Warm Water Aquaculture Feed Market Outlook - 2026

The warm water aquaculture feed market size was valued at $45,696.2 million in 2018, and is expected to reach $60,914.9 million by 2026, registering a CAGR of 3.7% from 2019 to 2026.

Aquatic livestock, such as fish, crustaceans, and shrimps, is a major source of protein in human diet. The major end use applications of warm water aquaculture feed include fish, crustaceans, and shrimps. Fishes and shrimps require specific dietary supplements based on energy, protein, fiber, minerals, vitamin needs, and body chemistry. Warm water aquaculture feed is crucial in stimulating growth, ingredient dispersion, and feed ingestion in diet.

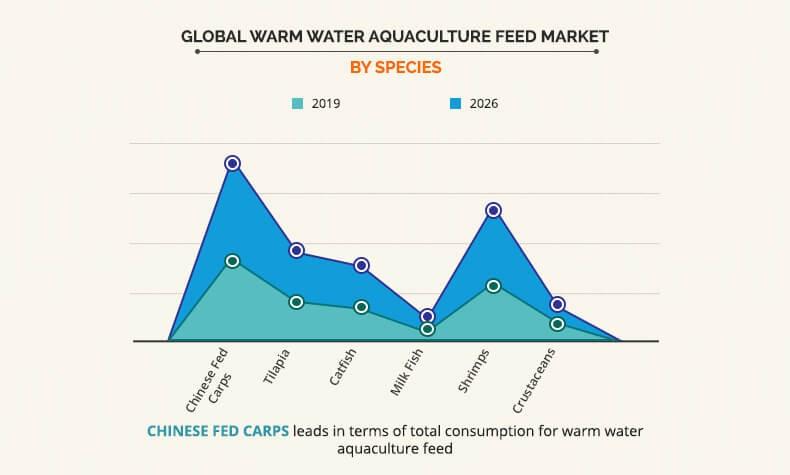

The Chinese fed carps segment dominated the overall warm water aquaculture feed market share in 2018 and is expected to remain dominant during the forecast period. Increase in Chinese fed carps consumption has been perpetual for decades partially due to increase in population along with technical developments in processing, preservation, logistics, and distribution channels. Furthermore, the hardiness and adaptability of carps have encouraged the domestication of this species across the region. In addition, high feed conversion ratio of carp has resulted in widespread adoption of Chinese fed carp for aquaculture which in turn resulting in growth of warm water aquaculture feed market.

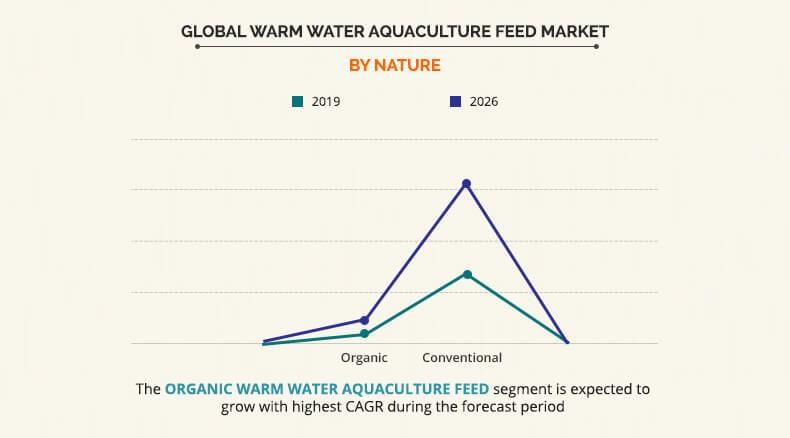

The organic food industry has witnessed significant growth over the past few years. As a result, considerable rise in demand of organic fish has been noticed over the period. Furthermore, consumers are adopting healthy eating practices, such as organic sea food, due to increase in health consciousness, which is expected to boost the market growth. Organic fish species such as black tiger shrimp, Pacific white shrimp, freshwater shrimp, Tilapia Pangasid catfish, and Carp have seen exponential growth in farmed organic fisheries. Therefore, the exponential increase in organic aquaculture attributed to the growing interest in organic farming, better return on investments, government initiatives, and sustainability. However, organic aquaculture still remains a niche segment and various initiates needs to be taken to revolutionize organic warm water aquaculture feed market.

The formulation of warm water aquaculture feed has seen new paradigm shift in the recent years. Function feeds have been developed to cater specific requirements of different fish species. They improve feed utilization, growth, and furthermore general health & stress resistance of fish. In addition, they enhance feed efficiency, disease resistance, growth performance and reduce the cost of production & medication. Therefore, introduction of such feed is expected to fuel the warm water aquaculture market growth in the coming years.

The report focuses on the growth prospects, restraints, and opportunities of the global warm water aquaculture feed market. The study provides Porter’s five forces analysis to understand the impact of various factors such as competitive intensity of competitors, bargaining power of suppliers, threat of substitutes, threat of new entrants, and bargaining power of buyers of the warm water aquaculture feed market.

The global warm water aquaculture feed market is segmented based on species, nature, and region. Based on species, the market is classified into Chinese fed carps, tilapia, catfish, milk fish, shrimps, and crustaceans. Based on nature, the market is bifurcated into organic and conventional. Based on region, the market is studied across Asia-Pacific and rest of the World.

Some of the key players operating in the warm water aquaculture feed market include Aller Aqua A/S, Alltech Inc., Beneo, Cargill, Incorporated, Charoen Pokphand Foods PCL, Nutreco N.V., Avanti Feeds Ltd, Biomin Holding GmbH, Biomar Group, and Nutriad.

Top impacting factors

Current and future warm water aquaculture feed industry trends are outlined to determine the overall attractiveness of the warm water aquaculture feed market. Top impacting factors highlight opportunities during the forecast period. Factors such as growth in aquaculture and increase in per capita fish consumption drive the growth of the warm water aquaculture feed market. However, stringent government regulations and increase in raw material cost are anticipated to restrain the market growth.

Regional Outlook

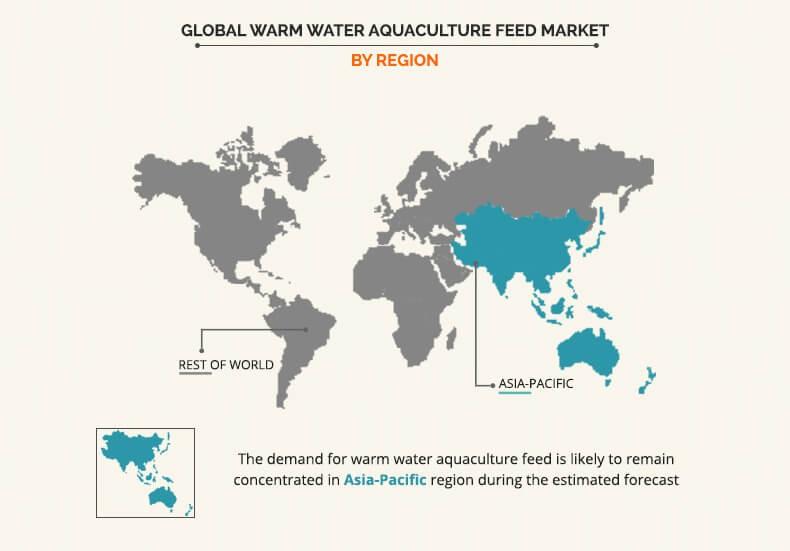

China is dominating the demand for warm water aquaculture feed followed by Indonesia, Vietnam, Bangladesh, and others. The Chinese aquaculture industry holds the overall global leadership position in aquaculture production with total production amounting to more than 57% of the global production for 2016. Favorable government initiatives promoting implementation of "green" certification (eco-certification), better management, and providing professional training will lead improvisation of the Chinese aquaculture industry. Furthermore, development of marine aquaculture, paddy-fish culture, freshwater integrated farming, as well as implementation of participatory community extension services augment the demand for warm water aquaculture feed in the region.

Key Benefits for Warm Water Aquaculture Feed Market:

- The report provides an extensive analysis of the current and emerging warm water aquaculture feed market trends and opportunities.

- The report provides detailed qualitative and quantitative analysis of the current trends and future estimations that help evaluate the prevailing market opportunities.

- The warm water aquaculture feed market forecast is offered along with information related to key drivers, restraints, and opportunities.

- The warm water aquaculture feed market analysis is conducted by following key product positioning and monitoring the top competitors within the market framework.

- The report provides extensive qualitative insights on the potential and niche segments or regions exhibiting favorable growth.

Warm Water Aquaculture Feed Market Report Highlights

| Aspects | Details |

| By SPECIES |

|

| By NATURE |

|

| By Region |

|

| Key Market Players | NUTRIAD, NUTRECO N.V, CARGILL, INCORPORATED, ALLTECH INC, ALLER AQUA A/S, BIOMIN HOLDING GMBH, BIOMAR GROUP, AVANTI FEEDS LTD, BENEO, CHAROEN POKPHAND FOODS PCL |

Analyst Review

The aquaculture production has witnessed considerable growth over the past few years. Similarly, there has been significant increase in the demand for aquaculture feed. The changing cost dynamics and shifting preferences from capturing fish to aquaculture will leave a significant global imprint, particularly on the aquaculture feed market.

Increase in disposable income and rise in popularity of warm water fish have resulted in widespread consumption of warm water fish and shrimps across the world, thereby boosting the market growth. Furthermore, expansion of the aquaculture industry, rise in per capita fish consumption, availability and flexibility in the usage of alternative raw materials drive the overall warm water aquaculture feed market. However, increase in cost of raw materials and regulatory framework & interference restrains the market growth.

The demand for warmwater aquaculture feed is highly concentrated in Asia-Pacific region. As a result, leading players are expanding their manufacturing in South East Asia. For instance, Cargill has expanded its production capacity of aquaculture feed to cater to domestic and regional demand for warmwater aquaculture feed species, such as tilapia and shrimp. Expansion of production capabilities is the top winning strategy adopted by stakeholders operating in the warm water aquaculture feed market.

The warm water aquaculture feed market size was valued at $45,696.2 million in 2018, and is expected to reach $60,914.9 million by 2026

The global Warm Water Aquaculture Feed market is projected to grow at a compound annual growth rate of 3.7% from 2019 to 2026 $60,914.9 million by 2026

ALLTECH INC, ALLER AQUA A/S, NUTRECO N.V, NUTRIAD, BIOMAR GROUP, CHAROEN POKPHAND FOODS PCL, AVANTI FEEDS LTD, BIOMIN HOLDING GMBH, CARGILL, INCORPORATED, BENEO

Asia-Pacific region to garner largest share

Rise in disposable income and increase popularity and thus consumption of warm water fish and shrimps have boosted the growth of the global warm water aquaculture feed market.

Loading Table Of Content...