Thermoset Molding Compound Market Research, 2033

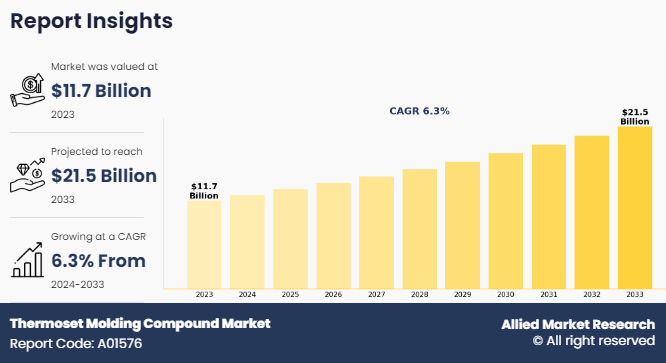

The global thermoset molding compound market size was valued at $11.7 billion in 2023, and is projected to reach $21.5 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033. The demand for thermoset molding compounds is driven by their growing applications in the electrical and electronics industries, coupled with an increase in need for lightweight and high-performance materials. These compounds offer exceptional thermal stability, mechanical strength, and electrical insulation properties that makes them ideal for use in various electronic components such as connectors, insulators, and circuit breakers.

Introduction

Thermoset molding compounds refer to a class of materials used in manufacturing processes where heat and pressure are applied to shape and cure these compounds into a final product. These materials are characterized by their ability to undergo a chemical reaction, typically irreversible that changes their state from a liquid or soft solid to a hardened, insoluble polymer network. This curing process is often triggered by heat, which causes cross-linking between polymer chains, resulting in a material that melted or reshaped once formed.

Key Takeaways

- The global thermoset molding compound market has been analyzed in terms of value ($billion). The analysis in the report is provided on the basis of type, end-use, 4 major regions, and more than 15 countries.

- The global thermoset molding compound market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the thermoset molding compound market are BASF SE, Rebling, SBHPP, Huntsman Corporation, Kyocera Corporation, Evonik Industries AG, Kolon Industries Inc., Plastics Engineering Company (PLENCO), HEXION INC., and Eastman Chemical Company.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global thermoset molding compound market.

Market Dynamics

Thermoset molding compounds exhibit excellent heat resistance, which is essential in electrical applications where components are exposed to elevated temperatures during operation or processing. Phenolic and epoxy resins offer high thermal stability and flame retardancy that makes them suitable for applications such as motor and transformer components, where safety and reliability under thermal stress are important. Furthermore, the versatility of thermoset molding compounds in manufacturing complex shapes and sizes through various molding processes supports their adoption in diverse electrical and electronic applications. According to the Internation Energy Agency (IEA), the energy consumed by information and communications technologies as well as consumer electronics is double in 2022 and increase threefold by 2030 to 1,700 Terawatt hours (TWh). All these factors are expected to drive the demand for thermoset molding compound market during the forecast period.

However, setting up manufacturing facilities for thermoset molding compounds requires significant capital investment. These compounds necessitate specialized equipment and infrastructure to handle their curing processes, which is complex and energy intensive. Manufacturers must invest in precise temperature and pressure control systems, as well as molds and tooling capable of withstanding high temperatures and pressures involved in the molding process. All these factors hamper thermoset molding compound market growth. As industries and consumers prioritize environmental sustainability, there is a growing demand for materials that reduce dependency on fossil fuels and minimize carbon footprints. Bio-based thermoset resins derived from renewable sources such as plant-based oils or biomass show promise in meeting these criteria. These materials offer comparable performance to traditional thermosets while offering the added benefit of lower environmental impact throughout their lifecycle. All these factors are anticipated to offer new growth opportunities for the thermoset molding compound market during the forecast period.

Segments Overview

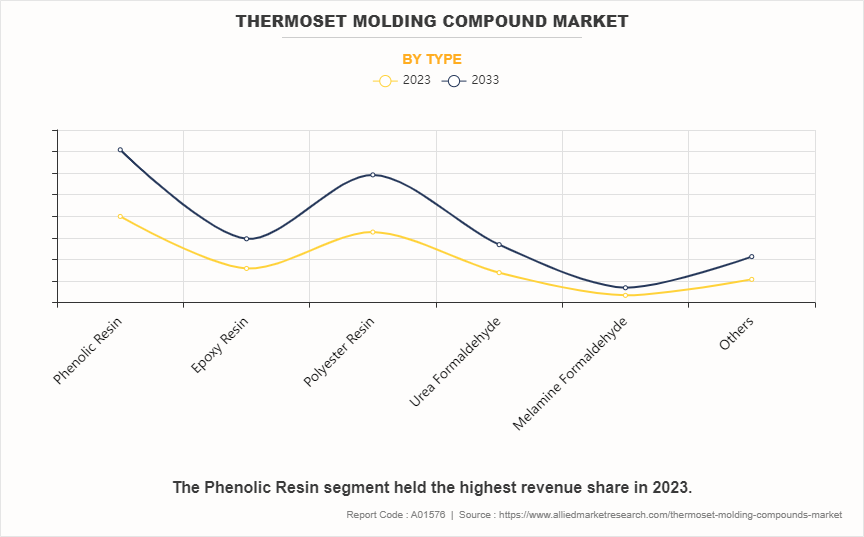

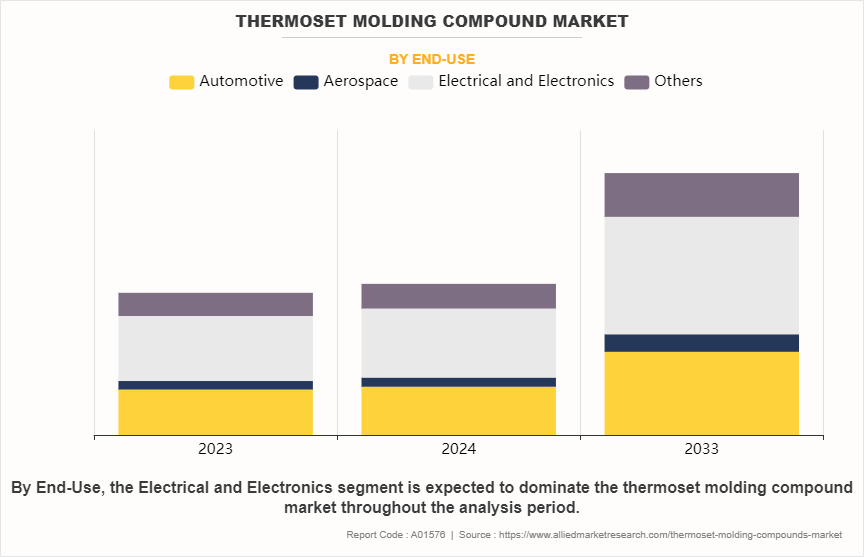

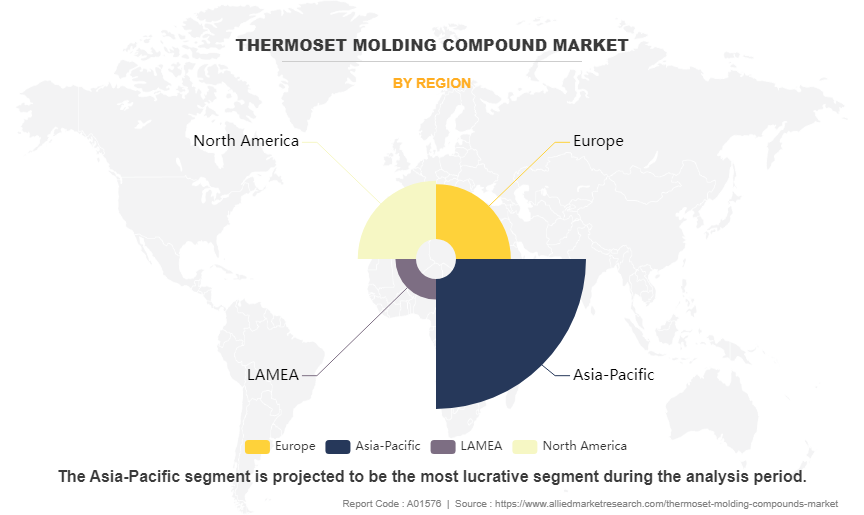

The thermoset molding compound market is segmented into type, end-use, and region. On the basis of type, the market is divided into phenolic resin, epoxy resin, polyester resin, urea formaldehyde, melamine formaldehyde, and others. By end-use, the market is segmented into automotive, aerospace, electrical and electronics, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

On the basis of type, the market is divided into phenolic resin, epoxy resin, polyester resin, urea formaldehyde, melamine formaldehyde, and others. The phenolic resin segment accounted for more than one-third of the thermoset molding compound market share in 2023 and is expected to maintain its dominance during the forecast period. Phenolic resins are valued for their mechanical strength and dimensional stability. They exhibit high stiffness, good impact resistance, and minimal creep under load, making them suitable for structural components and parts subjected to mechanical stress. This property extends their use to automotive brake pads, bearings, and industrial components where durability and reliability are essential.

By end-use, the market is segmented into automotive, aerospace, electrical and electronics, and others. The electrical and electronics segment accounted for less than half of the thermoset molding compound market share in 2023 and is expected to maintain its dominance during the forecast period. Thermoset molding compounds offer superior mechanical strength and dimensional stability compared to many thermoplastics that make them suitable for manufacturing components that require durability and reliability in harsh operating conditions.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA. Asia-Pacific accounted for less than half of the thermoset molding compound market share in 2023 and is expected to maintain its dominance during the forecast period. Government policies and initiatives play a significant role in driving the market for thermoset molding compounds in the region. Many Asia-Pacific countries are implementing policies aimed at promoting the use of advanced materials and technologies to boost their manufacturing sectors. For instance, the “Make in India” initiative and China’s “Made in China 2025” plan emphasize the development and adoption of high-performance materials to enhance domestic manufacturing capabilities. These initiatives provide substantial support and incentives for the adoption of thermoset molding compounds.

Competitive Analysis

Key players in the thermoset molding compound industry include BASF SE, Rebling, SBHPP, Huntsman Corporation, Kyocera Corporation, Evonik Industries AG, Kolon Industries Inc., Plastics Engineering Company (PLENCO), HEXION INC., and Eastman Chemical Company.

In the global thermoset molding compound industry, companies have adopted collaboration strategies to expand the market or develop new products. For instance, in March 2021, BASF announced a collaboration with Sumitomo (SHI) Demag to develop the first fully[1]automated, all-electric injection molding cell for manufacturing new high-performance polymers. This collaboration boosted the demand for thermoset molding compounds in the global market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the thermoset molding compound market forecast from 2024 to 2033 to identify the prevailing thermoset molding compound market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth thermoset molding compound market analysis and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global thermoset molding compound market trends, key players, market segments, application areas, and market growth strategies.

Thermoset Molding Compound Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 21.5 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 344 |

| By Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Eastman Chemical Company, Rebling, KYOCERA Corporation, BASF SE, Plastics Engineering Company (Plenco), Evonik Industries AG, SBHPP, HEXION INC., Kolon Industries, Inc., Huntsman International LLC. |

Analyst Review

According to the opinions of various CXOs of leading companies, the thermoset molding compound market is expected to witness an increase in demand during the forecast period. Growing applications of thermoset molding products in electrical and electronics and the increase in demand for lightweight and high-performance materials have increased the demand for thermoset molding compound during the forecast period. In the electrical and electronics industry, thermoset molding compounds play a critical role in producing components that require excellent electrical insulation properties, dimensional stability, and resistance to heat and chemicals. These materials are widely used in manufacturing electrical enclosures, insulators, connectors, and circuit protection devices. The ability of thermoset molding compounds to maintain their properties under harsh operating conditions, such as high temperatures and exposure to chemicals, makes them indispensable in ensuring the reliability and safety of electronic products.

Furthermore, advancements in material science and manufacturing technologies are expanding the capabilities of thermoset molding compounds. Manufacturers are continually developing formulations that offer enhanced mechanical properties, such as improved impact resistance, thermal stability, and flame retardancy. These advancements create new opportunities for thermoset materials in emerging sectors such as renewable energy, where durable and reliable components are needed for wind turbines, solar panels, and energy storage systems.

The global thermoset molding compound market size was valued at $11.7 billion in 2023, and is projected to reach $21.5 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

Sustainability and environmental considerations are the upcoming trends of Thermoset Molding Compound Market in the globe.

Electrical and electronics is the leading application of Thermoset Molding Compound Market.

Asia-Pacific is the largest regional market for Thermoset Molding Compound.

Key players in the thermoset molding compound market include BASF SE, Rebling, SBHPP, Huntsman Corporation, Kyocera Corporation, Evonik Industries AG, Kolon Industries Inc., Plastics Engineering Company (PLENCO), HEXION INC., and Eastman Chemical Company.

Loading Table Of Content...

Loading Research Methodology...