Term Loan Market Research, 2032

The global term loan market size was valued at $576.8 billion in 2023, and is projected to reach $991.2 billion by 2032, growing at a CAGR of 6.2% from 2024 to 2032. A term loan is a fixed-amount loan repaid over a specified period, with regular payments of principal and interest, often used for financing business investments or large purchases.

Market Introduction and Definition

A term loan is a lump sum amount borrowed from a financial institution, with a predetermined repayment schedule over a fixed period. This financial tool is a popular choice for individuals looking to fund various needs such as education, home renovation, medical expenses, or even a small business.

Term loans are mostly preferred by borrowers as the repayment of such loans is done in installments which helps the borrower to arrange the funds for making payments to the lenders. Furthermore, in case they are availed for a longer duration, term loans are offered at lower interest rates than those with a shorter term.

Key Takeaways

The term loan market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major term loan industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The use of advanced technologies in the loan process, such as the adoption of AI and software to streamline loan operations, is driving the term loan market growth by offering improved solutions to customers and facilitating online loan management, analysis, and fund disbursal. Furthermore, rise in the requirement for money to support their daily needs and increase in migration to smart urban cities are also contributing to the growth of the term loan market. However, credit history scrutiny, where lenders closely examine the borrower's credit history, is a challenge for some borrowers, and economic uncertainty is another restraint, as it can impact borrowers' ability to repay loans and lenders' willingness to extend credit, therby hinder the term loan market.

On the contrary, rise in demand for short-term loans, which are easier to obtain as they do not require collateral, leads to growth in the term loan market forecast period. The emergence of fintech companies and online loan providers, which have made obtaining personal loans more accessible, is expected to drive the term loan market in the upcoming years.

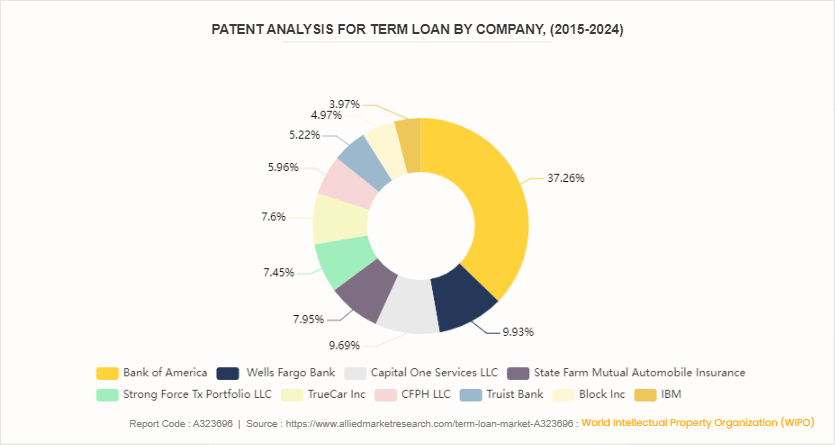

Patent Analysis for Global Term Loan Market

The patent analysis of the term loans market involves a comprehensive examination of patent applications related to term loans to identify trends, innovations, and the competitive landscape within this sector. This analysis delves into the technological advancements, strategies, and intellectual property portfolios of key players in the term loans market from 2015 to 2024. The below figure shows the number of patent document count by the top applicants which include Bank of America, Wells Fargo Bank, Capital One Services LLC, State Farm Mutual Automobile Insurance, Strong Force Tx Portfolio LLC, TrueCar Inc, CFPH LLC, Truist Bank, Block Inc, and IBM. The analysis denotes that the highest number of patent count is from the Bank of America applicant followed by Wells Fargo and Capital One Service LLC.

Market Segmentation

The term loan market outlook is segmented into type, interest rate, provider, and region. On the basis of type, the market is divided into short-term loans, intermediate-term loans, and long-term loans. On the basis of interest rate, the market is bifurcated into fixed interest rate and floating interest rate. On the basis of end user, the market is categorized into banks, financial institutions, credit unions, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/Country Market Outlook

In November 2023, Grindr started working with JPMorgan to refinance a term loan led by Fortress Investment Group in the U.S. The loan is worth $100 million and is part of a larger refinancing package. The package includes a $100 million term loan, a $50 million revolving credit facility, and a $50 million bridge loan.

In July 2022, in India, fintech startup Slice switched from providing credit lines through its app to classic term loans, after the Reserve Bank of India said that non-bank FinTech's cannot provide credit lines. Slice was among the most exposed by the RBI’s change, and it currently seems to have fundamentally altered the way it disburses credit to its customers to reflect this new restriction.

Industry Trends

In India, the Union Cabinet chaired by Prime Minister Narendra Modi on 17th August 2022, approved an interest subvention of 1.5 percent per annum on short-term agriculture loans. Interest subvention of 1.5 percent has been provided to lending institutions (Public Sector Banks, Private Sector Bank, Small Finance Banks, Regional Rural Banks, Cooperative Banks, and Computerized PACS directly ceded with commercial banks) for the financial year 2022-23 to 2024-25 for lending short term agri-loans up to US$3, 591 to the farmers.

In November 2021, Internet Brands Inc. issued a $4.805 billion first-lien term loan due August 2028 to refinance its existing first-lien debt and to fund a shareholder distribution. In addition to its first-lien debt, the company has a $575 million second-lien term loan due 2029 to refinance the existing second-lien tranche. RBC Capital Markets is the administrative agent on the second-lien tranche.

Competitive Landscape

The major players operating in the term loan market include Bajaj Finserv, Tata Capital Limited, Swoop Finance Ltd, Funding Circle Limited, Social Finance, Inc., Compare The Market Limited, US Fund Source, Loans Canada, Sunshine Loans, and Choose Wisely Limited. Other players in the term loan market include Cashpal Super Fast Same Day Loans, Rupee Station Pvt. Ltd., BankBazaar.com, and others.

Recent Key Strategies and Developments in Term Loan Industry

In April 2024, Talen Energy Corporation launched an anticipated repricing of its existing $863 million Term Loan B credit facility and its $470 million Term Loan C credit facility (collectively, the "Term Loans") . The repricing is intended to reduce the interest rate on the Term Loans, and in connection therewith, Talen will seek certain waivers and amendments to the terms of its credit facilities.

In November 2023, UnionDigital Bank, the digital bank subsidiary of Union Bank of the Philippines, launched a “configurable” loan product that allows customers to adjust the loan tenor to make it much shorter term.

Key Sources Referred

Federal Reserve

U.S. Small Business Administration

U.S. Department of the Treasury

Federal Deposit Insurance Corporation

Consumer Financial Protection Bureau

U.S. Census Bureau

Government Accountability Office

Securities and Exchange Commission

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the term loan market segments, current trends, estimations, and dynamics of the term loan market analysis from 2024 to 2032 to identify the prevailing term loan market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the term loan market segmentation assists to determine the prevailing term loan market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global term loan market trends, key players, market segments, application areas, and term loan market growth strategies.

Term Loan Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 991.2 Billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2024 - 2032 |

| Report Pages | 354 |

| By Type |

|

| By Interest Rate |

|

| By Provider |

|

| By Region |

|

| Key Market Players | Choose Wisely Limited, Bajaj Finserv, BankBazaar.com, Sunshine Loans, Swoop Finance Ltd, Tata Capital Limited, Compare The Market Limited, Rupee Station Pvt. Ltd., US Fund Source, Loans Canada, Cashpal Super Fast Same Day Loans, Social Finance, Inc., Funding Circle Limited |

A term loan is a loan provided by a bank or financial institution with a fixed amount of capital, to be repaid over a specified period with regular payments of principal and interest.

The base year is 2023 in term loan market.

The forecast period for term loan market is 2024 to 2033.

The market value of the term loan market in 2033 is $991.2 billion.

The total market value of the term loan market is $576.8 billion in 2023.

Loading Table Of Content...