Wireless Mesh Networks Market Insights:

The global wireless mesh networks market was valued at USD 5.2 billion in 2021 and is projected to reach USD 12.8 billion by 2031, growing at a CAGR of 9.8% from 2022 to 2031.

The rise in demand for work-from-home and remote working policies during the period of the COVID-19 pandemic propelled the demand for reliable communication networks, hence empowering the growth of the market. However, higher installation costs and maintenance challenges of wireless mesh network platforms can hamper the market during the forecast period. On the contrary, the development of advanced communication technologies, such as 5G communication networks and Wi-Fi 6 technology is expected to offer remunerative opportunities for the expansion of the wireless mesh networks market during the forecast period.

Wireless mesh networks are communication networks that consist of various radio nodes, which are arranged in a mesh topology. Mesh topology arrangement enables seamless integration of all nodes connected within a network. Mesh networks often have fewer moving parts, making rerouting easier to foresee and causing less latency in data transfer when all nodes are completely linked.

The report focuses on growth prospects, restraints, and analysis of the global wireless mesh networks market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global wireless mesh networks market share.

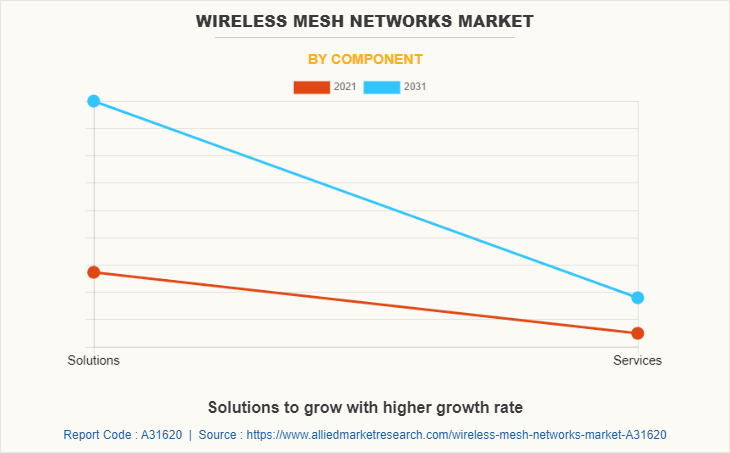

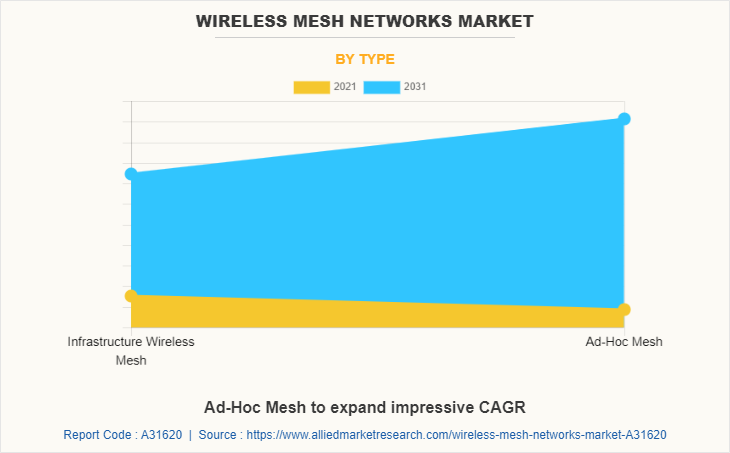

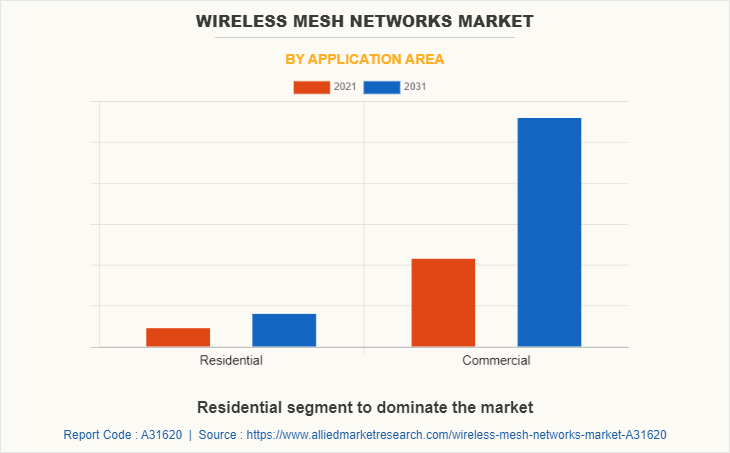

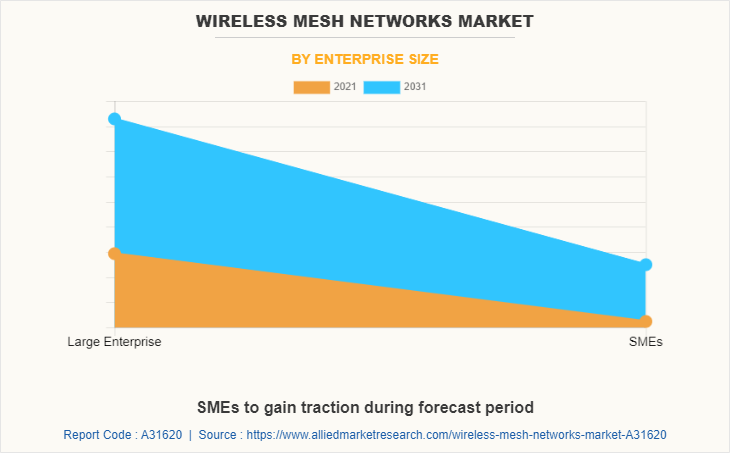

The wireless mesh network market is segmented on the basis of component, type, enterprise size, application area, and region. On the basis of component, the industry is divided into solutions and services. Depending on type, the market is classified into infrastructure wireless mesh and ad-hoc mesh. Based on enterprise size, the market is bifurcated into large enterprises and SMEs. The application area covered in the study include residential and commercial. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The wireless mesh networks use cutting-edge data packet routing protocols to give self-forming, self-healing, and self-configuring capabilities to data packets, simplifying their transmission through the network. These capabilities enable the wireless mesh networks to continuously adapt to the optimum state and deliver peak performance.

Depending on type, the infrastructure wireless mesh segment dominated the wireless mesh networks market share in 2021, and is expected to continue this trend during the forecast period owing to the growing demand for network communication hardware and services. However, the ad-hoc mesh segment is expected to witness the highest growth in the upcoming years, owing to the rising demand for mobile communication networks.

The global wireless mesh networks market has witnessed stable growth during the COVID-19 pandemic, owing to the dramatic increase in the demand for communication technology, which further fueled the demand for Wi-Fi coverage and mesh network system.

Moreover, the increasing work-from-home trends during COVID-19 generated a need for Wi-Fi mesh networks that use multiple nodes and can communicate with each other to seamlessly share a wireless connection within a larger area. It connects to an internet modem or wireless gateway (or a combination of a wireless router and modems) to a network, forming consistent coverage. This results in the whole system working together to provide the best coverage and fastest speeds available. Such factors propelled the growth of the global wireless mesh networks market solutions market during the period.

Rise in need to increase the efficiency of companies and the surge in demand for better business communication among these large organizations drive the growth of the wireless mesh market. In addition, the growing scale of operations of large enterprises and the increasing industry 4.0 trends in business organizations are fueling the growth of the wireless mesh networks market among large enterprises and wireless mess networks market size.

Region-wise, the wireless mesh networks market was dominated by Asia-Pacific in 2021, and is expected to retain its position during the forecast period, owing to its high concentration of communication hardware vendors. However, LAMEA is expected to witness significant growth during the forecast period, owing to rapid economic and technological developments in the region.

Top Impacting Factors:

Growing Internet and Digital Penetration

Due to the growing accessibility and availability, usage of the internet and newer digital technologies has increased dramatically over the past few years. Moreover, digital applications are frequently being used for rapid access to entertainment, online gaming, information, and marketing. In addition, businesses are creating digital workplaces more often in an effort to enable seamless collaboration between physical and virtual workplaces. As a result, wireless mesh network solutions are being provided by companies to agencies and educational institutes with special equipment to ensure risk-free wireless networks.

For instance, in April 2021, Aruba partner tackles the university's wireless network upgrade by expanding their services to Doane University, Nebraska's oldest private college, their shift to remote and hybrid learning led to the replacement of its older Cisco Systems wireless network system with Aruba's Edge Services Platform.

Rising Demand for Industrial Automation and Industry 4.0 Trends

The demand for industrial automation has been growing significantly over the last few decades due to the increasing need for reliable and cost-effective ways to optimize production. Automation and quality assurance are used every day in numerous industries such as the automotive industry, the food industry, and mechanical engineering. The rising demand for industrial automation is causing supporting the growth of wireless mesh networks. As a result, a highly reliable mesh network is needed for using these technologies to ensure efficiency and productivity.

For instance, in July 2022, The HPE-owned mesh networking specialist’s flagship Aruba Central platform has been bolstered with four new AI features that tap into the vendor’s massive data lake to give more actionable networking and security information to partners and IT administrators. Such factors are fueling the demand for the wireless mesh network market.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wireless mesh networks market analysis from 2021 to 2031 to identify the prevailing wireless mesh networks market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities coupled with Wireless Mess Networks Market Growth.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network for Wireless Mess Networks Industry.

- In-depth analysis of the wireless mesh networks market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market and Wireless Mess Networks Market Share.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wireless mesh networks market trends, key players, market segments, application areas, and market growth strategies.

Wireless Mesh Networks Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.8 billion |

| Growth Rate | CAGR of 9.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 250 |

| By Application Area |

|

| By Component |

|

| By Type |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Synapse Wireless, Cisco Systems Inc., Qorvo, In., Qualcomm Incorporated, Wirepas Ltd, Cambium Networks, Aruba Networks, Rajant Corporation, ABB Ltd, Strix Systems |

Analyst Review

Demand for wireless mesh networks has been on a rise for the past few years and the market is expected to continue this trend in the coming years as well, due to the emergence of trending technologies, such as Software-as-a-Service based applications, cloud networking, network analytics, Internet of Things, and virtualization that encouraged users and enterprises to adopt wireless mesh networking technologies for establishing a cost-effective and constant network availability. In addition, the growing demand for higher communication flexibility and reliability in many regions around the globe is promising new opportunities for the growth of the wireless mesh networks market.

Key providers of the wireless mesh network, such as Cisco Systems, Inc., Qualcomm Incorporated, and Cambium Networks account for a significant share of the market. With larger requirements for scalability and security, various companies have launched enhanced versions of their products to provide greater flexibility in terms of network design. For instance, in March 2022, Amazon launched eero Pro 6E and eero 6+, the newest additions to the eero 6 series of mesh Wi-Fi systems. eero Pro 6E, the first Wi-Fi 6E-enabled eero mesh Wi-Fi system, supports network speeds up to 2.3 Gbps, provides coverage for over 100 devices simultaneously, and offers access to the newly-authorized 6 GHz band, all of which ensure more devices can get gigabit+ speeds across home with access to 160 MHz radio channels for fast connectivity for activities like AR, VR, and 8K streaming, and support over 75 simultaneously-connected devices.

In addition, with increase in demand for wireless networks, various companies are expanding their current service range with increasing diversification among customers. For instance, in February 2022, MeshPlus Inc., joined the assembly ecosystem to accelerate the development of the first incentivized, wireless long-range network coverage for the Internet of Things. Its goal is to be the first-ever network truly suitable for the global Internet of Things. With the development of 5G, Wi-Fi 6, and LoRawan, the utilization of wireless technologies to connect with the world is rapidly increasing. In the Internet of Things (IoT), where low-energy use is required by the millions of smaller edge devices that enable the IoT, the demand for data integrity, supporting hardware and network coverage is especially urgent, which is provided by the mesh network.

Moreover, market players are expanding their business operations and customers by increasing their product range. For instance, in June 2022, NVIDIA NetQ, a highly scalable, modern networking operations tool providing actionable visibility for the NVIDIA Spectrum Ethernet platform, released NetQ 4.2.0 in April 2022, which includes simplified events management, enhanced flow telemetry analysis, new RoCE validation, and new DPU monitoring. It combines advanced telemetry with a user interface, making it easier to troubleshoot and automate network workflows while reducing maintenance and downtime.

The global wireless mesh network market size was valued at $5.19 billion in 2021

The global wireless mesh networks market is dominated by key players, such as Aruba Networks, ABB, Qualcomm Incorporated, Cisco Systems, Inc., Qorvo, Inc., Synapse Wireless, Wirepas Ltd., Rajant Corporation, Cambium Networks, and Sitrix Systems.

North America is the largest regional market for Wireless Mesh Networks

Network Management is the leading application of Wireless Mesh Networks Market

Implementation of NGN is seen as the upcoming trend of Wireless Mesh Networks Market in the world

Loading Table Of Content...