Voice Banking Market Research, 2031

The global voice banking market was valued at $984.6 million in 2021, and is projected to reach $3.7 billion by 2031, growing at a CAGR of 14.5% from 2022 to 2031.

Voice banking is a process that provides a person with voice management for all everyday banking operations. Voice banking is a process that allows a person to record a set list of phrases with their own voice, while they still have the ability to do so. This recording is then converted to create a personal synthetic voice. Moreover, voice banking enables personalized and expert service at a distance and is a powerful component of a comprehensive digital customer service strategy. The major benefit is that voice banking allows banks to interact with customers digitally, in a secure and efficient yet still human way.

The demand for voice banking service is increasing due rapid growth in digital banking service. The growth of digital banking is anticipated to benefit significantly from the increased incorporation of innovative technologies in voice banking service in the next years. In addition, personalized banking services to customers and reduction in bank visit by customers are driving the growth of the market. However, regulatory complications of voice banking and security and privacy concerns have emerged as key industry problems. On the contrary, growing usage of Artificial Intelligence in voice banking will further give major opportunity for the voice banking market growth.

The report focuses on growth prospects, restraints, and trends of the voice banking market analysis. The study provides Porter's five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the voice banking market size.

Segment Review

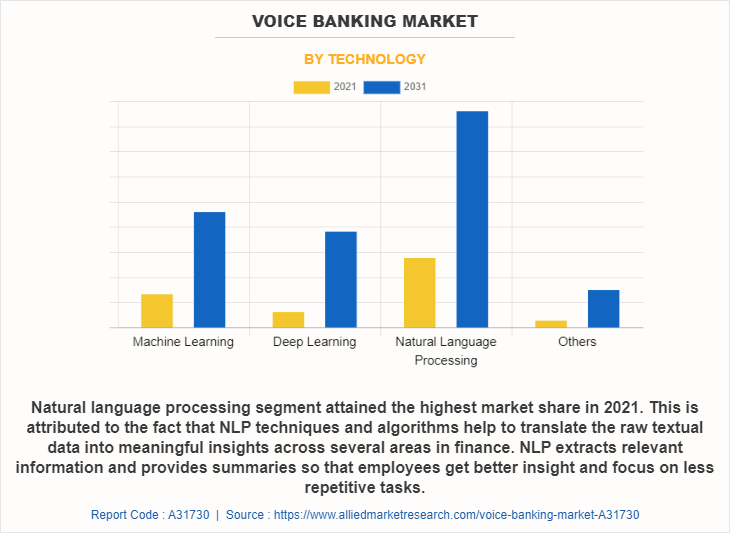

The voice banking market is segmented on the basis of component, deployment mode, and application. By component, it is segmented into solution and services. By deployment mode, it is bifurcated into on-premise and cloud. By technology, it is segmented into machine learning, deep learning, natural language processing and others. On the basis of application, it is segmented into banks, NBFCs, credit union, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on technology, the natural language processing segment attained the highest growth in 2021. This is attributed to the fact that NLP techniques and algorithms help to translate the raw textual data into meaningful insights across several areas in finance. NLP extracts relevant information and provides summaries so that employees get better insight and focus on less repetitive tasks.

Based on region, North America attained the highest growth in 2021. This is attributed to the voicebots are emerging as a game changer in banking and financial services. As an industry thats always been a forerunner in adopting innovative technology, Voicebot is helping them meet customer expectations in the best possible way. In addition, as per cognizant survey, customer behavior is changing from using the eyes to read text and fingers to swipe, to using voice and ears to talk and listen.

The report analyzes the profiles of key players operating in the Voice banking market such as Acapela Group, Axis Bank, BankBuddy, Central 1 Credit Union, DBS Bank, Emirates NBD Bank, HSBC, IndusInd Bank, NatWest Group and U.S. Bank. These players have adopted various strategies to increase their market penetration and strengthen their position in the voice banking market share.

Market Landscape and Trends

With most of the tech giants like Amazon, Google, Facebook, Microsoft and Apple becoming increasingly aggressive in the voice space, voice-activated technology is expected to become the next big platform for both consumers and businesses. Moreover, adoption of machine learning and blockchain are driving the growth of the voice banking market. In addition, customers may communicate with their bank through voice banking while at home by utilizing a laptop, tablet, or smartphone. It connects a client with a banker or financial counselor via live voice call. Furthermore, international banks are currently exploring voice technology to extend security measures for his or her customers. For instance, In February 2019, HSBC became the primary bank to use voice recognition in services discharged to its customers. This marked a leap toward a replacement direction in identity verification for the monetary services sector. In line with the bank, mobile banking customers now not got to keep in mind their secret and different knowledge to access their accounts.

Top Impacting Factors

Personalized Services to Customers

Personalization in banking is about delivering a valuable service or product to a customer based on personal experiences and historical customer data. Moreover, with the rapid invasion of innovative fintech companies, it became apparent that consumers are increasingly more inclined to switch to flexible service providers that shape their business models around customer experiences. In addition, the combination of personalized banking solutions, enhanced user experiences and real-time processing of big data means more opportunities for bank or credit union to meet user needs on a highly customized and dynamic basis. Furthermore, personalization in banking empowers business leaders to distinguish primary target audiences from secondary audiences. Moreover, the goal of personalization is to anticipate a customers wants and needs based on historical data. Therefore, this is a major growth factor for the voice banking industry.

Growth in Digital Banking Services

Growth in digital banking trends leads to the growing use of mobile phones and internet penetration all over the globe, banks are moving toward digital channels to provide their services. Moreover, banks are working in partnership with fintech corporations and other third-party interfaces to create additional customer-centric products & services, and thereby deliver an enhanced customer experience. In addition, government is also initiating and driving the use of digital banking services by various initiatives globally. Furthermore, many banks are implementing machine learning to predict fraud even before it occurs to enhance the security measures in the banking platform. The growth of digital banking is anticipated to benefit significantly from the increased incorporation of innovative technologies in voice banking service in the next years. Therefore, this is one of the major driving factor of the voice banking market

Privacy Concerns of Customers

Privacy and security concerns have emerged as key industry problems due to the extensive flow of customer data. The service providers of voice banking place a high priority on enhancing client data security against theft, data breaches, and other cyber risks as well as on assuring the secure administration and privacy of customer data. Moreover, with no all-encompassing federal law in place, banks and other financial institutions, including companies that offer digital financial services, face increasing pressure to be proactive in managing consumer privacy. For instance, 80% of bank executives polled in the World Retail Banking Report cited cyber security and privacy as major concerns as the shift to digital banking continues. Therefore, this is a major factor hampers the growth of voice banking market.

Regulatory Complications of Voice Banking

Banking and financial services is one of the most heavily regulated industries, and that applies to any new technology they introduce. Ensuring that they can handle customers' personal and sensitive information while remaining compliant with global financial regulations is a significant factor in whether a bank chooses to adopt voice recognition technology. Moreover, regulators and supervisors need to preserve the integrity of the financial system ensuring proper conduct by market participants. In addition, the speed of real-time payment systems, the immediate availability of funds and the anonymity may attract illegal economic transactions to real-time payment systems. Therefore, this is one of the major factors that hampers the growth of voice banking market.

Growing usage of Artificial Intelligence in Voice Banking

Artificial Intelligence enables banks to manage record-level high-speed data to receive valuable insights. Moreover, features such as digital payments, AI bots, and biometric fraud detection systems further lead to high-quality services for a broader customer base. Moreover, Artificial Intelligence comprises a broad set of technologies, including, but are not limited to, machine learning, natural language processing, expert systems, vision, speech, planning, and robotics. In addition, The AI in voice banking fundamentally reshapes the customer experience. The main premise of voice banking is to provide banking services around the clock, as well as to help customer support staff focus on more complex tasks. Therefore, these factors will provide major lucrative opportunities in the growth of the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the voice banking market forecast from 2021 to 2031 to identify the prevailing voice banking market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the voice banking market outlook segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global voice banking market trends, key players, market segments, application areas, and market growth strategies.

Voice Banking Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.7 billion |

| Growth Rate | CAGR of 14.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 227 |

| By Application |

|

| By Component |

|

| By Deployment Mode |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Emirates NBD Bank, Acapela Group, HSBC, Axis Bank, DBS Bank, IndusInd Bank, U.S. Bank, NatWest Group, Central 1 Credit Union, BankBuddy |

Analyst Review

Voice banking is a term used for performing banking transactions or professional banking consultations via a remote call connection. Moreover, voice calls save time and reduce or eliminate the need for bank employees to commute to work, which can result in shorter wait times for customers. In addition, voice communication also enables a more consistent customer journey. The main advantage is that voice banking enables banks to communicate with consumers digitally in a safe, effective, and humane manner.

Furthermore, market players are adopting partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, on July 2020, Axis Bank has partnered Vernacular.Ai to deploy its multi-lingual BOT AXAA on its phone banking IVR which will result in increased automation in customer service. The BOT, which is capable of conversation in English, Hindi and Hinglish, can recognize the nature and intent of customer queries and accelerates engagement and problem solving, using automated speech recognition and natural language understanding.

Some of the key players profiled in the report include Acapela Group, Axis Bank, BankBuddy, Central 1 Credit Union, DBS Bank, Emirates NBD Bank, HSBC, IndusInd Bank, NatWest Group and U.S. Bank. These players have adopted various strategies to increase their market penetration and strengthen their position in the voice banking market.

There is an increase in the demand for voice banking service due to personalized services to customers. Personalization in banking is about delivering a valuable service or product to a customer based on personal experiences and historical customer data. In addition, growth in digital banking services and reduction in bank visit by customers are driving the growth of the market.

North America is the largest regional market for voice banking market

The estimated industry size of voice banking market is projected to reach $3,690.82 million by 2031, growing at a CAGR of 14.5% from 2022 to 2031.

Acapela Group, Axis Bank, BankBuddy, Central 1 Credit Union, DBS Bank, Emirates NBD Bank, HSBC, IndusInd Bank, NatWest Group and U.S. Bank.

The voice banking service market is segmented on the basis of component, deployment mode, and application. By component, it is categorized into solution and services. By deployment mode, it is bifurcated into on-premise and cloud. By technology, it is classified into machine learning, deep learning, natural language processing and others. By application, it is divided into banks, NBFCs, credit union, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...

Loading Research Methodology...