Telecom Expense Management Market Overview

The global telecom expense management market size was valued at USD 3 billion in 2022, and is projected to reach USD 9.7 billion by 2032, growing at a CAGR of 12.7% from 2023 to 2032.

Additionally, the telecom expense management market is expected to witness notable growth owing to increase in adoption of mobile phones and other portable devices, surge in demand for managing the increasing telecom expense, and increased investment on 5G infrastructure. Moreover, the growing need for expense visibility and cost reduction is expected to provide a lucrative opportunity for the growth of the market during the forecast period. On the contrary, security issues and a lack of interoperability limit the growth of the telecom expense management market.

Key Market Trends & Insights

- By end user, the BFSI segment is anticipated to have fastest growth rate

- By deployment mode, the cloud segment is anticipated to have fastest growth rate.

- Region wise, Asia-Pacific is expected to witness fastest growth in the coming years.

Market Size & Forecast

- 2022 Market Size: USD 3 Billion

- 2032 Projected Market Size: USD 9.7 Billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 12.7%

Introduction

Telecom expense management (TEM) is a term that describes a range of tasks, processes, technologies, and services that enable an organization to better manage and control their costs and assets related to telecommunications services. Telecom services commonly include fixed wireline communications services such as voice, data, and network services. Telecom optimization efforts typically include reducing costs and waste by making more efficient use of existing communications investments. TEM involves the strategic oversight, analysis, and management of these expenses to ensure efficiency, cost-effectiveness, and compliance with organizational policies.

This process typically includes activities such as invoice validation, inventory management, contract negotiation, and optimization of telecom services. By implementing TEM practices, businesses aim to gain better visibility into their telecom expenses, identify areas for cost savings, and enhance overall operational efficiency in the realm of communication services. TEM solutions involve the use of specialized software platforms to automate processes and provide real-time insights into telecom spending, enabling organizations to make informed decisions and maintain control over their telecommunications budgets.

Segment Overview

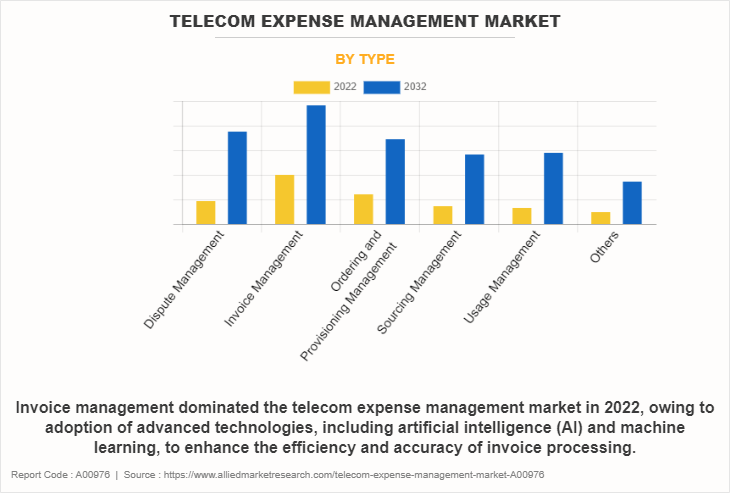

The telecom expense management market is segmented on the basis of type, deployment mode, enterprise size, end user, and region. On the basis of type, the market is categorized into dispute management, invoice management, ordering & provisioning management, sourcing management, usage management, and others. By deployment mode, it is divided into on-premise and cloud. On the basis of enterprise size, the market is classified into large enterprise and small & medium-sized enterprise. On the basis of end user, the market is segregated into BFSI, consumer goods & retail, IT and telecom, healthcare, manufacturing and automotive, and others. By region, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the invoice management segment dominated the telecom expense management market size in 2022, owing to the adoption of advanced technologies, including artificial intelligence (AI) and machine learning, to enhance the efficiency and accuracy of invoice processing. Moreover, automation tools are being integrated into TEM platforms, allowing for faster validation of charges, identification of discrepancies, and seamless payment processing. However, the usage management segment is expected to witness the fastest growth, owing to enhance policy compliance, ensuring that telecom services are used in accordance with established guidelines, thereby minimizing the risk of unauthorized or inefficient usage.

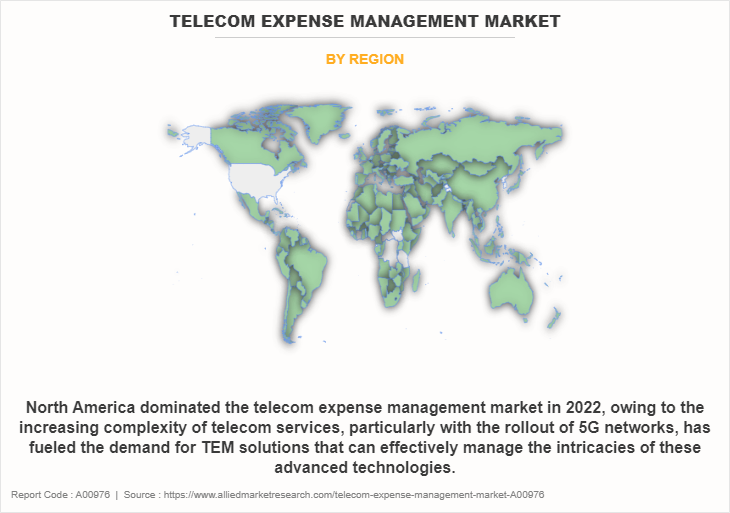

Region-wise North America dominated the telecom expense management market share in 2022, owing to the integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) into TEM solutions. This integration enhances automation, providing more efficient invoice processing, cost allocation, and proactive identification of optimization opportunities.

However, Asia-Pacific is expected to witness the fastest growth in the upcoming year, owing to the increasing adoption of 5G technology across various countries, leading to a surge in demand for TEM solutions that can effectively manage the complexities associated with the rollout of advanced telecommunications services. Moreover, with the rise of remote work and the proliferation of mobile devices, there is a growing need for TEM to provide comprehensive visibility into expenses, optimize data plans, and enforce policies to ensure cost-effective usage.

Top Impacting Factors

Increase in Adoption of Mobile Phones and other Portable Devices

The increasing adoption of mobile phones and other portable devices has emerged as a significant driver for telecom expense management (TEM). As more employees and businesses rely on mobile devices for communication and productivity, the associated telecom expenses have become more complex and challenging to manage. TEM solutions play a crucial role in addressing this complexity by providing organizations with the tools to efficiently monitor, track, and optimize mobile expenses. With a growing number of employees using company-issued or personal mobile devices for work-related tasks, TEM helps in controlling costs through features such as usage analysis, policy enforcement, and real-time monitoring.

Moreover, the integration of mobile device management (MDM) functionalities within TEM solutions enables businesses to enforce security policies, manage device inventory, and streamline the procurement process. The surge in mobile device adoption underscores the need for organizations to implement effective TEM strategies to gain better visibility into telecom expenses, ensure compliance with policies, and optimize costs in the rapidly evolving landscape of mobile communications.

Furthermore, the integration of mobile device management (MDM) capabilities within TEM solutions is crucial in the current landscape. As mobile devices become indispensable for work-related tasks, MDM helps organizations maintain control over their device inventory, enforce security policies, and facilitate efficient procurement processes. This integration not only ensures the security of sensitive company data but also streamlines administrative tasks associated with managing a fleet of mobile devices.

Surge in Demand for Managing the Increasing Telecom Expense

The escalating demand for managing the increasing telecom expense serves as a potent driver for the adoption of telecom expense management (TEM) solutions. As businesses expand their operations and become more reliant on diverse communication services, the associated telecom expenses grow in complexity. This surge is particularly evident with the widespread adoption of mobile devices, the increasing use of data-intensive applications, and the growing reliance on various telecommunication services. Managing these expenses manually can be daunting, prone to errors, and challenging to optimize.

TEM solutions step in to address this challenge by providing organizations with centralized tools for monitoring, analyzing, and controlling their telecom expenditures. These solutions offer real-time visibility into usage patterns, enabling businesses to identify cost-saving opportunities, negotiate favorable contracts with service providers, and enforce policy compliance. As the demand for effective cost management intensifies, TEM becomes an indispensable tool for organizations seeking to streamline operations, enhance financial efficiency, and ensure optimal utilization of telecommunication resources in an increasingly connected business environment.

The report focuses on growth prospects, restraints, and analysis of the global telecom expense management market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global telecom expense management market analysis.

Key Telecom Expense Management Companies:

The following are the leading companies in the telecom expense management market. Major players have adopted product launch, partnership, collaborations, and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the telecom expense management industry.

Accenture

CGI Inc.

WidePoint Corporation

Tangoe

Vodafone Group Plc

AVOTUS

Calero

Sakon

Upland Software, Inc.

TeleManagement Technologies, Inc.

Recent Partnership in the Market

On November 2023, British telecommunications giant Vodafone Group Plc partnered with IT consultancy firm Accenture to create a scaled, commercially driven and more efficient organization.

On October 2022, Sakon, a leading provider in device and telecom management partnered with TRG Screen, the leading provider of enterprise subscription management solutions, to streamline their expense and vendor management needs.

Recent Product Launch in the Market

On June 2022, Tangoe, the leading technology expense and asset management solution for more than 20 years, has unveiled a suite of curated bundles of their cutting-edge, full-lifecycle expense management and optimization platform, Tangoe One. The new tiered packages are designed to help mid-size businesses access the Tangoe One platform to simplify, manage, and optimize telecom, mobile, and cloud assets, and expenses from one consolidated portal.

Recent Acquisition in the Market

On October 2023, Accenture acquired MNEMO Mexico, a privately held company specializing in managed cybersecurity services, to grow business in Mexico, expand Accenture presence in Latin America and support our North America business.

On August 2023, Calero-MDSL, a leader in the high-growth Technology Expense Management (TEM) software space acquired Network Control, a boutique Telecom Expense Management company providing high-touch telecom expense management and managed mobility software and services. This acquisition provides Calero-MDSL with a perfect springboard to accelerate growth in the middle-market.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the telecom expense management market analysis from 2022 to 2032 to identify the prevailing telecom expense management market opportunities.

The telecom expense management market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the telecom expense management market forecast assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global telecom expense management market growth, key players, market segments, application areas, and market growth strategies.

Telecom Expense Management Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.7 billion |

| Growth Rate | CAGR of 12.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 434 |

| By Type |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | Vodafone Group Plc, Upland Software, Inc., Calero, AVOTUS, WidePoint Corporation, Accenture, Tangoe, TeleManagement Technologies, Inc., CGI Inc., Sakon |

Analyst Review

Telecom expense management (TEM) involves a comprehensive assessment of the market trends, key players, technological advancements, and overall industry dynamics related to the management of telecommunications expenses. Analysts typically evaluate TEM solutions, services, and strategies employed by businesses to control and optimize their communication-related costs. This review encompasses a thorough analysis of market growth, drivers, challenges, and emerging opportunities within the telecom expense management sector. It may include insights into the adoption of TEM solutions across different industries, the impact of regulatory changes, and the competitive landscape among TEM providers. Analysts may also explore innovations in TEM technologies, such as the integration of artificial intelligence, automation, and analytics to enhance efficiency and decision-making. By providing a detailed overview of the current state of TEM, analysts assist businesses in making informed decisions regarding the selection and implementation of TEM solutions that align with their specific needs and objectives. The analyst review plays a crucial role in helping stakeholders, including enterprises and TEM solution providers, stay abreast of industry trends and developments, facilitating strategic planning and decision-making in the ever-evolving telecom expense management landscape.

Furthermore, the challenges faced by organizations in implementing effective TEM solutions, such as data security concerns, the need for seamless integration with existing systems, and the complexity of managing diverse communication services. It aims to equip businesses with actionable intelligence to make informed decisions about selecting, implementing, and optimizing TEM solutions tailored to their unique requirements.

The telecom expense management market was valued at $3,017.48 million in 2022 and is estimated to reach $9,736.84 million by 2032, exhibiting a CAGR of 12.7% from 2023 to 2032.

North America is the largest regional market for Telecom Expense Management

The global telecom expense management market is dominated by key players such as Accenture, CGI Inc., WidePoint Corporation, Tangoe, Vodafone Group Plc, AVOTUS, Calero, Sakon, Upland Software, Inc., and TeleManagement Technologies, Inc.

Growing need for expense visibility and cost reduction is the leading application of Telecom Expense Management Market

Increase in adoption of mobile phones and other portable devices and surge in demand for managing the increasing telecom expense are the upcoming trends of Telecom Expense Management Market in the world

Loading Table Of Content...

Loading Research Methodology...