Children Entertainment Centers Market Overview

The global children entertainment centers market size was valued at USD 11.5 billion in 2022, and is projected to reach USD 30.7 billion by 2032, growing at a CAGR of 10.6% from 2023 to 2032.

The children entertainment centers market is expected to witness notable growth owing to continuous launch of new entertainment centers supporting family activities, F&B integration, and participatory play, increase in number of malls and favorable youth demographics. Moreover, the surge in investments in new games and attractions is expected to provide a lucrative opportunity for the growth of the market during the forecast period. On the contrary, the increase in ticket prices limits the growth of the market.

Key Market Insights

- By revenue source, the AR and VR gaming zones is expected to witness the fastest growth during the forecast period.

- By visitor demographic, the families with children (9-12) segment is expected to witness the fastest growth.

- By region, Asia-Pacific is expected to witness the fastest growth in the upcoming year.

Market Size & Forecast

- 2032 Projected Market Size: USD 30.7 Billion

- 2022 Market Size: USD 11.5 Billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 10.6%

How to Describe Children Entertainment Centers

Children entertainment centers are small outdoor or indoor enjoyment parks also known as amusement parks. These centers are specially marketed toward families with small children to teenagers, and often associated with a larger operational center such as a theme park. They offer a wide variety of entertainment activities for almost all age groups. The major activities include thrill rides that are modern embellishments to the classic family fun center which in turn is expected to drive the growth of the children entertainment centers market.

Moreover, children entertainment centers serve larger metropolitan areas in the sub-regional markets and are usually small compared to large-scale theme parks, with smaller number of attractions, and with low spending required for per-person per-hour to consumers than a traditional amusement park. Children entertainment centers are widely preferred as a recreational and entertainment aspect among families over the outdoor entertainment centers. This is among some of the major factors expected to drive the growth of the global market. However, smartphones, home gaming such as video games, and high initial investments required are the major factors that are expected to hinder the market growth to a certain extent.

Children Entertainment Centers Market Segment Review

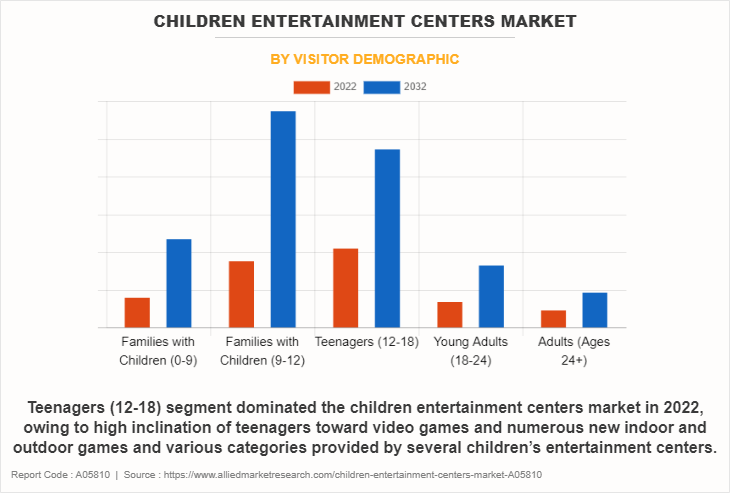

The global children entertainment centers market is segmented on the basis of visitor demographics, facility size, revenue source, and activity area, and region. On the basis of visitor demographics, the market is categorized into families with children (0-9), families with children (9-12), teenagers (12-18), young adults (18-24), and adults (Ages 24+). By facility size, it is divided into up to 5,000 sq. ft., 5,001 to 10,000 sq. ft., 10,001 to 20,000 sq. ft., 20,001 to 40,000 sq. ft., 1 to 10 acres, 11 to 30 acres, and over 30 acres. By revenue source, it is classified into entry fees & ticket sales, food & beverages, merchandising, advertisement, and others. In terms of activity area, the market is classified into arcade studios, AR and VR gaming zones, physical play activities, skill/competition games, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of visitor demographic, the teenagers (12-18) segment dominated the children entertainment centers market size in 2022, owing to high inclination of teenagers toward video games and numerous new indoor and outdoor games and various categories provided by several children’s entertainment centers. However, the families with children (9-12) segment is expected to witness the fastest growth, owing to fun learning and recreational activities such as sports and arts that add value to personality as well as sharpen children’s skills. Thus the families with children between the ages of 9 and 12 years are more focused on shaping their children’s future through these numerous activities.

Region-wise North America dominated the children entertainment centers market share in 2022, owing to the expansion of interactive and themed experiences within these entertainment centers. Moreover, there is a surge in emphasis on creating immersive environments that transport children into fantastical worlds through themed play areas, adventure zones, and storytelling-driven attractions. However, Asia-Pacific is expected to witness the fastest growth in the upcoming year, owing to the availability of a high number of malls in the region. The largest malls in the world are mostly in the Asia-Pacific region, accounting for nearly 80% of the retail space under construction globally. Moreover, the consistently growing middle-class population and increase in disposable income are the major factors that drive the market growth in this region.

The report focuses on growth prospects, restraints, and analysis of the global children entertainment centers market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global children entertainment centers market analysis.

What are the Top Impacting Factors in Market

Continuous launch of new entertainment centers supporting family activities, F&B integration, and participatory play

Indoor parks offer more profitable margins to most operators and developers as compared to outdoor theme parks as indoor parks are developed that are within reach of family distance. Thus, a number of operators across the globe are launching new children’s entertainment centers to attract a high number of customers. For example, profits gained in outdoor theme parks can range from $5 to $200 per visitor. At the same time, development costs of outdoor theme parks can be between $100 and $600+ per annual visitor.

For indoor parks, while the average profits per visitor are lower, range between $10 and $50, and the development costs bound in a lower range between $30 and $100 per visitor. These economics arise due to the constrained nature of ticket prices versus the unconstrained and high costs of development. It is difficult to justify paying more than $50 to $100 for an attraction. In addition, outdoor theme parks are sizable as well as land and infrastructure costs can be astronomical; therefore, there is a continuous rise in the popularity of indoor theme parks, which serves as a major growth opportunity.

Furthermore, operators are launching children entertainment centers, which support family activities, F&B integration, and participatory play to differentiate themselves from their competitors, which fuels the growth of the children entertainment centers market market. For instance, a growing set of developers and operators such as Dreamplay in Malaysia and Sports Monster in Korea have targeted more active, kinetic activities as a point of differentiation.

Increase in number of malls

The upsurge in the number of malls in developing economies drives the growth of the market, as children’s entertainment centers are attractively located in malls where customers visit frequently. Mall development in Asia-Pacific is intense and world-renowned, as the largest malls in the world are mostly in Asia-Pacific, and the region accounts for approximately 80% of the under-construction retail space globally.

Moreover, the idea of adding major children entertainment centers in malls has been gaining popularity rapidly over the past few years. This has led to construction of several new malls globally with substantial square footage allocated to children entertainment centers. They extend a mall draw, lengthen shopper stay, and increase revenue for other tenants.

Furthermore, shopping centers across the globe are now focusing on prime entertainment, with actual shopping taking a backseat. Moreover, there are malls offering over-the-top features, including indoor theme parks, indoor skihills, water parks, zoos, science centers, shooting ranges, and even an underground shark tunnel. For instance, NCR’s Mall of India has an indoor ski-range named Ski India. The Great India Place Mall has a water park and one of the best kids play zone in town, Worlds of Wonder and Kidzania.

Which are the Leading Companies in Children Entertainment Centers

The following are the leading companies in the market. Major players have adopted product launch, partnership, collaborations, and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the children entertainment centers industry.

Dave & Buster’s

CEC Entertainment, Inc.

Cinergy Entertainment

KidZania

Scene 75 Entertainment Centers

The Walt Disney Company

Lucky Strike Entertainment

FunCity

Smaaash Entertainment Pvt. Ltd.

LEGOLAND Discovery Center.

What are the Most Recent Partnerships, Expansions, and Acquisitions in the Market

Recent Partnership

On October 2023, Dave & Buster's Entertainment, Inc., the ultimate restaurant and entertainment destination, partnered with Universal Pictures to celebrate the release of the terrifying new Blumhouse film Five Nights at Freddy's, based on the blockbuster horror game phenomenon.

On October 2023, Chuck E. Cheese partnered with new California Dreamin’ water park in Sacramento, Califonia. The park will include a Chuck E. Cheese branded children’s and family area with branded rides, slides, and splash zones, as well as an arcade and branded retail shop, and a Pasqually’s Pizzeria Restaurant.

On June 2023, Landmark Group partnered with SirajPower, a prominent provider of distributed solar energy in the GCC region, with the aim of strengthening the Group’s dedication to sustainable practices and supporting the UAE’s sustainability agenda.

Recent Expansion

On January 2019, CEC Entertainment expands international footprints in Center America and Middle East. This expansion signs development agreements with franchisees for 25 new Chuck E. Cheese's restaurants across Mexico, Egypt, Kuwait, El Salvador, and Bahrain.

Recent Acquisition

On September 2023, Cinergy Entertainment Group announced today that it has acquired two formerly-owned Regal Cinemas locations. The new properties are located in Midland, TX and Amarillo, TX, to create spaces with luxury, dine-in auditoriums, arcades, bowling alleys, escape rooms, axe throwing, chef-inspired menus and sports bars.

What are the Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the children entertainment centers market analysis from 2022 to 2032 to identify the prevailing children entertainment centers market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the children entertainment centers market growth to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global children entertainment centers market forecast, key players, market segments, application areas, and market growth strategies.

Children Entertainment Centers Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 30.7 billion |

| Growth Rate | CAGR of 10.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 439 |

| By Revenue Source |

|

| By Activity Area |

|

| By Visitor Demographic |

|

| By Facility Size |

|

| By Region |

|

| Key Market Players | Cinergy Entertainment Group, Funriders, The Walt Disney Company, LANDMARK GROUP, CEC Entertainment Concepts, LP., KidZania, Dave and Buster’s, Inc., SCENE75 ENTERTAINMENT CENTERS LLC, LEGO System A/S, SMAAASH |

Analyst Review

The popularity of children entertainment centers is expected to increase due to a rise in development of malls in various cities of North America and Asia-Pacific. Consumers spend time or visit malls majorly on weekends for spending leisure time and shopping at brand store or restaurants. Thus, malls that integrate a high number of entertainment centers fulfill the need required by consumers to spend quality time with their family & friends while playing games and other indoor sports. This is a major factor to make entertainment centers a favorite hangout place for families due to availability of combinational centers such as food court, shopping, and play area. Hence, children entertainment centers are attracting families in huge numbers, which in turn is expected to impact revenue growth opportunities of the market during the forecast period.

These centers are evaluated based on their ability to provide a safe, engaging, and diversified experience for children and families. the range of activities and services offered, assessing the diversity and suitability for different age groups. They emphasize the importance of a secure and well-maintained environment, often spotlighting safety protocols and measures. Moreover, the quality of entertainment and educational value provided is a critical aspect, with a focus on activities that encourage creativity, physical activity, and cognitive development. In addition, the incorporation of technology and innovation in activities, whether through interactive games or educational tools, is often highlighted. The cost-effectiveness of the center concerning the value it offers to visitors. Furthermore, the food quality and options available within the center, along with the overall ambiance, are frequently assessed in reviews. As trends and consumer preferences continue to evolve, ongoing innovation, adaptation to modern technology, and a keen understanding of what engages and entertains children and families remain focal points for analyst evaluations. For the most current and specific assessments, accessing the latest reviews and reports is recommended, as the industry may have undergone changes or introduced new considerations since my last update.

The Children Entertainment Centers Market was valued at $11,531.67 million in 2022 and is estimated to reach $30,657.20 million by 2032, exhibiting a CAGR of 10.6% from 2023 to 2032.

The global children entertainment centers market is dominated by key players such as Disney, LEGO System A/S, Dave and Buster’s, Inc., SCENE75 ENTERTAINMENT CENTERS LLC, CEC Entertainment Concepts, LP., Funriders, KidZania, LANDMARK GROUP, SMAAASH, and Cinergy Entertainment Group.

North America is the largest regional market for Children Entertainment Centers

Surge in investments in new games and attractions is the leading application of Children Entertainment Centers Market

Increase in number of malls and favorable youth demographics are the upcoming trends of Children Entertainment Centers Market in the world

Loading Table Of Content...

Loading Research Methodology...