Used Cooking Oil Market Research, 2035

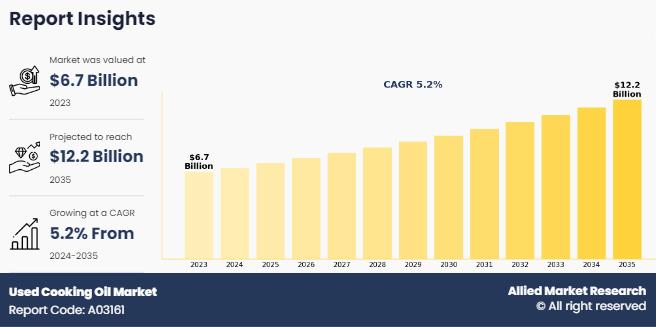

The global used cooking oil market size was valued at $6.7 billion in 2023 and is projected to reach $12.2 billion by 2035, growing at a CAGR of 5.2% from 2024 to 2035. The demand for used cooking oil is high owing to its role as a key feedstock for biodiesel production, which offers a sustainable alternative to fossil fuels. In addition, used cooking oil helps reduce waste and supports environmental sustainability by repurposing what would otherwise be discarded. Growing regulatory support for renewable energy and the drive towards more sustainable practices further boost its demand.

Used cooking oil, also known as waste cooking oil, is obtained owing to the repeated usage of vegetable oils for food in restaurants, hotels, and food industries as well as household sectors. Used cooking oil is obtained from a range of vegetable oils including sunflower, palm, rape, and soya, and is usually available in huge volumes in mixed composition. It is a substitute for vegetable oil in biodiesel, oleo chemicals, and animal feed production. It is considered a waste material and does not compete in the market. Thus, it has low cost as compared to vegetable oil and is easily available in bulk quantities. This drives the growth of the used cooking oil market size.

Key Takeaways

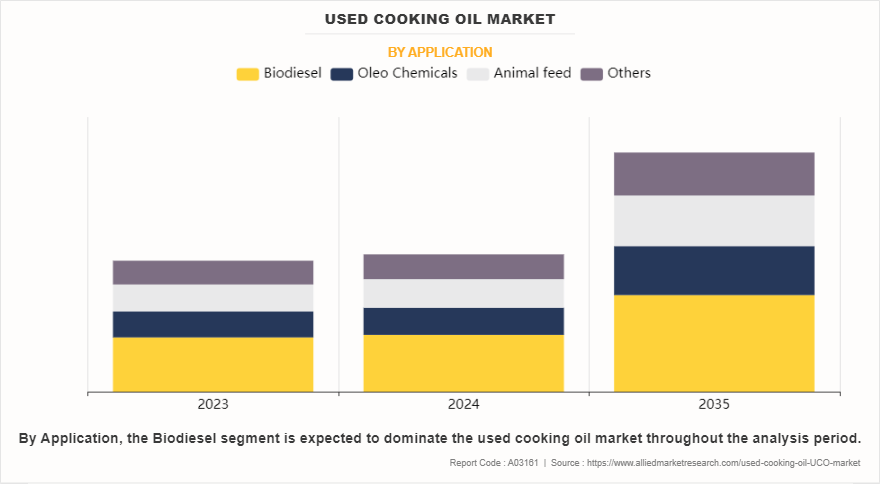

- By application, the biodiesel segment was the highest revenue contributor to the market in 2023.

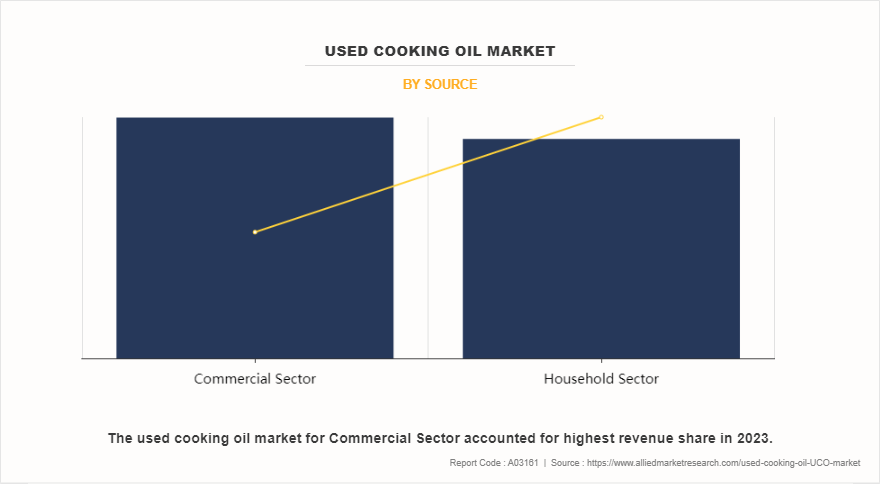

- By source, the commercial sector segment was the largest segment in the global center pivot irrigation materials during the forecast period.

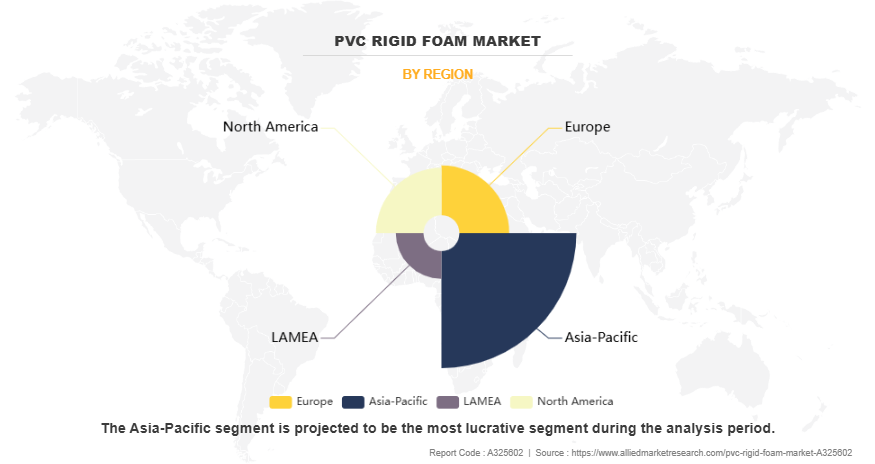

- Region-wise, Europe was the highest revenue contributor in 2023.

Market Dynamics

An increase in biodiesel production significantly drives the expansion of the used cooking oil market by creating a high demand for this waste product. As countries strive to reduce carbon emissions and dependency on fossil fuels, biodiesel, a renewable and cleaner-burning alternative, has gained traction. According to the International Energy Agency (IEA), global biodiesel use has expanded at nearly 6% a year for the past 5 years, with substantial contributions from used cooking oil as a feedstock. This trend is fueled by governmental mandates and incentives promoting renewable energy sources. For instance, the European Union's Renewable Energy Directive aims for 14% of transport fuels to be renewable by 2030, incentivizing the use of waste oils for biodiesel production. Similarly, the U.S. Environmental Protection Agency’s Renewable Fuel Standard requires increasing volumes of renewable fuel in transportation. These policies enhance the economic viability of recycling used cooking oil into biodiesel. Consequently, the rise in demand for biodiesel directly boosts the collection and processing of used cooking oil, driving the growth of the market and encouraging the development of infrastructure and technologies for its efficient recycling.

However, theft of used cooking oil significantly hampers market growth by disrupting legitimate collection and recycling processes. With the rise in value of used cooking oil, driven by its demand for biodiesel production, theft has become increasingly common. For instance, the National Renderers Association estimates that up to $75 million worth of used cooking oil is stolen annually. These thefts result in financial losses for legitimate businesses and undermine supply chain stability. Stolen oil often gets sold in black markets, bypassing regulatory standards, which leads to quality and safety issues in biodiesel production. In addition, companies affected by theft might face increased insurance premiums and security costs, further straining their operations. Illegal activities, such as stealing and bypassing regulatory standards, reduce the availability of used cooking oil for licensed recyclers, thereby limiting the overall market supply. As a result, the effectiveness of recycling programs and the sustainability goals associated with biodiesel production are compromised, posing a considerable challenge to used cooking oil market growth.

Moreover, technological innovations in the collection and processing of used cooking oil have created significant opportunities in the market by enhancing efficiency and reducing costs. Advanced collection systems, such as automated storage tanks equipped with sensors, allow real-time monitoring of oil levels, optimizing collection schedules and minimizing transportation expenses. For example, IoT-enabled smart containers alert recyclers when they need to be emptied, ensuring timely and efficient collection. On the processing side, advancements in filtration and purification technologies have improved the quality and yield of recycled oil, making it more suitable for biodiesel production and other applications. Innovations such as ultrasonic cleaning and advanced centrifugation have streamlined the removal of impurities, enhancing the overall value of the product. These technological advancements lower operational costs and increase the scalability & sustainability of recycling operations, attracting more participants to the market, and driving growth of used cooking oil industry.

Segmental Overview

The used cooking oil market is segmented on the basis of source, application, and region. By source, it is classified into the household sector and the commercial sector. By application, it is divided into biodiesel, oleo chemicals, animal feed, and others. By region, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, the Netherlands, and the rest of Europe), Asia-Pacific (China, India, Australia, Japan, and the rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By Source

By source, the market is segmented into the household sector and the commercial sector. The commercial sector segment accounted for a major share of the used cooking oil market in 2023 and is expected to grow at a significant CAGR during the forecast period. The rise in the number of food & service industries and hotels results in huge production of used cooking oil globally, which is collected in bulk quantity by the suppliers. In addition, the efforts taken by the used cooking oil suppliers for initiating an organized collection of used cooking oil along with providing containers to the restaurants for collecting used cooking oil contribute to the used cooking oil market demand.

By Application

By application, the market is segmented into biodiesel, oleo chemicals, animal feed, and others. The biodiesel segment held the major used cooking oil market share in 2023 and is expected to grow at a significant CAGR during the forecast period. Biodiesel is a fuel that can be made from pure or waste vegetable oils such as soybean oil, rapeseed oil used cooking oil, and others. However, the production of Biodiesel from used cooking oil is economical as compared to vegetable oil. This is due to the easy availability and low cost of used cooking oil over vegetable oil, which encourages biodiesel manufacturers to use used cooking oil as a major feedstock in Biodiesel production. This is expected to propel the demand during the used cooking oil market forecast.

By Region

By region, the market is divided into North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, the Netherlands, and the rest of Europe), Asia-Pacific (China, India, Australia, Japan, and the rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). The Europe region accounted for a major share of the used cooking oil market in 2023 and is expected to grow at a significant CAGR during the forecast period. Europe is the key region that contributes toward the growth of the used cooking oil market. This is attributable to the rise in environmental concern and government-supportive regulation in the region. The Renewable Energy Directive and the Fuel Quality Directive in Europe are promoting the use and production of renewable sources of energy, which is one of the key factors driving the growth of the used cooking oil industry in this region.

Competitive Analysis

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have also been focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the used cooking oil market include Valley Proteins, Inc., Quatra, Baker Commodities Inc., Arrow Oils Ltd, Olleco, Waste Oil Recyclers, Grand Natural Inc., GREASECYCLE, Brocklesby Limited, and Oz Oils Pty Ltd.

Recent Developments in Used Cooking Oil Market

- In March 2023, Olleco Bunge announced the acquisition of Rafrinor, S.L. and Discoil, S.L., two used cooking oil collectors and processors in Spain to expand their foothold in Europe and to serve both new and existing customers in Spain with national coverage.

- In February 2023, Olleco planned to open a new used cooking oil processing plant at Stolthaven Terminals facility to expand its business in the southeast of England.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the used cooking oil market analysis from 2023 to 2035 to identify the prevailing used cooking oil market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the used cooking oil market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global used cooking oil market trends, key players, market segments, application areas, and market growth strategies.

Used Cooking Oil Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 12.2 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2023 - 2035 |

| Report Pages | 227 |

| By Application |

|

| By Source |

|

| By Region |

|

| Key Market Players | Baker Commodities Inc., Waste Oil Recyclers, Inc., Oz Oils Pty Ltd., Brocklesby Limited., Grand Natural Inc., Greasecycle LLC, Olleco Limited, Valley Proteins, Inc., ARROW OILS LTD., Quatra |

Analyst Review

According to the key suppliers of Used cooking oil (UCO), there is a rise in the demand for used cooking oil as feedstock worldwide due to the increase in low-carbon fuels globally. Moreover, used cooking oil is a potential raw material to produce products including oleo chemicals products, animal feed, grease, bio lubricants, and others. Moreover, their continuous effort on making a well-organized collection method for used cooking oil in bulk from restaurants, hotels, caters, and other commercial sectors also fosters the growth of the used cooking oil market. According to the suppliers of used cooking oil, the rise in environmental concern and the trend of using sustainable, eco-friendly, and renewable resources in the chemical industry are the factors that encourage the adoption of used cooking oil globally.

Moreover, the rise in focus on the production of secondhand generation fuel across all countries drives the demand for used cooking oil. Thus, this factor is anticipated to offer a lucrative opportunity for the growth of the used cooking oil market. However, the rise in theft of used cooking oil and the lack of awareness regarding the use of used cooking oil are anticipated to hamper the growth of the used cooking oil market in the upcoming years.

The global used cooking oil market was valued at $6.7 billion in 2023 and is projected to reach $12.2 billion by 2035, growing at a CAGR of 5.2% from 2024 to 2035.

The used cooking oil market is segmented on the basis of source, application, and region. By source, it is classified into the household sector and the commercial sector. By application, it is divided into biodiesel, oleo chemicals, animal feed, and others. By region, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, the Netherlands, and the rest of Europe), Asia-Pacific (China, India, Australia, Japan, and the rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Europe is the largest regional market for used cooking oil

The major players operating in the used cooking oil market include Valley Proteins, Inc., Quatra, Baker Commodities Inc., Arrow Oils Ltd, Olleco, Waste Oil Recyclers, Grand Natural Inc., GREASECYCLE, Brocklesby Limited, and Oz Oils Pty Ltd.

The global used cooking oil market report is available on request on the website of Allied Market Research.

Loading Table Of Content...

Loading Research Methodology...