Wide Bandgap Semiconductors Market Research, 2032

The global wide bandgap semiconductors market size was valued at $1.6 billion in 2022 and is projected to reach $5.4 billion by 2032, growing at a CAGR of 13.2% from 2023 to 2032. Wide band gap semiconductors, compared to more conventional semiconductor materials like gallium arsenide and silicon carbide, enable devices to function at high temperatures, high voltages, and frequencies.

Consumers are making energy conservation, carbon reduction, and environmental preservation a shared priority as a result of the growing environmental issues brought on by carbon emissions and global warming. Their objective is to progressively enhance energy efficiency and decrease energy consumption. The UN has declared that it wants to limit global warming to 2°C.

![]()

Additionally, a 50% rise in power usage is anticipated. Improving energy generation and utilization is therefore a key trend in the industrial sector to achieve this aim. Throughout the projected period, rising demand for the products is driving the wide bandgap semiconductors industry.GAN bandgap semiconductors are utilized to create blue LEDs and lasers, as well as ultraviolet LEDs with wavelengths between 200 and 250 nm. The primary barrier impeding wide band gap semiconductor production, on the other hand, is their high cost.

To operate devices at high voltages, temperatures, and frequencies, wide bandgap semiconductor materials are frequently employed. The need for wide bandgap semiconductors is rising for this reason. The primary component utilized in the production of green and blue LEDs and lasers is wide bandgap semiconductors. Wide bandgap semiconductors are also expected to be in demand, particularly for military radars. Additionally, the growing popularity of tablets and smartphones is helping producers in the wide bandgap semiconductors industry.

Consequently, it is anticipated that throughout the projection period, the wide bandgap semiconductor market is expected to experience significant growth. Wide bandgap semiconductor demand is further fueled by the growing popularity of tablets and smartphones in the consumer electronics sector. These materials aid in the creation of high-performing, power-efficient electronics that satisfy the constantly rising expectations of contemporary technology users.

The wide bandgap semiconductors market is expected to experience significant growth in the market as long as technology keeps improving. Wide bandgap semiconductors are expected to become even more efficient and affordable because of advancements in material science and semiconductor manufacturing techniques, which will increase their appeal for a wider range of applications. Post-pandemic, the industry quickly adjusted as the demand for wide bandgap semiconductors grew alongside an increase in the sale of silicon carbide (SiC) and gallium nitride (GaN). This shift led to innovation and a subsequent rebound in the market.

Segment Overview

The wide bandgap semiconductors market analysis is segmented into material, industry vertical, and region.

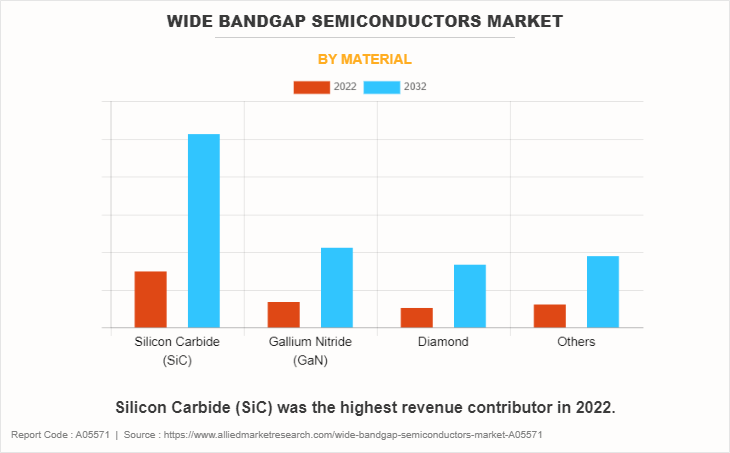

By material, the market is classified into silicon carbide (SiC), gallium nitride (GaN), diamond, and others. The silicon carbide (SiC) segment generated the largest revenue in 2022.

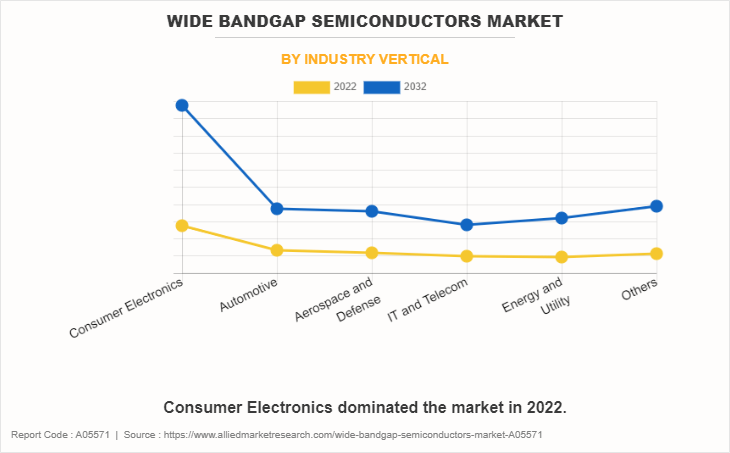

By industry vertical, it is bifurcated into consumer electronics, automotive, aerospace and defense, IT and telecom, energy and utility, and others. Consumer Electronics dominated the market in 2022.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA, along with their prominent countries. North America garnered a significant wide bandgap semiconductors market share in 2022.

Country-wise, the U.S. acquired a prime share in the wide bandgap semiconductor market in the North American region, and it is expected to grow at a significant CAGR during the wide bandgap semiconductors market forecast of 2023-2032.

In Europe, the UK dominated the wide bandgap semiconductor market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. However, the UK is expected to emerge as the fastest-growing country in Europe's surrounding wide bandgap semiconductor market with a CAGR of 12.29%.

In Asia-Pacific, China is expected to emerge as a significant market for the wide bandgap semiconductor market industry, owing to a significant rise in investment by prime players due to an increase in the growth of consumer electronics in rural and urban regions.

In the LAMEA region, the Middle East garnered a significant market share in 2022. The LAMEA wide bandgap semiconductor market has witnessed an improvement, owing to the growth in the inclination of prime vendors towards utilizing the wide bandgap semiconductor across this region. Moreover, the Middle East region is expected to grow at a high CAGR of 14.28% from 2023 to 2032.

Competitive Analysis

Competitive analysis and profiles of the major global wide bandgap semiconductor market players that have been provided in the report include Infineon Technologies AG, Microsemi Corporation, STMicroelectronics, Maxell Ltd., ROHM Semiconductor, Texas Instruments Inc., Vishay Intertechnology Inc., Panasonic Corporation, Genesis Semiconductor, Nexperia, and Wolfspeed, Inc. These key players adopt several strategies such as new product launch & development, acquisition, partnership & collaboration, and business expansion to increase the wide bandgap semiconductor market share during the forecast period.

Top Impacting Factors

The wide bandgap semiconductor market is expected to witness notable growth owing to growing investments in research and development activities for wide bandgap materials and a surge in demand for EVs, driving the global wide bandgap semiconductors market demand. Moreover, the growing demand for wide bandgap devices in electric vehicles is expected to provide a lucrative opportunity for the growth of the market during the forecast period. On the contrary, the high cost of wide bandgap semiconductors limits the growth of the wide bandgap semiconductors market opportunity.

Historical Data & Information

The global wide bandgap semiconductor market is highly competitive, owing to the strong presence of existing vendors. Vendors of the wide bandgap semiconductor market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Infineon Technologies AG, Microsemi Corporation, STMicroelectronics, Maxell Ltd., and ROHM Semiconductor are the top companies holding a prime share in the wide bandgap semiconductor market. Top market players have adopted various strategies, such as product launches, to expand their foothold in the wide bandgap semiconductor market.

- In August 2023, STMicroelectronics (ST) will supply BorgWarner Inc. with the latest third-generation 750V silicon carbide (SiC) power MOSFET dice for their proprietary Viper-based power module. This power module is used in Borg Warner's traction inverter platforms for several current and future Volvo Cars electric vehicles. The collaboration between ST and BorgWarner will provide Volvo Cars with inverters that offer superior vehicle performance and range. ST is committed to expanding SiC capacity and reinforcing its SiC supply to support global automotive and industrial customers in their shift to electrification and higher efficiency.

- In June 2023, Airbus and STMicroelectronics (ST)signed an agreement to collaborate on power electronics research and development (R&D) to support more efficient and lighter power electronics for aircraft electrification. The collaboration will focus on the development of advanced power electronics devices and systems based on wide-bandgap (WBG)semiconductor materials, such as silicon carbide (SiC) and gallium nitride (GaN).

- In November 2023, ROHM developed a new gate driver IC optimized for GaN devices that achieves gate drive speeds on the order of nanoseconds. This new IC will contribute to smaller, more energy-efficient, higher-performance applications.

Key Benefits for Stakeholders

- This study comprises an analytical depiction of the Wide Bandgap Semiconductors Market Trends along with the current trends and future estimations to depict the imminent investment pockets.

- The overall wide bandgap semiconductor analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

Wide Bandgap Semiconductors Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.4 billion |

| Growth Rate | CAGR of 13.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By Material |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | STMicroelectronics, Nexperia, Texas Instruments Inc., Wolfspeed, Inc., ROHM Semiconductor, Microsemi Corporation., Infineon Technologies AG, Genesic Semiconductor, Vishay Intertechnology Inc., Panasonic Corporation |

Analyst Review

The wide bandgap semiconductor market is expected to leverage high potential for the gallium nitride (GaN) material and Silicon (SiC) during the forecast period. Wide bandgap semiconductor vendors, investing in R&D and skilled workforce, are anticipated to gain a competitive edge over their rivals. The competitive environment in this market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The constant advancement of consumer electronics, from wearables to smartphones, has made improved micro batteries with extended lifespans, high energy densities, and effective power transfer.

Leading economies are leading the way in realizing the strategic significance of sophisticated wide bandgap semiconductor, including the U.S., China, UK, and Japan. These countries actively engage in the creation and use of cutting-edge wide bandgap semiconductor technology across a range of industries in addition to being large consumers. The U.S., which is renowned for its innovation ecosystem, is leading R&D efforts to produce wide bandgap semiconductor that solve environmental sustainability issues and satisfy the ever-expanding needs of consumer devices.

China, a global manufacturing powerhouse, is strategically investing in the mass production of wide bandgap semiconductor to meet the escalating demands of its domestic and international markets. Simultaneously, the UK and Japan, renowned for their technological advancements, foster collaborations between industry and research institutions to accelerate the development of advanced wide bandgap semiconductor industry. The surge in demand for wide bandgap semiconductors in consumer electronics across the globe for power transmission drives the need for enhanced wide bandgap semiconductors. Moreover, major economies, such as the U.S., China, the UK, and Japan plan to develop and deploy advanced micro batteries in various sectors.

Key wide bandgap semiconductor market leaders profiled in the report include Infineon Technologies AG, Microsemi Corporation, STMicroelectronics, Maxell Ltd., ROHM Semiconductor, Texas Instruments Inc., Vishay Intertechnology Inc., Panasonic Corporation, Genesic semiconductor, Nexperia and Wolfspeed, Inc.

Consumer electronics is the leading industry vertical of Wide Bandgap Semiconductors Market.

The upcoming trends of Wide Bandgap Semiconductors Market are growing investments in research and development activities for wide bandgap materials.

North America is the largest regional market for Wide Bandgap Semiconductors.

The wide bandgap semiconductor market was valued at $1.6 billion in 2022 .

Infineon Technologies AG, Microsemi Corporation, STMicroelectronics, Maxell Ltd., and ROHM Semiconductor are the top companies to hold the market share in Wide Bandgap Semiconductors.

Loading Table Of Content...

Loading Research Methodology...