U.S. Fundus Camera Market Insight 2030

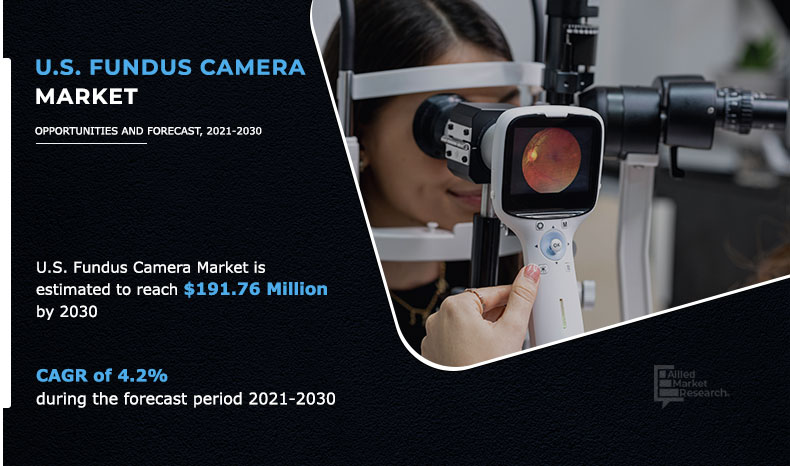

The U.S. fundus camera market size was valued at $124.56 Million in 2020, and is estimated to reach $191.76 Million by 2030, growing at a CAGR of 4.2% from 2021 to 2030. A fundus camera or retinal camera is a specialized low power microscope with an attached camera designed to photograph the interior surface of the eye, including the retina, retinal vasculature, optic disc, macula, and posterior pole.

The growth of the U.S. fundus camera market is majorly driven by increase in prevalence of chronic diseases such as diabetes & hypertension, and incidences of retinal disorders such as macular hole and retinal detachment. The diabetes is responsible for diabetic retinopathy. For instance, according to the International Diabetes Federation (IDF), it was reported that approximately 537 million adults (20-79 years age) are living with diabetes. As per the same source, it was also reported that total number of population living with diabetes is projected to rise to 643 million by 2030 and 783 million by 2045. Thus, increase in prevalence of diabetic retinopathy in population contributes in the growth of the market.

Furthermore, increase in geriatric population contributes toward growth of the market. The geriatric population is more prone to eye disorders such as age-related macular degeneration (AMD). For instance, according to Bright Focus Foundation, in 2020, about 11 million population in the U.S. are diagnosed with age-related macular degeneration and this number is expected to double to nearly 22 million by 2050.

In addition, increase in prevalence of eye disorders such as glaucoma, macular hole, macular degeneration and retinal detachment drives the growth of the market. For instance, according to the Bright Focus Foundation, in 2020, it was analyzed that more than 3 million Americans are living with glaucoma, and 2.7 million of whom aged 40 and older are affected by open-angle glaucoma.

Furthermore, rise in awareness about eye disorders and rise in number of working ophthalmologists drive the growth of market. For instance, as per the U.S. Bureau of Labor Statistics (BLS), in 2020, there were 36,690 optometrists working in the U.S. Thus, availability of ophthalmologists, surges the demand for fundus camera and drives the growth of the market.

Moreover, incidences of retinopathy in children and retinopathy of Prematurity (ROP contributes toward the growth of the U.S. fundus camera market. According to the Journal of American Association Pediatric Ophthalmology and Strabismus (AAPOS), in April 2020, it was analyzed that approximately 3.9 million infants are born in the U.S. each year. As per the same source, it was estimated that about 14,000 are affected by ROP and 90% of those affected have only mild disease and about 1,100- 1,500 develop disease severe enough to require medical treatment. Therefore, it will increase the demand for fundus camera and further boost the U.S. fundus camera market growth.

In addition, increase in government initiatives and cost effective surgical procedures drives the demand of fundus camera. According to the Healio, in February 2021, approximately 4 million cataract procedures are performed every year in the U.S.

Furthermore, advancements in fundus camera devices and latest product launches in the market by key players contribute in the growth of the market. For instance, in November 2020, Optomed, a medical technology company and one of the leading providers of handheld fundus cameras, launched Aurora IQ, a handheld fundus camera with integrated artificial intelligence for faster eye screening.

U.S. Fundus Camera Market Segmentation

The U.S. fundus camera market is segmented on the basis of product, portability, and end user. By product, the market is categorized into mydriatic fundus cameras, non-mydriatic fundus cameras, hybrid fundus cameras, and ROP fundus cameras. By portability, the market is bifurcated into handheld and tabletop. By end user, it is divided into hospital, ophthalmology clinics, and others.

By Product

Non-Mydriatic Fundus Cameras segment held a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Segment Review

Depending on product, the non-mydriatic cameras segment dominated the market in 2020, and this trend is expected to continue during the forecast period, due to increase in demand for non-mydriatic camera. Increase in ability of non-mydriatic cameras to view detailed retinal anatomy, further improves the diagnosis and management of eye disorders, and surge the growth of the U.S. fundus camera market.

Based on portability, the tabletop segment dominated the market in 2020 and this trend is expected to continue during the forecast period, due to increase in advantages of tabletop cameras. However, the handheld segment is expected to witness considerable growth during the forecast period, due to advancements in technology in development of advanced handheld camera, and increase in number of key player to manufacture handheld camera.

By Portability

Tabletop segment held a dominant position in 2020 and would continue to maintain the lead over the forecast period.

By end user, the hospitals segment led the market in 2020, and is anticipated to maintain its lead during the forecast period, owing to rise in prevalence of diabetes, due to increased acceptance by optometrists for primary eye care, and attendance of well-equipped hospitals. However, ophthalmology clinics is expected to witness considerable growth during the forecast period, due to an increase in the number of ophthalmology clinics and prevalence of retinal disorders.

The key players operating in the U.S. fundus camera market include Bosch group, Canon Inc., Carl Zeiss Meditec Inc., Kowa Company, Ltd., Nidek Co., Ltd., Optomed OY Ltd., Optovue Incorporated, Revenio Group Corporation, Samsung Electronics Co. Ltd., and Topcon Corporation.

By End User

Hospitals segment held a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Key Benefits For Stakeholders

- The report provides an in-depth analysis of the U.S. fundus camera market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers market analysis from 2021 to 2030, which is expected to enable the stakeholders to capitalize on the prevailing opportunities in the market.

- A comprehensive analysis of the region assists to understand the regional market and facilitate strategic business planning and determine prevailing opportunities.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook of the U.S. fundus camera market growth.

U.S. Fundus Camera Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Portability |

|

| By End User |

|

| By Key Market Players |

|

Analyst Review

According to perspective of CXOs of the leading companies, the U.S. fundus camera market gained prominence in 2020, and is expected to witness a significant rise in the near future. This is attributed to rise in incidence of retinal problems due to rise in elderly population and chronic diseases such as diabetes and hypertension.Diabetic Retinopathy (DR), age-related Macular Degeneration (AMD), and Retinopathy of Prematurity (ROP) are some of the most common retinal diseases. In addition, rise in awareness about eye disorders and introduction of a number of technologically improved goods are expected to boost the market throughout the forecast period. These are the factors that reinforce the growth of the market. However, high cost associated with the fundus camera is expected to hamper the market growth.

Many significant key players across the globe are planning to expand their production capacities and delivery services in order to meet the rising demand due to the pandemic, which is expected to offer high growth opportunities to the key players.

Advancements in digital camera, red-free fundus camera, film-based fundus camera to the development of other for clear and in-depth fundus imaging as well as growing adoption of these new technologies in emerging countries, which are expected to drive the demand for these products during the forecast period. Furthermore, market expansion is projected to be aided by favorable government policies.

The total market value of U.S. fundus camera Market is $124.56 million in 2020.

The forecast period in the report is from 2021 to 2030

The market value of U.S. fundus camera market in 2021 was $132.57 million.

The base year for the report is 2020.

Yes, U.S. fundus camera market companies are profiled in the report.

The top companies that hold the market share in U.S. fundus camera market are Bosch group, Canon Inc., Carl Zeiss Meditec Inc., Kowa Company, Ltd., Nidek Co., Ltd., Optomed OY Ltd., Optovue Incorporated, Revenio Group Corporation, Samsung Electronics Co. Ltd., and Topcon Corporation.

The key trends in the U.S. fundus camera market are increase in prevalence of chronic diseases such as diabetes & hypertension, and incidences of retinal disorders such as macular hole and retinal detachment.

Loading Table Of Content...