AI In Genomics Market Research, 2031

The AI in genomics market size was valued at $346.3 million in 2021 and is projected to reach $9,859.7 million by 2031, registering a CAGR of 40.6% from 2022 to 2031. Genomics is a field of biology that studies the structure, function, and evolution of genomes, which are the complete sets of genetic information present in the DNA of an organism. Artificial intelligence (AI) has been making significant contributions to the field of genomics in recent years. Genomics is the study of an organism's genetic material, including the DNA sequences and their variations. AI techniques such as machine learning and deep learning are being applied to genomic data to make predictions about an individual's health, identify potential disease-causing mutations, and develop personalized treatments.

Market dynamics

Advancements in AI technology have the potential to act as a major driver for AI in genomics market. AI is a powerful tool that can analyze vast amounts of genomic data quickly and accurately, helping to unlock the secrets of the human genome and revolutionize the field of genomics. With the ability to process large amounts of data, AI algorithms can help identify patterns, trends, and anomalies that may not be easily recognizable by human researchers. This can lead to new discoveries and insights into the underlying biology of diseases, as well as the development of more targeted and personalized treatments. According to the 2019 report of Biomed central, Advances in AI software and hardware, especially deep learning algorithms and the graphics processing units (GPUs) that power their training, have led to a recent and rapidly increasing interest in medical AI applications

Artificial intelligence (AI) has made significant strides in the field of drug discovery and disease diagnosis. In drug discovery, AI has the potential to significantly reduce the time and cost required to develop new drugs. This is accomplished through the use of machine learning algorithms to predict the properties of molecules and identify those with potential therapeutic benefits. AI-based drug discovery platforms can also aid in the optimization of existing drugs and identify new targets for drug development. Furthermore, in the field of disease diagnosis, AI has shown great promise in improving the accuracy and efficiency of diagnosis. Machine learning algorithms can analyze large amounts of medical data to identify patterns and predict disease outcomes. This can lead to earlier diagnosis and more personalized treatment plans for patients. AI-powered diagnostic tools can also aid in the detection of rare diseases and improve the accuracy of medical imaging.

Artificial intelligence (AI) is revolutionizing the field of personalized medicine by enabling physicians to provide individualized treatment plans to patients based on their unique genomic, clinical, and environmental data. One application of AI in personalized medicine is in disease diagnosis. By analyzing patient data, AI algorithms can identify patterns and provide physicians with accurate diagnoses. This helps doctors develop personalized treatment plans that target the specific needs of each patient. Furthermore, AI algorithms can identify potential drug targets and predict how different drugs will interact with a patient's genetic makeup. This can lead to the development of more effective and personalized treatments However, limited availability of skilled professionals and data quality issues are key factors anticipated to hamper the market growth.

The outbreak of COVID-19 has disrupted workflows in the healthcare sector around the world. The disease has forced several industries to shut down temporarily, including several sub-domains of the healthcare sector. The pandemic reduced accessibility to the research centers and offices which delayed the development in AI programs. However AI-driven diagnostics emerged as great solution for quick diagnosis of the disease.

Segmental Overview

The AI in genomics market size is segmented into offering, technology, application, end user and region. Based on offering, the market is segmented into software, services and hardware. By technology, the market is segmented into machine learning and computer vision. By application, the market is segmented into drug discovery & development, precision medicine, diagnostics, and others. By end user, the market is segmented into pharmaceutical and biotech companies, healthcare providers, and research centers. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

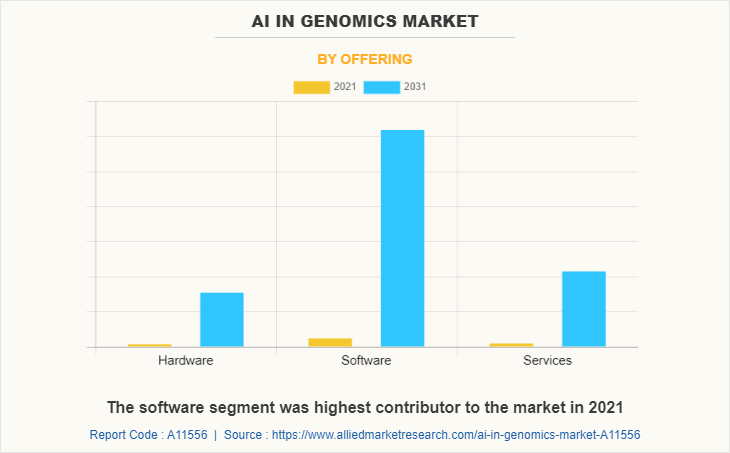

By Offering:

On the basis of offering, the market is segmented into software, services and hardware. the software segment was highest contributor to the AI in genomics market Size in 2021. However, the hardware segment is anticipated to grow at the highest CAGR during the forecasted. AI hardware has been increasingly used in genomic analysis owing to the reason that AI enables the processing of vast amounts of data generated by genomic sequencing technologies.

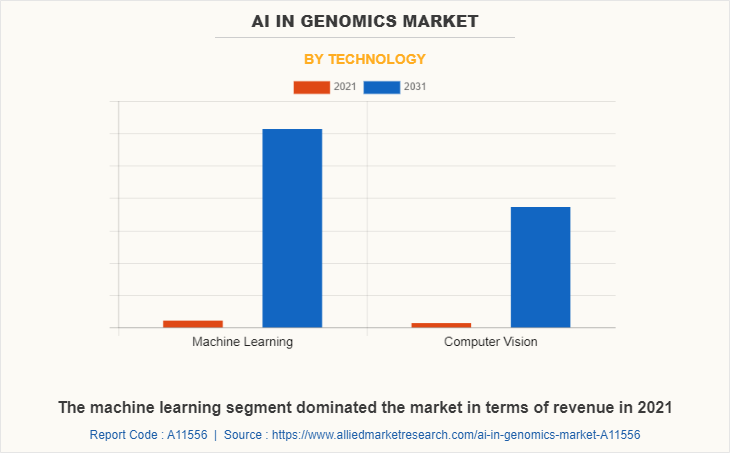

By Technology:

On the basis of technology, the AI in genomics market is segmented into machine learning and computer vision. the machine learning segment dominated the market in terms of revenue in 2021 and is expected to grow with a faster CAGR during the forecast period. This is attributed to the preference of large number of applications in genomic data analysis, drug discovery, and precision medicine.

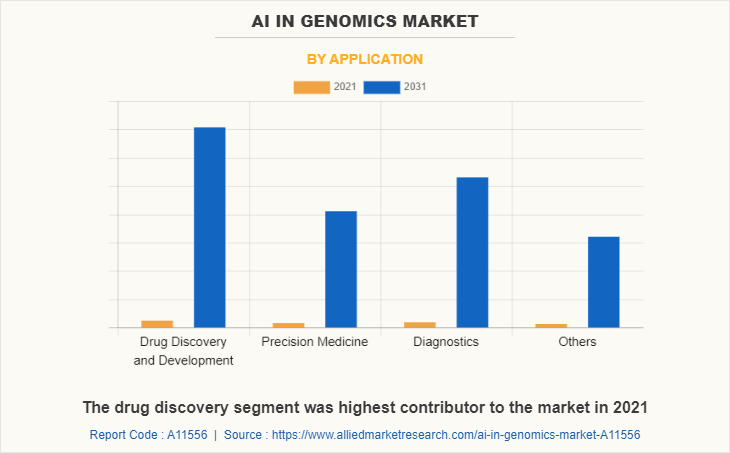

By Applications:

On the basis of application, the AI in genomics market is segmented into drug discovery & development, precision medicine, diagnostics, and others. The drug discovery segment was highest contributor to the market in 2021 owing to streamline the drug discovery process by reducing the time and cost required to develop new drugs, while also improving the success rate. However, the diagnostics segment is anticipated to grow at the highest CAGR during the forecasted period owing to the reason that application of AI in genomics has greatly enhanced the accuracy and speed of diagnostic tests.

By End User:

On the basis of end user, the AI in genomics market is segmented into pharmaceutical and biotech companies, healthcare providers, and research centers. The pharmaceutical and biotech companies' segment was highest contributor to the market in 2021. However, the healthcare providers segment is anticipated to grow at the highest CAGR during the forecasted period owing to the significant increase in use of AI for disease diagnosis in hospitals by healthcare providers.

By End User

Healthcare providers segment is anticipated to grow at the highest CAGR during the forecast period

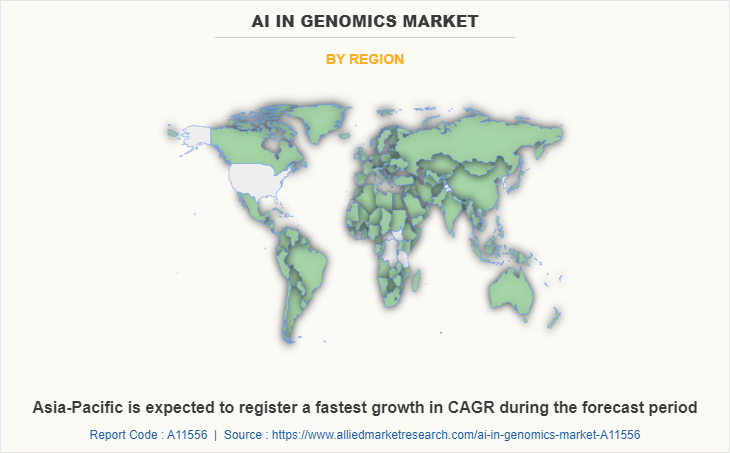

By Region:

By region, the AI in genomics market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America was the highest revenue contributor to the market in 2021. This is attributed to a large number of universities and research institutions that are at the forefront of AI research, including Stanford, MIT, Carnegie Mellon University, and the University of California, Berkeley. These institutions attract top talent from around the world and conduct cutting-edge research. Furthermore, The U.S. government and private industry have invested heavily in AI research and development.

However, Asia-Pacific is expected to register a fastest growth in CAGR during the AI in genomics market forecast period, owing to an increase in investments for development of AI and an increase in the number of key players developing AI drives the growth of the market during the forecast period. Furthermore, Asian countries, India, China, the Philippines, and Thailand possess a large patient pool that suffers from cancer. For instance, according to WHO cancer is one of the leading causes of death worldwide with nearly 10 million deaths reported in 2020. The WHO South-East Asia Region reported an estimated 2.2 million new cases and 1.4 million cancer related deaths the same year - which accounted for more than 1 in 10 deaths in the region. This provides opportunities for entry of manufacturers that provide personalized medicines made using AI and drive the AI in genomics market growth.

Competition Analysis

Competitive analysis and profiles of the major key players that operate in the AI in genomics market share are Microsoft, IBM, NVIDIA Corporation, Deep Genomics, DATA4CURE, INC, Freenome holdings, Inc, Thermo fisher scientific, Illumina, Inc., Sophia Genetics, and BenevolentAI. are provided in the report. Major players have adopted acquisition, and product launch as key developmental strategies to improve the product portfolio of the invisible orthodontics market.

Some Examples of Collaboration in The Artificial Intelligence in Genomics Market

- In November 2020, BioMarin Pharmaceutical Inc. and Deep Genomics announced that the companies have entered into a preclinical collaboration that will use Deep Genomics' artificial intelligence drug discovery platform (The AI Workbench) to identify oligonucleotide drug candidates in four rare disease indications with high unmet need.

- In September 2021, Deep Genomics announced the start of a collaboration with Mila, the Quebec Artificial Intelligence Institute. This collaboration will allow the company to join Mila's community and to take advantage of the recruitment activities offered by the research institute.

Some Examples of Partnership In The Artificial Intelligence in Genomics Market

- In October 2020, NVIDIA announced a partnership with GSK and its AI group, which is applying computation to the drug and vaccine discovery process.

- In March 2022, IBM and Genomics England announced a strategic partnership. Genomics England provides researchers access to genomic datasets to enable scientific discovery. The partnership allows IBM to support the rapid expansion of Genomic England by enabling the consumption of cloud services through its AI capabilities

- Some Examples of Acquisition In The Artificial Intelligence in Genomics Market

- In June 2020, Illumina Inc announced the acquisition of BlueBee, a cloud-based software company that provides genomics analysis solutions for research and clinical customers

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ai in genomics market analysis from 2021 to 2031 to identify the prevailing ai in genomics market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ai in genomics industry segmentation assists to determine the prevailing AI in genomics market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global AI in genomics market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ai in genomics market trends, key players, market segments, application areas, and market growth strategies.

AI in Genomics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 9.9 billion |

| Growth Rate | CAGR of 40.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 420 |

| By Technology |

|

| By Offering |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | IBM Corporation, Data4Cure, Inc, Microsoft Corporation, NVIDIA Corporation (Mellanox Technologies), Illumina, Inc., BenevolentAI, Deep Genomics, Freenome Holdings, Inc, Thermo Fisher Scientific Inc., Sophia Genetics |

Analyst Review

The analyst’s review section provides various opinions of top-level CXOs in the global AI in the genomics market. According to the insights of CXOs, an increase in demand for AI and a rise in investments for research and development to explore more applications of AI in genomics are expected to offer profitable opportunities for the expansion of the AI in Genomics Market Size. In addition, favorable government initiatives and higher spending for AI development, have piqued the interest of several companies to develop AI software and services for genomic applications.

CXOs further added that AI is increasingly being used in drug design, drug discovery, and drug development to speed up the process of identifying potential drug candidates and bring new therapies to market more quickly, thereby driving the growth of the market. By analyzing large datasets of biological and chemical information, AI can be used to identify new drug targets. Researchers can identify potential drug targets by predicting which proteins or other molecules are expected to be involved in a specific disease. AI algorithms can be used to sift through large databases of chemical compounds and predict which ones will be most effective as drugs. Reducing the number of compounds that must be tested in the lab, can speed up the drug discovery process. Furthermore, AI has the potential to revolutionize disease diagnosis by enabling faster and more accurate disease identification, improving patient outcomes, and lowering healthcare costs. However, it is critical that AI is developed and deployed responsibly, with appropriate consideration given to issues such as data privacy and algorithm bias. It is also important to note that AI should be viewed as an aid to clinical decision-making rather than a replacement for human clinicians. These are two of the major drivers of AI in the genomics market

Furthermore, North America is expected to witness the highest growth, in terms of revenue, owing to the increase in the adoption of AI for drug development by pharmaceutical and biotechnological companies and the rise in the healthcare and IT industry driving the growth of AI in genomics. The upsurge in healthcare expenditure in emerging economies is anticipated to offer lucrative opportunities for market expansion. However, Asia-Pacific is anticipated to witness notable growth, owing to an increase in investments for the development of AI and an increase in the number of key players developing AI, driving the growth of the market during the forecast period.

Upcoming trends for AI in genomics are the development of personalized medicine coupled with its application in drug discovery and disease diagnosis.

The drug discovery segment was highest contributor to the market in 2021

North America was the highest revenue contributor to the market in 2021.

The AI in genomics market was valued at $346.3 million in 2021, and is projected to reach $9859.7 million by 2031, registering a CAGR of 40.6% from 2022 to 2031.

Thermo Fisher Scientific Inc., Deep Genomics,Illumina, Inc., Data4Cure, Inc., BenevolentAI and Microsoft Corporation were the top companies to hold the highest market share in AI in Genomics Market

Yes, competitive landscape included in the AI in Genomics Market

Asia Pacific is the fastest-growing region in AI in Genomics Market in 2021.

Advancements in AI technology have the potential to act as a major driver for the AI in genomics market. AI is a powerful tool that can analyze vast amounts of genomic data quickly and accurately, helping to unlock the secrets of the human genome and revolutionize the field of genomics.

Loading Table Of Content...

Loading Research Methodology...