Workflow Management Systems Market Overview

The global workflow management systems market was valued at USD 9.8 billion in 2022, and is projected to reach USD 99.9 billion by 2032, growing at a CAGR of 26.2% from 2023 to 2032.

The key factors that drive the growth of the market include the rising adoption of advanced technologies across several industries. It is optimizing business operational processes with the integration of advanced technologies and cloud solutions. Leveraging automation trends and the use of smart operations in industries such as banking and finance lead to predictive maintenance and predictive quality. The rise of remote and distributed workforces is further fueled by government regulations and industry standards. The remote and distributed teams often need to collaborate on projects and tasks from different locations, which in turn has surged the demand for workflow management system solutions among end users.

Introduction

Workflow management system (WMS) is the discipline of creating, documenting, monitoring, and improving upon the series of steps, or workflow, that is necessary to complete a specific task. The motive of workflow management is to optimize the steps in the workflow to ensure the task is completed effectively, consistently, and efficiently. Workflow management tools allow users to manage workflows faster and better and more easily roll out new ones and change existing ones. Workflow management platforms typically support customized workflows. But they also offer a service catalog of prebuilt workflows, which lets teams quickly implement managed workflows to rapidly streamline business processes.

However, a significant challenge in this market is the high implementation costs associated with workflow management systems. Huge capital expenditure (CAPEX), along with increasing upfront installation costs, is certainly restraining the adoption of workflow management system solutions across the globe. In addition, there are complexities in integrating workflow management systems with existing systems. Businesses frequently utilize a range of apps and software using various technologies. The process of integrating a workflow management system can be complicated since it may need to operate with several platforms, databases, and technologies, which in turn are expected to hinder global market growth. However, rise in implementation of cloud-based technologies is anticipated to emerge as a lucrative opportunity for the growth of the workflow management systems market.

The report focuses on growth prospects, restraints, and trends of the workflow management systems market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the market.

Segment Review

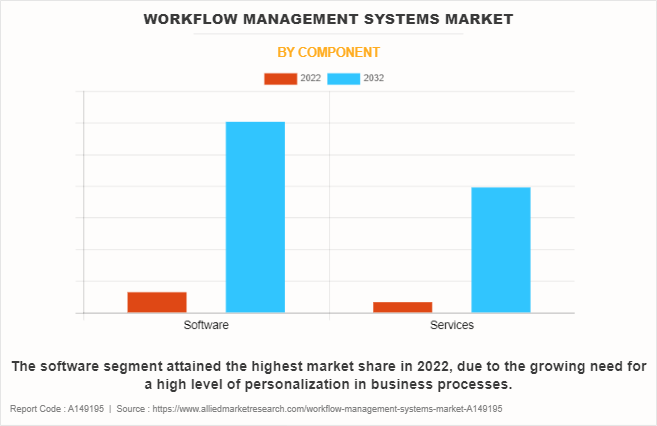

The workflow management systems market is segmented on the basis of component, enterprise size, deployment mode, industry, and region. On the basis of component, the market is segmented into software and services. On the basis of enterprise size, the market is segmented into large enterprises and small and medium-sized enterprises (SMEs). On the basis of deployment mode, the market is segmented into on-premise and cloud. On the basis of industry, the market is segmented into BFSI, retail, education, IT and telecom, healthcare transportation and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the global workflow management systems market share was dominated by the software segment in 2022 and is expected to maintain its dominance in the upcoming years, as the growing need for a high level of personalization are one of the primary reasons enterprises are increasing their investment in the market. However, the services segment is expected to witness the highest growth, as these services help to reduce the time and costs associated with optimizing systems in the initial phase of deployment.

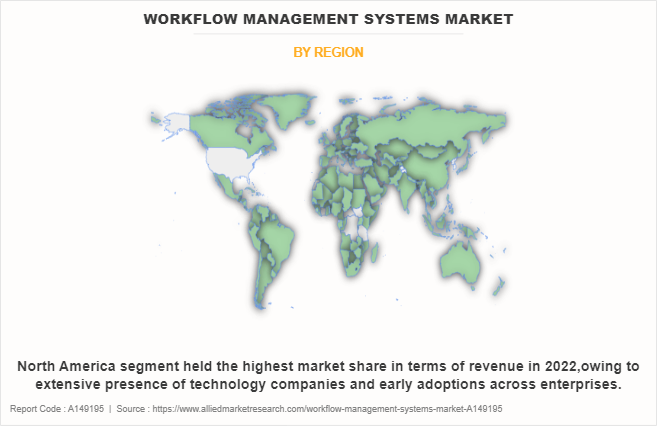

By region, North America dominated the market share in 2022 for the market. This region is more focused on regulatory compliance solutions for data privacy and security further anticipated to propel the growth of the workflow management systems market size. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is attributed to the increase in penetration of digitalization and higher adoption of advanced technology are expected to provide lucrative growth opportunities for the market in this region.

Top Impacting Factors

Rising Adoption of Advanced Technologies Across Several Industries

The increase in the adoption of advanced technologies in several sectors has proliferated the demand for workflow management systems market. It is optimizing business operational processes with the integration of advanced technologies and cloud solutions. Leveraging automation trends and the use of smart operations in industries such as banking and finance could lead to predictive maintenance and predictive quality.

In addition, the technical developments accelerate the digital transformation initiatives to recover lost time, reduce the cost of customer service, and de-risk traditional business models. Thus, the technological breakthrough in the development of digital infrastructure led to a surge in demand for workflow management system solutions to improve process optimization and customer experience for real-time operations and control. These factors are expected to propel market growth.

Further, the implementation of advanced technologies helps in determining the specific inefficiencies and avoiding them by simulating business processes in different scenarios. It also prevents the anticipated process inefficiency through predictive simulation. Hence, several companies and government authorities are leveraging advanced technologies intending to improve business operations.

For instance, in June 2023, Datadog, Inc. launched Workflow Automation, the new product enables teams to automate end-to-end remediation processes with actions and pre-built templates—across all systems, apps and services to help identify, investigate and resolve service disruptions and security threats faster. This launch initiative will deliver new customer experiences coupled with modernized technology infrastructure in the cloud segment, thus, further pave numerous opportunities for market growth.

High Implementation Costs Associated with Workflow Management Systems

The major challenge for the growth of the global workflow management systems industry is project funding due to high initial cost and expense considerations. Huge capital expenditure (CAPEX), along with increasing upfront installation costs, is certainly restraining the adoption of workflow management system solutions across the globe. Further, the integration of highly sophisticated technologies and components to provide efficient, reliable, and safe services. However, these sophisticated technologies and equipment are expensive, and the design, development, and implementation of digitalized systems involve high costs, which would be the major restraining factor for the growth of the global workflow management systems market.

In addition, these technically advanced systems entail a combination of electronic components and several subsystems to offer real-time data to the business authority. It usually costs billions of dollars and more installation time compared to the conventional system, which leads to less preference among business operators. Therefore, both the cost and time, which are required for the installation and development of digital technologies would prove to be the major obstacle to this market growth across the globe.

Rise in Implementation of Cloud-based Technologies

The surge in the expansion of cloud-based technologies is a key driver for the growth of the global market. Cloud computing provides the infrastructure and resources needed to deliver digitalization to end-users, making it an essential enabler for businesses. This is attributed to the rising number of countries committing to adopt cloud-based workflow management solutions. Further, government policies are undertaking increased initiatives to embrace advanced technology, with plans for integrating a new digital solution.

For instance, in April 2023, the Japanese government raised $31.7 million (4.2 billion yen) in funding to develop shared quantum computing using a business-friendly cloud platform. The Japanese government intends to broaden quantum computing's accessibility so that businesses may take advantage of its benefits. Therefore, cloud-based workflow management solutions gained wider traction among end-users, taking advantage of cloud computing solutions in several industries.

Moreover, cloud-based solutions leverage the economies of scale provided by cloud computing. Organizations may avoid the upfront costs associated with purchasing and maintaining on-premises hardware infrastructure. Consequently, regional governments and private and public businesses invest in cloud-based AI solutions. For instance, in July 2023, Trimble launched log inventory and management system (LIMS) PRO, a new cloud-hosted version of its widely used log inventory and management system (LIMS) to manage sawmill raw material procurement. As a cloud-based log settlement solution, LIMS PRO is designed to improve operational visibility for mills. Such investment and advancements in cloud-based solutions will eventually contribute to the growth of the global market.

Key Market Players

Competitive analysis and profiles of the major players in the Appian Corporation, Bizagi Limited, IBM Corporation, Microsoft Corporation, Newgen Software Technologies Limited., Nintex Global Limited, Oracle Corporation, Pegasystems Inc., ServiceNow, Inc., Software AG and TIBCO Software Inc. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the workflow management systems market growth globally.

Key Industry Development

Recent Partnerships in the Market

For instance, in September 2023, Hexure partnered with Paperclip, to enhance application data workflows and streamline operations through the integration of Hexure’s sales automation platform. Such trends are influencing IT and telecom operators to increase their workforce management system spending in order to counter such threats.

Recent Product Launches in the Market

For instance, in May 2023, Monday.com Ltd. launched Monday Dev, a new product offering that centralizes software development tracking in one place so developers, engineers and administrators can collaborate more easily. In addition, it allows developers to facilitate project management among different personnel and teams using common workflow and communication tools.

Market Landscape and Trends

The workflow management systems market has witnessed stable growth during the COVID-19 pandemic, owing to the rapidly increased dependence on digital devices. The growing online presence of people during the period of COVID-19-induced lockdowns and social distancing policies fueled the need for workflow management system solutions. This was critical for many businesses during the period as effective workflow management system solutions helped businesses to come up with effective plans to cope with the evolving business landscape post the outbreak of the COVID-19 pandemic.

For instance, in October 2023, Relay.app launched a workflow automation product, which combines AI assistance, human-in-the-loop collaboration, and a robust multiplayer experience to help teams save time on repeated tasks. Similar trends were being noticed all across the world, which supported the growth of the global workflow management systems industry during the period. Moreover, the growing demand for automation and remote work tools during the social distancing phase of the pandemic further fueled the dependence on workflow management system during the period.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the workflow management systems market forecast from 2022 to 2032 to identify the prevailing market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities of market outlook.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists in determining the prevailing workflow management systems market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global workflow management systems market trends, key players, market segments, application areas, and market growth strategies.

Workflow Management Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 99.9 billion |

| Growth Rate | CAGR of 26.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 494 |

| By Component |

|

| By Enterprise Size |

|

| By Deployment Mode |

|

| By Industry |

|

| By Region |

|

| Key Market Players | Appian Corporation, Software AG, Oracle Corporation, Newgen Software Technologies Limited., Bizagi Limited, Microsoft Corporation, IBM Corporation, TIBCO Software Inc., Pegasystems Inc., ServiceNow, Inc., Nintex Global Limited |

Analyst Review

The workflow management systems market is characterized by intense competition, which can be attributed to the strong presence of established vendors. The workflow management system provides automation capabilities to various industries, reducing operational costs, increasing efficiency and accuracy, and improving customer experience. Automation capabilities have become increasingly important as businesses strive to streamline their operations and increase productivity. With the growth of urbanization, there is an increasing demand for intelligent business systems that can improve business operations. Overall, the workflow management systems market is driven by the need for intelligent and automated systems that can process and analyze vast amounts of data in real-time, enabling organizations to make informed decisions and take actions based on data-driven insights. Furthermore, the competitive landscape within the market is anticipated to become even more intense as a consequence of technological advancements, product expansions, and various strategies employed by key vendors.

The workflow management systems market is anticipated to grow significantly during the forecast period. There are few major trends in the workflow management systems market such as growing adoption of cloud-based workflow management system solutions and surging emphasis on real-time information. These trends are positively impacting the overall workflow management systems market.

Moreover, managed workflow management services are witnessing an increase in popularity across diverse industry verticals and enterprises. These service operators help large enterprises manage their information technology infrastructure with the addition of advanced security frameworks. This is also expected to fuel competition in the workflow management systems market. In addition, continuous developments in cloud-based workflow management system to cater diverse customer requirements are expected to support overall market growth.

By region, the workflow management systems market trends have been analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America contributed maximum revenue in 2022 and is expected to grow at a significant growth rate as compared to other regions. Factors such as the presence of prominent technology companies and industry consortiums focusing on automated infrastructure have contributed to the demand for advanced workflow management systems and services. Asia-Pacific is the fastest-growing region in the market, which is mainly attributed to the growing focus of the market players to address the demands for advanced frameworks with cost-effectiveness.

Major companies operating in the workflow management systems market are focusing on strategic partnerships to develop advanced workflow management solutions. For instance, in July 2023, Trimble launched log inventory and management system (LIMS) PRO, a new cloud-hosted version of its widely used log inventory and management system (LIMS) to manage sawmill raw material procurement. As a cloud-based log settlement solution, LIMS PRO is designed to improve operational visibility for mills. Similar strategies by the market players operating at a global and regional level will help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Appian Corporation, Bizagi Limited, IBM Corporation, Microsoft Corporation, Newgen Software Technologies Limited., Nintex Global Limited, Oracle Corporation, Pegasystems Inc., ServiceNow, Inc., Software AG and TIBCO Software Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the workflow management systems market.

The global workflow management systems market was valued at $9.8 billion in 2022, and is projected to reach $99.9 billion by 2032

The global workflow management systems is projected to grow at a compound annual growth rate of 26.2% from 2023 to 2032 to reach USD 99.9 billion by 2032

North America is the largest regional market for workflow management systems.

Appian Corporation, Bizagi Limited, IBM Corporation, Microsoft Corporation, Newgen Software Technologies Limited., Nintex Global Limited, and Oracle Corporation are the top companies to hold the market share in workflow management systems.

The market's growth is primarily driven by the increasing adoption of advanced technologies across various industries.

Loading Table Of Content...

Loading Research Methodology...