Vacation Ownership (Timeshare) Industry Market Research, 2032

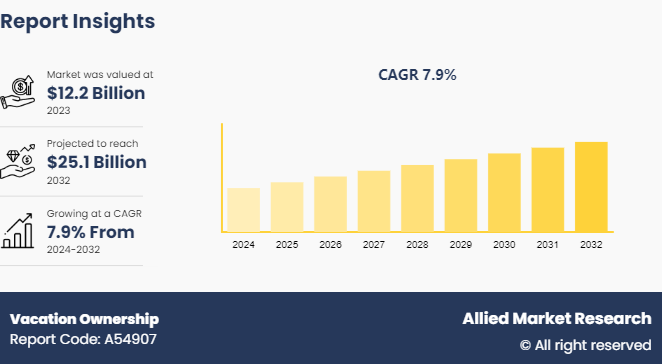

The global vacation ownership market was valued at $12.2 billion in 2023, and is projected to reach $25.1 billion by 2032, growing at a CAGR of 7.9% from 2024 to 2032. Vacation Ownership shift towards more flexible, points-based systems that allow owners greater customization and freedom in their vacation planning. Additionally, there's an increased focus on sustainability and eco-friendly practices, with resorts adopting green initiatives to attract environmentally conscious travelers.

Market Introduction and Definition

Vacation ownership, commonly known as timeshare, is a unique approach to vacationing that allows individuals to own a share or portion of a vacation property, typically a resort condominium, for a specified period each year. In a timeshare arrangement, multiple owners collectively own the property, with each owner entitled to use the accommodations for a specific week or weeks annually. Timeshare properties are often located in popular tourist destinations such as beach resorts, ski resorts, or urban centers, offering owners access to high-quality accommodations and amenities. This form of ownership provides individuals with the opportunity to enjoy regular vacations in desirable locations without the hassle and expense of owning a second home outright.

Key Takeaways

The vacation ownership market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major vacation ownership industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global vacation ownership market share to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The market dynamics of vacation ownership market size, are influenced by a variety of factors such as supply-demand and consumer behavior in the industry. The cyclical nature of the travel and tourism market impacts the overall demand for vacation ownership products. Economic conditions, consumer confidence, and travel trends influence the level of interest in timeshare ownership, with periods of economic growth typically correlating with increase in demand for leisure travel and vacation ownership opportunities. In addition, regulatory factors play a significant role in shaping the timeshare market dynamics. Regulations governing timeshare sales and marketing practices vary by jurisdiction, and changes in legislation or consumer protection laws impact the way timeshare products are marketed, sold, and regulated. This is expected to affect both consumer confidence and industry practices, influencing the overall supply and demand dynamics in the market.

Moreover, technological advancements and industry innovations are driving changes in the timeshare market dynamics. The emergence of online booking platforms, digital marketing strategies, and virtual tour experiences has transformed the way timeshare properties are marketed and sold, expanding reach and accessibility to a broader audience. These technological advancements have also facilitated greater transparency and information sharing, empowering consumers with more knowledge and options when considering timeshare ownership. Furthermore, demographic shifts and changing consumer preferences are shaping the market dynamics of vacation ownership. As millennials and younger generations become a larger segment of the travel market, there is a growing demand for experiences over material possessions and a preference for flexible and personalized vacation options. This has led to increase in points-based ownership models and a shift towards more experiential and adventure-oriented vacation offerings in the vacation ownership industry.

Government Policies of Vacation Ownership Market

Government policies regarding vacation ownership market size, vary by jurisdiction and are typically aimed at protecting consumers, ensuring fair business practices, and regulating the industry to prevent fraud and abuse. One key aspect of government policy is the regulation of timeshare sales and marketing practices. Many countries have laws and regulations governing the disclosure of information to potential buyers, including details about the property, ownership rights, maintenance fees, and cancellation policies. These regulations are designed to ensure that consumers are fully informed about the terms and conditions of timeshare ownership before making a purchase, thereby reducing the risk of misrepresentation or fraud. In addition, government policies often include measures to regulate the operation and management of timeshare resorts. This involves requirements for licensing, registration, or accreditation of timeshare developers and property managers, as well as standards for maintenance, safety, and quality of accommodations and amenities. These regulations aim to protect the interests of timeshare owners and ensure that resorts maintain the standards promised to consumers at the time of purchase.

Moreover, some governments have established consumer protection agencies or regulatory bodies specifically tasked with overseeing the timeshare industry and handling complaints or disputes between consumers and timeshare developers or operators. These agencies are expected to provide guidance, mediation services, or enforcement actions to address violations of consumer rights or industry regulations, promoting transparency, accountability, and fairness in the vacation ownership market. Furthermore, tax policies and regulations are expected to impact the financial aspects of timeshare ownership, including tax treatment of maintenance fees, rental income, and property taxes associated with timeshare properties. Governments are anticipated to offer tax incentives or deductions for timeshare owners, developers, or operators to encourage investment in the industry or support tourism development initiatives.

Market Segmentation

The vacation ownership market is segmented into type, tour type, tourist type, and region. On the basis of type, the market is divided into fixed week, floating week, and point-based week. On the basis of tour type, the market is divided into domestic and international. On the basis of tourist type, the market is divided into independent travelers and tour groups. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The regional outlook of vacation ownership, or timeshare, varies depending on factors such as market maturity, regulatory environments, economic conditions, and cultural attitudes towards vacationing and property ownership. In mature vacation ownership markets such as North America and parts of Europe, the outlook is characterized by steady growth, consumer confidence, and a diverse range of vacation ownership options. These regions have well-established regulatory frameworks governing timeshare sales, marketing, and operations, providing consumers with protections and assurances when purchasing and using timeshare products. In addition, there is a wide range of resorts and destinations to choose from, catering to different preferences and budgets.

In emerging vacation ownership market such as parts of Asia-Pacific, Latin America, and Africa, the outlook is more dynamic and evolving. These regions are experiencing growing interest and investment in vacation ownership as disposable incomes rise, and travel becomes more accessible to the growing middle class. However, the regulatory landscape may be less developed, leading to challenges related to consumer protection, transparency, and industry standards. Nonetheless, there is significant potential for growth and expansion in these markets, with developers and operators seeking to capitalize on the demand for vacation ownership and tap into new sources of revenue.

Furthermore, the regional outlook of vacation ownership is influenced by cultural factors and preferences for vacationing. In some regions, such as Europe, timeshare ownership is well-established and widely accepted as a mainstream vacation option. In contrast, in other regions, such as parts of Asia-Pacific, there may be cultural barriers or perceptions surrounding vacation ownership and property ownership in general, which can impact the adoption and growth of the timeshare industry.

Industry Trends

In February 2022, SellMyTimeshareNow.com, the world's most active online marketplace for timeshares for sale and rent by owner, celebrated the sustained success of its timeshare resale and rental platform, with a 68% growth in the purchase and rental offer prices year-over-year

In 2021, SellMyTimeshareNow.com received over 4.1 million visitors to its family of websites, resulting in over 48, 000 bids to buy or rent timeshares on SellMyTimeshareNow.com, totaling more than $287 million, reaching pre-pandemic activity levels.

Competitive Landscape

The major players operating in the vacation ownership market include Bluegreen Vacations Unlimited, Inc., The Walt Disney Company, Hilton Grand Vacations Inc., InterContinental Hotels Group, Hyatt Corporation, Marriott International, Inc., Vidanta, Westgate Resorts, Inc., Wyndham Destinations, and The Boca Raton

Recent Key Strategies and Developments

In January 2024, Hilton Grand Vacations Inc. officially completed its acquisition of Bluegreen Vacations. The all-cash transaction, which is valued at approximately $1.5 billion, expands HGV's offerings, consumer and retail mining to position HGV as the leading provider in the vacation ownership experience industry.

In April 2024, Global holiday vacation ownership company, Holiday Inn Club Vacations Incorporated, unveiled its achievement of 12 American Resort Development Association (ARDA) awards. These accolades included the prestigious ARDA Circle of Excellence (ACE) award, which marked the highest levels of professional excellence.

In January 2024, Travel + Leisure Company, a leading membership and leisure travel organization, revealed an agreement to buy the vacation ownership division of global hospitality leader Accor in exchange for a U.S. deal of $48.4 million.

In May 2024, ARDA’s announced its monthly AIF Leisure Ownership Sentiment Index, reflecting the ongoing optimism among timeshare owners in the first quarter of 2024 for travel. The index provides a monthly overview of timeshare owners’ sentiment and expected future actions.

Key Sources Referred

Travel + Leisure Company

Holiday Inn Club Vacations Incorporated

Hilton Grand Vacations Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the vacation ownership market analysis from 2024 to 2032 to identify the prevailing vacation ownership market growth.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the vacation ownership industry market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global vacation ownership market trends, key players, market segments, application areas, and market growth strategies.

Vacation Ownership (Timeshare) Industry Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 25.1 Billion |

| Growth Rate | CAGR of 7.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 219 |

| By Type |

|

| By Tour Type |

|

| By Tourist Type |

|

| By Region |

|

| Key Market Players | Vidanta, Westgate Resorts, Inc., InterContinental Hotels Group, Bluegreen Vacations Unlimited, Inc., Wyndham Destinations, The Boca Raton, The Walt Disney Company, Hilton Grand Vacations Inc., Hyatt Corporation, Marriott International, Inc. |

The vacation ownership (Timeshare) industry market was valued at $12.2 billion in 2023, and is estimated to reach $25.1 billion by 2032, growing at a CAGR of 7.9% from 2024 to 2032.

The major players operating in the vacation ownership (timeshare) market include Bluegreen Vacations Unlimited, Inc., The Walt Disney Company, Hilton Grand Vacations Inc., InterContinental Hotels Group, Hyatt Corporation, Marriott International, Inc., Vidanta, Westgate Resorts, Inc., Wyndham Destinations, and The Boca Raton.

North America is the largest regional market for Vacation Ownership (Timeshare) Industry as of 2023.

Enhanced marketing strategies and increased awareness about timeshare ownership is the leading application of Vacation Ownership (Timeshare) Industry Market.

Increase in disposable income to afford luxury vacations and rise in demand for flexible vacation options are the upcoming trends of Vacation Ownership (Timeshare) Industry Market in the globe.

Loading Table Of Content...