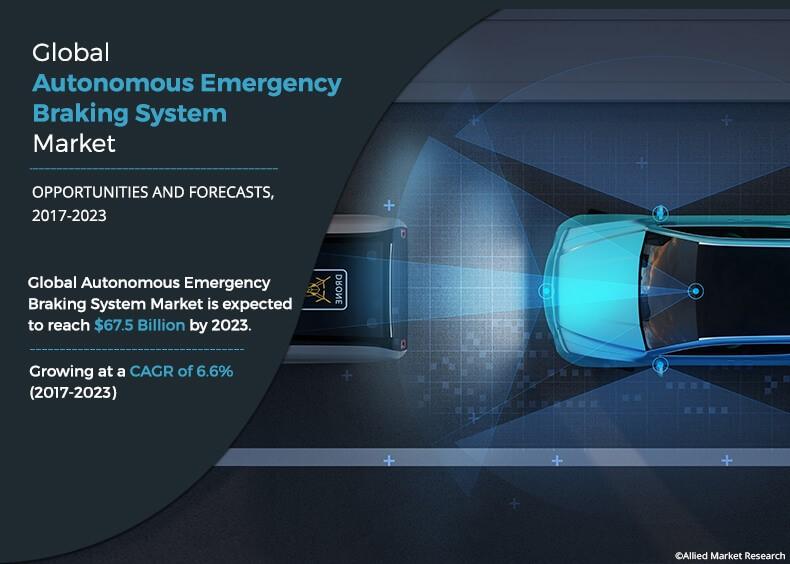

Autonomous Emergency Braking System Market Insights, 2023

The global autonomous emergency braking system market size was valued at USD 43.7 billion in 2016, and is projected to reach at USD 67.67 billion by 2023, growing at a CAGR of 6.7% from 2017 to 2023.The global market is driven by rise in number of road accidents, and high adoption rate of advanced braking systems. However, high cost of AEBS technology hampers the market growth.

Autonomous emergency braking system (AEBS) is a new safety technology increasingly being fitted to vehicles, which monitors the traffic conditions ahead and automatically brakes the car if the driver fails to respond to an emergency situation. AEB is seen by experts as an important development as is the seatbelt, but rather than protecting the occupant in the event of a crash, it aims to prevent the crash happening in the first place. The application of autonomous emergency braking system industry is engaged in advanced driver assistance system (ADAS).

The market players have implemented a number of strategies including partnership, expansion, collaboration, joint ventures, and others to heighten their status in the industry. These market players have implemented a number of strategies including partnership, expansion, collaboration, joint ventures, and others to heighten their status in the industry. Significant players operating in the autonomous emergency braking system market are Robert Bosch GmbH, Continental AG, Delphi Automotive LLP, ZF Friedrichshafen AG, Mobileye, Autoliv Inc., Hyundai Mobis, AISIN SEIKI Co., Ltd., Hitachi Automotive Systems, Ltd., and Mando Corporation.

Segment Overview

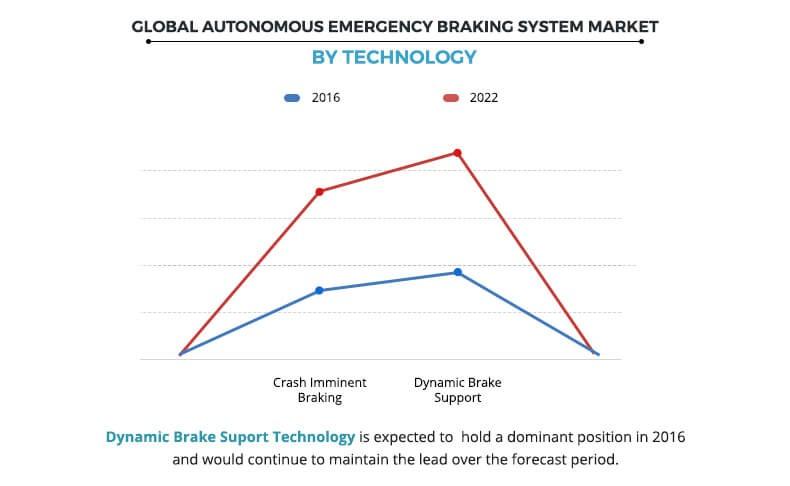

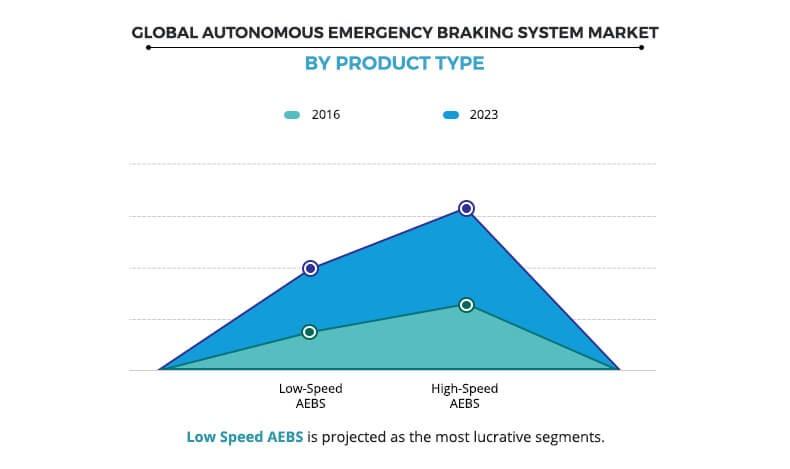

The global autonomous emergency braking system industry is segmented on the basis of product type, technology, vehicle type, and region. By product type, the market is divided into low-speed AEBS & high-speed AEBS. By technology, the AEBS is classified into crash imminent braking and dynamic brake support. By vehicle type, the market is categorized into passenger and commercial vehicles. Based on region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Top Impacting Factors

Factors that are expected to impact the global autonomous emergency braking system market during the forecast period are rise in number of road accidents and high adoption rate of advanced braking systems. However, the impact of factors, such as high cost of AEBS technology, is expected to diminish during the forecast period.

Rise in Number of Road Accidents

According to the fact sheet of “World Health Organization”, road traffic injuries are the leading cause of death among people aged between 15 and 29 years & 1.25 million people die every year as a result of road accident. Also, 90% of the world's fatalities on the roads occur in low & middle economical countries, though such countries have approximately 54% of the world's vehicles. Moreover, for most of the countries road accidents cost 3% of their gross domestic product (GDP). Such factors result in increased demand of the vehicles, which are equipped with autonomous emergency braking system (AEBS) for safety & security of the vehicle, driver, and people. Furthermore, road accidents cause considerable economic losses to individuals, their families, and to nations as a whole. Such losses arise from the cost of treatment as well as lost productivity for people killed or disabled by their injuries, and for the rest of family members which in turn fuels the demand of AEBS to avoid road accidents.

High Adoption Rate of Advanced Emergency Braking System

Advanced emergency braking systems (AEBS) market has a very high potential in case of crash avoidance & crash mitigation. basic functions of AEBS are to either avoid or at least mitigate a collision with a vehicle ahead or a stationary vehicle. This can be achieved either by warning the driver or, if applicable, by an autonomous braking of the vehicle. Systems with enhanced functions also respond on pedestrians, bicyclists, and other road users. Such advantages of AEBS are increasing its adoption rate over the globe. For instance, according to the German Automobile Club (ADAC), advanced emergency braking systems industry have already offered for about 85% of all passenger car models that are available in Germany. In addition, the European general safety regulation has already made AEBS mandatory for commercial vehicles (with the exemption of category N1) as well as for buses and coaches.

High Cost of AEBS

The cost of installation of autonomous emergency braking system market (AEBS) increases the overall price of the vehicle and becomes the prime factor in terms of overall cost of the vehicle. Due to the presence of such cost constraints, the more efficient (expensive) systems are first implemented in premium brand vehicles, where the impact of the cost of the system on the overall cost of the vehicle is minor than for standard brands vehicles. For instance, Subaru’s EyeSight starts at $1,195. Moreover, for standard brands, less expensive systems are implemented but it usually covers less scenarios. It induces a smaller benefit for the road safety even if they have higher autonomous emergency braking system market share. For instance, Toyota’s system costs as little as $500.

Key Benefits Autonomous Emergency Braking System Market Study:

This study comprises analytical depiction of the global AEBS market with current trends and future estimations to depict the imminent investment pockets.

The overall autonomous emergency braking system market potential is determined to understand the profitable trends to gain a stronger foothold.

The autonomous emergency braking system market report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

The current market is quantitatively analyzed from 2017 to 2023 to highlight the financial competency of the AEBS market.

Porter’s Five Forces analysis illustrates the potency of the buyers and suppliers in the autonomous emergency braking system industry.

Autonomous Emergency Braking System Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By TECHNOLOGY |

|

| By VEHICLE TYPE |

|

| By Region |

|

| Key Market Players | DELPHI AUTOMOTIVE LLP, CONTINENTAL AG, HITACHI AUTOMOTIVES SYSTEMS, LTD, HYUNDAI MOBIS, AISIN SEIKI CO., LTD, ROBERT BOSCH GMBH, MOBILEYE, AUTOLOV INC, MANDO CORPORATION, ZF FRIEDRICHSHAFEN AG |

Analyst Review

The global autonomous emergency braking system market is expected to witness high growth rate due rise in number of road accidents and high adoption rate of advanced braking system. However, the installation coast of the AEBS technology impedes the market growth.

Autonomous emergency braking system (AEBS) is a new safety technology increasingly being fitted to vehicles, which monitors the traffic conditions ahead and automatically brakes the car if the driver fails to respond to an emergency situation. AEB is seen by experts as an important development as the seatbelt, but rather than protecting the occupant in the event of a crash, it aims to prevent the crash happening in the first place. The application of AEBS is engaged in advanced driver assistance system (ADAS).

AEBS uses on-board sensors, cameras, and radars to detect vehicles, pedestrians, and other obstacles. AEBS is mandatory in the U.S. and Europe to reduce fatalities. Several regulations are made by the government to reduce the road accidents. Furthermore, autonomous emergency braking system industry is witnessing increased demand for passenger vehicle registration and rise in demand for luxury vehicles.

Robert Bosch GmbH, Continental AG, Delphi Automotive LLP, ZF Friedrichshafen AG, Mobileye, Autoliv Inc., Hyundai Mobis, AISIN SEIKI Co., Ltd., Hitachi Automotive Systems, Ltd., and Mando Corporation are key market players that occupy a significant revenue share in the autonomous emergency braking system market.

The global autonomous emergency braking system market was valued at USD 43.7 billion in 2016, and is projected to reach USD 67.67 billion by 2023.

The global autonomous emergency braking system (AEBS) market is projected to grow at a compound annual growth rate of 6.7% from 2017 to 2023.

Significant players operating in the autonomous emergency braking system market are Robert Bosch GmbH, Continental AG, Delphi Automotive LLP, ZF Friedrichshafen AG, Mobileye, Autoliv Inc., Hyundai Mobis, AISIN SEIKI Co., Ltd., Hitachi Automotive Systems, Ltd., and Mando Corporation.

LAMEA is the highest revenue contributor.

Factors that are expected to impact the global autonomous emergency braking system market during the forecast period are rise in number of road accidents and high adoption rate of advanced braking systems. However, the impact of factors, such as high cost of AEBS technology, is expected to diminish during the forecast period.

Loading Table Of Content...