Vertical Farming Market Summary, 2032

The global vertical farming market was valued at $4.5 billion in 2022, and is projected to reach $42.5 billion by 2032, growing at a CAGR of 25.5% from 2023 to 2032. Vertical farming is a revolutionary approach used to produce food in vertically stacked layers such as in a skyscraper, used warehouse, or shipping container. It facilitates huge quantity of nutritious and quality fresh food without relying on favorable weather, high water usage, skilled labor, and high soil fertility. Moreover, it enables reliable yield and consistency along with climate control, and no effects of external environmental factors such as disease, pest, or predator attacks.

Segment Overview

The vertical farming market is segmented into component, structure and growth mechanism. Vertical farming involves growing plants indoors, that is why it is sometimes also known as indoor farming. Instead of sunlight and rain, vertical farms use LED lighting and controlled growing and nutrition systems. Plants are stacked vertically in layers, so the farms look like warehouses filled with large shelving units.

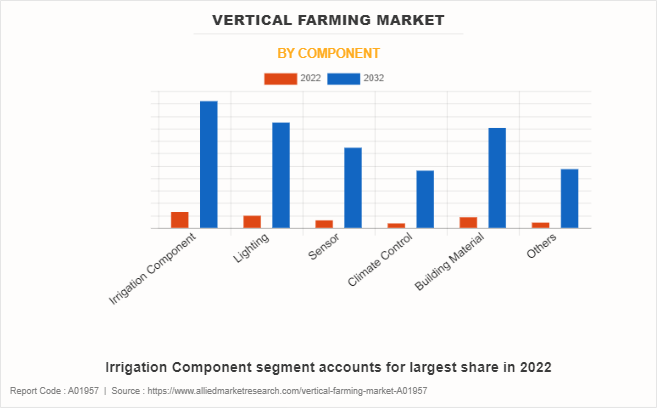

By component, the market is categorized into irrigation component, lighting, sensor, climate control, building material, and others. In 2022, the irrigation component segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. Moreover, the climate control segment is expected to grow at a high CAGR during the period of 2023-2032.

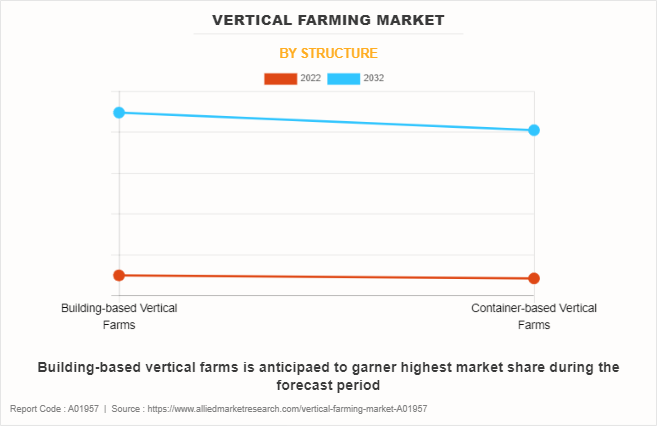

By structure, the market is bifurcated into building based vertical farms and container based vertical farms. In 2022, building-based Vertical Farms dominate the market in terms of revenue and are expected to follow the same trends during the forecast period.

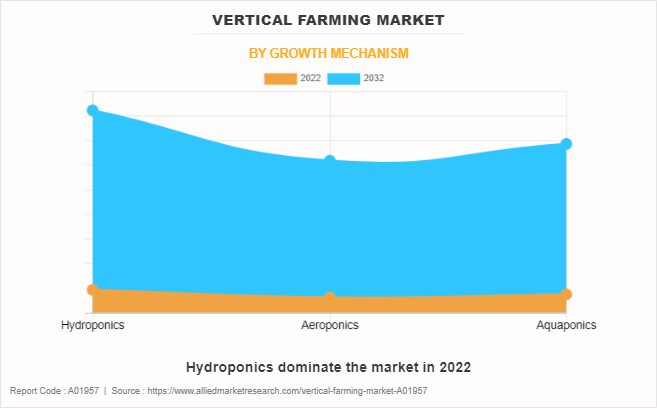

Vertical farming commonly uses hydroponics or aeroponics, significantly reducing water usage compared to conventional soil-based agriculture. Closed systems recirculate water, addressing concerns related to water scarcity. The controlled indoor setting in vertical farming reduces the likelihood of pests and diseases, resulting in a reduced need for pesticides and herbicides. This promotes crop production that is both healthier and environmentally sustainable.

By growth mechanism, the market is divided into hydroponics, aeroponics and aquaponics. In 2022, the aeroponics segment is expected to grow at a high CAGR during the period of 2023-2032.

One of the important drivers of the market is the optimum use of vertical space and balance, energy utilization for crop production. This trend is primarily fueled by rising concerns about rapid urbanization, less farming space, resource efficiency, sustainable agriculture, and the need to address environmental challenges associated with traditional farming practices. For example, utilization of effective stacked or multi-tiered structures optimize vertical space usage.

By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Netherlands, and the rest of Europe), Asia-Pacific (China, Japan, India, Australia, Singapore, and the rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Asia-Pacific, Specifically China., remains a significant participant in the market. Major organizations and government institutions in the Asia-Pacific region have significantly put resources into action to develop enhanced vertical farming which is driving the growth of the vertical farming industry in Asia-Pacific region.

Vertical farming offers numerous advantages. It utilizes vertical space, enabling the cultivation of crops in stacked layers or towers, optimizing land use efficiency, and allowing for increased crop yield in a smaller footprint compared to traditional horizontal farming. The indoor operation of vertical farming, facilitated by controlled environments and artificial lighting, supports year-round crop production independent of external weather conditions, ensuring consistent and predictable harvests.

While conventional farming requires a lot of space which makes it nearly impossible to do in big cities. Incorporating energy-efficient LED lighting systems tailored for distinct plant growth stages minimizes energy waste. Enhancing reliance on natural sunlight through intelligent design and transparent materials reduces the need for artificial lighting during daylight hours. Embracing soil-less cultivation techniques such as hydroponics and aeroponics enhance water efficiency and nutrient delivery. Selecting crops that are ideally suited for vertical farming, offer a high yield per unit of space.

On the other hand, high initial investments hinder the growth of the vertical fmarket. The rise of vertical farming presents a significant opportunity for sustainable agriculture. This faces a significant barrier in the form of substantial upfront investments. Establishing vertical farming facilities involves significant upfront expenses related to infrastructure, technology, and specialized equipment. Constructing multi-layered structures with precision climate control systems, energy-efficient LED lighting, and automated processes necessitate a noteworthy financial commitment.

In addition, implementing technologies such as hydroponics or aeroponics further raises the initial investment. Overcoming this constraint requires careful financial planning, governmental support, and technological advancements that could potentially reduce entry barriers, promoting widespread adoption of vertical farming for a more robust and efficient future in agriculture.

The demand for agrotonomy is expected to increase rapidly during the forecast period, owing to various factors such as rise in popularity of organic food, optimum use of vertical space and balanced energy utilization, ease of crop monitoring and harvesting, and decrease in arable land. However, high initial investments and involvement of nascent technology hamper market growth. However, growing urban population and surge in adoption of technology driven agriculture are expected to provide lucrative growth opportunities to the vertical farming market players.

The vertical farming market forecast is segmented based on structure, growth mechanism, component, and region. By structure, the market is bifurcated into building based vertical farms and container based vertical farms. In 2022, building-based Vertical Farms dominate the market in terms of revenue and are expected to follow the same trends during the forecast period.

By growth mechanism, the market is divided into hydroponics, aeroponics and aquaponics. In 2022, the aeroponics segment is expected to grow at a high CAGR during the period of 2023-2032. By component, the market is categorized into irrigation component, lighting, sensor, climate control, building material, and others. In 2022, the irrigation component segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. Moreover, the climate control segment is expected to grow at a high CAGR during the period of 2023-2032.

By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Netherlands, and the rest of Europe), Asia-Pacific (China, Japan, India, Australia, Singapore, and the rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Asia-Pacific, Specifically China., remains a significant participant in the vertical farming market. Major organizations and government institutions in the Asia-Pacific region have significantly put resources into action to develop enhanced vertical farming which is driving the growth of the vertical farming industry in Asia-Pacific region..

Competitive Analysis

Competitive analysis and profiles of the major vertical farming market demand players, such as 4D Bios Inc., AeroFarms, Agrilution, AMHYDRO, Everlight Electronics Co., Ltd., Hort Americas, Urban Crop Solutions, Signify Holding, GreenTech, and ams-OSRAM AG are provided in this report. Product launch and acquisition business strategies were adopted by the major market players in 2022.

Country Analysis

North America-wise, the U.S. acquired a prime share in the vertical farming market in the North American region and is expected to grow at a CAGR of 23.82% during the forecast period of 2023-2032. The U.S. holds a dominant position in the vertical farming market, owing to the growing concerns about food security and nutrition.

In Europe, the Germany dominated the Europe vertical farming market share in terms of revenue in 2022 and is expected to follow the same trend during the forecast period. Furthermore, the Rest of Europe is expected to emerge as one of the fastest growing countries in Europe's Vertical farming industry with a CAGR of 28.17%, owing to the rise in awareness about these innovative farming techniques across the region.

In Asia-Pacific, China holds a dominated market share in Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to increase in demand for organic food. However, India is expected to emerge as a highest CAGR in vertical farming market Asia-Pacific in this region.

In LAMEA, Latin America is growing the fastest in the vertical farming market because of its growing economy, increasing disposable income, and ongoing expansion of agriculture throughout the area. Moreover, the Middle East region is expected to grow at a high CAGR of 27.14% from 2023 to 2032, owing to less arable land availability and rising water scarcity.

Top Impacting Factors

The vertical farming market size is expected to witness notable growth owing to optimum use of vertical space and balanced energy utilization, ease of crop monitoring and harvesting and increase in popularity of organic foods. Moreover, the growth in urban population is expected to provide lucrative opportunity for the growth of the vertical farming market during the forecast period. On the contrary, high initial investments limit the growth of the vertical hydroponics.

Historical Data & Information

The vertical farming market growth is highly competitive, owing to the strong presence of existing vendors. Vendors of vertical farming with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this vertical farming market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Recent Expansion in Vertical Farming Market

In July 2023, AeroFarms announced expansion of retail availability of its microgreens at both Walmart and Stop & Shop across the Mid-Atlantic and Northeast, respectively.

In May 2023, AeroFarms, announced national expansion with Amazon Fresh online and at all Amazon Fresh grocery store locations, known for its unique, high-tech consumer-focused grocery store experience.

In September 2022, Hort Americas announced a division within the company to bring quality, technically advance and cost-effective products to commercial greenhouse growers in Canada. It provides the bestin-class products, educating growers and continuing to research advancements in controlled environment agriculture.

Recent Joint Venture in Vertical Farming Market

On February 2023, The Public Investment Fund signed a joint venture agreement with AeroFarms, a US-based commercial market leader in vertical farming, to establish a company in Riyadh to build and operate indoor vertical farms in Saudi Arabia and the wider Middle East and North Africa (MENA) region. The agreement optimizes the utilization of natural resources, including water and agricultural lands, through the implementation of indoor vertical farming, with no need for arable land, resulting in significantly higher yields.

Recent collaboration in Vertical Farming Market

In May 2021, IKEA launched vertical farming pilot at Malmö store in collaboration with Urban Crop Solutions. The company is growing a variety of greens inside the container farm. The container farm is a product of the Belgium-based company, enabling to grow a wide variety of greens in a CEA space.

Recent Product Launch in Vertical Farming Market

In June 2023, ort Americas announced a division within the company to bring quality, technically advanced and cost-effective products to commercial greenhouse growers in Canada. It provides the best-in-class products, educating growers and continuing to research advancements in controlled environment agriculture.

In September 2020, Urban Crop Solutions launched their ModuleX Plant Factory, a vertical farming system focused on helping entrepreneurs achieve profitability faster.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the vertical farming market analysis from 2022 to 2032 to identify the prevailing vertical farming market opportunity.

The vertical farming market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the vertical farming market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global vertical farming market trends, key players, market segments, application areas, and market growth strategies.

Vertical Farming Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 42.5 billion |

| Growth Rate | CAGR of 25.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Component |

|

| By Structure |

|

| By Growth mechanism |

|

| By Region |

|

| Key Market Players | ams-OSRAM AG, Signify Holding, AeroFarms, 4D Bios Inc, Urban Crops Solution, GreenTech, Am Hydro, EVERLIGHT ELECTRONICS CO., LTD., Hort Americas, AGRILUTION |

Analyst Review

The growth of the vertical farming market is driven by factors such as rise in trend of using organic food (healthy food without pesticides), optimum use of vertical space, and minimal impact of weather on yield. Increase in population leads to a rise in demand–supply gap for food. Thus, the need for alternative farming techniques such as vertical farming is expected to increase in the near future.

In addition, the upsurge in per capita income in developing countries and occupational changes along with globalization have changed food preferences. Such trends have led toward the demand for new innovations in agriculture and the need for such innovations to be integrated with mainstream agriculture.

The lighting devices segment accounts for the largest market share, followed by the irrigation component segment, due to an increase in adoption of LED lighting systems in vertical farming. However, the hydroponics segment dominates the market, owing to the benefits associated with environment sustainability and costs. Aeroponics registers the highest growth rate, owing to an increase in awareness about plant growth among end users. The Asia- Pacific region accounted for about 48% of the global vertical farming market due to its immense popularity in Japan, China, and Singapore.

However, limited variety of crops, high initial investment, and lack of technical insights are the key restraining factors of the global vertical farming market. Moreover, the cost incurred due to crop failure is a major deterring factor for the adoption of this technique among farmers. For instance, in June 2023, ams OSRAM launched OSLON Optimal family 640 nm Red LED. It provides broader coverage of the LED. It plays an important part in raising energy efficiency and reducing the cost of electric power in all horticultural lighting applications, including greenhouse top lighting and inter lighting, and vertical farming.

The global Vertical Farming Market was valued at $4.5 billion in 2022 and is projected to reach $42.5 billion by 2032.

The global vertical farming market to grow at a CAGR of 25.5% from 2023 to 2032.

Key players in the vertical farming market include AeroFarms, PlantLab, Spread Co., Bowery Farming, InFarm, Plenty, Gotham Greens, AgriCool, CropOne, and Green Spirits Farm.

While specific regional market shares are not detailed in the provided sources, the Asia-Pacific region is expected to be a major market for vertical farming due to increased adoption of advanced technologies in the area.

Factors driving the vertical farming market include the efficient use of space, reduced dependency on arable land, and the ability to produce food in challenging environments where traditional agriculture is not feasible.

Loading Table Of Content...

Loading Research Methodology...