Universal Life Insurance Market Research, 2033

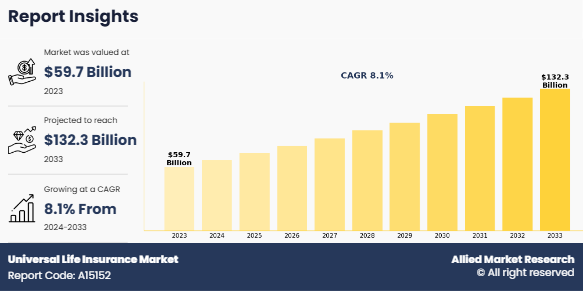

The global universal life insurance market was valued at $59.7 billion in 2023, and is projected to reach $132.3 billion by 2033, growing at a CAGR of 8.1% from 2024 to 2033.

Global universal life insurance is a type of permanent life insurance that provides lifetime coverage if the policyholder pays the premiums and meets any other requirements to maintain coverage. It combines a savings component called cash value, with a death benefit. The cash value grows tax-deferred over the policyholder's lifetime and be borrowed against or cashed in. Universal life insurance offers more flexibility than whole life insurance, as policyholders adjust their premiums and death benefits within certain limits. However, if the policyholder's investments underperform or they underpay for too long, it could affect their death benefit or cause the policy to lapse. The cost of insurance (COI) is the minimum amount required to keep the policy active, and it consists of several items rolled together. When the policyholder dies, the insurance company keeps the account's cash value, and their beneficiaries will be paid just the death benefit. Universal life insurance policies may come with a minimum interest rate, protecting the policyholder from significant losses if interest rates drop.

Surge in adoption of low cost insurance plans and the ability to accumulate cash value over time boosts the growth of the global universal life insurance market. In addition, factors such as the higher possibility of estate planning and wealth transfer of universal life insurance have positively impacted the universal life insurance market growth. However, interest rate sensitivity and complexity and understanding are expected to hamper market growth. On the contrary, rise in demand for financial planning solutions is expected to offer remunerative universal life insurance market opportunity during the forecast period. Each of these factors is projected to have a positive impact during global universal life insurance market forecast.

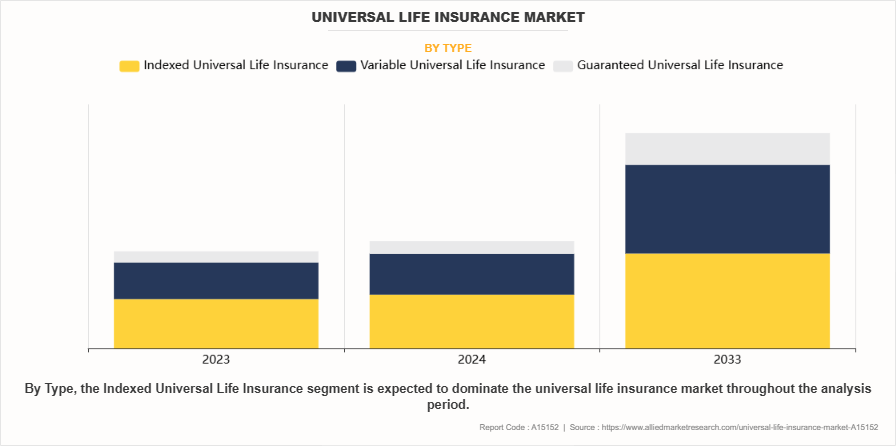

By type, the global universal life insurance market size was led by the indexed universal life insurance segment in 2023 and is projected to maintain its dominance during the forecast period, owing to increasing demand for policies that offer the potential for higher returns than traditional universal life insurance. However, the guaranteed universal life Insurance segment is expected to grow at the highest rate during the forecast period, owing to technological advancement and a rise in awareness among the people is projected to attract many new consumers, which boost the global universal life insurance market size.

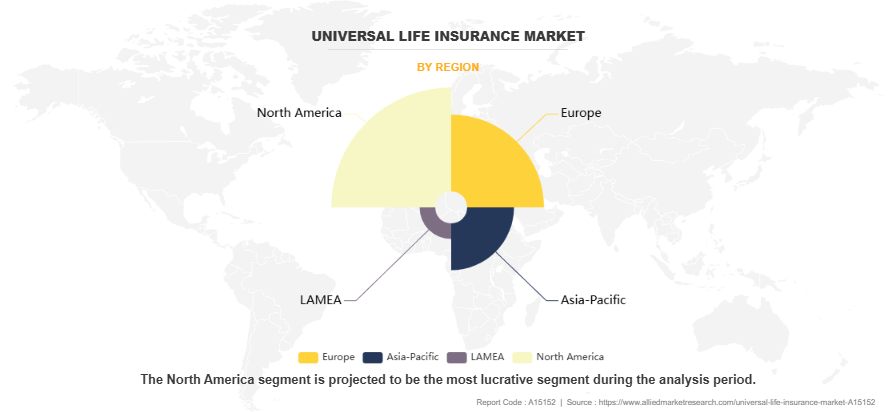

Region-wise, the universal life insurance market share was dominated by North America in 2023 and is expected to retain its position during the forecast period. This is attributed to rising income levels, and longer life expectancies. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to consumer awareness and major players of the market targeting developing countries of Asia-Pacific.

The report focuses on the growth prospects, restraints, and trends of global universal life insurance market analysis. The study provides Porter's five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global universal life insurance market outlook.

Key Findings of The Study

By type, the indexed universal life insurance segment accounted for the largest universal life insurance market share in 2023.

Region wise, North America generated the highest revenue in 2023.

Depending on distribution channel, the guaranteed universal life insurance segment generated the highest revenue in 2023.

Segment review

The universal life insurance industry is segmented into type, distribution channel, and region. In terms of type, the market is fragmented into Indexed universal life insurance, variable universal life insurance, and guaranteed universal life insurance. Depending on the distribution channel, it is divided into direct sales, brokers/agents, banks, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in the global universal life insurance industry are American International Group, Inc., AXA, John Hancock, MetLife Services and Solutions, LLC., Mutual of Omaha Insurance Company, Penn Mutual, Progressive Casualty Insurance Company, Protective Life Corporation, Prudential Financial, Inc., and Symetra Life Insurance Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Market Landscape and Trends

Insurance providers are diversifying their product offerings to cater to a broader range of customer needs. Universal life insurance, with its flexibility and cash value component, is part of this diversification strategy. Insurance companies are increasingly looking for opportunities to expand their footprint globally, reaching new markets and demographics. Insurers are investing in digital technologies to enhance customer experiences, streamline processes, and offer more personalized services. Online platforms and digital tools are becoming integral to the insurance landscape. Consumers are seeking personalized insurance solutions that align with their individual needs and preferences. Insurance providers are responding by offering more customizable features within universal life insurance policies. There is a growing awareness among consumers about the benefits of permanent life insurance, including the cash value accumulation feature and potential tax advantages.

Top Impacting Factors

Surge in adoption of low-cost insurance plans

Universal life insurance allows customers to purchase insurance policies at a low cost, and with flexible payment plans. This allows customers to purchase insurance coverage without the need to make a large up-front payment. In addition, customers take advantage of the cash value feature offered through universal life policies. The cash value of the policy is used for a variety of purposes, such as providing extra financial security or funding a child's college tuition. One of the primary drivers fueling the growth of the universal life insurance market is the flexibility and customization it offers to policyholders. Universal life insurance policies allow individuals to adjust their premium payments and death benefits within certain limits, providing a level of flexibility not typically found in traditional life insurance products. Policyholders tailor their coverage to align with changing financial needs, making universal life insurance an attractive option for those seeking adaptable and personalized financial protection.

The ability to accumulate cash value over time

Another significant driver of the universal life insurance market is the ability to accumulate cash value over time. Unlike term life insurance, universal life insurance includes a cash value life insurance component that grows on the basis of interest rates and other factors. This cash value is accessed by policyholders during their lifetime for various purposes, such as supplementing retirement income or covering unforeseen expenses. The potential for cash value accumulation enhances the overall value proposition of universal life insurance, attracting individuals looking for a hybrid life insurance product that provides both protection and a savings element.

Interest rate sensitivity

One notable restraint for the universal life insurance market is its sensitivity to interest rates. The cash value component of universal life insurance policies often earns interest based on prevailing market rates. In a low-interest-rate environment, policyholders may experience slower growth in the cash value of their policies. This interest rate sensitivity impacts the overall attractiveness of universal life insurance as an investment, especially for individuals seeking robust cash value accumulation hampers growth of the universal life insurance market.

Complexity and understanding

The complexity of universal life insurance policies acts as a restraint, particularly for consumers who may find the intricacies of these policies challenging to understand. The flexibility in premium payments, various interest crediting options, and the interaction between the death benefit and cash value create complexity. This complexity may lead to misunderstandings or misinterpretations of policy terms, potentially causing dissatisfaction among policyholders. It underscores the importance of effective communication and education by insurers to ensure that policyholders fully comprehend the features and implications of their universal life insurance coverage. As a result, it is expected to hinder the market of universal life insurance market.

Rise in demand for financial planning solutions

Growing demand for comprehensive financial planning solutions drives market growth. As individuals increasingly recognize the importance of holistic financial strategies, universal life insurance positions itself as a key component of a well-rounded financial plan. The ability to integrate life insurance coverage with long-term financial goals, such as retirement planning and legacy creation, presents an opportunity for insurers to cater to the evolving needs of consumers. By emphasizing the role of universal life insurance in broader financial planning, insurers tap into a market seeking integrated solutions for financial security and wealth management.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the universal life insurance market analysis from 2023 to 2033 to identify the prevailing universal life insurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the universal life insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global universal life insurance market trends, key players, market segments, application areas, and market growth strategies.

Universal Life Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 132.3 billion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 250 |

| By Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Protective Life Corporation, American International Group, Inc., AXA, Penn Mutual, John Hancock, Mutual of Omaha Insurance Company, MetLife Services and Solutions, LLC., Prudential Financial, Inc., State Farm, Transamerica Corporation, Northwestern Mutual Life Insurance Company, Symetra Life Insurance Company, Nationwide Mutual Insurance Company, Principal Financial Group Inc., Progressive Casualty Insurance Company |

Analyst Review

Universal life insurance (ULI) is a form of life insurance that offers flexible premiums, adjustable death benefits, and a cash value component in which the policy accumulates savings. While ULI is more expensive than term life insurance, it provides the policyholder with a great deal of flexibility and control. The policy holders are able to increase or decrease premiums on a regular basis, as well as the death benefit amount, to stay within their budget and meet their financial goals.

Key providers in the universal life insurance market are Allianz SE, Allstate Corporation, Aviva, AXA, Insurethebox, and Liberty Mutual Insurance. With the rise in demand for usage-based insurance solutions, various companies have established partnership strategies to increase their solutions offerings in AI solutions. For instance, in September 2023, the Floow and Otonomo Technologies Ltd partnered with Definity and Munich Re to bring a new, innovative, usage-based auto insurance product to Canada. Such strategies are expected to drive market growth.

In addition, with increase in demand for usage-based insurance, several companies have expanded their current product portfolio to continue with the rising demand for stability and predictability in life insurance coverage in the market. For instance, in September 2023, OneAmerica launched OneAmerica Variable Universal Life (VUL) insurance. Distributed through the Individual Life and Financial Services (ILFS) line of business, this new insurance provides customers with a strong vehicle for protection, while also offering them the opportunity to invest in the financial markets.

For instance, in October 2023, Massachusetts Mutual Life Insurance Company acquired American Financial Group, Inc. This acquisition immediately broadens American Financial Group, Inc product offerings, further diversifies its distribution capabilities, and generates additional earnings, enabling Mutual life insurance company to help even more people secure their future.

Universal life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured.

Trends include increased demand for indexed and variable universal life policies, the addition of long-term care riders, and a shift toward digital policy management and personalized offerings.

Key market segments By Type o Indexed Universal Life Insurance o Variable Universal Life Insurance o Guaranteed Universal Life Insurance By Distribution Channel o Direct Sales o Brokers/Agents o Banks

The guaranteed universal life Insurance segment is expected to grow at the highest rate during the forecast period, owing to technological advancement and a rise in awareness among the people is projected to attract many new consumers, which boosts the global market.

Several factors, including rising earnings, an increase in the demand for healthcare services, and a desire for more comprehensive healthcare coverage options, contributed to the rapid expansion.

Loading Table Of Content...

Loading Research Methodology...