Light Commercial Vehicle Powertrain Sensor Market Insights, 2033

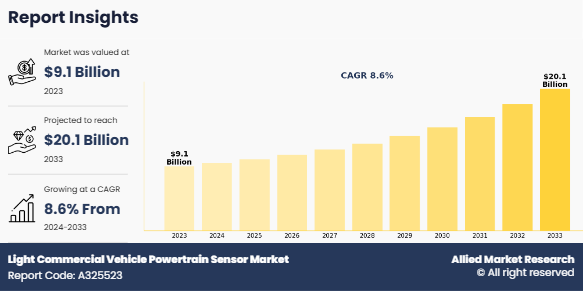

The global Light Commercial Vehicles Powertrain Sensors Market Size was valued at USD 9.1 billion in 2023, and is projected to reach USD 20.1 billion by 2033, growing at a CAGR of 8.6% from 2024 to 2033.

The Light Commercial Vehicle (LCV) Powertrain Sensor Market refers to the segment of the automotive industry focused on the production and utilization of sensors specifically designed for monitoring and optimizing the powertrain systems in light commercial vehicles. These sensors are integral to the operation of various components within the powertrain, including the engine, transmission, exhaust, and electric drive systems. Their primary functions include monitoring vehicle performance, fuel efficiency, emissions, and the overall health of powertrain components. Sensors in this market enable real-time data collection, diagnostics, and predictive maintenance, allowing fleet operators to optimize the operation of their vehicles, reduce costs, and improve vehicle lifespan.

Key Takeaways

- The Light Commercial Vehicles Powertrain Sensors Market Size covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious Light Commercial Vehicles Powertrain Sensors Market Growth objectives.

In light commercial vehicles, powertrain sensors are essential for compliance with stringent emission regulations, particularly in markets like Europe and North America, where environmental standards are becoming more rigorous. For instance, the European Union introduced the Euro 7 regulations, set to be implemented on July 1, 2025, for new light-duty vehicles. These regulations significantly tighten emission limits, reducing the permissible NOx emissions from 0.08 g/km under Euro 6 to 0.02 g/km under Euro 7. To meet these stringent standards, manufacturers are required to employ advanced emission control technologies, which rely heavily on various sensors. For instance, technologies such as Lean NOx Traps (LNT) and Selective Catalytic Reduction (SCR) systems depend on accurate data from NOx sensors to function effectively. In addition, sensors like Exhaust Gas Pressure and Temperature sensors, Particulate Matter (PM) sensors, Oxygen/Lambda sensors, and Manifold Absolute Pressure (MAP) and Mass Air Flow (MAF) sensors are integral to monitoring and controlling emissions in real-time.

Key market players like Robert Bosch GmbH, known for its advanced oxygen sensors, Continental AG, offering a variety of emission sensors for efficient engine management; and Denso Corporation, providing advanced sensors for cleaner operations. HELLA GmbH & Co. KGaA specializes in NOx sensors that optimize AdBlue usage, while NGK Spark Plug Co., Ltd. (Niterra) delivers Exhaust Gas Temperature Sensors (EGTS) for overheating protection. Walker Products, Inc. stands out with its aftermarket-focused Genuine OE NOx program, and Valeo supplies an extensive portfolio of over 1,700 engine sensor references. These companies are prominent in developing the standard sensor technologies required to meet evolving regulatory demands and ensure cleaner, more efficient light commercial vehicles.

As electric vehicles (EVs) and hybrid models continue to gain market share, the demand for specialized powertrain sensors to monitor energy consumption, battery management systems (BMS), and other critical components is increasing. The market also includes sensors that monitor vehicle safety, vehicle-to-vehicle communication, and overall operational efficiency, with technologies such as IoT and wireless sensors driving innovation.

In addition, the LCV powertrain sensor market is growing due to factors such as the rising adoption of electric and hybrid commercial vehicles, the ongoing demand for better fuel efficiency and emissions control, and advancements in sensor technology. These sensors enable fleet operators and manufacturers to enhance the performance, safety, and efficiency of their light commercial vehicle fleets, contributing to cost savings and improved operational outcomes. As the automotive industry moves toward cleaner, smarter, and more automated vehicles, the demand for advanced powertrain sensors in LCVs is expected to continue to rise. According to International Council on Clean Transportation, in 2023, global sales of light-duty electric vehicles (EVs) reached more than 13 million, accounting for about 15% of new light-duty vehicles (LDVs) sold worldwide. Around 88% of EVs sold globally were in the four largest LDV markets: China, Europe, the U.S., and India, which together accounted for about 63% of global LDV sales.

Furthermore, in China, three manufacturers dominated sales: Tesla, BYD, and SAIC Motor (manufacturer of the Wuling Hongguang Mini). In Europe, Tesla models accounted for the highest Light Commercial Vehicles Powertrain Sensors Market Share of BEV sales, at 17%, followed by the Volkswagen Group (14%) with four of its top-selling models: VW ID.4, koda Enyaq iV, VW ID.3, and Audi Q4 e-tron. Moreover, for the first time, SAIC Motor made it into Europe̢۪s 10 best-sellers list with its MG4 model. In the United States, Tesla recorded the most sales, with its Model Y and Model 3 jointly accounting for 49% of all BEV sales. In India, Tata Motors dominated the EV market with four best-selling models; its Tiago and Nexon models accounted for 57% of BEV sales in 2023.

The increasing adoption of electric vehicles (EVs) is a major driver for the Light Commercial Vehicle (LCV) powertrain sensor market. As businesses and governments push for greener transport options, the demand for electric LCVs has surged, necessitating the integration of advanced powertrain sensors. These sensors are critical for managing various aspects of EVs, such as battery performance, energy efficiency, and motor control. Powertrain sensors help optimize the operation of electric vehicles by ensuring the smooth functioning of essential components, like the battery management system (BMS) and the electric motor. Additionally, as more businesses transition their fleets to electric models, there is a growing need for sensors that can improve operational efficiency, lower energy consumption, and extend vehicle range. The transition to electric LCVs is expected to continue to drive demand for advanced sensor technologies, further boosting the growth of the market.

One of the key restraints in the LCV powertrain sensor market is the high initial cost of advanced sensor technologies. While these sensors offer significant long-term benefits, such as improved fuel efficiency, lower emissions, and reduced maintenance costs, the upfront investment required to integrate them into light commercial vehicles can be a deterrent, particularly for small and medium-sized businesses or fleet operators. The cost of developing and manufacturing these sensors, as well as the installation expenses, can be a significant financial burden, especially in price-sensitive markets. Moreover, the high cost of sensors may limit their adoption in regions with less stringent regulatory requirements or where cost considerations outweigh environmental or efficiency goals. As a result, despite the technological advantages, some fleet operators may delay the adoption of advanced sensor systems, which can slow the growth of the LCV powertrain sensor market.

The expansion of electric vehicle (EV) infrastructure, including charging stations and supporting technologies, presents a significant opportunity for the LCV powertrain sensor market. As more countries and cities commit to increasing the availability of EV charging stations, the adoption of electric LCVs is expected to rise, creating a greater demand for related sensor technologies. Sensors are critical to the efficient operation of electric LCVs, as they monitor key aspects like battery charging and discharging, power distribution, and energy recovery systems. The growing EV infrastructure enables businesses to transition their commercial fleets to electric models, and as this shift accelerates, the need for advanced sensors will increase. This presents a unique opportunity for sensor manufacturers to develop innovative products tailored specifically to electric powertrains, optimizing vehicle performance, energy usage, and operational efficiency. With the expansion of EV infrastructure, the market for LCV powertrain sensors is expected to witness significant growth.

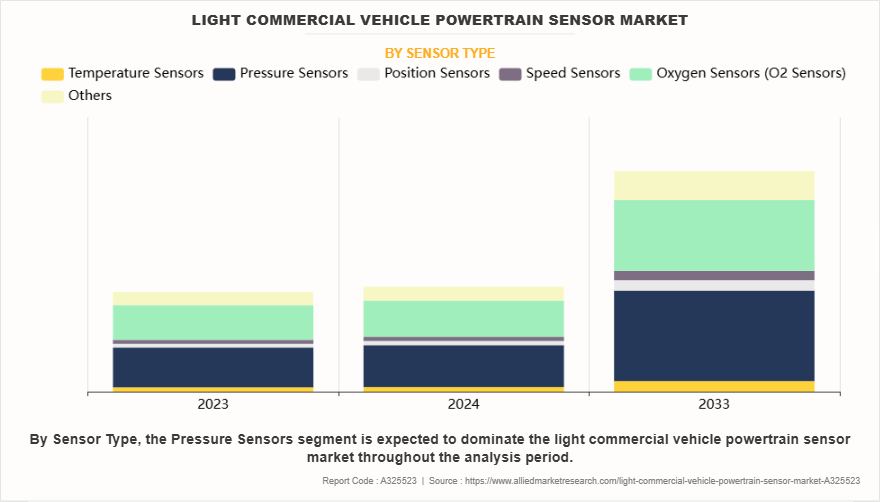

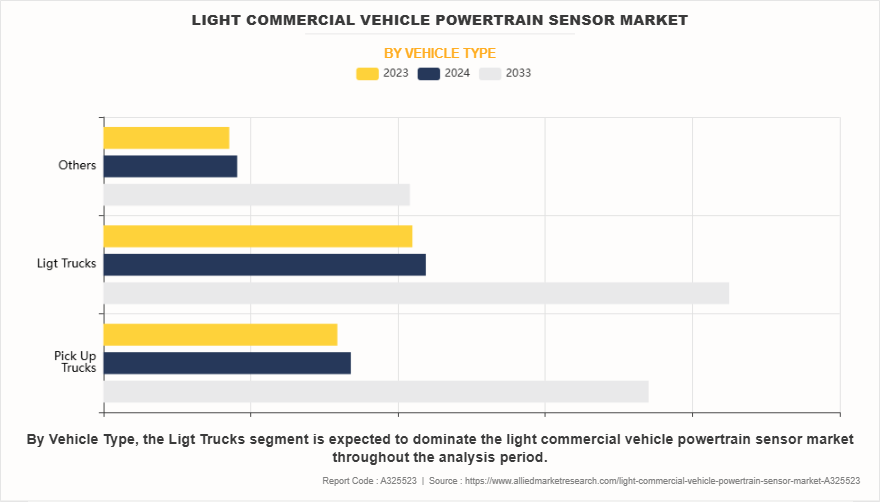

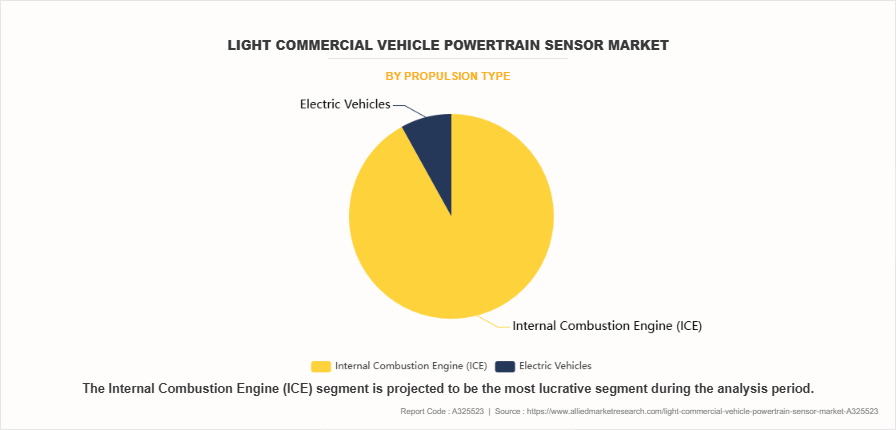

The light commercial vehicle (LCV) powertrain sensor market is segmented into sensor type, vehicle type, propulsion type, sales channel, and region. By sensor type, the market is divided into temperature sensors, pressure sensors, position sensors, speed sensors, oxygen sensors (O2 sensors), and others. By vehicle type, the segmentation pick-up trucks, light trucks, and others. By propulsion type, the market is divided into internal combustion engine (ICE) vehicles, and electric vehicles (EVs). By sales channel, it includes Original Equipment Manufacturers (OEMs) and the aftermarket. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Sensor Type

Based on sensor type, Pressure Sensors segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to their critical role in monitoring and optimizing engine performance, fuel efficiency, and emissions control in light commercial vehicles. The growing adoption of advanced powertrain technologies and stringent emission regulations are further driving demand for pressure sensors.

By Vehicle Type

Based on vehicle type, Light Trucks segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to their widespread use for commercial applications, including logistics, construction, and last-mile deliveries. The increasing demand for fuel-efficient and high-performance vehicles in urban and suburban areas is also contributing to the dominance of this segment.

Propulsion Type

Based on propulsion type, the Internal Combustion Engine (ICE) segment dominated the global market in the year 2023 and is likely to remain dominant during the Light Commercial Vehicles Powertrain Sensors Market Forecast period. This is attributed to the continued reliance on ICE vehicles in commercial fleets due to their cost-effectiveness, widespread refueling infrastructure, and high payload capacity. While electrification is gaining traction, ICE-powered light commercial vehicles remain the preferred choice in many regions.

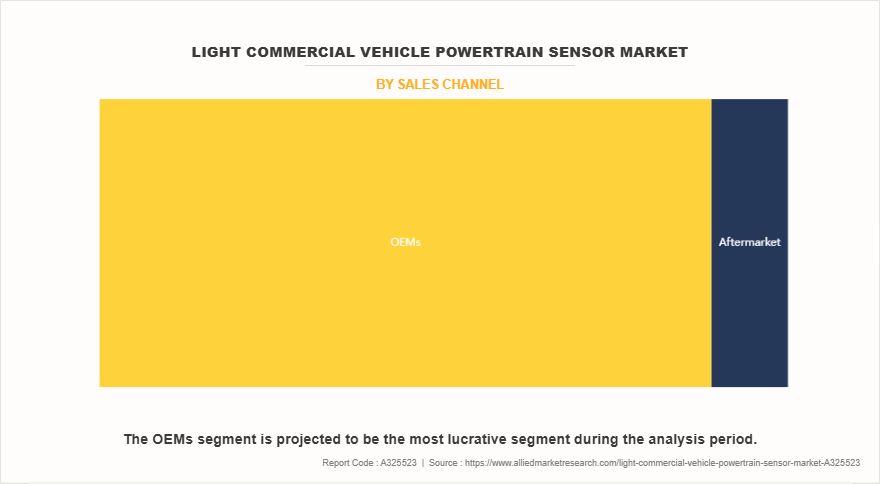

Sales Channel

Based on sales channel, OEMs dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the increasing integration of advanced powertrain sensors at the manufacturing stage to comply with regulatory standards and enhance vehicle performance. OEMs are also investing in sensor technologies to improve vehicle efficiency and longevity, boosting their dominance in the market.

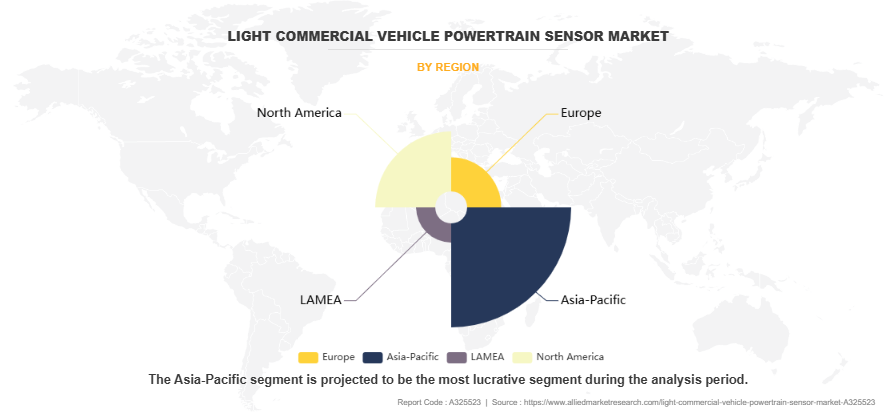

Region

Based on region, Asia-Pacific dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the high production and sales of light commercial vehicles in key countries such as China, India, and Japan. The presence of major automotive manufacturers, rapid urbanization, and expanding e-commerce and logistics industries are further driving the Light Commercial Vehicles Powertrain Sensors Market Demand in this region.

The key players included in the Light Commercial Vehicles Powertrain Sensors Market Analysis are Continental AG, Robert Bosch GmbH, DENSO CORPORATION, Honeywell International Inc., Sensata Technologies, Inc., PHINIA Inc. (Delphi Technologies PLC), Valeo, Hitachi Astemo, Ltd., ZF Friedrichshafen AG, Infineon Technologies AG, HELLA GmbH & Co. KGaA, Niterra India PVT. LTD., CTS Corporation, and Amphenol Corporation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current Light Commercial Vehicles Powertrain Sensors Market Trends, estimations, and dynamics of the light commercial vehicle powertrain sensor market analysis from 2023 to 2033 to identify the prevailing light commercial vehicle powertrain sensor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the light commercial vehicle powertrain sensor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global Light Commercial Vehicles Powertrain Sensors Industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global light commercial vehicle powertrain sensor market trends, key players, market segments, application areas, and Light Commercial Vehicles Powertrain Sensors Industrygrowth strategies.

Light Commercial Vehicle Powertrain Sensor Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 20.1 billion |

| Growth Rate | CAGR of 8.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Sensor Type |

|

| By Vehicle Type |

|

| By Propulsion Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Niterra India PVT. LTD., Infineon Technologies AG, Honeywell International Inc., Valeo, ZF Friedrichshafen AG, CTS Corporation, PHINIA Inc. (Delphi Technologies PLC), Amphenol Corporation, Hitachi Astemo, Ltd., DENSO CORPORATION, Sensata Technologies, Inc., HELLA GmbH & Co. KGaA, Robert Bosch GmbH, Continental AG |

Analyst Review

The Light Commercial Vehicle (LCV) powertrain sensors market is poised for substantial growth as technological innovations, regulatory pressures, and the shift toward electric vehicles (EVs) drive demand for advanced sensor systems. Powertrain sensors play a crucial role in monitoring and optimizing vehicle performance by providing real-time data on critical parameters such as engine speed, transmission, and energy efficiency. As governments globally push for stricter emission standards and sustainable transport solutions, fleet operators are turning to LCVs equipped with advanced sensors to ensure compliance with environmental regulations while maintaining operational efficiency. For instance, in Israel, over 80% of logistics companies expanded their fleets with modified LCVs in 2023, integrating technologies such as refrigerated units and utility modifications to meet specific operational requirements and industry standards. This shift is especially evident in the growing adoption of electric LCVs, which require more sophisticated sensors to manage battery systems, powertrains, and energy flow effectively.

Technological advancements, particularly on the Internet of Things (IoT) and real-time data analytics, are enhancing sensor functionalities, allowing fleet operators to gain deeper insights into vehicle performance and improve fuel consumption. For instance, Bosch has been at the forefront of integrating IoT technologies into automotive systems, transforming vehicles into "IoT devices on wheels." This evolution allows for the implementation of new functions primarily through software, enhancing vehicle performance and efficiency. Furthermore, Kinetica also offers real-time vehicle and automotive analytics solutions, utilizing IoT sensors to collect data on GPS, speed, acceleration, and fuel consumption. This data is crucial for monitoring vehicle performance, diagnosing issues, and improving efficiency.

Predictive maintenance capabilities, enabled by these advanced sensor systems, reduce downtime and enhance fleet productivity, offering a significant return on investment for businesses. As sensor systems evolve, they are also playing a critical role in the development of autonomous LCVs, which require sensors not only for powertrain management but also for navigation, safety, and operational control.

However, the market faces certain challenges, including the high costs associated with advanced sensors and the complexity of retrofitting legacy vehicles. Upgrading older LCVs with state-of-the-art sensor technologies often involves significant investments in infrastructure and labor, which can deter some businesses from making the switch. Despite these barriers, the long-term benefits of advanced sensor integration in LCVs, especially for electric and autonomous vehicles, present a significant growth opportunity. As the automotive industry continues its transition toward cleaner, more efficient transportation, the LCV powertrain sensors market is set to play a pivotal role in the evolution of fleet management and vehicle technology.

The light commercial vehicle powertrain sensor market was valued at $9,086.7 million in 2023 and is estimated to reach $20,071.1 million by 2033, exhibiting a CAGR of 8.6% from 2024 to 2033.

The report sample/ company profile section for market report can be obtained on demand from the website.

Rise of Electrification and Hybrid Powertrains, Integration of IoT and Smart Sensors are some of the upcoming trends in Light Commercial Vehicle Powertrain Sensors industry

The key growth strategies adopted by the Market players includes innovations, merger, product launch, investment, joint venture, partnership and business developments with the increased RnD expenditure.

The key players included in the analysis are Continental AG, Robert Bosch GmbH, DENSO CORPORATION, Honeywell International Inc., Sensata Technologies, Inc., PHINIA Inc. (Delphi Technologies PLC), Valeo, Hitachi Astemo, Ltd

Loading Table Of Content...

Loading Research Methodology...