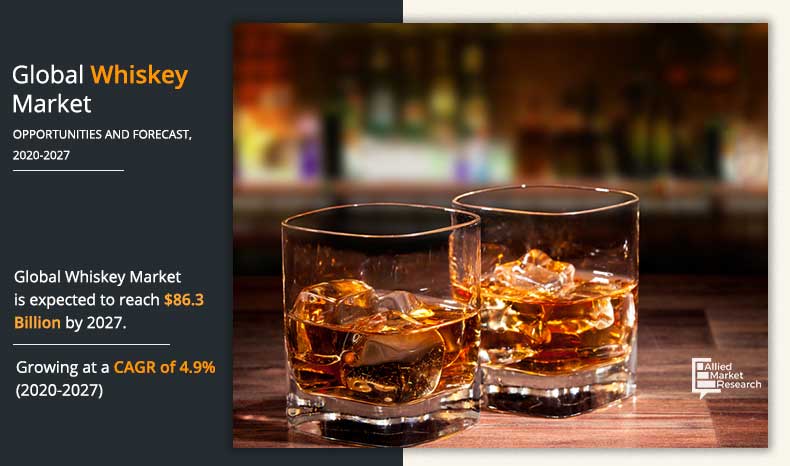

The global whiskey market was valued at $59,631.2 million in 2019, and is projected to reach $86,389.5 million by 2027, registering a CAGR of 4.9% from 2020 to 2027. In 2019, the scotch whiskey segment accounted for the highest market share in the whiskey market. Whiskey refers to an alcoholic beverage distilled from grains and aged in wood barrels. The type of whiskey produced depends on the type of grain and barrel used in the distilling process. Additionally, the location also plays an important part in defining a whiskey.

In the recent years, the number of bars, pubs, restaurants, and breweries serving alcoholic beverages have grown exponentially. This is primarily driven by the increase in consumer spending, product innovations, rapid urbanization and growing demand from young consumers. There has been a shift from beer and wine to spirits consumption. Millennia value quality, authenticity and provenance, and hence are willing to pay more to enjoy this. Additionally, millennia are inclined to experiment with their alcoholic beverages, which has essentially led to the rise in ‘cocktail culture’. This trend has further enhanced the usage of whiskey as an ingredient, thereby propelling the global whiskey market growth. Likewise, rise in spirit tourism especially in the western countries, encourages tourists from overseas to indulge and develop taste for local beverages, including whiskeys. Countries such as the UK, France, the U.S., Scotland and others, have developed spirit led-tourism which enables tourists to comprehend the history and processes involved in producing whiskeys. This is regarded as one of the highest revenues generating factor for the whiskey market. However, the popularity of alcoholic beverages could lead to issues of dependency, addiction and excessive consumption leading to health concerns. The rise in number of consumers suffering from alcohol addiction has been a concern for governments. Hence, many governments have made stringent rules and regulations about the sales and distributions of these products. These restrictions are thereby expected to hamper the growth of the global whiskey market.

On the contrary, general shift in consumer consciousness and demand for innovative products, has led to an increased desire for whiskey distilled with organic malted barley made and grains. This consumer demand can be regarded as an opportunity by whiskey manufactures to further expand market base in the global whiskey market.

According to global whiskey market report, the market is segmented on the basis of product type, distribution channel and region. Based on product type, the market is categorized into Irish whiskey, Scotch whiskey, Japanese whiskey, American whiskey and Canadian whiskey. By distribution channel, the market is bifurcated into on-trade and off-trade. Region wise, the market is studied across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, New Zealand and Rest of Asia-Pacific), and LAMEA (Middle East, Latin America, and Africa).

On the basis of product type, the scotch whiskey segment accounted for the maximum share in the global market in 2019. Scotch whiskey has the highest set of product offerings by the whiskey manufacturing companies owing to its consumer demand. Furthermore, due to its strict, regulated methods of production and rich, smooth flavor, it has become the most popular choice of whiskey among the other products. Scotch whiskey has also been used as a mixer in cocktails, which has further enabled to expand the market base to include young consumers. Thus, owing to these key characteristics, scotch whiskey segment accounted for a higher value share in the global whiskey market analysis.

On the basis of distribution channel, the off-trade category was the dominant global whiskey market segment in 2019 with more than half of the market share and is expected to retain its dominance throughout the forecast period. Off-trade sales channel comprises all retail outlets including supermarket/hypermarket, wines & spirits shops, and convenience stores among others. Majority of the whiskey sales volume are generated by large supermarket chains. This is due to the sales promotions through in-store strategies such as price off promotions, tastings for selective products and others. Hence, the off-trade category accounted for a larger market share and is anticipated to retain its position during the global whiskey market forecast period.

By Product Type

The canadian whiskey segment would witness the fastest growth, registering a CAGR of 6.60% during the forecast.

On the basis of region, Europe was the prominent market in 2019 and accounted for the maximum share in the global whiskey market. This can be attributed to the tremendous popularity and substantial consumption of alcohol in the region. Consumers in the EU-member states and the UK drink a regular amount of alcohol almost daily. However, the Asia-Pacific region is expected to witness a significant CAGR, owing to rapid demand and acceptance of whiskey for social drinking coupled with the rise in income spending in these regions and rise in young consumers.

By Distribution Channel

On-Trade segment would witness the fastest growth, registering a CAGR of 5.40% during the forecast period.

The key players operating in the global whiskey market include Diageo plc., Pernod Ricard, William Grant & Sons Ltd, Bacardi Limited, Beam Suntory, Inc., The Brown–Forman Corporation, Constellation Brands, Inc., Asahi Group Holdings, Ltd., La Martiniquaise and Loch Lomond Distillers Ltd.

By Region

Asia-Pacific region woud witness the fastets growth, registering a CAGR of 6.00% from 2019-2026.

Key Benefits For Stakeholders

- The report provides a quantitative analysis of the current global whiskey market trends, estimations, and dynamics from 2020 to 2027 to identify the prevailing opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the global whiskey market size and segmentation assists in determining the prevailing whiskey market opportunities.

- The major countries in each region are mapped according to their revenue contribution to the market.

- The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the global whiskey industry.

Whiskey Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By DISTRIBUTION CHANNEL |

|

| By Region |

|

| Key Market Players | BEAM SUNTORY, INC, BROWN-FORMAN CORPORATION, BACARDI, DIAGEO PLC, CONSTELLATION BRANDS, INC, WILLIAM GRANT & SONS LTD, PERNOD RICARD S.A, LA MARTINIQUAISE, LOCH LOMOND DISTILLERS LTD, ASAHI GROUP HOLDINGS, LTD |

Analyst Review

According to the CXO of leading companies, the whiskey market is expected to grow at a significant rate during the forecast period, owing to various factors such as premium positioning and craft varieties through product innovations, rising acceptance and consumption of alcoholic beverages and growing demand from young consumers.

The whiskey consumption is led by Europe and the region also has higher per capita daily consumption of alcoholic beverages, as compared to other regions. The spirit-led tourism culture and growth of whiskey producers in the European countries is one of the most significant driving factors for the whiskey market. To match this increasing demand, Scottish distillers have been setting up new facilities to cater to whiskey tourists. In addition, consumers in the western countries have spurred great potential and demand for super-premium whiskeys.

The CXOs further added that Asia-Pacific is projected to register a significant growth as compared to the mainstream markets of Europe and North America, due to factors such as rise in consumer spending, increase in consumption of whiskey and its acceptance in social gatherings and events, especially in countries such as India, China and Singapore.

The global whiskey market was valued at $59,631.2 million in 2019, and is projected to reach $86,389.5 million by 2027

The global Whiskey market is projected to grow at a compound annual growth rate of 4.9% from 2020 to 2027

CONSTELLATION BRANDS, INC, BEAM SUNTORY, INC, BROWN-FORMAN CORPORATION, PERNOD RICARD S.A, LOCH LOMOND DISTILLERS LTD, ASAHI GROUP HOLDINGS, LTD, BACARDI, LA MARTINIQUAISE, WILLIAM GRANT & SONS LTD, DIAGEO PLC

Asia-Pacific region woud witness the fastets growth

Growing consumption of whiskey among young consumers and the rise in acceptance of alcoholic beverages in social gatherings, especially in the Asia-Pacific region is expected to propel the demand for the whiskey market

Loading Table Of Content...