Traction Control System Market Overview

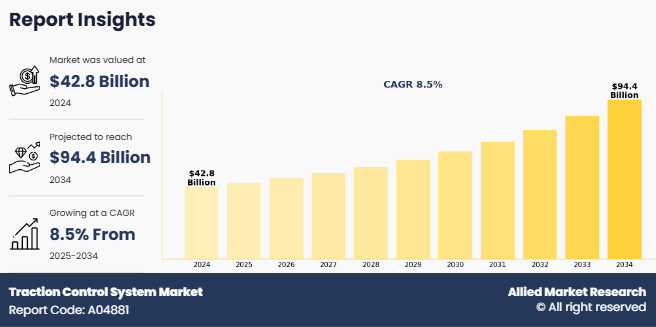

The global traction control system market size was valued at USD 42.8 billion in 2024, and is projected to reach USD 94.4 billion by 2034, growing at a CAGR of 8.5% from 2025 to 2034.

A traction control system (TCS) is a vital safety feature in modern vehicles that helps maintain grip between the tires and the road surface during acceleration. It works by preventing wheel slip, especially on slippery or uneven terrains, ensuring optimal traction and vehicle stability. The system continuously monitors the speed of each wheel using sensors and, when it detects a loss of traction, it automatically applies brake force to the slipping wheel or reduces engine power to restore control.

Key Takeaways

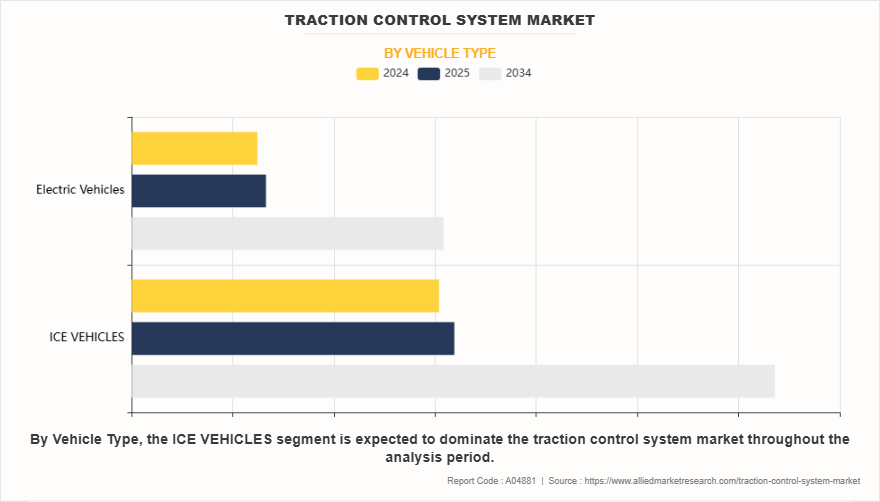

- On the basis of vehicle type, the ICE Vehicle segment held the largest share in the traction control system market in 2024.

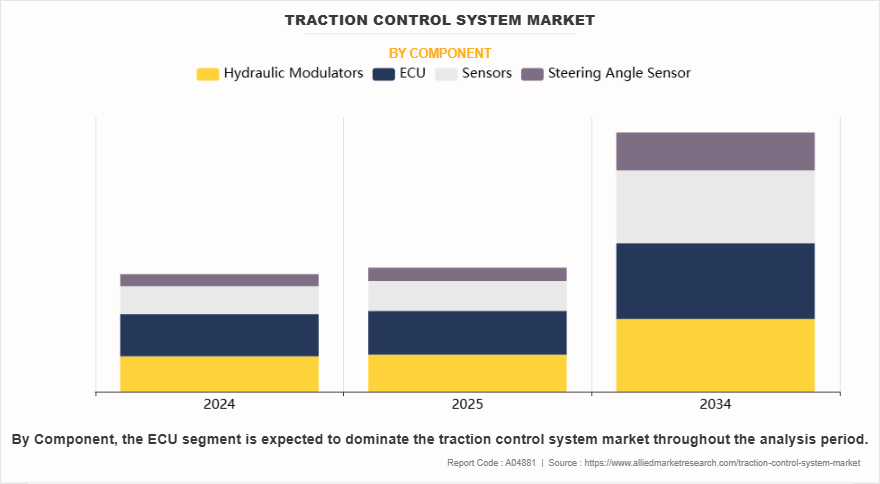

- By component, the ECU segment was the major shareholder in 2024.

- By type, the mechanical segment dominated the market in terms of share in 2024.

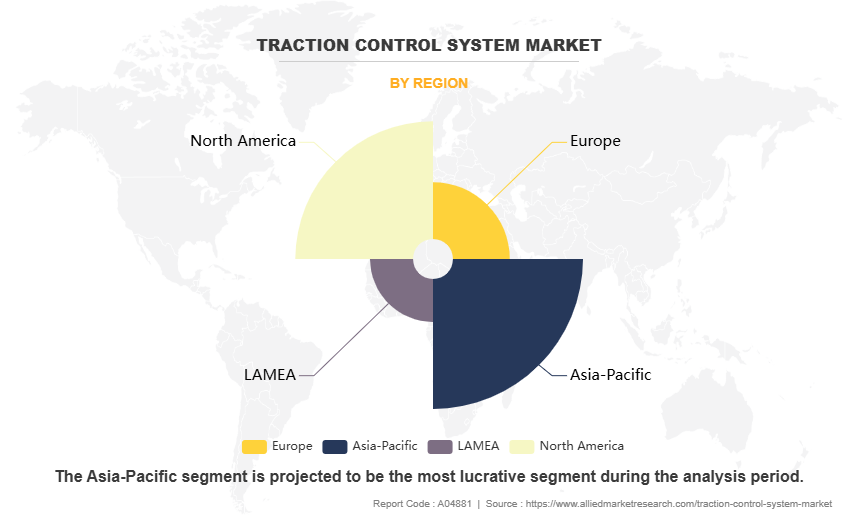

- Region wise, Asia-Pacific region held the largest market share in 2024.

Traction control is often integrated with other systems like anti-lock braking systems (ABS) and electronic stability control (ESC), enhancing overall vehicle safety. It is particularly useful during adverse weather conditions such as rain, snow, or ice, where the risk of wheel spin is high. As vehicle technologies advance and safety regulations tighten, traction control systems have become standard in most passenger cars, commercial vehicles, and electric vehicles, contributing to safer driving experiences.

For instance, in November 2023, Bosch launched its advanced modular Motorcycle Stability Control (MSC) system, combining ABS and a 3D IMU to improve rider safety and vehicle performance. Featured in the KTM RC 390, the system includes traction control and cornering ABS, enhanced by a pressure sensor for precise braking. Bosch also offers an MSC variant with ABS 10 and 3D IMU for emerging markets, providing key features like cornering brake and traction control. This launch highlights Bosch’s focus on flexible traction control solutions tailored to diverse market needs.

Moreover, in February 2024, Kawasaki launched two lean-sensitive traction control modes to enhance rider safety and performance. Mode 1, specifically tuned for sport riding, offers minimal intervention, allowing for greater control while maintaining traction during aggressive cornering. This mode supports smoother and faster corner exits by optimizing power delivery without compromising stability.

The growing emphasis on vehicle safety is significantly boosting the demand for traction control systems. As consumers increasingly prioritize advanced safety features, automakers are integrating technologies like traction control to enhance stability and prevent wheel slip, especially during acceleration and cornering. Government regulations mandating safety systems in vehicles are accelerating adoption. This rising demand reflects a broader industry shift toward improved driver and passenger safety across all vehicle segments. Furthermore, increase in global safety protocols, and growth in two-wheeler and passenger vehicle sales globally have driven the demand for the traction control system industry.

However, high maintenance costs are restraining the growth of the traction control system industry. These systems involve complex sensors and electronic components that require specialized servicing, leading to increased repair and maintenance expenses. For cost-sensitive consumers, especially in emerging markets, the long-term upkeep can be a deterrent. Limited availability of skilled technicians for advanced safety systems further adds to the challenge, affecting wider adoption across mid-range and budget vehicle segments. Furthermore, complex installation and maintenance requirements are hampering the growth of the traction control system market.

On the contrary, Expansion in emerging markets, driven by the rising demand for two-wheelers, presents a lucrative opportunity for the traction control system market share. As urbanization accelerates and disposable incomes grow, consumers in countries like India, Indonesia, and Vietnam are increasingly seeking safer and more reliable vehicles. Incorporating traction control systems in mid-range two-wheelers addresses safety concerns, aligns with evolving regulatory standards, and creates significant growth potential for manufacturers targeting these high-volume, price-sensitive markets.

Segment Review

The traction control system market is segmented on the basis of vehicle type, component, type and Region. Based on vehicle type, the market is divided into ICE vehicles and electric vehicles. By component, it is classified into hydraulic modulators, ECU, sensor, and steering angle sensor. On the basis of type, it is categorized into mechanical linkage and electrical linkage. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Vehicle Type

On the basis of vehicle type, the ICE Vehicle segment acquired the highest market share in 2024 in the traction control system market. This is primarily due to the widespread adoption of internal combustion engine vehicles globally. With decades of dominance in the automotive sector, ICE vehicles have long integrated traction control systems as a standard safety feature to enhance driving stability and prevent wheel slip under various road conditions. The mature infrastructure, cost-efficiency, and consumer familiarity with ICE vehicles have supported their continued demand. Despite the growing adoption of electric vehicles, the sheer volume of ICE vehicle production and sales ensures their leading position in traction control system installations.

By Component

On the basis of component, the ECU segment acquired the highest market share in 2024 in the traction control system market outlook. This dominance is attributed to its critical role in processing input data from various sensors and executing precise control over braking and engine torque. As the brain of the traction control system, the ECU ensures real-time monitoring and response to traction loss, significantly enhancing vehicle safety and stability. With the rising demand for advanced driver assistance systems (ADAS) and smart vehicle technologies, the integration of sophisticated ECUs has become more prevalent, further fueling their dominance in the market compared to other components like hydraulic modulators or sensors.

By Region

Region-wise, Asia-Pacific attained the highest market share in 2024 and emerged as the leading region in the traction control system market growth, driven by the rapid expansion of the automotive industry, rising disposable incomes, and growing consumer awareness regarding vehicle safety. Countries such as China, India, and Japan witnessed increased production and sales of both two-wheelers and passenger vehicles equipped with advanced safety features. Government regulations mandating safety technologies and the rising demand for electric vehicles further boosted adoption. The region’s strong manufacturing base, cost-effective production capabilities, and increasing investments in automotive innovation contributed significantly to its dominance in the global traction control system market size.

Meanwhile, North America is projected to grow at the fastest rate in the traction control system market during the forecast period, driven by stringent government regulations regarding vehicle safety, increasing consumer preference for premium and high-performance vehicles, and the rising adoption of electric and autonomous vehicles. The presence of major automotive manufacturers and advanced infrastructure for testing and deploying cutting-edge safety technologies also supports market growth. Growing awareness among consumers about road safety and the integration of advanced driver assistance systems (ADAS) are further fueling the demand for traction control systems across the region.

The report focuses on growth prospects, restraints, and trends of the traction control system market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the Traction control system market.

Competitive Analysis

The report analyses the profiles of key players operating in the Traction control system market such as Continental AG, Robert Bosch GmbH, AUTOLIV, HL Mando Corp., ZF Friedrichshafen AG, DENSO CORPORATION, Hitachi Ltd., ADVICS CO., LTD., NISSIN KOGYO Co., Ltd., Hyundai Mobis Co.,Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the traction control system market.

Market Drivers

Growing The Demand for Safety Features

The rise in demand for advanced safety features is significantly boosting the traction control system (TCS) market. As road safety becomes a global priority, consumers and automotive manufacturers are increasingly focusing on technologies that enhance vehicle stability and prevent accidents. Traction control systems play a critical role by preventing wheel slip during acceleration, especially on slippery or uneven surfaces. This not only improves handling and control but also reduces the risk of skidding, thereby enhancing overall driving safety. The growing implementation of stringent safety regulations by governments and automotive safety authorities worldwide is also compelling manufacturers to integrate TCS in vehicles, including entry-level models. Moreover, the rise in consumer awareness regarding vehicle safety, along with the demand for improved driving experience, is pushing automakers to offer TCS as a standard or optional feature. This growing emphasis on occupant safety is expected to continue fueling the adoption of traction control systems across various vehicle segments globally.

Integration of Electronics and Sensors in Automotive Systems

The growing integration of electronics and sensors in modern automotive systems is significantly boosting the demand for traction control systems. As vehicles become more technologically advanced, the reliance on real-time data and responsive control mechanisms has intensified. Traction control systems utilize sensors to monitor wheel speed, steering angle, throttle position, and road conditions to prevent wheel slippage during acceleration. The incorporation of electronic control units (ECUs), advanced driver-assistance systems (ADAS), and intelligent braking systems requires seamless coordination with traction control units to enhance vehicle stability and safety. This trend is especially prominent in premium and mid-range passenger vehicles, where manufacturers are focusing on improving driving dynamics and occupant protection. Moreover, with the rising popularity of electric and hybrid vehicles that rely heavily on electronic architecture, traction control systems are becoming standard components. As automakers continue to innovate with integrated electronics, the traction control system market is poised for consistent growth across all vehicle segments

Rise in Demand of Two-wheeler and Passenger Vehicle Sales Globally

The global rise in two-wheeler and passenger vehicle sales is significantly boosting the demand for traction control systems (TCS). As personal mobility becomes more essential—especially in densely populated and urbanizing regions—sales of motorcycles, scooters, and passenger cars are witnessing a notable surge. This growth is further accelerated by rising disposable incomes, improved road infrastructure, and expanding middle-class populations in developing countries. With increasing vehicle adoption, consumer focus is shifting toward safety and performance, compelling manufacturers to incorporate advanced safety technologies like TCS. In the two-wheeler segment, especially premium and mid-range models, TCS is becoming a key differentiator, enhancing ride stability and control under slippery or challenging road conditions. Similarly, in passenger vehicles, TCS is now often offered as a standard feature, reflecting growing customer expectations and regulatory requirements. As vehicle ownership continues to grow globally, the integration of TCS is expected to rise in parallel, driving sustained demand in the market.

High Maintenance Costs

High maintenance costs are significantly hampering the demand for the traction control system (TCS) market. TCS relies on a complex network of electronic and mechanical components, including sensors, ECUs, and hydraulic modulators, which require regular servicing and calibration to function effectively. Over time, wear and tear or system malfunctions can lead to expensive repairs or component replacements, especially in vehicles that are frequently driven in harsh road conditions.

Furthermore, the need for skilled technicians and advanced diagnostic tools to service TCS adds to the cost burden for vehicle owners. In cost-sensitive markets, these ongoing expenses can discourage consumers from opting for vehicles equipped with traction control systems, particularly in lower-income segments. In addition, fleet operators and commercial vehicle owners often avoid integrating such systems to reduce operational expenses. As a result, the high maintenance costs associated with TCS are limiting its widespread adoption, especially in developing regions and price-conscious consumer markets.

Dependency on Sensor and Software Reliability

The traction control system (TCS) heavily relies on the precision and reliability of sensors and software to function effectively, and this dependency can hamper its market growth. TCS operates through real-time monitoring of wheel speed, acceleration, and road conditions, which is only possible with highly sensitive sensors and advanced control algorithms. Any malfunction or delay in sensor response can compromise the system’s effectiveness, leading to inaccurate interventions or even system failure. In harsh environments or poor road conditions, sensors may become prone to damage or provide faulty data, reducing the overall reliability of the system. Similarly, software glitches or outdated algorithms can impair performance, making drivers hesitant to rely entirely on TCS for safety. These concerns are particularly significant for cost-sensitive and remote markets where regular calibration, diagnostics, or software updates are difficult to access. Consequently, the system’s dependency on seamless hardware-software coordination remains a key restraint for broader market adoption.

Expansion in Emerging Markets with Rise in Two-Wheeler Demand

The expansion into emerging markets, particularly with the rising demand for two-wheelers, offers a lucrative opportunity for the traction control system (TCS) market. Countries such as India, Indonesia, Vietnam, and Brazil are witnessing a surge in two-wheeler sales due to growing urbanization, increasing middle-class population, and inadequate public transport infrastructure. As consumer expectations shift toward improved safety and performance, manufacturers are focusing on integrating advanced safety technologies, including TCS, even in budget and mid-range two-wheelers.

Furthermore, governments in these regions are gradually tightening vehicle safety norms, encouraging the adoption of technologies that reduce road accidents and enhance rider safety. Major OEMs are also leveraging this trend by launching two-wheelers equipped with TCS to gain competitive advantage and cater to the evolving demands of safety-conscious consumers. With a large untapped customer base, supportive regulatory outlook, and rising awareness of vehicle safety, emerging markets are poised to become strong growth drivers for the global TCS market.

Expansion in Untapped Market of Developing Countries

The expansion into untapped markets of developing countries presents a lucrative opportunity for the traction control system (TCS) market. Rapid urbanization, increasing disposable incomes, and growing awareness of road safety are driving demand for advanced safety features in vehicles across emerging economies in Asia-Pacific, Latin America, and Africa. Governments in these regions are also introducing stricter vehicle safety regulations and promoting the adoption of safety-enhancing technologies, which is expected to support TCS integration.

Moreover, the rising sales of passenger vehicles and two-wheelers, particularly in countries like India, Indonesia, Brazil, and South Africa, provide a vast customer base for automotive safety systems. As global OEMs expand their manufacturing footprint and launch affordable models tailored for local markets, the inclusion of traction control systems becomes more viable. In addition, initiatives to improve road infrastructure and growing investments in the automotive sector further enhance market potential. These factors collectively make developing regions a high-growth frontier for the TCS market.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Traction control system market analysis from 2024 to 2034 to identify the prevailing Traction control system market forecast.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the Traction control system market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global Traction control system market trends, key players, market segments, application areas, and market growth strategies.

Traction Control System Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 94.4 billion |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 353 |

| By Vehicle Type |

|

| By Component |

|

| By Type |

|

| By Region |

|

| Key Market Players | HL Mando Corp., AUTOLIV, DENSO CORPORATION, Robert Bosch GmbH, Hyundai Mobis Co Ltd., Hitachi Ltd., Continental AG, ZF Friedrichshafen AG, ADVICS CO., LTD., NISSIN KOGYO Co., Ltd. |

Analyst Review

Traction control system is an advanced active braking system used in automobiles, which helps drivers to control their vehicles. It allows wheels of a vehicle to maintain dynamic contact with the road surface, which is proportional to the braking inputs given by the driver. It is an active vehicle safety feature designed to help vehicles make effective use of the traction available on the road when accelerating on low-friction road surfaces. When a vehicle without traction control attempts to accelerate on a slippery surface such as ice, snow, or loose gravel, the wheels are inclined to slip. The result of wheel slip is that the tires spin quickly on the surface of the road without gaining any actual grip, so the vehicle does not accelerate. Traction control activates when it senses that the wheels may slip, helping drivers make the most of the traction that is available on the road surface.

Growth in the demand for safety features such as ABS, traction control system and ESC, owing to the increasing number of road accidents around the world, drives the growth of the world traction control system market in almost all the geographies. According to The Global Burden of Disease, published by The Harvard School of Public Health on behalf of the World Health Organization and the World Bank, road accidents will become the third leading cause of death by 2020. This has created an upsurge in the demand for safety features to be incorporated in automobiles, for the protection of lives. As per Bosch Research Studies and ASEAN, 26% of all powered two-wheeler accidents in Germany can be prevented through ABS ad traction control system technologies.

Market players focus on product launch and merger to expand their presence in the market and improve their offerings. For instance, ZF TRW expanded its business by manufacturing integrated brake control (IBC) system, a vacuum independent technology which simplifies the brake system architecture in high volume for vehicle manufacturers.

Opportunities such as usage of development of advanced braking systems for two wheelers, electric vehicles, and autonomous vehicles are expected to boost the traction control system market growth.

The Traction Control System market is being shaped by several key emerging trends: AI and machine learning enable predictive traction adjustments using real-time data like weather and driver behavior; integration with ADAS and V2X connectivity is enhancing coordinated vehicle safety

The leading application of the traction control system (TCS) market is in passenger vehicles, as automakers increasingly integrate TCS to enhance safety, stability, and compliance with strict global automotive safety regulations.

Asia-Pacific is the largest regional market for Traction Control System

traction control system market" was valued at $42.8 billion in 2024, and is estimated to reach $94.4 billion by 2034, growing at a CAGR of 8.5% from 2025 to 2034.

Continental AG, Robert Bosch GmbH, AUTOLIV, HL Mando Corp., ZF Friedrichshafen AG, DENSO CORPORATION, Hitachi Ltd., ADVICS CO., LTD., NISSIN KOGYO Co., Ltd., Hyundai Mobis Co.,Ltd.

Loading Table Of Content...

Loading Research Methodology...