Anti-Piracy Protection Market Insights:

The global anti-piracy protection market was valued at USD 204.6 million in 2021 and is projected to reach USD 575.6 million by 2031, growing at a CAGR of 11.1% from 2022 to 2031.

Growth in demand for the adoption of cloud-based solutions and the increase in the growth of pirated content boost the growth of the global anti-piracy protection market. In addition, the rapid growth of digitization and high internet penetration positively impact the growth of the anti-piracy protection market. However, the high cost of products, services, technological glitches and lack of technical proficiency, and lack of awareness are hampering the anti-piracy protection market growth. On the contrary, rise in government regulations related to data privacy and high spending on safeguarding the IT infrastructure are expected to offer remunerative opportunities for the expansion of the anti-piracy protection market during the forecast period.

Anti-piracy protection monitors manage and counter internet piracy. In addition, many businesses are deploying these solutions to send out stringent warnings to piracy masterminds and unwanted illegal downloaders. Furthermore, many companies offering anti-piracy solutions and services monitor search engine activities and also conduct manual searches for automated search engine monitoring. Moreover, these companies trained professionals to seek out and remove illegitimately duplicated or copied copyrighted content. Furthermore, many anti-piracy protection companies offer a combination of human proficiency and machine expertise ensure to provide clean material. These anti-piracy protection companies monitor search engine results to verify the legality of content and also ensure that pirated copies are removed by notifying the concerned search engine operators.

Segment Review:

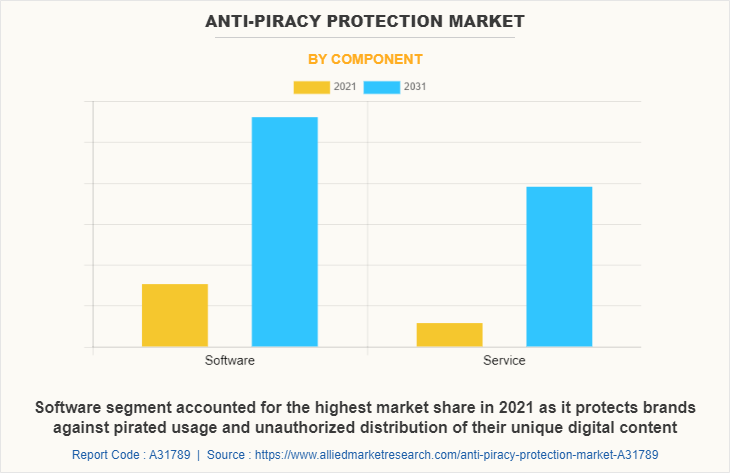

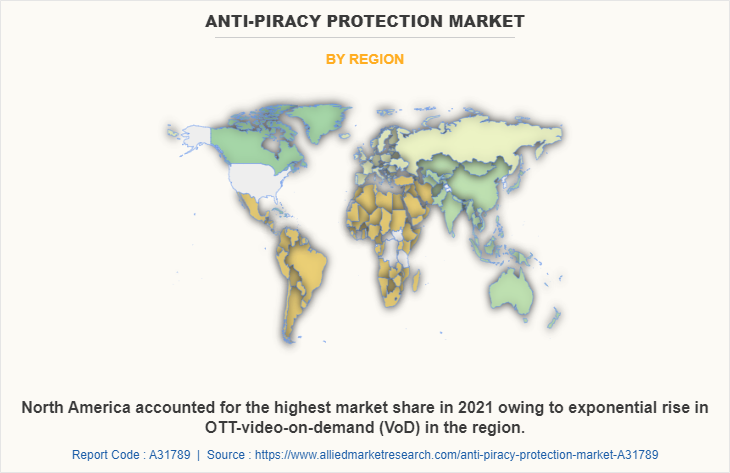

The anti-piracy protection market is segmented on the basis of component, end user, and region. On the basis of component, the market is categorized into software and service. On the basis of end-user, the market is classified into film & TV, OTT platforms, publication & media, gaming, music, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the software segment holds the largest anti-piracy protection market share as it assists organizations in detecting zero-day attacks and predicts any future loopholes. However, the service segment is expected to grow at the highest rate during the forecast period, owing to rise in COVID-19 pandemic which increased the demand for aiding employees working remotely to be able to access their work network more securely and conveniently.

On the basis of region, the anti-piracy protection market size was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the presence of major players that offer advanced solutions and invest heavily in solutions that offers a lucrative opportunity for the market. However, Asia-Pacific is expected to witness significant growth during the forecast period owing to increase in awareness regarding the importance of anti-piracy protection among employers adopting cloud services.

The key players that operate in the anti-piracy protection market are App Global, Brightcove Inc, castLabs, Friend MTS Limited, Irdeto, McAfee, LLC, NAGRA, Red Points, Synamedia, and Verimatrix. These players have adopted various strategies to increase their market penetration and strengthen their position in the anti-piracy protection industry.

Top Impacting Factors:

Growth in Demand for the Adoption of Cloud-based Solutions

As more organizations move to the cloud, they need to be proactive in securing their cloud applications, and anti-piracy protection that provides a comprehensive level of visibility, compliance, and data security for the cloud transformation of the organization. Organizations are seeking new methods and best practices to implement security controls in cloud environments with the explosive rate of enterprises moving toward the use of cloud service providers (CSPs). Many organizations have already securely and successfully migrated their productivity suites and web applications. Now they are moving their business-critical and highly sensitive systems, including HR applications, customer relationship management systems, and enterprise resource planning (ERP) software to the cloud. In addition, many key players are enhancing their services to provide security for sensitive enterprise information.

For instance, in February 2022, Verimatrix launched Secure Delivery Platform a cloud ecosystem that combines cybersecurity and anti-piracy services into a single pane of glass experience for media companies, content owners, streaming media providers, and broadcast operators worldwide, by securing their content, applications, and devices in a unified user experience. The platform offers new levels of efficiency and cost savings while greatly accelerating revenue protection and agility. Therefore, such initiatives are drive the growth of the anti-piracy protection market.

Increase in Pirated Content

There is an alarming rise in the cyber security threat due to number of pirated content sites and platforms on a global scale. In addition, large companies are seeking solutions and anti-piracy technologies to safeguard their data. Furthermore, cyber breaches have increased significantly in the U.S., China, India, and Russia. Therefore, copyright content owners are looking to adopt anti-piracy security and services to protect assets from exploitation. Moreover, anti-piracy software protection solutions help monitor and take down illegal copies of content on online content distribution platforms including social media and P2P sites which drives the growth of the market. Thus, companies are increasingly focused on using anti-piracy services to safeguard web content and ensure a strong data security framework.

Digital Capabilities:

Anti-piracy protection is designed to prevent piracy, stop unauthorized access, and maximize monetization for media and IT software organizations. Many companies adopting digital technologies compiled with anti-piracy protection to protect brands against pirated usage and unauthorized distribution of unique digital content. In addition, cybersecurity services supply technical and forensic device analysis of software applications, and infrastructure vulnerability scanning.

Moreover, blockchain in anti-piracy allows timestamping in an immutable, tamper-proof way, making plagiarizing previously copyrighted material impossible. Cloud computing service providers offer data encryption that uses mathematical encoding to prevent unauthorized access to information. Moreover, Content Delivery Networks, have emerged as an essential backbone in the entire video content delivery infrastructure, by using advanced analytics and artificial intelligence technology to optimize content delivery and protect the server from attempted data hacks and distributed denial-of-service (DDoS) attacks.

End-User Adoption:

Increase in the adoption of anti-piracy protection, owing to its security is one of the most significant factors that drives the growth of the market. Various companies have established alliances to increase their capabilities with the surge in demand for deception technology. For instance, in April 2022, The National Intellectual Property Rights Coordination Center partnered with the Recording Industry Association of America (RIAA) on digital antipiracy efforts to strengthen the digital ecosystem, conduct joint training events, educate consumers on the dangers of illegal streaming, enforce the intellectual property rights laws of the nation, and dismantle large-scale online criminal enterprises.

In addition, with further growth in investment across the world and the rise in demand for anti-piracy protection, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in June 2021, Irdeto, a solutions provider for cybersecurity, anti-cheat, and anti-piracy for content, software, and IoT, revealed significant growth in demand for anti-piracy solutions in North America, driven by the increased demand for media and entertainment, video games, and connected device cybersecurity.

For instance, in September 2020, Synamedia, a video technology provider company, launched a new security model and cloud-managed services that eradicate businesses of streaming pirates, while protecting revenues of legitimate providers with a data-led model that also enables measurement of efficacy and ROI of anti-piracy campaigns.

Moreover, with the increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, in May 2022, Synamedia, a video software provider, acquired Utelly, a UK-based privately held content discovery platform provider with solutions or products targeted at the entertainment industry. The acquisition is expected to help Synamedia utilize the solution of Utelly which simplifies the complexity of consumer content discovery across TV channels, on-demand services, and numerous streaming platforms.

For instance, in February 2021, Corsearch, Inc acquired Entura, a pioneer in the protection of content against online piracy this new deal cements position of Corsearch as the market leader for end-to-end online content protection. It is important for content companies to provide a full-service approach to reduce piracy on both the consumer and distributor sides.

Government Regulation:

All well-governed IT industries should be able to demonstrate due diligence to ensure regulatory compliance in applicable fields, including IT. Organizations are adopting AI to manage, store, and extract relevant and useful information from the data stored. For Instance, the U.S. Stop Online Piracy Act (SOPA) provides explicit privacy rights and allows users to know how their information will be used in the future. Moreover, it expands the ability of U.S. law enforcement to combat online copyright infringement and online trafficking in counterfeit goods. Furthermore, the cloud security regulations are strongly adhered by AI service providers to operate as global service providers. For instance, in June 2021, the German government launched Federal Constitutional Protection Act to secretly monitor online activities of a target.

Organizations are adopting anti-piracy protection to manage, store, and extract relevant and useful information from the data stored. For instance, in April 2021, the government of Canada committed to ensuring the Copyright Act for online intermediaries to make sure it reflects the evolving digital world.

Increase in cyber thefts and increase in streaming piracy governments of many countries are partnering with technology related companies. For instance, in April 2020, Philippines partnered with Motion Picture Association (MPA), which has agreed to assist in developing an effective pirate monitoring system and a rolling site-blocking regime that would prevent piracy sites from being accessed and also helps to provide training on different anti-piracy tactics. The group will also offer practical support to IPOPHL and other relevant agencies in implementing site blocking and takedown in a timely and effective manner.

Furthermore, many countries started funding to develop anti-piracy protection. For instance, in 2021, Government of France the five-year INTERPOL Stop Online Piracy (I-SOP) With EUR 2.7 million in funding from the Korean Ministry of Culture, Sport and Tourism the initiative will counter online piracy and crimes involving intellectual property rights infringement, identifying, and dismantling linked illicit online marketplaces, as well as targeting the criminal networks and confiscating assets. .

In addition, federal and state governments are improving their track plans for improved safety, simplified routine tasks and a higher level of productivity across companies, which are applicable for data that are involved in their operations. For instance, in September 2021, Singapore launched a new initiative to encourage the adoption of cyber security and online piracy protection technologies. Europe is set to take the advantage of AI for providing data protection facilities to different organizations. The European Government adopted the new General Data Protection Regulation (GDPR). The act seeks to regulate the collection, storage, and processing of information about individuals. The key aim of GDPR is to protect critical data of industrial sectors of the European nation.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global anti-piracy protection market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global anti-piracy protection market trends is provided in the report.

- The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the anti-piracy protection industry.

- The anti-piracy protection market analysis from 2022 to 2031 is provided to determine the market potential.

Anti-Piracy Protection Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 575.6 million |

| Growth Rate | CAGR of 11.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 265 |

| By Component |

|

| By End User |

|

| By Region |

|

| Key Market Players | Verimatrix, Kudelski SA, Brightcove Inc, Synamedia, APP Global, castlabs, Red Points, Friend MTS Limited, McAfee, LLC, Irdeto |

Analyst Review

Anti-piracy protection monitors, manages and counters internet piracy. In addition, these solutions are deployed by businesses to send out stringent warnings to piracy masterminds and unwanted illegal downloaders. Furthermore, companies offering anti-piracy solutions and services monitor search engine activities and also conduct manual searches to automated search engine monitoring.

The anti-piracy protection market is expected to register high growth due to the increasing technological advancements in developed and developing countries are most vulnerable to piracies and cyber-attacks are expected to drive industry growth. Thus, increase in adoption of anti-piracy protection, owing to its security is one of the most significant factors driving the growth of the market. In addition, the increasing technological advancements in developed and developing countries are most vulnerable to piracies and cyber-attacks. With surge in demand for anti-piracy protection, various companies have established alliances to increase their capabilities. For instance, in October 2020, Friend MTS partnered with Axinom enabling consumers to receive complementary watermarking and monitoring solutions to Axinom’s DRM. This partnership will also create opportunities for E2E DRM and watermarking protection for both live and VOD content.

In addition, with further growth in investment across the world and the rise in demand for anti-piracy protection, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in November 2021, Verimatrix, a content security company, launched anti-piracy technology for HTML5, named Verimatrix Watermarking, to improve cybersecurity protection across multiple platforms.

Moreover, with increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, February 2021, Corsearch, Inc acquired Entura, a pioneer in the protection of content against online piracy help to deal cement Corsearch's position as the market leader for end-to-end online content protection.

The anti-piracy protection market is estimated to grow at a CAGR of 11.1% from 2022 to 2031.

The anti-piracy protection market is projected to reach $ 575.64 million by 2031.

Growth in demand for the adoption of cloud-based solutions and the increase in the growth of pirated content boost the growth of the global anti-piracy protection market. In addition, the rapid growth of digitization and high internet penetration positively impact the growth of the anti-piracy protection market.

The key players profiled in the report include App Global, Brightcove Inc, castLabs, Friend MTS Limited, Irdeto, McAfee, LLC, NAGRA, Red Points, Synamedia, and Verimatrix.

The key growth strategies of anti-piracy protection market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...