U.S. Enterprise Agile Transformation Services Market Outlook - 2026

An agile transformation service helps enterprises to sustain the intense competition in the market and the threat of market disruption that is driven by advances in technology. Increase in inclination toward digital transformation among conventional organizations is one of the major factors driving the adoption of agile services across the U.S. Moreover, rise in awareness about agile transformation services and surge in need to reallocate resources skillfully & rapidly are the major factors anticipated to drive the U.S. enterprise agile transformation services market growth in this region. Furthermore, presence of multiple companies, which focus on embedding customer centricity in their product offerings is anticipated to offer lucrative opportunity for market expansion in this region. The U.S. enterprise agile transformation services market size was valued at $4,915.43 million in 2018, and is projected to reach $18,189.32 million by 2026, registering a CAGR of 17.9% from 2019 to 2026.

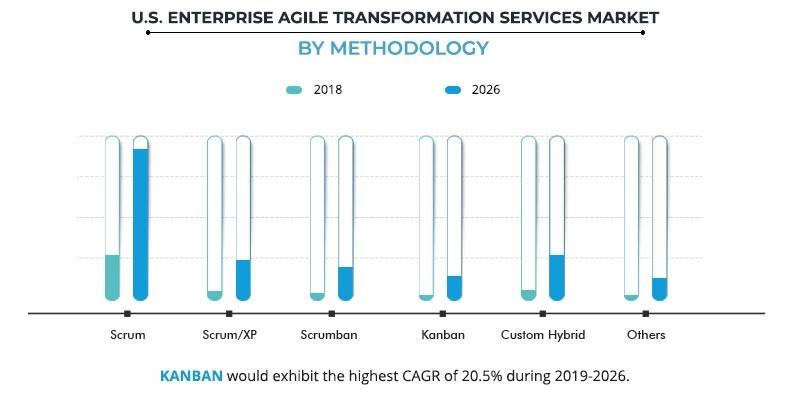

The scrum segment dominated the overall U.S. enterprise agile transformation services market size in 2018, and is expected to continue this trend during the forecast period, due to increase in need to efficiently manage the team structure and work. Furthermore, the custom hybrid segment is expected to grow at a rapid pace throughout the U.S. enterprise agile transformation services market forecast period.

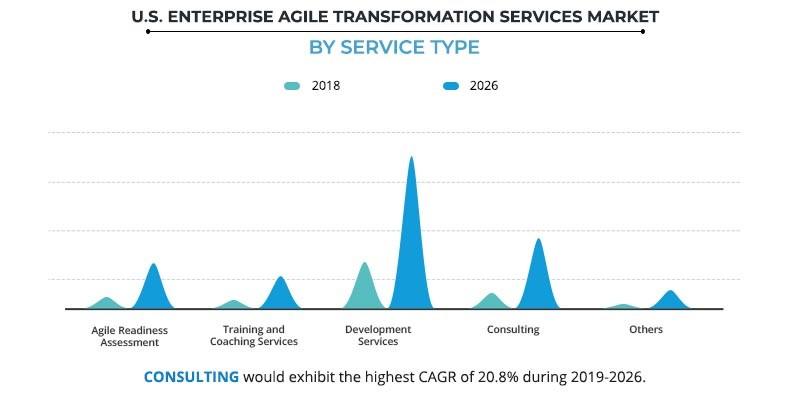

The development services segment is expected to garner significant U.S. enterprise agile transformation services market share in forecast period. The growth of this segment is mainly attributed to the evolving technologies and growing need to transform industries.

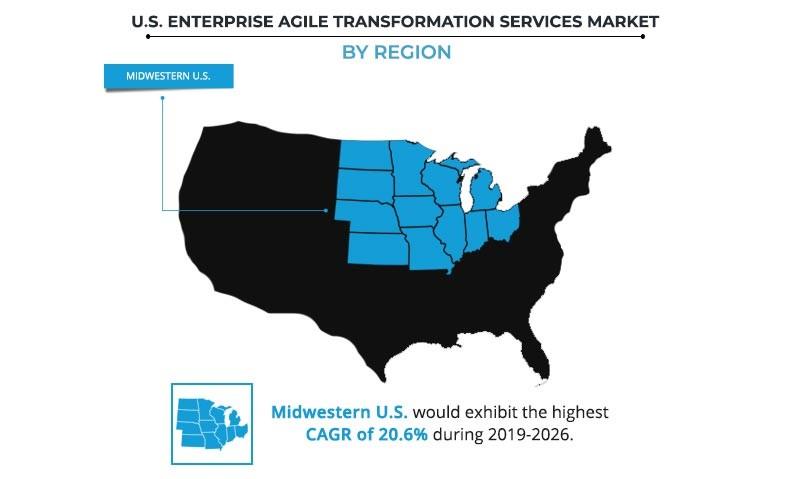

The Western U.S. accounted for the highest U.S. enterprise agile transformation services market share in 2018, and is projected to remain dominant during the forecast period owing to presence of major market players in the country. In addition, increase in demand for agile transformation services from small-scale industries is fueling the market growth in this region. Furthermore, Southwestern U.S. is expected to exhibit the highest CAGR during the forecast period, and considered as a major U.S. enterprise agile transformation services market opportunity.

The report focuses on the growth prospects, restraints, and trends of the U.S. enterprise agile transformation services market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the U.S. enterprise agile transformation services market.

Segment review

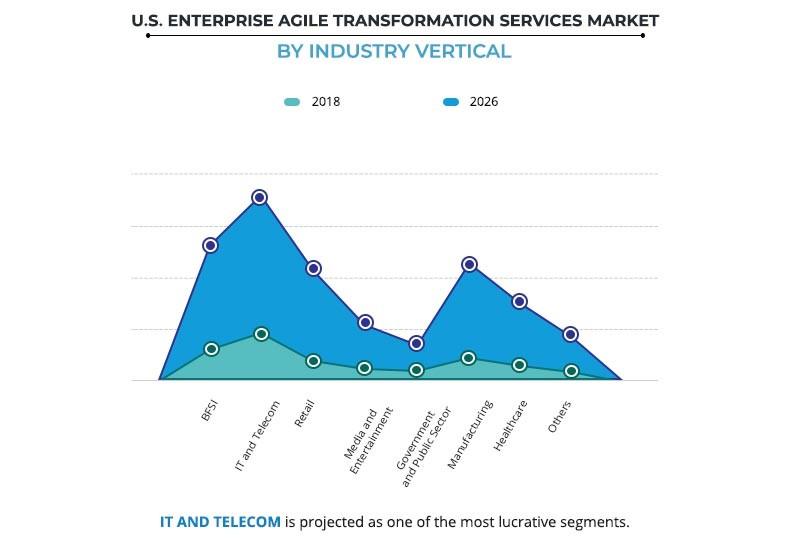

The U.S. enterprise agile transformation services market is segmented based on methodology, service type, organization size, industry vertical, and region. Depending on methodology, the market is divided into scrum, scrumXP, scrumban, kanban, custom hybrid, and others. By service type, it is categorized into agile readiness assessment, training & coaching services, development services, consulting, and others. On the basis of organization size, it is bifurcated into large enterprises and SMEs. As per industry vertical, it is classified into, BFSI, IT & telecom, retail, media & entertainment, government & public sector, manufacturing, healthcare, and others. Region wise, it is analyzed across Western U.S., Southeastern U.S., Southwestern U.S., Northeastern U.S., and Midwestern U.S.

Some of the key players covered in the U.S. enterprise agile transformation services industry such as Accenture Plc., Agile Sparks Broadcom Inc., Endava Plc, Hexaware Technologies Limited, International Business Machines Corporation, LeadingAgile, Symphony Solutions, Xebia Group, and Cognizant Technology Solutions Corporation, and others.

Top impacting factors

Current and future U.S. enterprise agile transformation services market trends are outlined to determine the overall attractiveness of the market. Top impacting factors highlight the opportunities during the forecast period. Factors such as upsurge in need for faster time-to-market in product development, continuous changes in business needs, and increase in need for better communication & collaboration among businesses, along with the rise in shift from traditional transformation toward agile transformation are the key factors that drive the growth of the U.S. enterprise agile transformation services market. Several benefits of agile transformation, such as reduced costs, more flexibility, quicker time to release, better predictability & quality, and early risk detection boost the adoption of this process among organizations. However, certain issues associated with adoption of agile transformation, such as structural complexities and other architectural complexities are expected to hinder the growth of the market. On the contrary, rise in adoption of agile approaches among major non-IT industries, such as manufacturing, retail, and transportation, and emerging applications of agile approaches in growing Big Data-based complex landscape are expected to present major opportunities for U.S. enterprise agile transformation services market expansion during the forecast period.

Increase in need for accelerated product development

Prolonged development timelines have been considered as one of the major obstacles when it comes to generating returns on innovation as well as product development. The reduced speed-to-market in terms of product development & management offers several financial and nonfinancial benefits. These benefits include faster innovation, lower development costs, high forecasting accuracy, and larger market share. Agile transformation is considered as a crucial factor, which enables time to market, and helps to react faster to changes, thus satisfying user’s requirements. Various studies have shown the benefits of agile adoption in the recent years, as the teams using agile have been?50% faster to market, as well as 25% more productive. By adopting agile, the companies are able to strategize their businesses by reacting quickly to competitors’ moves. In addition, lower development costs offered by agile transformation, owing to streamlined processes and limited iterations present agile as one of the top selective alternatives for faster time to market needs. This serves as a key driver of U.S. enterprise agile transformation services market expansion.

Shift in business needs

The technological disruption across all the industry verticals has pushed the limits of all enterprises across the world. This has led to intense competition across all the markets, as new entrants come up with innovative business ideas, due to varying consumer demands and business needs. Moreover, traditional ways of handling business are failing owing to lack in adoption of recent technologies and improper management of teams & businesses, which in turn boost the adoption of agile transformations services. Furthermore, rise in business risks and fluctuations in market dynamics heavily impact business operations, which further drive the demand for agile transformation services.

Increase in adoption of agile services among non-IT industries

Though agile development and transformation have been heavily used in IT organizations, a significant adoption trend has been noticed in non-IT organizations. The core principles of agile help organizations to deal with complex systems and processes within an organization. Several useful features such as workflow tracking and story mapping & analytics are some major factors to attract end-user industries, such as BFSI, manufacturing, retail, transportation, and others. In addition, the need for improved visibility & predictability among teams and focus on continuous improvement in product development & management have been shifting the preference of companies from traditional methodologies to agile methodologies. Moreover, various successful implementations of agile transformation have been recorded in the recent years. For instance, head staff of Air Methods, an emergency air transport company, started using agile practice of keeping a prioritized backlog in a public Trello board to manage the strategy for creating training and education for the organization. Adoption of agile practice of the prioritized backlog helped its employees in achieving better and transparent communication. More number of such implementations are expected in other fields such as energy & utilities, healthcare, and transportation, thereby offering remunerative opportunities for the U.S. enterprise agile transformation services market.

Key Benefits for U.S. Enterprise Agile Transformation Services Market:

- This study presents the U.S. enterprise agile transformation services market analysis, trends and future estimations to determine the imminent investment pockets.

- A detailed analysis of the segments measures the potential of the market. These segments outline the favorable conditions for the U.S. enterprise agile transformation services market.

- The report presents information related to key drivers, restraints, and opportunities.

- The current U.S. enterprise agile transformation services market is quantitatively analyzed from 2018 to 2025 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the industry.

U.S. Enterprise Agile Transformation Services Market Report Highlights

| Aspects | Details |

| By Methodology |

|

| By Service Type |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Broadcom Inc., Endava Plc., Xebia Group, Hexaware Technologies Limited, AgileSparks, Accenture Plc., Symphony Solutions, Cognizant Technology Solutions Corporation, LeadingAgile, International Business Machines Corporation (IBM) |

Analyst Review

Agile transformation services have witnessed a significant increase in adoption among businesses to tackle the challenges associated with high competition and market disruption threats. These services help organizations to enable and implement delivery functions to foster engagement and collaboration. Agile transformation aids to create more collaborative, open, creative, and efficient business environment as compared to traditional business models. Moreover, several benefits are associated with agile transformation such as reduced costs, high product quality, higher levels of customer satisfaction & success, shortened time-to-market, more flexibility in project management, and faster feedback & ROI, which drive the adoption of these services across various industries. In addition, significant demand for rapid product development, constant changes in business needs, and need for improved & enhanced communication among teams contribute toward the market growth. However, high failure rate in large organizations, owing to several factors such as organization challenges, is the key factor that majorly hinders the growth of the market.

The U.S. enterprise agile transformations services market is consolidated with the presence of key vendors such as Cognizant, IBM Corporation, Accenture, and others, which constitute a large share. Western U.S. and Northeastern U.S. are the major shareholders of the U.S. enterprise agile transformations services market, owing to significant adoption of agile approaches among their well-established business industries. Some of the key players profiled in the report include Accenture Plc., Agile Sparks Broadcom Inc., Endava Plc., Hexaware Technologies Limited, International Business Machines Corporation, LeadingAgile, Symphony Solutions, Xebia Group, and Cognizant Technology Solutions Corporation.

Loading Table Of Content...