Underfloor Heating Market Research, 2030

The global underfloor heating market was valued at $5.2 billion in 2023, and is projected to reach $8.1 billion by 2030, growing at a CAGR of 6.7% from 2024 to 2030.

Introduction

Underfloor heating is a central heating system that provides thermal comfort through conduction, radiation, and convection by installing heating elements beneath the floor surface. There are two primary types electric and hydronic. Electric systems use heating cables, mats, or films, ideal for small areas or renovations due to easy installation. Hydronic systems, suitable for larger areas or new constructions, circulate heated water through pipes embedded in the floor, offering greater long-term efficiency.

Underfloor heating ensures even heat distribution, reducing energy consumption and providing consistent warmth, improving comfort and air quality by minimizing dust circulation. It also enhances aesthetics by freeing up space typically occupied by radiators, allowing flexible interior design. In addition, underfloor heating systems pose fewer safety risks and require less maintenance compared to traditional heating methods. Its growing adoption is driven by technological advancements, energy efficiency standards, and a focus on sustainable building practices.

Key Takeaways

- The underfloor heating market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2030.

- More than 1, 500 product literature, industry releases, annual reports, and other documents of major valine industry participants, authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve the most ambitious growth objectives.

Market Dynamics

The underfloor heating market is experiencing significant growth driven by the increasing demand in cold regions for efficient heating solutions. Factors such as enhanced energy efficiency, low maintenance requirements of electric heating systems, design flexibility, and easy installation are key drivers propelling the market forward. Both electric and hydronic radiant heating systems offer efficient warmth by heating a room from the floor, with hydronic systems circulating hot water through pipes and electric systems warming wiring beneath the floor. Compared to traditional radiators, underfloor heating industry provides consistent and customizable warmth without overheating, maintaining a comfortable environment based on user-set temperatures.

However, challenges such as high upfront costs and limited awareness about radiant heating systems among consumers have hindered market growth. Nevertheless, the push towards achieving net-zero carbon targets by 2050 and the phasing out of gas boilers for residential heating purposes through government policies create favorable conditions for the underfloor heating market. This regulatory support is encouraging the adoption of sustainable heating solutions, driving market expansion, and incentivizing consumers to invest in energy-efficient underfloor heating systems.

Moreover, the rapid growth of the construction industry in developing countries like India and China, coupled with the presence of cold zones in these regions, is fueling the demand for underfloor heating solutions. In addition, countries with semi-desert and desert climates contribute to underfloor heating market growth as the demand for efficient heating solutions in such regions becomes important. This trend indicates a positive outlook for the underfloor heating market share as it continues to expand its presence in various regions, driven by a combination of regulatory support, technological advancements, and growing awareness of the benefits of underfloor heating systems.

Segment Overview

The underfloor heating market is segmented based on product type, system, installation type, application, and region. On the basis of product type, the market is categorized into hydronic and electric. On the basis of system, the global underfloor heating market is segmented into heating system, and control system. On the basis of installation type, it is divided into new installations, and retrofit installations. On the basis of application, it is classified into residential, commercial, and industrial. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

HVAC Industry Impact On Underfloor Heating Market

The Heating, Ventilation, and Air Conditioning (HVAC) industry is a cornerstone of modern living, providing essential climate control for residential, commercial, and industrial buildings. Within this expansive sector, the underfloor heating market has seen significant growth, driven by trends in energy efficiency, environmental sustainability, and advanced home heating technologies. Harsh winter conditions, like those experienced in January 2023, underscore the critical role of reliable and efficient home heating systems. With average temperatures dipping just above 35 degrees Fahrenheit and multiple winter storms impacting vast regions of the U.S., the demand for effective heating solutions intensifies. Underfloor heating systems, known for their efficiency and comfort, become increasingly attractive in such climates.

Winter emissions often surpass summer levels due to the heightened use of heating systems. Traditional heating methods, such as coal-fed boilers, emit significant pollutants. While natural gas and oil are cleaner alternatives, they still contribute to high CO2 and greenhouse gas emissions. Buildings account for 26% of global energy-related emissions, with a substantial portion stemming from heating. Underfloor heating systems, especially those utilizing renewable energy sources like geothermal and solar, offer a more sustainable solution. These systems can reduce overall emissions by operating more efficiently and leveraging cleaner energy.

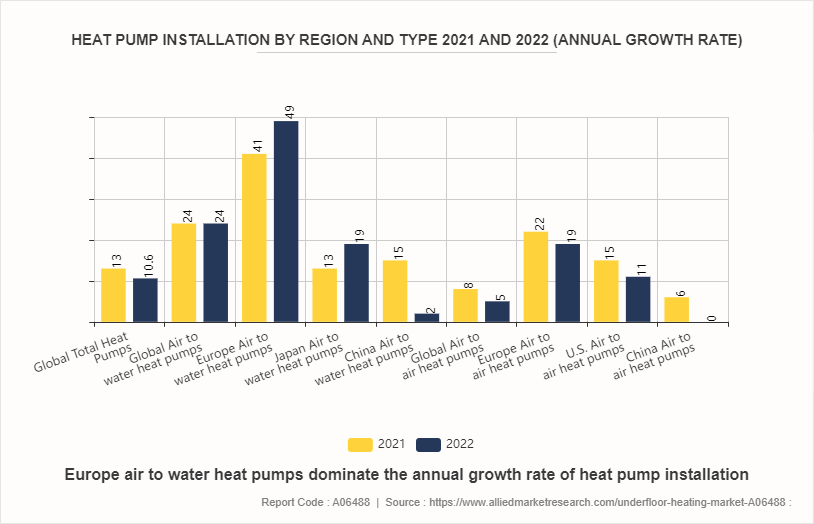

Heat Pump Installation By Region and Type 2021 and 2022

Heat pumps are poised to continue their significant impact on the underfloor heating market size from 2024 to 2050. By 2030, global heat pump sales are projected to meet nearly 20% of the heating needs in buildings, up from around 10% currently. This growth is driven by increased policy support, rising energy prices, and a commitment to reduce greenhouse gas emissions. In Europe, where underfloor heating is prevalent, sales of air-to-water heat pumps have surged, particularly in countries like Germany, Poland, and the Nordic region, where these systems integrate seamlessly with underfloor heating technologies.

In North America, the shift towards heat pumps continues, with projections indicating a steady increase in adoption rates, especially in colder regions where underfloor heating combined with heat pumps offers efficient heating solutions. Asia, including Japan and Korea, is also expected to see continued growth in heat pump installations for underfloor heating systems, driven by incentives and technological advancements enhancing energy efficiency.

Looking towards 2050, heat pumps are envisioned as a cornerstone of global efforts to achieve net-zero emissions. Policies aimed at phasing out fossil fuel-based heating systems are expected to accelerate heat pump adoption worldwide, including in regions where upfront costs have been a barrier. This trajectory underscores heat pumps' role not only in enhancing comfort and energy efficiency but also in advancing sustainable heating solutions across diverse global markets.

Competitive Analysis

The major companies profiled in this report include Danfoss, Daikin, Emerson Electric Co., Honeywell, Mitsubishi Electric Corporation, Pentair Plc, Robert Bosch, Siemens, Schneider Electric, and Thermosoft International. Rapid development of industrialization, modernization and spread of information through internet led to the development of tourism industry which in-turn has fuelled the demand for infrastructure hence driving the growth of the market. Additional growth strategies such as product launch, acquisition, partnership, and research & innovation lead to attain key developments in the global underfloor heating market trends.

In addition to the above mentioned companies Warmup, Uponor Corporation Amuheat, Rehau AG, and nVent Electric are also competing for the share of the market through expansion of production capabilities, partnership, and product launch to meet the future demand for underfloor heating market forecast period

Parent Market Overview

The HVAC (Heating, Ventilation, and Air Conditioning) industry is a dynamic and evolving sector that plays a crucial role in maintaining indoor comfort and air quality across residential, commercial, and industrial buildings. Key trends in the industry are driven by the increasing focus on energy efficiency, the integration of renewable energy sources, and the rise of smart home technologies.

The HVAC industry is focused on improving energy efficiency to reduce emissions and operational costs. Modern underfloor heating systems, a segment within the HVAC market, are designed to maximize heat distribution while minimizing energy consumption. For instance, energy-efficient underfloor heating systems can achieve up to 30% energy savings compared to traditional heating methods. Properly sealed ducts, routine maintenance, and energy assessments are critical in enhancing overall efficiency and aligning with the broader trends in the HVAC industry.

With the global shift towards renewable energy, the HVAC industry is incorporating solar, geothermal, and bioenergy sources into heating systems. The integration of these renewable sources is expected to contribute significantly to the industry's growth, driven by government incentives and the increasing demand for sustainable solutions. Underfloor heating is particularly well-suited for these integrations, offering a low-emission alternative to traditional heating methods.

The rise of smart home technology is transforming the HVAC industry, with smart thermostats and home automation systems playing a pivotal role. These technologies allow for precise control of underfloor heating, optimizing energy use and enhancing comfort. Smart HVAC systems can adjust heating patterns based on occupancy and weather forecasts, leading to improved efficiency and cost savings.

Key Sources Referred

- IEA

- Underfloor Heating Solutions

- Centre for Sustainable Energy

- BEAMA Underfloor

- The Electric Underfloor Heating Alliance

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the underfloor heating market analysis from 2024 to 2030 to identify the prevailing underfloor heating market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the underfloor heating market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global underfloor heating market trends, key players, market segments, application areas, and market growth strategies.

Underfloor Heating Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 8.1 Billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2024 - 2030 |

| Report Pages | 340 |

| By Product Type |

|

| By System |

|

| By Installation |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Danfoss A/S, Schneider Electric, Emerson Electric Co., Robert Bosch GmbH, ThermoSoft International, Daikin Industries Ltd, Honeywell, Pentair plc, Siemens AG, Mitsubishi Electric Corporation |

The global underfloor heating market was valued at $5.2 billion in 2023, and is projected to reach $8.1 billion by 2030, growing at a CAGR of 6.7% from 2024 to 2030.

Technological advancements, increasing demand for energy efficiency, integration with smart home systems, use of sustainable and environmentally friendly materials are the upcoming trends of underfloor heating market in the globe.

Residential is the leading end-use of underfloor heating market.

Europe is the largest regional market for underfloor heating market.

Danfoss, Daikin, Emerson Electric Co., Honeywell are the top companies to hold the market share in underfloor heating market.

Loading Table Of Content...