Automotive Logging Device Market Outlook – 2027

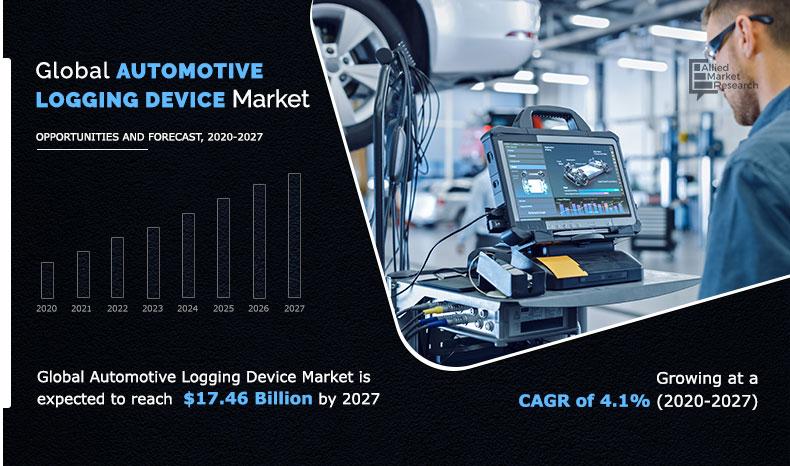

The global automotive logging device market size was valued at $12.73 billion in 2019, and is projected to reach $17.46 billion by 2027, registering a CAGR of 4.1% from 2020 to 2027. Automotive logging devices or ELDs are the electronic hardware used in a vehicle to monitor or track working hours of the professional vehicle drivers. They are attached and synchronized to the engines of vehicles in order to gather essential information. These define major applications in gathering information about the movement of a vehicle, vehicle miles driven, and vehicle engine condition.

Recent new trends in technology is boosting the automotive logging device market such as currently automotive logging device are connected with smartphones; this helps to display information on smartphones and issues are expected to be detected. There is automotive logging device smartphone app that programs the record of vehicle information, which is the driver’s security, compliance, and safety manager.

Automotive logging device systems are useful to periodically check the health of vehicle components. They are also helpful in tracking and monitoring driver activities and vehicle condition, basically automotive logging device tracks location, engine performance, and working hours and also maintain records of the time, date and performance.

The automotive logging device market is currently in its growth stage and is expected to register substantial growth in the near future. Factors that drive the market growth include increase in demand for automobile, government rules mandating the incorporation of the automotive logging device in vehicles in order to record and fulfill the hours of service compliance, increased digitization in transport and logistics and rise in trends and technologies in monitoring vehicle condition.

Major economies such as the U.S., the UK, Germany, China, and Japan among others, have adopted ELD devices, which monitors and reports the conditions of vehicle and ensure driver safety. For instance, the countries in Europe and North America have witnessed rapid growth in the market due to the regulatory framework in countries such as the U.S. and Canada, from December 2017. The U.S. Department of Transportation’s Federal Motor Carrier Safety Administration has provided a mandatory rule for all motor carriers to use ELDs on all trucks and commercial buses.

By Service Type

Intermediate segment will maintain the lead throughout the forecast period

Factors such as increasing government mandate toward safety and security of vehicle, and increasing trends toward vehicle condition monitoring act as major drivers for the automotive logging device market growth globally. However, high cost associated with automotive logging device and slow adoption of ELDs in emerging economies is expected to pose major threats for the automotive logging device market share. Furthermore, growth in service offering by transport companies and increasing demand for commercial vehicles and trucks is expected to offer lucrative automotive logging device market opportunity globally.

By Vehicle Type

LCV segment will dominate the market with a highest CAGR of 6.9% during 2020 - 2027

Segment Overview

The automotive logging device market is segmented based on service type, vehicle type, component, form factor and region. By service type, the market is categorized into entry level, intermediate and high level. By vehicle type, the market is segmented into light commercial vehicles (LCV), trucks, bus and cars. By component, the market is categorized into display, telematics unit and others. By form factor, the market is bifurcated into integrated and embedded. Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA along with its prominent countries.

By Component

Telematics Unit segment is projected to be the most lucrative segment

Competitive Analysis

The key players profiled in the automotive logging device industry include AT&T Business, Blue Tree System, Coretex, DriverTech, ELD Solutions, Garmin International, Geotab Inc, Omnitracs LLC, Teletrac Navman, and Zonar Systems. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance the automotive logging device market forecast and penetration.

By Form Factor

Integrated segment will grow at a highest CAGR of 5.2% during the forecast period

The ongoing spread of COVID-19 has become one of the biggest threats to the global economy and is causing widespread concerns and economic hardship for consumers, businesses, and communities across the globe. The “New Normal” that includes social distance and working from home has created challenges with daily activities, regular work, needs, and supplies, causing delayed initiatives and missed opportunities.

By Region

Asia-Pacific region will dominate the market with a highest CAGR of 6.7% during 2020 - 2027

According to the automotive logging device market, the COVID-19 has severely impacted the global manufacturing and industrial sector as production facilities have stalled, which, in turn, have led to significant demand in industries. Emergence of COVID-19 has declined growth of the automotive logging device market in 2020, and is estimated to witness slow growth till the end of 2021. Implementation of partial or complete lockdown across various countries globally is the prime reason for this decline in growth rate. As industries were temporarily shut, it reduced the need for maintenance from various industries.

Top Impacting Factors

Notable factors positively affecting the automotive logging device market include increasing government mandate toward safety and security of vehicle, and increasing trends toward vehicle condition monitoring. However, high cost associated with automotive logging device and slow adoption of ELDs in emerging economies hampers the growth of the market. Furthermore, growth in service offering by transport companies and increasing demand for commercial vehicles and trucks are expected to offer lucrative opportunities for the automotive logging device market outlook in the coming years.

Increasing Government Mandate toward Safety and Security of Vehicle

The major factor boosting the automotive electronic logging device market is government rules mandating the incorporation of the record of duty device in commercial vehicles in order to record and fulfill the hours of service compliance (HOS). Government has made the policies to mandate the use of automotive ELDs as it monitors and tracks working hours of the professional truck/bus drivers and commercial motor carriers on the basis of hours of service compliance.

High Cost Associated with Automotive Logging Device

Automotive electronic logging device requires high cost in installation and maintenance. The embedded system is costly; this is the main reason, which is stopping the growth and usage of automotive electronic logging device. The cost associated with hardware, training, and installation is high. The app used to get the information and logs adds additional cost to the price of automotive logging device as it is customizable as per the situation. This leads to increase in cost and automotive logging device cost is one of the hurdles in growth and adaptation.

Key Benefits For Stakeholders

This study includes the analytical depiction of the automotive logging device market along with the current trends and future estimations to determine the imminent investment pockets.

The report presents information regarding the key drivers, restraints, and opportunities in the automotive logging device market analysis.

The automotive logging device market trends are quantitatively analyzed from 2019 to 2027 to highlight the financial competency of the industry.

Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Automotive Logging Device Market Report Highlights

| Aspects | Details |

| By SERVICE TYPE |

|

| By VEHICLE TYPE |

|

| By COMPONENTS |

|

| By FORM FACTOR |

|

| By Region |

|

| Key Market Players | OMNITRACS LLC, BLUE TREE SYSTEMS (ORBCOMM INC.), GEOTAB INC., .ELD SOLUTIONS, GARMIN INTERNATIONAL, ZONAR SYSTEMS, TELETRAC NAVMAN, DRIVERTECH, CORETEX, AT&T BUSINESS |

Analyst Review

The global automotive logging device market is highly competitive, owing to strong presence of existing vendors. Automotive logging device technology vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by key vendors.

Automotive logging device market is expected to witness a significant growth with increase in transportation, E-commerce sector, import and export business and more to improve operations efficiency and government encouragement in different regions. Technological advancements have augmented the overall industrial development within a wide range of industries. Light commercial vehicles, cars, trucks bus, which use logging devices to ascertain safety and security and gain operations efficiency.

The automotive logging device market is highly competitive. Reduction in the cost of human-assisted security paired with a rise in initiative by government and private firms is impacting the market growth. Asia-Pacific is projected to dominate the market during the forecast period, owing to growth in the automotive industry. The countries in this region already have an improved automotive industry, with China manufacturing massive amounts of automobiles and electric vehicle each year.

The automotive logging device market provides numerous growth opportunities to the players such Zonar Systems, Omnitracs LLC, and ELD Solutions among others.

The Automotive Logging Device Market is estimated to grow at a CAGR of 4.1% from 2020 to 2027.

The Automotive Logging Device Market is projected to reach $17.46 billion by 2027.

To get the latest version of sample report

Increasing government mandate toward safety and security of vehicle, and increasing trends toward vehicle condition monitoring etc. boost the Automotive Logging Device market growth.

The key players profiled in the report include AT&T Business, Blue Tree System, Coretex, DriverTech, ELD Solutions, Garmin International, and many more.

On the basis of top growing big corporations, we select top 10 players.

The Automotive Logging Device Market is segmented on the basis of service type, vehicle type, component, form factor and region.

The key growth strategies of Automotive Logging Device market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

LCV segment would grow at a highest CAGR of 6.9% during the forecast period.

Telematics Unit segment will dominate the market by the end of 2027.

Loading Table Of Content...