), Numi Tea, Yogi Tea, Traditional Medicinals |

Regional Dynamics and Competition

Asia-Pacific remains the dominant region in both tea production and consumption. Countries like China, India, Sri Lanka, and Japan are major producers, with China and India leading the global tea supply. Green tea is especially popular in East Asia (China and Japan), while black tea is favored in India and Sri Lanka. The competitive landscape in this region is marked by established local brands like Tata Tea, Dilmah, and Ten Ren Tea. Additionally, artisanal and specialty teas are gaining traction as consumers shift towards premium, organic, and wellness-focused products. However, price volatility and climate change present challenges for growers and exporters. Europe is one of the fastest-growing markets for specialty and wellness teas, such as green tea, herbal teas, and functional blends. The UK remains a stronghold for black tea consumption, with brands like Twinings, PG Tips, and Lipton dominating the market.

Competition Analysis

The major players operating in the tea industry focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have been also focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the tea market include Associated British Foods plc, BARRY'S TEA, HAIN CELESTIAL GROUP, INC., ITO EN, LTD., Mcleod Russel India limited, Nestle S.A., TAETEA, Tata Global Beverages, The Republic of Tea, INC., UNILEVER GROUP.

Tea Market News Release

In June 2023, Bigelow Tea announced the launch of three new tea varieties: Lavender Chamomile Plus, Orange & Spice Herbal Tea, and Matcha Green Tea with Turmeric. Each new tea is crafted to offer unique flavor profiles and health benefits, catering to diverse consumer preferences. Bigelow Tea aims to continue its tradition of providing high-quality teas.

In March 2024, PepsiCo announced a partnership with Unilever to launch Pure Leaf Zero Sugar Sweet Tea, a new product aimed at meeting the growing demand for zero-sugar beverages. This latest addition to the Pure Leaf brand offers a sweet tea flavor without added sugars, providing a healthier option for consumers conscious of their sugar intake.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the tea market analysis from 2022 to 2032 to identify the prevailing tea market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the tea market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global tea market trends, key players, market segments, application areas, and market growth strategies.

Tea Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 93.2 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 555 |

| By Type |

|

| By PACKAGING |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | HAIN CELESTIAL GROUP, INC., R.C. Bigelow, Inc., Nestle S.A., Mcleod Russel India Limited, Associated British Foods plc, The Republic of Tea, Inc., Barrys Tea, Unilever PLC, ITO EN, LTD., Tata Consumer Products Limited |

Analyst Review

According to the insights of the CXOs, the global tea market is expected to witness robust growth during the forecast period. This is attributed to several factors such as the increasing focus on health and wellness, the rising popularity of specialty teas, the convenience of tea products, and the growing demand for tea in emerging economies. Additionally, the market is being driven by innovation and new product development, geographic expansion, e-commerce and online sales channels, and sustainability initiatives.

CXOs further added key players in the tea market have the opportunity to capitalize on these trends by diversifying their product portfolio, targeting new markets, and investing in research and development to create new and innovative tea products that cater to changing consumer preferences. Despite challenges such as price competition and supply chain issues, the tea market is expected to continue to grow due to its appeal to a wide range of consumers and its adaptability to changing market trends.

The global tea market size was valued at $49 billion in 2021, and is projected to reach $93.2 billion by 2031

The global Tea market is projected to grow at a compound annual growth rate of 6.7% from 2022 to 2031 $93.2 billion by 2031

Some of the key players in the tea market include Associated British Foods plc, BARRY'S TEA, HAIN CELESTIAL GROUP, INC., ITO EN, LTD., Mcleod Russel India limited, Nestle S.A., TAETEA, Tata Global Beverages, The Republic of Tea, INC., UNILEVER GROUP.

Asia-Pacific remains the dominant region in both tea production and consumption

The increasing consumer awareness regarding the health benefits of tea is a key driver in the global tea market

Loading Table Of Content...

Loading Research Methodology...