U.S. And Europe Polyphenol Market Overview:

The U.S. and Europe polyphenol market is projected to reach $584,907 million by 2025, registering a CAGR of 5.0% and a market volume of 17,892 tons, with a CAGR of 7.7% from 2018 to 2025.

Polyphenol is a chemical substance found in plants. Phenolic acids, flavonoids, and tannins are the most commonly available phenolic substances consumed by humans. Polyphenol can be extracted through a number of fruits and vegetables sources, in which apples, green tea, and pomegranate are some of the richest sources of polyphenol. There are over 8,000 identified polyphenols found in tea, wine, chocolates, fruits, vegetables, olive oil, and others. The health effects of polyphenols depend on the amount consumed and on their bioavailability. Polyphenols have diverse health benefits, which include fighting cancer and inhibiting angiogenesis, protecting skin against photo damage caused by ultraviolet radiations, helping in reducing aging, promoting brain health, supporting blood sugar level, protecting the cardiovascular system, and others. Moreover, many skin care products or cosmeceuticals have been developed on polyphenol enriched plant extracts.

The leading players in the meat, poultry, and seafood have focused on product launch and business expansion as their key strategies to gain a significant share in the market. The key players profiled in the report include Amax Nutrasource, Inc., Cargill Inc., Koninklijke Dsm N.V., Frutarom Industries Ltd., Futureceuticals, Inc., Glanbia Nutritionals, Inc., Herza Schokolade GmbH and Co. Kg, Indena S.P.A., Swanson Health Products, and Berkem.

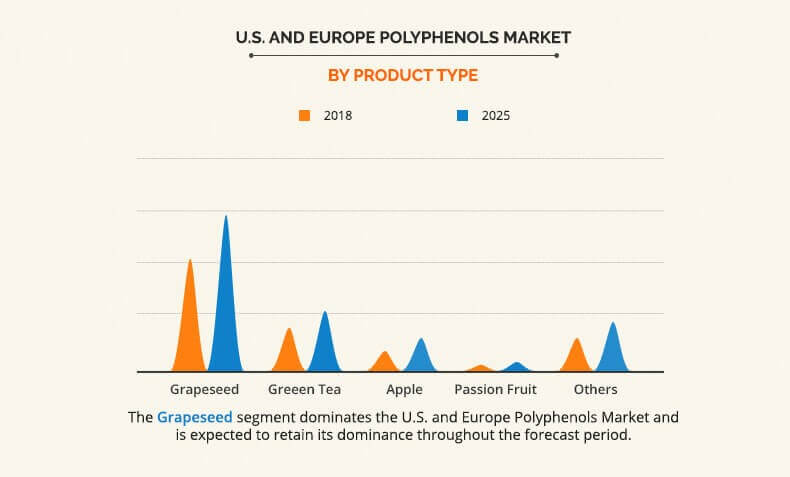

In 2017, grapeseed segment dominated the U.S. and Europe polyphenol market. This is attributed to grape seed being used as a remedy for a number of health conditions due to the presence of anti-oxidant polyphenols and high macro and micro nutritional value. The grape seed extract experiences growth due to its antioxidant and antiaging properties along with the increase in demand from personal care and skin care market.

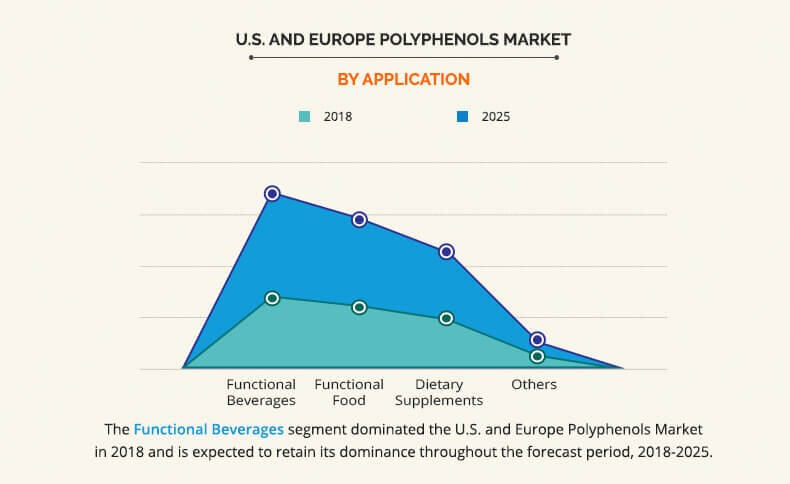

In 2017, the functional beverage segment accounted for the highest contribution in the U.S. and Europe polyphenol market owing to rise in health consciousness in people in the U.S. and Europe. The busy lifestyle and the lack of time caused by the busy lifestyle has encouraged people to find alternative to food that is nutritious and tasty, which leads to the adoption of functional beverages. The health benefits and the convenience offered by functional drinks has been the major factor that drives the growth of the functional beverage segment in the polyphenol market.

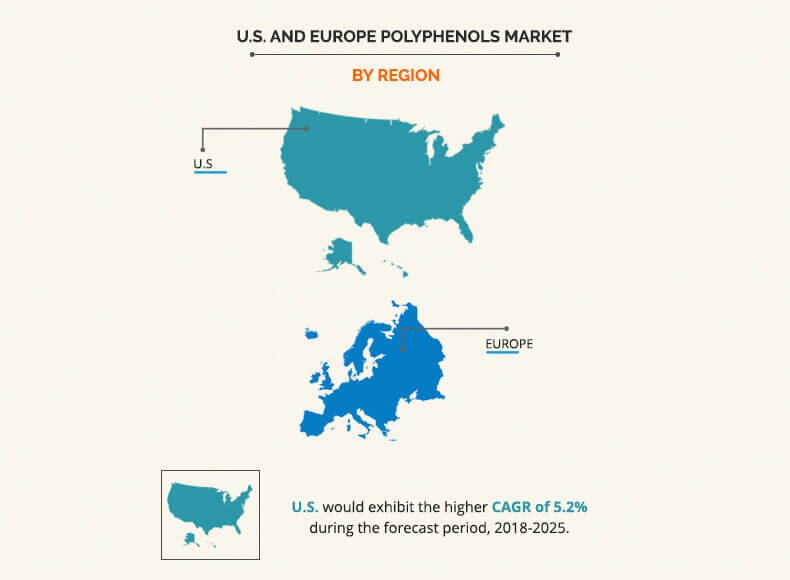

In 2017, Europe dominated the market. Rise in knowledge about health and health products among the consumers drives the growth of the polyphenol market in Europe. The increase in adoption of healthy lifestyle coupled with a hectic daily schedule due to longer working hours especially in the corporate sector has encouraged people to find convenient alternatives for nutrition. The search of these convenient sources of nutrition has led to high adoption of supplements, functional food, and beverages, which drives the market for polyphenol in Europe. However, the U.S. market is expected to grow at a higher CAGR owing to the growth in preference of functional and herbal products among the population in the U.S. The surge in aging population in the U.S. boosts the growth of the polyphenol market due to rise in health awareness. The search of these convenient sources of nutrition, such as supplements, functional food, and beverages also drives the market for polyphenol in the U.S.

Key Benefits For U.s. And Europe Polyphenol Market:

The report provides an in-depth analysis of the current trends, drivers, and dynamics of the U.S. and Europe polyphenol market to elucidate the prevailing opportunities and tap the investment pockets.

It offers qualitative trends and quantitative analysis of the global market from 2018 to 2025 to assist stakeholders to understand the market scenario.

In-depth analysis of the key segments demonstrates the types of polyphenol available.

Competitive intelligence of the industry highlights the business practices followed by key players across geographies and the prevailing market opportunities.

Key players and their strategies and developments are profiled to understand the competitive outlook of the market.

U.s. And Europe Polyphenol Key Market Segments:

By Type

Apple

Green Tea

Grape Seed

Maracuy/Passion Fruit

Others

By Application

Functional Beverages

Functional Foods

Dietary Supplements/Nutraceuticals,

Others

By Region

U.S.

Europe

U.S. and Europe polyphenol Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | NATUREX S.A., GLANBIA PLC. (GLANBIA NUTRITIONALS, INC.), FUTURECEUTICALS, AMAX NUTRASOURCE, INC., BERKEM, KONINKLIJKE DSM N.V., SWANSON HEALTH PRODUCTS, INC., INDENA S.P.A., CARGILL INC., NOF AMERICA CORPORATION |

Analyst Review

The polyphenol market holds a substantial scope for growth in the U.S. and Europe. It is in its growth stage currently; however, its contribution to the U.S. and Europe market is expected to increase significantly within the next seven years. Rise in health awareness and increase in geriatric population in the U.S. and Europe boost the growth of the polyphenol market, significantly.

Increase in R&D activities coupled with technological advancement such as supercritical carbon dioxide (SC-C02) technologies increased the application of polyphenols in food & beverages to fortify their nutritional content on account of generally recognized as safe (GRAS) status given to them. In addition, advancements in the biotechnology sector help in the extraction of polyphenol from plants and herbs for the development of herbal products. There is an increase in the demand for herbal products among the sick and elderly owing to the growth in the popularity of herbal medicines that contain polyphenols. This further drives the growth of the market.

Rise in awareness among consumers toward the health benefits and the nutritional & skin benefits provided by these compounds attract the consumers providing opportunities for the market players to develop innovative products and upgrade the available technologies. In addition, the antiaging properties associated with polyphenols drive the growth of the market in the cosmetic industry.

U.S. and Europe polyphenol market is projected to reach $584,907 million by 2025, registering a CAGR of 5.0% and a market volume of 17,892 tons

The global U.S. and Europe polyphenol market is projected to grow at a compound annual growth rate of 7.7%

NATUREX S.A., GLANBIA PLC. (GLANBIA NUTRITIONALS, INC.), SWANSON HEALTH PRODUCTS, INC., INDENA S.P.A., NOF AMERICA CORPORATION, BERKEM, KONINKLIJKE DSM N.V., FUTURECEUTICALS, AMAX NUTRASOURCE, INC., CARGILL INC.

The health benefits and the convenience offered by functional drinks has been the major factor that drives the growth of the functional beverage segment in the polyphenol market.

Loading Table Of Content...