Beef Market Research, 2032

The global beef market was valued at $445.1 billion in 2022, and is projected to reach $625.8 billion by 2032, growing at a CAGR of 3.5% from 2023 to 2032.

Beef is a flesh that is obtained from mature cattle. It is a red-colored meat that includes various essential nutrients such as protein, zinc, selenium, and iron. Beef with the presence of high soft intramuscular fat is considered of premium quality as it improves the flavor of the meat. In the initial production process, beef is first divided into further subsections that are usually referred to as cuts. These cuts are named differently worldwide such as sirloin, brisket, and shank.

Market Dynamics

The beef industry encompasses the production, distribution, and sale of beef products derived from cattle. It is a significant component of the global food industry, driven by factors such as population growth, dietary preferences, income levels, and cultural traditions. The market offers various beef cuts, processed items, and value-added products to consumers, with supply chains often influenced by trade agreements, sustainability concerns, and changing consumer demands.

Certified beef surges the beef market by assuring consumers of specific quality standards, safety, and ethical practices. Certification programs verify attributes like organic production, humane animal treatment, or sustainability. This builds consumer trust, attracts health-conscious and environmentally aware customers, and opens doors to niche markets. Certified beef responds to evolving consumer preferences and promotes industry transparency, driving increased demand and beef market growth.

Moreover, Organic beef has surged in popularity, driving growth in the market. Consumers are increasingly prioritizing health and sustainability, leading to a heightened demand for organic, grass-fed, and pasture-raised beef. Organic beef meets these criteria, offering a healthier and environment-friendly option. With a focus on animal welfare, no synthetic hormones or antibiotics, and adherence to organic farming practices, organic beef appeals to health-conscious and eco-conscious consumers, leading to an expansion of the organic beef segment and thus, the overall beef market growth.

Advanced technology is revolutionizing the beef market by enhancing efficiency, safety, and sustainability. Precision agriculture tools, such as GPS-guided equipment and data analytics, optimize cattle farming practices. Blockchain technology improves traceability, ensuring food safety. In addition, innovations in meat processing, like automation and robotics, boost production speed and quality. These technological advancements reduce costs, minimize waste, and meet the increasing global demand for high-quality beef products, propelling market growth. A healthy diet that packs essential proteins and nutrition is becoming a preferred choice among consumers.

In developed nations, the working population seeks to meet its proper food requirements for meat and protein by making small changes in the daily schedule. To address this, companies are further innovating their product offerings to provide more convenient meat options such as heat-and-eat meats from Hormel Foods. The company offers beef, pork, chicken, and turkey with different flavors which require minimal preparation time. In addition, consumers are also experimenting with their tastes by trying new blends with restaurants and home-cooked food with purchased items.

The leading beef production countries such as Italy, France, Spain and Ireland have been significantly impacted. As per the European Commission, reduced cattle production therefore contributes to increasing beef prices consequently forcing consumers to cut down on beef and look for affordable alternative meat protein options. Although prices are increasing, the demand for beef is still notably high. Shift in consumer consumption habits and supportive responses from manufacturers maintain the market. According to a Gallup poll in 2020, 49% of consumers stated a high preference for sustainably produced meat. Tyson Foods has invested heavily in its sustainable production of beef including the launch of BRAZEN Beef brand, which claims to reduce greenhouse gases, such factors surge the beef market size.

The growth of online distribution channels, including e-commerce and food delivery platforms, has significantly surged the beef market demand. These platforms offer convenience and a wide range of beef products to consumers, making it easier to access and purchase beef. The ability to order beef online has expanded its reach, attracted a broader customer base and boosted overall beef market share. According to Today’s Beef Consumer report, COVID-19 pandemic witnessed a shift in consumer behavior, with 76% consumers preparing their meal at home. This surge in home cooking led to increased demand for beef through e-commerce channels. Consumers, looking for convenient and high-quality ingredients, turned to online platforms for easy access to a variety of beef cuts. The e-commerce sector capitalized on this trend, offering a convenient way to purchase beef products, thereby driving the demand in the online market.

Consumers from Generation X and Millennials are driving the beef market by prioritizing food sources that offer instant protein. Their busy lifestyles and focus on health and fitness lead them to choose beef as a quick and protein-rich option. Convenient beef-based products such as beef jerky or protein bars, align with their preferences for on-the-go nutrition. This demand for convenient protein sources is a key factor surging the market among these generational segments.

The increase in veganism is a significant restraint for the beef market as more consumers opt for plant-based diets while reducing beef consumption. Veganism aligns with environmental, health, and ethical concerns, prompting a shift away from meat products. This trend has led to the development and popularity of alternative protein sources, such as plant-based meat substitutes, which directly compete with traditional beef products, impacting the market's growth potential. Moreover, an increase in beef prices can significantly restrain the market by deterring consumers due to higher costs. This can lead to a shift toward more affordable protein sources, thus impacting the overall beef demand. In addition, higher prices may squeeze profit margins for food service providers and retailers, potentially reducing their willingness to carry beef products, and further limiting market growth.

Organic beef surges the beef market by meeting the growing demand for sustainable and health-conscious food options. Produced without synthetic pesticides, antibiotics, or hormones, organic beef appeals to consumers seeking environmentally friendly and ethically raised meat. It aligns with trends favoring organic and natural products, expanding market opportunities, and catering to a niche but increasingly influential segment of health and eco-conscious consumers. In addition, meat consumers in China are shifting from pork to protein sources like beef. Increasing per capita income is another factor that is expected to elevate meat consumption. Various companies have launched new beef products including the Aberdeen Angus range by Sainsbury’s, which is 25% low in carbon footprint. This product launch was the strategy adopted by the company to strengthen its market position in the UK as there are very few companies that provide this level of sustainable product.

Segmental Overview

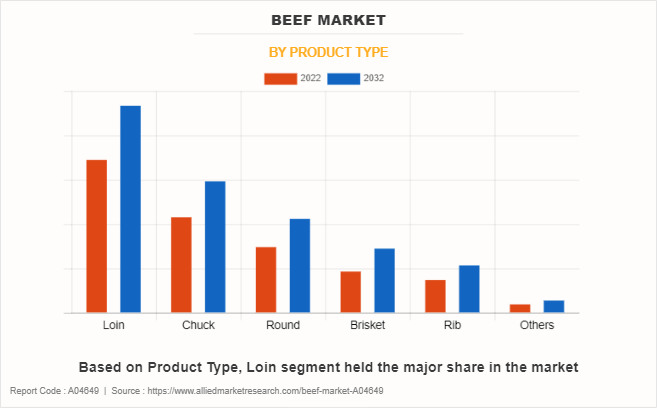

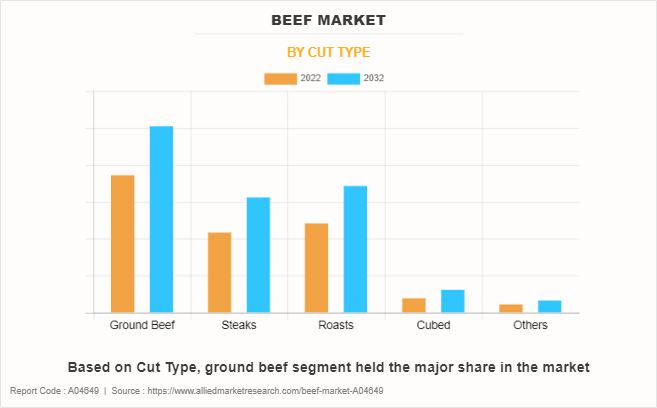

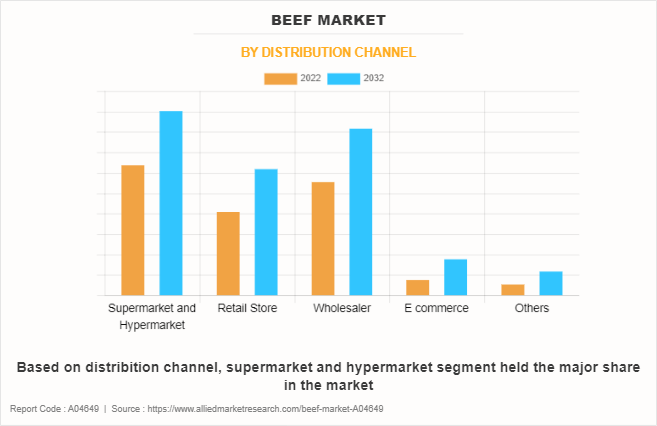

The beef market is segmented on the basis of product type, cut type, distribution channel, and region. By product type, the market is classified into loin, chuck, round, brisket, rib, and others. By cut type, the market is segmented into ground beef, steaks, roasts, cubed, and others. On the basis of distribution channel, the market is segmented into supermarkets and hypermarkets, retail stores, wholesalers, e-commerce, and others. Region-wise, the market is analyzed across North America (U.S., Canada, Mexico), Europe (Germany, France, UK, Russia, Spain, Italy, and Rest of Asia-Pacific), Asia-Pacific (China, India, Japan, Australia, South Korea, and Rest of Europe), and LAMEA (Brazil, Argentina, Chile, South Africa, Egypt, and Rest of LAMEA).

By Product Type

By product type, the loin segment held the major share in the market in 2022. Loin cuts in the beef market are experiencing a surge in popularity. Cuts such as ribeye and tenderloin are sought for their tenderness and rich flavor. Consumers are willing to pay a premium for these high-quality options. However, the brisket segment is expected to witness the highest CAGR during the market forecast period. Brisket, a flavorful and versatile beef cut, is experiencing growing popularity in the market. Traditionally used for barbecue and smoking, it is now being featured in diverse culinary creations.

By Cut Type

By cut type, the ground beef segment held the major share in the market in 2022. Ground beef remains a staple in the market due to its versatility and convenience. Recent trends in ground beef consumption include a rising demand for leaner varieties, driven by health-conscious consumers. However, the cubed beef segment is expected to witness the highest CAGR during the forecast period. Cubed beef, typically derived from cuts like chuck or round, is gaining popularity in the beef market size. Its convenience and versatility make it ideal for quick cooking methods, such as stir-frying and kebabs.

By Distibution Channel

By distribution channel, the supermarkets and hypermarkets segment held the major share of the market in 2022. Supermarkets and hypermarkets continue to dominate the beef market distribution channel. Consumers favor these large retail outlets for their convenience and wide product selection. However, the e-commerce segment is expected to witness the highest CAGR during the forecast period. E-commerce is experiencing notable trends in the market. Online meat shopping platforms and grocery delivery services have gained popularity, especially in response to the COVID-19 pandemic.

By Region

North America held the major share in the market in 2022. In North America, the market is characterized by a growing consumer preference for lean and sustainably sourced beef products. Health-conscious choices and environmental concerns drive the demand for grass-fed and organic beef. However, the Asia-Pacific region is expected to witness the highest CAGR during the forecast period. In the Asia-Pacific region, the beef market share is experiencing notable trends including population growth, urbanization, and rise in disposable incomes, which are driving increased demand for beef products.

Competition Analysis

The major players operating in the beef industry focus on key strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have also been focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the beef industry include American Foods Group, LLC, Leverandørselskabet Danish Crown AmbA, JBS S.A., Tyson Foods, Inc., NH Foods Ltd., Smithfield Foods, Inc, Marfrig Global Foods S.A., Agri Beef Co., Cargill, Incorporated, and The Kroger Co.

Recent Developments in the Meat-Based Flavor Market

- In 2022, American Foods Group, LLC announced the opening of a new state-of-the-art beef processing facility in Warren County, Missouri to generate more revenue.

- In 2022, Kroger Co. announced the opening of a new facility location in Louisville, Kentucky in collaboration with Customer Fulfillment Center (CFC) in Monroe, Ohio to expand Kroger delivery's ability to serve more customers in the Greater Louisville area.

- In 2022, Tyson Foods, Inc. announced plans to establish a prepared food facility at Caseyville to meet the growing demand for Tyson Foods’ Hillshire Farm and Jimmy Dean branded products.

- In 2020, Agri Beef Co. announced to build a new beef processing plant as part of a partnership with cattle producers in the region around Jerome, Idaho, to provide a beef-processing solution to production interruptions caused by the COVID-19 pandemic.

- In 2020, Marfrig Global Foods S.A. acquired the U.S.-based National Beef Packing Company, LLC, to increase beef production in the U.S.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the beef market analysis from 2022 to 2032 to identify the prevailing beef market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the beef market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global beef market trends, key players, market segments, application areas, and market growth strategies.

Beef Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 625.8 billion |

| Growth Rate | CAGR of 3.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Distribution Channel |

|

| By Product Type |

|

| By Cut Type |

|

| By Region |

|

| Key Market Players | Tyson Foods, Inc., Agri Beef Co., The Kroger Co., Cargill, Incorporated, Marfrig Global Foods S.A., American Foods Group, LLC, NH Foods Ltd., JBS S.A., Leverandørselskabet Danish Crown AmbA, Smithfield Foods, Inc |

Analyst Review

According to CXOs, the beef market is expected to witness a significant growth rate during the forecast period, driven by various factors including population growth, rise in incomes, and urbanization are expected to boost the demand for beef products globally. However, sustainability concerns and dietary shifts toward plant-based options are also influencing market dynamics. Experts predict increased demand for sustainably produced and premium beef, which aligns with consumer preferences for ethically raised and environmentally responsible products. In addition, advancements in technology and supply chain management are expected to enhance efficiency and food safety in beef production. Furthermore, the market may face challenges related to regulatory changes, trade dynamics, and consumer health considerations. Overall, the beef market is witnessing a significant CAGR, adaptation to evolving consumer trends and sustainability imperatives is expected to be crucial for long-term success.

The global beef market was valued at $445.1 billion in 2022, and is projected to reach $625.8 billion by 2032

The global Beef market is projected to grow at a compound annual growth rate of 3.5% from 2023 to 2032 $625.8 billion by 2032

The major players operating in the beef industry focus on key strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have also been focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the beef industry include American Foods Group, LLC, Leverandørselskabet Danish Crown AmbA, JBS S.A., Tyson Foods, Inc., NH Foods Ltd., Smithfield Foods, Inc, Marfrig Global Foods S.A., Agri Beef Co., Cargill, Incorporated, and The Kroger Co.

North America held the major share in the market in 2022.

Increase in Online Meat Distribution Channels, Increase in Prices

Loading Table Of Content...

Loading Research Methodology...