carmine market outlook - 2025

The global carmine market size was valued at $33.9 million in 2017 and is expected to grow at a CAGR of 6.7% to reach $57.5 million by 2025. Carmine is a natural food colorant. It is derived from the shell of the female cochineal insect (Dactylopius coccus Costa). This insect Dactylopus coccus costa attaches itself to specific varieties of cactus found in the semi-arid areas of Peru, Chile, Bolivia, Mexico, and The Canary Islands.

Carmine is completely natural and is one of the only colorants approved by the FDA for use around the eye. It is the only red approved for use in foods in the U.S. and the European Union due to government restrictions to artificial dyes in foods. Carmine industry offers wide range of applications in cosmetics, pharmaceutical coatings, cake icings, fillings, and hard candy, icings, yogurt, gelatin dessert, alcoholic beverages, bakery products, and cosmetics. The carmine market growth is expected to have a positive impact on natural food colorant companies, food additive companies, and other related spectrums. This highlights the multi-functionality of carmine. The dairy and frozen products segment accounted for the highest share in 2017. However, the carmine market for the cosmetics segment is anticipated to witness lucrative opportunities throughout the forecast period.

The growth of the global carmine market is driven by factors such as health fears over artificial food additives and the colors used in the production of such additives. Also, growth in need for naturally extracted carmine for processed food and rise in demand for natural colors on account of health benefits and cost-effectiveness. Although, slow adoption of carmine in developing nations, lack of awareness in undeveloped nations, and high cost associated with extraction of carmine on account of biotech processes are some of the factors that hamper the growth of the market. However, technological advancements in food industries, continuous R&D for deriving cost-effective carmine by private organizations and government are expected to provide avenues for growth in the coming future.

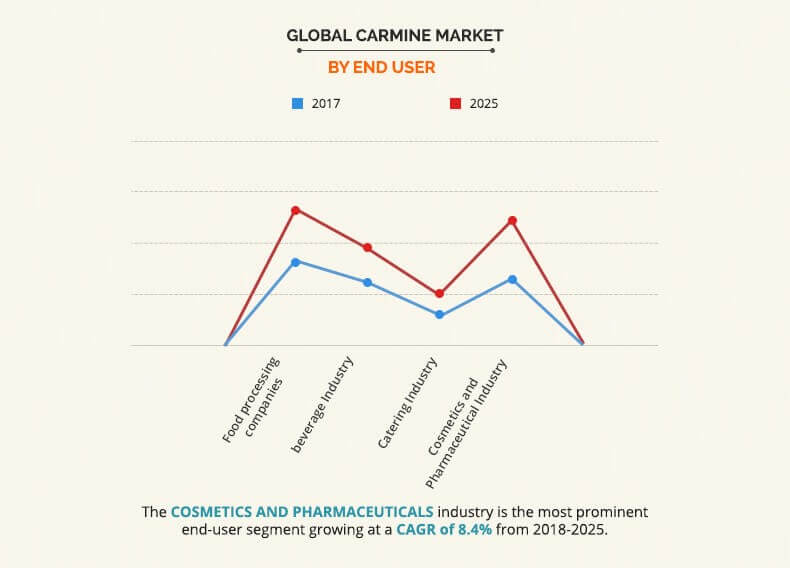

The carmine market has been segmented based on form, application, end user, and region. Based on form, the market is divided into powder, liquid, and crystal. By application, it is classified into dairy & frozen products, food & beverages, cosmetics, bakery & confectionery, and meat products. By end user, the market is categorized into food processing companies, beverage industry, catering industry, and cosmetics & pharmaceutical industry. By region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

In 2017, the dairy & frozen products segment accounted for the highest share in the carmine market. This is attributed to its major use in dairy products such as drinking yogurt, chocolate milk, eggnog, and whey-based drinks. The powdered carmine segments has captured the maximum share of 36.8% in the global market.

In 2017, by end users, the food processing companies acquired the maximum market share of 34.1%. This is due to the growth in need for natural carmine extracts for processed food and rise in health consciousness among the people globally.

The cosmetics and pharmaceutical industry is anticipated to grow with the highest CAGR of 8.4% during the forecast period (2018-2025). The cosmetics segment is estimated to be the fastest growing sector in the application segment during the forecast period. Carmine in cosmetics is mostly used to add color vibrancy and shade intensity to makeup. In cosmetics, it is used as natural color for personal care application. It is used as natural ingredients for makeup application and coloring cosmetic formulas. The increase in consumption of cosmetics and personal care products by majority of women worldwide is anticipated to drive the market in future during the forecast period.

In 2017, North America dominated the global carmine market. Asia-Pacific is expected to grow at the highest rate throughout the forecast period owing to consumer outrage over artificial products, widening media exposure, improving lifestyle, and rising health awareness. Asia-Pacific along with North America contributed more than 60% in the global carmine market share. The market in North America is primarily driven by high consumption of meat products in the U.S. over the past few years. Also, growth in demand from North America is attributed to rise in substitution of synthetic red colors with carmine in dairy & frozen products and meat industry.

The key market players in the market focus on expansion as the prominent strategy to overcome competition and to maintain as well as improve their market share in the global market. The key players profiled in the report include Amerilure, The Hershey Company, DDW The Color House, Sensient Colors LLC, Proquimac, Chr. Hansen Holding A/S, Naturex, colorMaker, Inc., Biocon, and Roha.

Key Benefits for carmine market:

- The report provides a quantitative analysis of the current carmine market trends, estimations, and dynamics of the market size from 2018 to 2025 to identify the prevailing market opportunities.

- The key countries in all the major regions are mapped based on their shares.

- Porters five forces analysis highlights the potency of the buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplierbuyer network.

- In-depth analysis on the carmine market segment and size assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global industry. Market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of market players.

- The report includes revenue generated from the sales of carmine products and the carmine market forecast across North America, Europe, Asia-Pacific, and LAMEA.

- The report includes the carmine market analysis at regional as well as the global level, key players, market segments, carmine application areas, carmine market size and growth strategies.

Carmine Market Report Highlights

| Aspects | Details |

| By FORM |

|

| By APPLICATION |

|

| By END USER |

|

| By Region |

|

| Key Market Players | BIOCON, DDW THE COLOUR HOUSE, SENSIENT TECHNOLOGIES CORPORATION, ROHA DYECHEM PVT. LTD, COLORMAKER, INC, NATUREX (GIVAUDAN), AMERILURE INC, CHR. HANSEN HOLDING A/S, THE HERSHEY COMPANY, PROQUIMAC PFC, S.A. (PROQUIMAC) |

Analyst Review

Carmine is a substance found in high concentration in cochineal insects. It is extracted from the insect’s body and eggs and is mixed with aluminum or calcium salts to make carmine dye (also known as cochineal). It has wide application in cosmetics, pharmaceutical coatings, cake icings, fillings, and hard candy, icings, yogurt, gelatin dessert, alcoholic beverages, bakery products, and cosmetics. Increase in health awareness over artificial food additives and the colors used in manufacturing, rise in need for naturally extracted carmine, and technological advancements in food industry are the factors that boost the growth of the market.

The powder segment accounted for maximum share in 2017 as it is used to color oral and topical pharmaceutical preparations and also used with yellow colors to produce green colors. Furthermore, it is a completely non-toxic natural coloring ingredient used in the food industry. This factor fuels the growth of the global carmine market.

The dairy & frozen products segment dominated the global carmine market in 2017, accounting for almost half the share, and is expected to grow at a significant growth rate during the forecast period. The cosmetics segment is expected to witness the highest growth rate during the forecast period.

The food processing companies accounted for the maximum share in 2017, owing to rise need for natural carmine extracts for processed food and surge in health consciousness among the people. However, the cosmetics and pharmaceutical industry is anticipated to grow at the highest CAGR of 8.4% during the forecast period (2018-2025).

The global carmine market size was valued at $33.9 million in 2017 and is expected to reach $57.5 million by 2025

The global Carmine market is projected to grow at a compound annual growth rate of 6.7% $57.5 million by 2025

COLORMAKER, INC, THE HERSHEY COMPANY, NATUREX (GIVAUDAN), SENSIENT TECHNOLOGIES CORPORATION, DDW THE COLOUR HOUSE, CHR. HANSEN HOLDING A/S, AMERILURE INC, BIOCON, ROHA DYECHEM PVT. LTD, PROQUIMAC PFC, S.A. (PROQUIMAC)

North America

Health fears over artificial food additives, the colors used in the production of such additives, growth in need for naturally extracted carmine for processed food, and rise in demand for natural colors on account of health benefits & cost-effectiveness have fueled the growth of the global carmine market.

Loading Table Of Content...