Baby Infant Formula Market Research, 2031

The global baby infant formula market size was valued at $25.5 billion in 2021, and is projected to reach $56.6 billion by 2031, growing at a CAGR of 8.1% from 2022 to 2031.

Baby infant formula comprises infant milk, follow-on milk, specialty baby milk, and growing-up milk designed for infants’ and toddlers’ consumption. Infant milk contains the necessary nutrients, minerals, and vitamins for normal development of the baby. Physicians recommend infant formula as an alternative to breastmilk, as it can be fed anywhere and at any time, which makes it convenient for working mothers. Many working mothers return to their jobs shortly after giving birth. Thus, infant formula can be fed at convenience and provides a healthy & nutritious alternative.

Market Dynamics

The baby infant formula industry is projected to be fueled by the high nutritional content of infant formula. The infant formula segment accounted for the highest share in the global baby infant formula market. Breastfeeding is not always possible for mothers working outside homes; thus, infant formula is an appropriate alternative for the infant as its composition is similar to that of breastmilk. Infant formulas contain nucleotides, necessary for the metabolic processes, such as energy metabolism and enzymatic reactions. Moreover, physicians recommend the use of infant formula for babies as a substitute to breastmilk, owing to its high nutritional content, thereby driving the market growth.

In addition, the baby infant formula market is driven by rise in number of women working outside their houses. Most of the working mothers return to their jobs shortly after their delivery. Breastfeeding is not always possible for working mothers due to lack of time and inconvenience. Infant formulas provide an appealing alternative for working mothers, thus fulfilling their requirements for healthy and nutritious food with their need for convenience.

The baby infant formula market demand is propelled by positive demand dynamics such as low breastfeeding rates and fertility rates, which show an early reliance on breast milk substitutes. Parents' demand for the product is being fueled by its convenience and improved composition. Baby infant formula market size is anticipated to be positively impacted by the rise in investment made by the key players in the research & development of novel products. For instance, Nestle S.A. inaugurated a brand-new research facility in Ireland in January 2019. For the global market, the center is anticipated to concentrate on creating innovations in milk-based newborn and maternal nutrition products.

Moreover, the other key reasons that propel the market globally are the attention and emphasis on newborns' nutritional demands that are expanding at the highest rate. The number of working moms and women has increased, and their discretionary expenditure has increased significantly. These factors have increased demand for baby nourishment items. Some of the contributing elements that can increase the demand for the product include the rising number of lactation cases, medicine, a lack of assistance and skilled lactation experts, unsupportive work regulations, and cultural standards.

In addition, the expansion of home healthcare services and growth in awareness of personal care are two major factors driving the demand for baby infant formula. The significance of healthy nutrition and wellbeing during the formative years of a child's growth is being recognized by consumers. Home health service providers have been supplying cost-efficient, integrated, and high-quality infant care as a component of tailored childcare help. Baby milk consumption is anticipated to expand as a result of the increased excellent healthcare provided to reduce newborn mortality and morbidity rates, which also is projected to encourage the expansion of companies that make baby infant formula.

However, concerns related to food safety hamper the baby infant formula market growth. Infant formula is a sensitive food product, as it is a substitute to breastmilk and is added to the diet of infants for their proper development. Cases related to adulteration of infant formula have been reported across the globe. A case of melamine poisoning of infant formula was revealed in China, where milk was adulterated with the chemical, leading to the death of six babies and illnesses in thousands of infants. Thus, the concerns related to the safety of baby infant formula act as the major restraint to the market growth.

Segment Overview

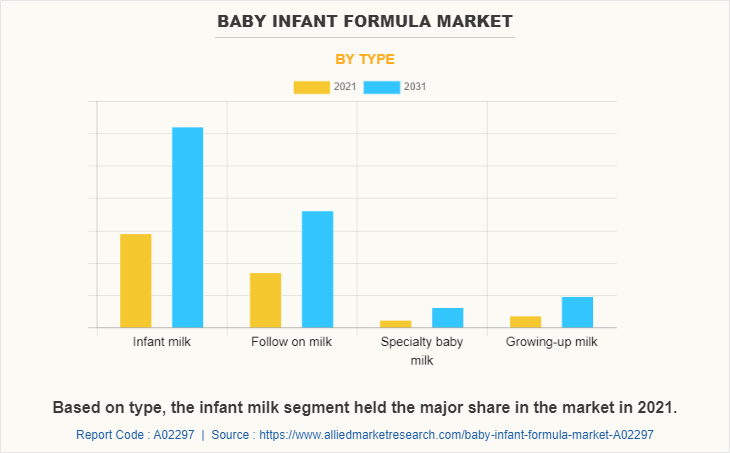

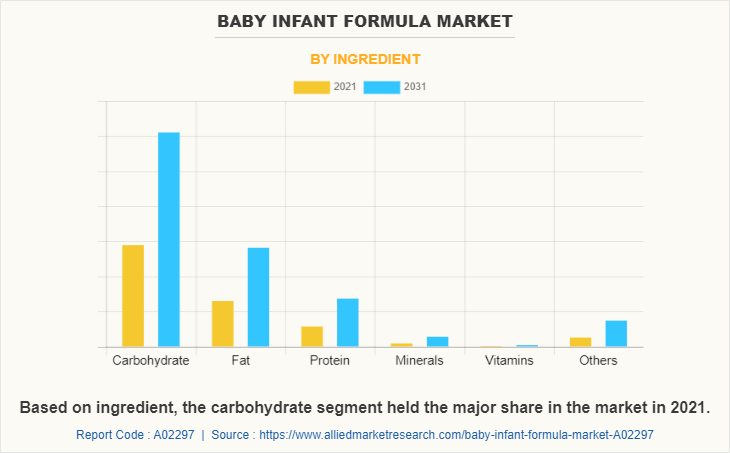

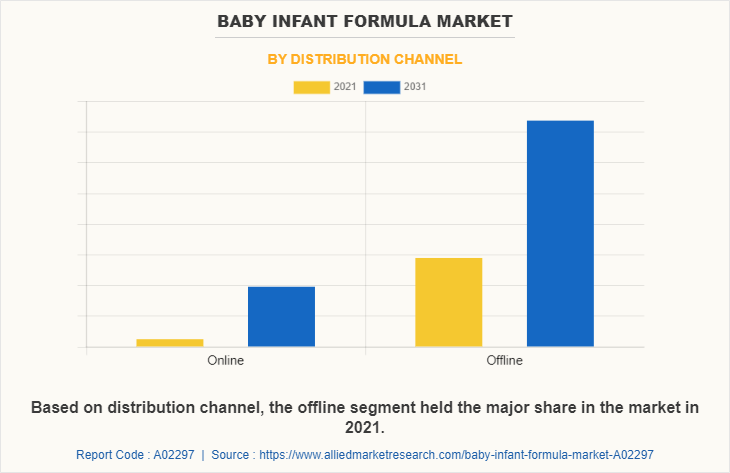

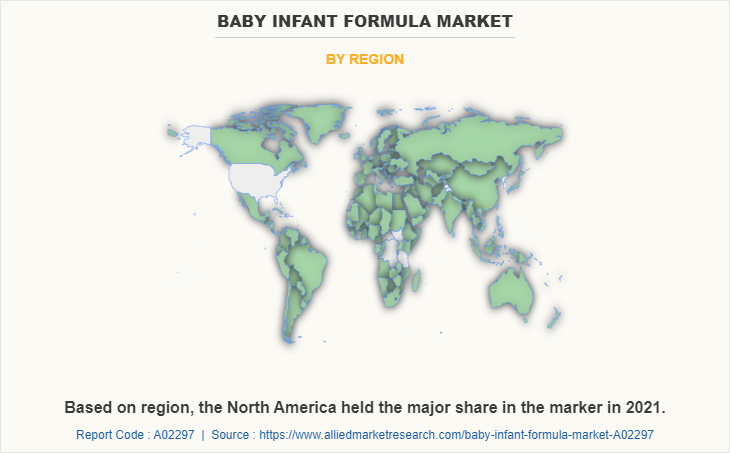

The baby infant formula market forecast is segmented on the basis of type, ingredient, distribution channel, and region. By type, the market is classified into infant milk, follow on milk, specialty baby milk, and growing up milk. By ingredient, the market is fragmented into carbohydrate, fat, protein, minerals, and vitamins. By distribution channel, the market is categorized into online and offline. Furthermore, the offline segment is divided into hypermarkets & supermarkets, pharmacy/medical store, specialty stores, and hard discounter store. Region wise, it is analyzed across North America (U.S., Canada, Mexico), Europe (UK, Germany, France, Italy, Spain, Turkey, Russia, and Rest of Europe), Asia-Pacific (China, India, South Korea, Japan, Philippines, Indonesia, and Rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, Saudi Arabia, UAE, and rest of LAMEA).

By type, the market is classified into infant milk, follow-on milk, specialty baby milk, and growing-up milk. The infant milk segment accounted for a major baby infant formula market share in 2021 and is expected to grow at a significant CAGR during the forecast period. Infant milk is specially designed to meet the growing needs of babies under six months of age, who are not breastfed or partially breastfed. Lack of acceptable alternatives as only breast milk is a viable substitute for infant milk and increase in infant population in India, China, Indonesia, Philippines, Brazil and other emerging countries are expected augment the demand for infant milk segment in market.

By ingredient, the market is divided into carbohydrate, fat, protein, minerals, and vitamins. The carbohydrate segment accounted for a major share in the baby infant formula market in 2021 and is expected to grow at a significant CAGR during the forecast period. Carbohydrates are an important source of energy for growing infants, as they account for almost 40% of their daily energy intake. In most cow milk-based formulas, lactose is the main source of carbohydrates. Lactose may benefit the gut microbiota and help in absorption of calcium. Thus, such benefits of carbohydrates drive the growth of the overall market globally.

By distribution channel, the market is bifurcated into online and offline. The offline segment accounted for a major share in the baby infant formula market in 2021 and is expected to grow at a significant CAGR during the forecast period. Manufacturers consistently work to improve their products' shelf visibility; as a result, they focus mostly on offline sales. As a result, a larger selection of food items, including baby food, are offered offline. In addition, since the bulk of products are bought in offline stores and brand preference is easier to acquire in rural areas of developing countries, the offline market is crucial for customers living there. As a result, these elements are promoting market expansion.

Furthermore, offline segment is classified into hypermarkets & supermarkets, pharmacy/medical store, specialty stores, and hard discounter store. The hypermarkets and supermarkets segment accounted for a major share in the baby infant formula market in 2021 and is expected to grow at a significant CAGR during the forecast period. Healthy economic growth, increase in disposable income, change in demographic profile, and consumer tastes & preferences drive growth of hypermarkets in various emerging economies. Hypermarkets and supermarkets are large retail establishments. North America consists of hypermarket chains such as Walmart, Fred Meyer, Kmart Super Center, and others. Customers can more easily locate and buy the product as hypermarkets and supermarkets have a specific section for food items. In addition, the growth of new superstores and hypermarkets in the suburbs has given customers and producers the chance to investigate the market for food items.

By region, the baby infant formula market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific market accounted for a major share in 2021 and is expected to grow at a significant CAGR during the forecast period. The living standards in China, India, South Korea, and other countries in Asia-Pacific have improved due to the growing economy of the respective countries. Rise in disposable income has led to higher spending on infant nutrition. Rapid increase in female participation in labor force in India, coupled with high infant population, is anticipated to provide opportunities to the infant formula manufacturers, thereby boosting the market growth.

Competition Analysis

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have been also focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the baby infant formula market include Abbott Laboratories, Arla Foods amba, Campbell Soups, Dana Dairy Group Ltd, Danone, D-Signstore, HiPP GmbH & Co. Vertrieb KG, Reckitt Benckiser (Mead Johnson & Company LLC), The Hain Celestial Group, Inc., The Kraft Heinz Company, Reckitt Benckiser Group plc, Royal FrieslandCampina N.V., bellamy's organic, Nestle S.A., and yili group.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the baby infant formula market analysis from 2021 to 2031 to identify the prevailing baby infant formula market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the baby infant formula market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global baby infant formula market trends, key players, market segments, application areas, and market growth strategies.

Baby Infant Formula Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 56.6 billion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 387 |

| By Distribution Channel |

|

| By Type |

|

| By Ingredient |

|

| By Region |

|

| Key Market Players | Nestle S.A., Royal FrieslandCampina N.V., Arla Foods amba, Dana Dairy Group, Reckitt Benckiser Group PLC, The Hain Celestial Group, Inc., Danone S.A., Abbott Laboratories, Campbell Soup Company, The Kraft Heinz Company |

Analyst Review

According to the insights of the CXOs, the global baby infant formula market is expected to witness robust growth during the forecast period. This is attributed to high nutritional content of infant formula. The infant formula segment accounted for the highest share in the global baby infant formula market. Breastfeeding is not always possible for mothers working outside homes; thus, infant formula is an appropriate alternative for the infant as its composition is similar to that of breastmilk. Furthermore, to attract consumers around the globe, key players in the market are investing in R&D activities and advertising & promotion of products.

CXOs further added that growth in preference for organic baby food & drinks is further creating opportunities in the baby infant formula market. In the present scenario, consumers have become more health conscious and prefer minimally processed foods and natural drinks for their babies. Parents are on a constant look out for foods that are healthy for consumption by their children. Thus, baby infant formula free from ingredients such as added sugar, sodium, and preservatives is expected to present new opportunities for manufacturers. However, concerns related to food safety has increased among consumers, which hampers the market growth.

The global baby infant formula market size was valued at $25.5 billion in 2021, and is projected to reach $56.6 billion by 2031

The global Baby Infant Formula market is projected to grow at a compound annual growth rate of 8.1% from 2022 to 2031 $56.6 billion by 2031

Some of the key players in the baby infant formula market include Abbott Laboratories, Arla Foods amba, Campbell Soups, Dana Dairy Group Ltd, Danone, D-Signstore, HiPP GmbH & Co. Vertrieb KG, Reckitt Benckiser (Mead Johnson & Company LLC), The Hain Celestial Group, Inc., The Kraft Heinz Company, Reckitt Benckiser Group plc, Royal FrieslandCampina N.V., bellamy's organic, Nestle S.A., and yili group

The Asia-Pacific market accounted for a major share in 2021

The global baby infant formula market is experiencing growth due to various factors, such as an increase in the number of women participating in the labor force, the high nutritional value of infant formula, and the rise in the middle-class population in emerging economies

Loading Table Of Content...

Loading Research Methodology...