Utilities Security Market Overview

The global utilities security market was valued at USD 7.3 billion in 2022 and is projected to reach USD 31.2 billion by 2032, growing at a CAGR of 15.9% from 2023 to 2032.

Surge in evolving cyber threat and advancements and modernization of technology primarily drive the growth of the utilities security market. However, financial limitations and integration issues hamper market growth to some extent. Moreover, operational resilience is expected to provide lucrative opportunities for market growth during the forecast period.

The utilities security market is a thriving industry committed to defending the utilities sector's vital infrastructure against a range of physical and cyber threats. The creation and application of security services and solutions are the main activities in this industry. The goal is to guarantee the safe and continuous functioning of vital utilities such as gas, water, and power supply systems. Fundamentally, the market tackles the growing susceptibilities of utility infrastructure to various security threats. These hazards include physical threats such as vandalism, sabotage, and unauthorized access, as well as cyber threats that target digital networks and systems. The goal of the market is to offer complete security solutions that guarantee the dependability of vital services and guard against future interruptions.

The increase in sophistication of cyberattacks targeting utility networks is one of the factors propelling the utilities security market. Strong cybersecurity measures are essential as utilities embrace smart technology and go through a digital revolution. Moreover, regulatory compliance also plays a big part, requiring utilities to follow strict security guidelines to reduce operational and legal risks. However, the market is limited in many ways, including financial limitations that prevent some utilities from making large investments in security measures. There are additional integration problems since integrating security solutions into the current utility infrastructure necessitates careful planning and implementation.

Segment Overview

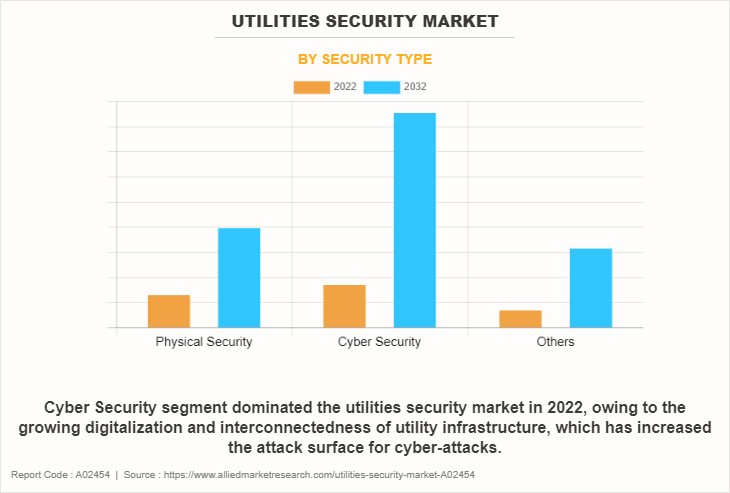

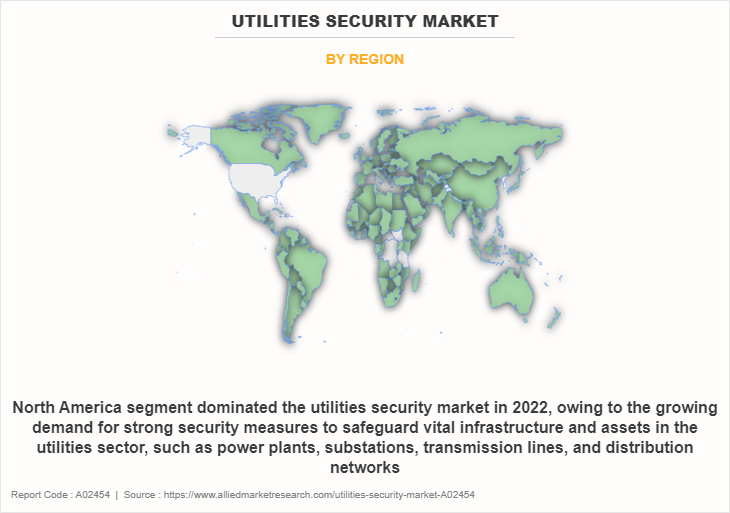

The utilities security market is segmented on the basis of security type, deployment mode, end user, and region. On the basis of security type, it is categorized into physical security, cyber security, and others. On the basis of deployment mode, it is bifurcated into on-premise and cloud. On the basis of end user, it is fragmented into oil & gas, electricity, and other. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of security type, cyber security segment dominated the utilities security market in 2022 and is expected to maintain its dominance in the upcoming years and also expected to witness the highest growth, expected to witness the highest growth, owing to the growing digitalization and interconnectedness of utility infrastructure, which has increased the attack surface for cyber-attacks propels the market growth significantly.

On the basis of region, the utilities security market size was dominated by North America in 2022 and is expected to retain its position during the utilities security market forecast period, owing to the growing demand for strong security measures to safeguard vital infrastructure and assets in the utilities sector, such as power plants, substations, transmission lines, and distribution networks aiding the growth of the market. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to the growing use of smart grid technology and the incorporation of renewable energy sources which is expected to fuel the market growth in this region.

Top Impacting Factors

Evolving cyber threat

The utilities security market is rising owing in substantial part to the evolving cyber threat landscape, which is pushing utilities to strengthen their infrastructure against increasingly sophisticated digital assaults. Strong cybersecurity measures are more important as utilities embrace digital transformation and integrate technologies such as smart grids and Internet of Things (IoT) devices, which increases the attack surface. Moreover, the integrity and dependability of utility operations are seriously threatened by the increasing complexity and frequency of cyberattacks. Malicious actors, who include both independent hackers and state-sponsored organizations, target vital infrastructure with the aim of interfering with the provision of basic services such as electricity and water. These cyberattacks have a variety of motivations, from monetary gain to ideological goals, highlighting the various difficulties utilities have in maintaining security.

Therefore, to address this ever-changing threat landscape, the utilities security market offers cutting-edge cybersecurity solutions that are specifically designed to address the vulnerabilities found in utility infrastructure. This includes safeguards against data breaches, tampering, and unauthorized access to vital systems. The market's solutions include essential elements including threat intelligence, network monitoring, and endpoint protection that work together to proactively identify and neutralize cyber threats and thus propelling the market growth.

Advancements and modernization of technology

Modernization and technological advancements drive the utilities security market's growth to prominence in the industry. The necessity for strong security measures increases as utilities experience huge technology transitions that include smart grids, sophisticated sensors, and Internet of Things (IoT) devices. Data-driven decision-making is made possible by the integration of smart technology, which also improves operational efficiency and makes real-time monitoring easier.

However, additional vulnerabilities brought about by this modernization make utility infrastructure vulnerable to cyberattacks and possible disruptions. With utilities becoming increasingly digitally reliant and networked, it is critical to safeguard these technologies. In response to this trend, the utilities security market provides specialized solutions to guard against new risks brought on by improvements in technology. This also includes cybersecurity protocols intended to protect IoT devices. In order to proactively address the changing cyber world, advanced threat detection and response capabilities become indispensable.

Furthermore, modernization goes beyond digital elements to encompass physical security of utility facilities. To mitigate physical risks such as vandalism, sabotage, or unauthorized access, integrated security systems that integrate perimeter defenses, digital surveillance, and access controls become essential. These factors significantly contribute to the increase in demand for utilities security solutions and its market growth.

Competition Analysis

The key players operating in the utilities security industry include Honeywell International Inc., Cisco Systems, Inc., Thales, Bosch Sicherheitssysteme GmbH, McAfee, LLC, Fortinet, Inc., Schneider Electric, Johnson Controls, IBM, Siemens. Furthermore, it highlights the strategies of the key players to improve the utilities security market share and sustain competition for utilities security industry.

Recent Agreement in the Market

On September 2020, The Department of Energy's (DOE) Office of Cybersecurity, Energy Security, and Emergency Response (CESER) signed a formal agreement with Schneider Electric as the first equipment manufacturer for DOE's Cyber Testing for Resilient Industrial Control System program (CyTRICS). CyTRICS enables DOE to evaluate software and firmware in energy sector equipment to identify and mitigate cybersecurity vulnerabilities in the supply chain, helping to ensure the integrity and reliability of critical system components nationwide.

Recent Product Launch in the Market

On August, 2023 Schneider Electric, the leader in the digital transformation of energy management and industrial automation, launched a Managed Security Services (MSS) offering to help customers in operational technology (OT) environments address the increased cyber risk associated with the demand for remote access and connectivity technologies. With the manufacturing industry reporting the highest share of cyberattacks in 2022, business owners increasingly recognize the need for innovative cybersecurity solutions to help minimize downtime, loss of intellectual property and other disruption caused by system vulnerabilities.

On September 2023, Johnson Controls launched new OpenBlue Service: Ensuring Security Device Performance offering, designed to help customers enhance building safety, manage risk, and maximize the value of investments made in security technology. The offering combines Johnson Controls OpenBlue suite of connected solutions, and the ability to monitor and manage security devices across vendors, with remote support services and meaningful insights from skilled engineers, as well as simplified, integrated zero-trust cybersecurity protection. OpenBlue Service: Ensuring Security Device Performance is making its debut at Global Security Exchange (GSX) 2023.

Recent Expansion in the Market

On October 2023, IBM and KPMG LLP expanded their alliance to help enable business transformations for clients implementing SAP S/4HANA® across the energy and utilities industry. Cloud enterprise resource planning (ERP) projects run the potential risk of failing without the right technology in place and the right business expertise to fully integrate it. IBM Consulting and KPMG together are bringing a breadth of consulting, operations, tax, risk and finance experience to the ERP implementation process to help energy and utilities companies automate and manage core business processes for optimal performance.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the utilities security market analysis from 2022 to 2032 to identify the prevailing utilities security market opportunities.

The utilities security market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the utilities security market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global utilities security market trends, key players, market segments, application areas, and utilities security market growth strategies.

Utilities Security Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 31.2 billion |

| Growth Rate | CAGR of 15.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 364 |

| By Deployment Mode |

|

| By Security Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Honeywell International Inc., Bosch Sicherheitssysteme GmbH, Cisco Systems, Inc., Siemens, McAfee, LLC, Johnson Controls, Schneider Electric, IBM, Fortinet, Inc., Thales |

Analyst Review

A vital component required for guaranteeing the robustness, dependability, and integrity of critical infrastructure is the utilities security. The dynamic environment of physical vulnerabilities and cybersecurity threats demands a planned and preemptive approach to utility operations security. Utility providers understand that making significant investments in security measures is both strategically and legally necessary. Offering solutions to reduce the risks of cyberattacks, illegal access, and other disruptions, the utilities security market supports the main objective of guaranteeing continuous utility services. Cyber resilience is a cornerstone that key players see in the market, especially in this period of growing cyber threats. Since utility systems are interconnected, protecting digital networks and important data requires advanced cybersecurity solutions. This strategic investment guarantees quick recovery and reaction capabilities in addition to incident prevention. For utility providers, adherence to strict security regulations is a top priority. The Utilities Security Market offers ways to go beyond legal requirements, lower legal risks, and make sure companies follow established security practices. Enterprises recognize that hazards take many different forms, thus they appreciate the market's contribution to all-encompassing risk reduction. In addition to physical security measures to guard against sabotage, vandalism, and unauthorized access to vital infrastructure, security measures should also cover cyber threats.

For instance, in December 2020, the Department of Energy's (DOE) Office of Cybersecurity, Energy Security, and Emergency Response (CESER) partnered with the North American Electric Reliability Corporation's Electricity Information Sharing and Analysis Center (E-ISAC) to pilot enhancements to the energy sector’s information sharing capabilities and rapidly identify security threats to utilities across the nation. In collaboration with E-ISAC, CESER launched the CRISP Essence Integration Pilot, a joint operational technology (OT) pilot with the Cybersecurity Risk Information Sharing Program (CRISP). CRISP leverages DOE’s unique intelligence capabilities, expertise, and advanced threat detection technologies to collect, analyze, and distribute actionable threat information to the energy sector.

The Utilities Security Market was valued for $7,263.2 million in 2022 and is estimated to reach $31,195.68 million by 2032, exhibiting a CAGR of 15.9% from 2023 to 2032.

Evolving cyber threat and advancements and modernization of technology are the upcoming trends of Utilities Security Market in the world.

Operational resilience is the leading application of Utilities Security Market.

North America is the largest regional market for Utilities Security.

Honeywell International Inc., Cisco Systems, Inc., Thales, Bosch Sicherheitssysteme GmbH, McAfee, LLC, Fortinet, Inc., Schneider Electric, Johnson Controls, IBM, Siemens. are the top companies to hold the market share in Utilities Security.

Loading Table Of Content...

Loading Research Methodology...