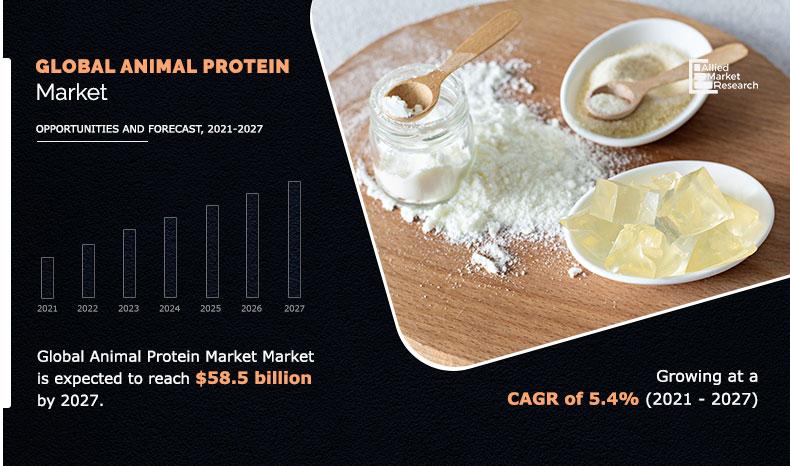

The global animal protein market size was valued at $44,090.0 million in 2019, and is projected to reach $58,500.3 million by 2027, registering a CAGR of 5.4%.

Animal protein is a type of protein ingredient that is specifically derived from the sources such as egg, dairy, fish, and others. Animal protein is widely used in food & beverage, cosmetics, and nutraceuticals industries as a foaming agent, emulsification, and others. There are different variants of animal protein available in the market that include egg protein, fish protein, gelatin, and dairy protein. Rise in demand for infant formula drives the demand for animal protein such as dairy protein in the market. Moreover, rising demand for animal protein from cosmetics and personal care industry is expected to offer immense opportunity for the animal protein market growth during the forecast period. In addition, the animal protein market analysis is done based on regions, key players, end users and segments.

The COVID-19 has severely impacted the consumer purchase for cosmetics and other personal care products. The shutdown of restaurants, party events, offices, and others has resulted in decline in the sales of cosmetics and personal care products globally. This in turn has also hampered the demand for animal protein ingredients used for manufacturing cosmetic and personal care products, which in turn hindered the growth of the market during the global pandemic.

The global animal protein market segments are categorized into product type, form, application, and region. By product type, it is classified into egg protein, dairy protein, fish protein and gelatin. By form, the market is bifurcated into solid and liquid. By application, it is divided into food & beverages, pharmaceuticals & nutraceuticals, cosmetics & personal care and feed. Region wise, the animal protein market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia, and rest of Europe), Asia-Pacific (China, India, Australia & New Zealand, Japan, ASEAN, Korea and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, Turkey and Rest of LAMEA).

By product type, the egg protein segment accounted for the highest animal protein market in 2019 The growth of the egg proteins market is driven by increase in consumption in preparation of food products such as bakery, confectionery, snack products, processed meat, and seafood products. However, the gelatin segment is expected to grow at the highest CAGR during the forecast period.

By Product Type

The egg protein segment dominates the global animal protein market and is expected to retain its dominance throughout the forecast period.

By form, the solid segment accounted for the highest animal protein market share in 2019. This is attributed to its better stability and ease of handling and storage, to liquid form. Solid format of protein is the most preferable way of consumption for its target customers. Solid form of proteins influences the physical bulk state characteristics of the formulation. However, liquid segment is anticipated to grow at the highest CAGR during the forecast period.

By Form

The solid segment dominates the global animal protein market and is expected to retain its dominance throughout the forecast period.

By application, the food & beverages segment accounted for the highest animal protein market share in 2019, growing at a CAGR of 4.0%. The animal protein products such as gelatin, whole egg, yolk egg and others are widely consumed in the food & beverages industries. This is attributed to the fact that animal protein such as, gelatin, egg proteins are considered as an ideal source of essential amino acids; thus, animal proteins are used as a key protein source in many food & beverages. However, the pharmaceuticals & nutraceuticals segment is expected to grow at the highest CAGR during the forecast period.

By Application

The food & beverages segment dominates the global animal protein market and is expected to retain its dominance throughout the forecast period.

Region wise, the animal protein market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Europe accounted for the highest market share in 2019. The Europe market dominates the use of animal protein. However, Asia-Pacific is anticipated to grow at the highest CAGR during the animal protein market forecast period.

By Region

The europe segment dominates the global animal protein market and is expected to retain its dominance throughout the forecast period.

The key players operating in the global animal protein market focus on prominent strategies to overcome competition, maintain as well as improve their share worldwide. Some of the major players in the global animal protein industry analyzed in this report include Archer Daniels Midland Company, Arla Foods Inc., Cargill, Incorporated, Darling Ingredients Inc., Kerry group plc. The Kewpie Group, Nitta Gelatin Inc. , PeterLabs Holdings, Shenzhen Taier and Trobas Gelatine B.V

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the current animal protein market trends, estimations, and dynamics of the market size from 2019 to 2027 to identify the prevailing opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the animal protein market size and segmentation assists in determining the prevailing animal protein market opportunities.

- Major countries in each region have been mapped according to their revenue contribution to the global industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of market players.

- The report includes the analysis of the regional as well as global market, key players, market segments, application areas, and growth strategies.

Animal Protein Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Form |

|

| By Application |

|

| By Region |

|

| Key Market Players | KEWPIE CORPORATION, CARGILL, INCORPORATED, DARLING INGREDIENTS INC., ARLA FOODS INC, SHENZHEN TAIER BIOTECHNOLOGY CO., LTD, PETERLABS HOLDINGS, NITTA GELATIN INC., KERRY GROUP PLC, TROBAS GELATINE B.V., ARCHER DANIELS MIDLAND COMPANY |

Analyst Review

According to some key animal protein manufacturers, wide application of animal protein in food & beverages sector has driven the growth of the market. Moreover, the product innovation and rise in demand for organic protein ingredient is anticipated to offer immense opportunity for the growth of the market during the forecast period.

The market players have adopted key developmental strategies such as new product launch to maintain their position in the animal protein market, in terms of value sales. They also emphasize on continuous innovations in their products to keep a strong foothold in the market and to boost the sales of animal protein.

According to the key market players, the demand for animal protein ingredients in innovative food and other industrial applications have led the ingredient manufacturers to invest more in R&D activities to provide animal protein ingredients with superior functionalities for preparing or processing of innovative food & beverage products, cosmetic products and others in the market.

The global animal protein market size was valued at $44,090.0 million in 2019, and is projected to reach $58,500.3 million by 2027

The global Animal Protein market is projected to grow at a compound annual growth rate of 5.4% $58,500.3 million by 2027

Some of the major players in the global animal protein industry analyzed in this report include Archer Daniels Midland Company, Arla Foods Inc., Cargill, Incorporated, Darling Ingredients Inc., Kerry group plc. The Kewpie Group, Nitta Gelatin Inc. , PeterLabs Holdings, Shenzhen Taier and Trobas Gelatine B.V

The europe segment dominates the global animal protein market

The global demand for animal protein is expected to rise due to the increasing adoption of animal protein such as dairy protein, gelatin, egg protein and fish protein in the food & beverages sector, pharmaceuticals & nutraceuticals sectors and other

Loading Table Of Content...