Automotive Switches Market Insights, 2033

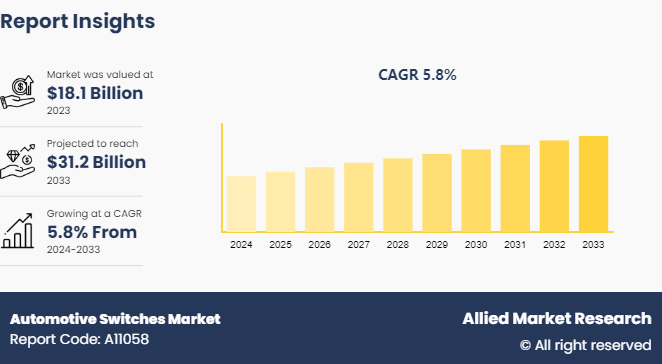

The global automotive switches market size was valued at USD 18.1 billion in 2023, and is projected to reach USD 31.2 billion by 2033, growing at a CAGR of 5.8% from 2024 to 2033.

Market Introduction and Definition

Automotive switches are one of the basic components of a vehicle. They regulate the entire electrical equipment installed in an automobile. Automotive switches play a crucial role in managing the automotive lighting and nearly all the working inside an automotive. They are also used for engine start & stop applications and several other automobile functions. Globally, increasing technological upgrades and rising demand for installing car accessories are expected to boost the automotive switches market growth over the forecast period.

The global automotive industry has experienced tremendous transformation in the past few years. The ever-growing demand for passenger safety and comfort is making the vehicle manufacturers focus incessantly on forming new design experiences by enabling efficient incorporation of new technologies and processes. The dramatic change from the usage of mechanical parts to electronic parts is anticipated to fortify the demand for automotive switches up to a great degree over the forecast timeframe.

Key Takeaways

The automotive switches market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major automotive switches industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In September 2023, Continental and Ethernovia, Inc. announced a partnership to develop a high-bandwidth, low-latency switch using a 7nm process tailored for automotive applications, enhancing data movement within software-defined vehicles (SDVs) . Their initial focus will be on integrating this advanced switch into High-Performance Computers (HPC) developed by Continental. Following this, the collaboration will extend to creating a highly integrated network chip specifically for automotive use.

In May 2022, Marvell Technology, Inc. unveiled its third-generation Marvell Brightlane Ethernet Switch, recognized as the advanced secure managed switch in the automotive industry. This switch is the first to feature lockstep dual-core Arm processing redundancy, ensuring high reliability for mission-critical applications that enhance vehicle safety and performance. Designed as a digital framework for next-generation Ethernet-based zonal architectures, the new switch offers a range of advanced security and networking features, along with increased bandwidth and a higher number of ports compared to its predecessor.

In June 2023, Marvell Technology, Inc., renowned for its data infrastructure semiconductor solutions, introduced the Brightlane Q622x family of central Automotive Ethernet switches. With an impressive bandwidth of 90 Gbps, the Brightlane Q622x switch family offers nearly double the bandwidth of currently available solutions. Furthermore, this switch family integrates an advanced suite of security technologies aimed at bolstering encryption and thwarting man-in-the-middle and other potential attacks.

Key Market Dynamics

The global automotive switches industry is growing due to several factors such as increasing demand for advanced driver assistance systems (ADAS) , growth in electric vehicle adoption, and technological advancements in automotive switches. However, high cost of advanced automotive switches and stringent regulatory requirements hinder the market growth. In addition expansion in emerging markets and development of smart and connected switches will provide ample opportunities for the market's development during the forecast period.

The automotive industry is experiencing a transformative shift towards advanced driver assistance systems (ADAS) , which is significantly driving the growth of the automotive switches market. ADAS encompasses a wide range of technologies designed to improve vehicle safety and enhance the driving experience by automating, adapting, and enhancing vehicle systems for safer and more efficient driving. These systems include adaptive cruise control, lane departure warning, automatic parking, and collision avoidance systems, all of which rely heavily on an array of automotive switches and sensors to function effectively. The automotive switches market size is expected to grow significantly in the coming years due to increasing vehicle production.

As consumers and regulatory bodies alike place a growing emphasis on vehicle safety and efficiency, the adoption of ADAS is rapidly increasing. Automotive switches play a critical role in these systems, providing the necessary interface between the driver and the vehicle's electronic control units (ECUs) . These switches must be highly reliable, durable, and capable of operating under various conditions to ensure the safety and performance of ADAS features. The integration of ADAS into vehicles requires a complex network of switches to manage various functions, from simple toggles to sophisticated touch-sensitive and proximity switches.

Moreover, the increasing popularity of smart and autonomous vehicles presents a major automotive switches market opportunity for manufacturers. The continuous advancements in ADAS technology are pushing manufacturers to innovate and develop more advanced switch systems. This includes the incorporation of smart switches that can provide haptic feedback, touch sensitivity, and even gesture recognition, enhancing the overall user experience and interaction with the vehicle. As a result, the demand for high-quality, advanced automotive switches is expected to continue growing, driven by the increasing penetration of ADAS in both high-end and mid-range vehicles. The automotive switches market forecast indicates a rise in demand for electronic switches, as they offer greater functionality and reliability.

Market Segmentation

The automotive switches market is segmented into type, design, vehicle type, sales channel, and region. Based on type, it is further divided into ignition switches, HVAC switches, steering wheel switches, window switches, overhead console switches, seat control switches, door switches, hazard switches, multi-purpose switches, and others. As per design, it is classified into rocker switches, rotary switches, toggle switches, push switches, and other switches. Depending on the vehicle type, it is fragmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. Based on sales channel, it is bifurcated into original equipment manufacturers and aftermarket. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The expanding automotive industry and rise in industrialization across emerging nations, such as China, India, Indonesia, and others in the Asia-Pacific region are anticipated to promote the growth of the automotive switches market.

The automotive switches market in the Asia-Pacific region is experiencing robust growth due to several key factors. One of the major drivers is the rapid expansion of the automotive industry in countries such as China, India, and Japan. These countries are seeing a surge in vehicle production and sales, driven by increasing disposable incomes, urbanization, and the growing middle-class population. This growth in the automotive sector directly translates to a higher demand for automotive components, including switches.

In China, which is the largest automotive market globally, there is a significant push towards electric vehicles (EVs) due to government policies promoting sustainable transportation. The adoption of EVs requires advanced electronic components and switches to manage various functions such as power distribution, battery management, and user interfaces. This trend is further bolstered by the Chinese government's incentives for EV manufacturers and buyers, making it a major factor for the growth of the automotive switches market in the region.

India, on the other hand, is witnessing a boom in the two-wheeler and passenger car segments. The increasing preference for personal mobility solutions due to inadequate public transportation infrastructure is driving vehicle sales. Additionally, the Indian government's focus on the "Make in India" initiative is encouraging domestic production of automotive components, including switches, which supports local manufacturers and reduces dependency on imports.

Japan, known for its technological advancements, is continuously innovating in the automotive sector. The country is a hub for major automotive manufacturers like Toyota, Honda, and Nissan, who are investing heavily in research and development. These companies are focusing on integrating advanced driver assistance systems (ADAS) and autonomous driving technologies into their vehicles, necessitating the use of sophisticated automotive switches. The trend towards smart and connected vehicles is also prominent in Japan, further driving the demand for advanced switch systems.

Furthermore, the Asia-Pacific region benefits from a strong manufacturing base for electronic components, which includes automotive switches. Countries like South Korea and Taiwan are key suppliers of electronic parts, supporting the regional automotive industry's needs. The availability of these components at competitive prices provides an edge to manufacturers in the region, enabling them to produce cost-effective and technologically advanced vehicles.

In addition, the rising awareness and implementation of safety regulations across the Asia-Pacific region are compelling automotive manufacturers to incorporate more reliable and efficient switches in their vehicles. This regulatory push ensures that vehicles meet international safety standards, which in turn drives the demand for high-quality automotive switches.

In December 2023, The Central Government of India implemented initiatives such as the Production Linked Incentive (PLI) schemes for automotive technology and advanced chemistry cells, and the FAME India Scheme Phase-II with its Phased Manufacturing Programme to boost domestic electric vehicle manufacturing and reduce reliance on imports.

In December 2023, China's updated taxation policy for buying new energy vehicles (NEVs) took effect at the beginning of this year. This new policy replaces the previous tax exemption that allowed NEV buyers to avoid purchase taxes (except for some ultra-luxury vehicles) , a benefit that had been in place for nearly ten years. As per the revised scheme announced in June by China's Ministry of Finance, NEV buyers are now eligible for a tax break of up to $4, 230 (RMB 30, 000) per vehicle for two years, from January 1, 2024 to December 31, 2025.

Competitive Landscape

The major players operating in the automotive switches market include C&K Switches, Eaton Corporation PLC, INENSY, Omron, Johnson Electric Holdings Limited, Leopold Kostal GmbH & Co. Kg, Marquardt GmbH, Preh GmbH, Tokai Rika Co Ltd., Toyodenso Co., Ltd., Valeo, and ZF Friedrichshafen AG. Innovations in switch technology, such as the development of touch-sensitive controls, are likely to impact the automotive switches market share.

Industry Trends

In August 2023, Bosch launched innovative solutions for software-defined mobility and latest advancements for safe and sustainable transportation at IAA Mobility 2023 in Munich. One notable innovation is the Bosch powernet guardian, which guarantees continuous power supply to the vehicle's safety-related functions. In case of a fault, an electronic isolating switch disconnects the safety-critical electrical system from non-essential components like seat heating and window lifters.

Key Sources Referred

European Automobile Manufacturers Association (ACEA)

Institute of Electrical and Electronics Engineers (IEEE)

Society of Automotive Engineers (SAE)

International Organization of Motor Vehicle Manufacturers (OICA)

Automotive Aftermarket Suppliers Association (AASA)

European Automobile Manufacturers Association (ACEA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive switches market analysis from 2024 to 2033 to identify the prevailing automotive switches market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive switches market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive switches market trends, key players, market segments, application areas, and market growth strategies.

Automotive Switches Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 31.2 Billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Type |

|

| By Design |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | INENSY , Eaton Corporation PLC , ZF Friedrichshafen AG. , Preh GmbH , Valeo , Leopold Kostal GmbH & Co. Kg , Marquardt GmbH , Toyodenso Co., Ltd. , Johnson Electric Holdings Limited , Tokai Rika Co Ltd. , C&K Switches |

The major players operating in the automotive switches market include C&K Switches, Eaton Corporation PLC, INENSY, Omron, Johnson Electric Holdings Limited, Leopold Kostal GmbH & Co. Kg, Marquardt GmbH, Preh GmbH, Tokai Rika Co Ltd., Toyodenso Co., Ltd., Valeo, and ZF Friedrichshafen AG.

The largest regional market for Automotive Switches is Asia-Pacific

The global automotive switches market size was valued at $18.1 billion in 2023, and is projected to reach $31.2 billion by 2033, growing at a CAGR of 5.8% from 2024 to 2033.

Upcoming trends of Automotive Switches Market are expansion in emerging markets and development of smart and connected switches

The leading vehicle type of Automotive Switches Market is passenger cars

Loading Table Of Content...