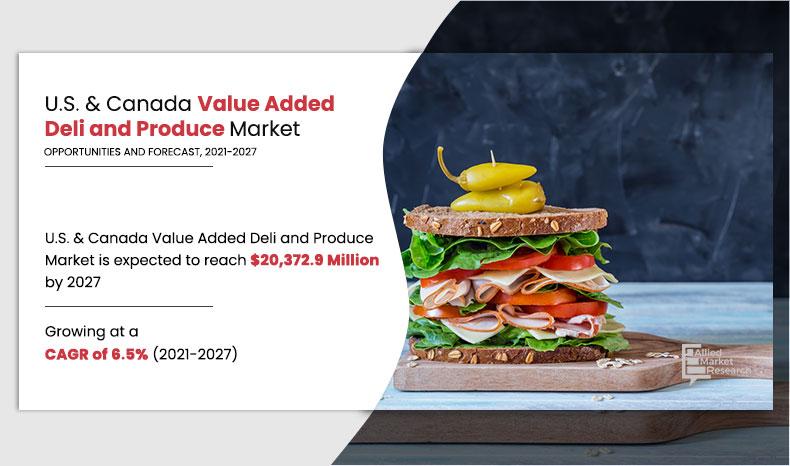

The U.S. & Canada value added deli and produce market size was valued at $12,823.8 million in 2019, and is expected to reach the market size of $20,372.9 million by 2027, growing at a CAGR of 6.5% from 2021-2027. The ready-to-eat salad segment was the most prominent segment in 2019, and is expected to continue this trend throughout the forecast period. U.S. accounted for the majority of value share in 2019, and is estimated to continue this trend throughout the forecast period.

A delicatessen store or a deli store is referred to a retail establishment, which offers ready-to-eat items to customers. Ready to eat products can be consumed at outlet itself or can be taken away for consuming later. Produce is used as a generalized term for fresh fruits and vegetables in the U.S. and Canada.

Value added deli and produce is included in the category of products that is purchased by consumers frequently and the demand for such products remains very consistent among consumers. The outbreak of the novel coronavirus has significantly affected the growth of the market. The recent outbreak of COVID-19 pandemic has reinforced the idea of healthy diet and has encouraged consumers to invest more on fresh fruits and vegetables. This, in turn, has increased the demand for value added deli and produce among consumers, thereby positively impacting the sale of U.S. & Canada value added deli and produce market.

The growth of the U.S. & Canada value added deli and produce market can be attributed to the convenience such food offers. These food products are ready-to-eat and do not require time and effort for preparation. Moreover, superstores, clubs, and grocery stores are the major retail formats preferred by consumers to procure daily eatables. Furthermore, rapidly developing retail infrastructure and surge in adoption of veganism has also driven the sales of U.S. & Canada value added deli and produce market. Other factors contributing toward the market growth include surge in adoption of healthy snacking habit among millennials and changes in lifestyle of people leading to less time for cooking or preparing food. However, high price of value-added deli and produce acts as a major restraint of the market. Conversely, increase in adoption of organic fruits and vegetables among buyers is expected to provide potential opportunities for the U.S. & Canada value added deli and produce market growth.

The U.S. & Canada value added deli and produce market is segmented into type, sales channel, and country. Depending on type, the market is fragmented into sandwiches, wraps, ready-to-eat salads, ready-to-eat meals, and produce. On the basis of sales channel, it is differentiated into grocery stores, supercenters, and club. Country wise, the market has been studied across the U.S. and Canada.

Based on the U.S. & Canada value added deli and produce market analysis by type, the ready to eat salads segment was the largest revenue generator in 2019, and is expected to continue this trend throughout the forecast period. The growth of this segment can be attributed to rise in adoption of good-for-you food such as salads and greens among consumers. Furthermore, increase in concerns about appearance coupled with rise in health consciousness has encouraged people to adopt various forms of diets, which include green leafy vegetables and different salads. This alongside the convenience offered by packaged or ready-to-eat salads makes it a popular choice among the health conscious population.

By Type

U.S. & Canada Value Added Deli and Produce Market, by Type, 2019-2027 ($Million)

Based on the U.S. & Canada value added deli and produce market forecast by sales channel, the grocery stores segment garnered majority of the share in 2019, and is expected to lead during the forecast period. This is attributed to the fact that grocery stores are conveniently located and eatables are available in reasonable prices. However, the superstores segment is expected to grow at the highest CAGR of 7.1% from 2021 to 2027.

By Packaging

U.S. & Canada Value Added Deli and Produce Market, by Packaging, 2019-2027 ($Million)

By country, the U.S. was the dominant market, contributing the largest market share in the U.S. & Canada value added deli and produce market. The growth is attributed to higher awareness about the benefits of balanced nutrition among the populace in this country. Moreover, higher disposable income coupled with increase in work hours has encouraged people to invest in value added deli and produce.

By Country

U.S. & Canada Value Added Deli and Produce Market, by Country, 2019-2027 ($Million)

Key players in the market have relied on agreement, acquisitions, product launch, partnerships, and business expansion as their key strategic move to stay relevant in the industry and improve their stance in the U.S. & Canada value added deli and produce market share. The key player in the U.S. & Canada value added deli and produce industry profiled in the report are Bonduelle, Bridgford Food Corporation, Bright farms, Calavo Growers, Inc, Dole Food Company, Dutchman's Store, Fresh Express, Freshway Foods, Mann Packing Co., Inc., Sunripe Freshmarket, and Taylor Farms.

Key Benefits For Stakeholders

- The report provides a quantitative analysis of the current U.S. & Canada value added deli and produce market trends, estimations, and dynamics of the market size from 2019 to 2027 to identify the prevailing opportunities.

- Porter’s five forces analysis highlights the potency of the buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the market size and segmentation assists in determining the prevailing U.S. & Canada value added deli and produce market opportunities.

- The major countries in South America along with U.S. are mapped according their revenue contribution the industry.

- The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the industry.

Key Market Segments

By Type

- Sandwiches

- Wraps

- Ready-to-eat salads

- Ready-to-eat meals

- Produce

By Packaging

- Grocery Stores

- Superstore

- Clubs

By Region

- U.S.

- Canada

U.S. & Canada Value Added Deli and Produce Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By SALES CHANNEL |

|

| By COUNTRY |

|

| Key Market Players | SUNRIPE FRESHMARKET, BRIGHTFARMS, FRESHWAY FOODS, DUTCHMAN’S STORE, BRIDGFORD FOODS CORPORATION, MANN PACKING CO., INC, BONDUELLE GROUP, CALAVO GROWERS, INC. (RENAISSANCE FOOD GROUP), DOLE FOOD COMPANY INC., TAYLOR FARMS, FRESH EXPRESS INCORPORATED |

Analyst Review

Based on the insights of various CXOs of leading companies, the U.S. & Canada value-added deli and produce market exhibits high growth potential. Surge in working population in the U.S. and Canada further drives the market growth. Furthermore, rise in affinity of consumers toward good-for-you foods such as fruits and green leafy vegetables and increase in awareness about health and importance of nutrition in diet boost the sale of value-added deli and produce in the U.S. and Canada. However, high price of value-added deli and produce makes it prohibitive to price-sensitive consumers, acting as the major restraint of the market. On the contrary, upsurge in adoption of organic fruits and vegetables among buyers is expected to provide lucrative opportunities for growth for the U.S. & Canada value-added deli and produce market during the forecast period.

The U.S. & Canada value added deli and produce market size was valued at $12,823.8 million in 2019, and is expected to reach the market size of $20,372.9 million by 2027

The global U.S. & Canada Value Added Deli and Produce market is projected to grow at a compound annual growth rate of 6.5% from 2021-2027 $20,372.9 million by 2027

The key player in the U.S. & Canada value added deli and produce industry profiled in the report are Bonduelle, Bridgford Food Corporation, Bright farms, Calavo Growers, Inc, Dole Food Company, Dutchman's Store, Fresh Express, Freshway Foods, Mann Packing Co., Inc., Sunripe Freshmarket, and Taylor Farms.

Rise in demand for ready-to-eat, developing retail infrastructure, and surge in adoption of veganism drive the growth of the U.S. & Canada value added deli and produce market.

Loading Table Of Content...