Citric Acid Market Research, 2032

The global citric acid market size was valued at $3.3 billion in 2018, and is projected to reach $7 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032.

Citric acid is a natural acid and its available in a crystalline powder with an acidic flavor that is utilized in the food and beverage industries, pharmaceutical industry, cosmetic industry and others as an acidity regulator, flavoring agent, preservation agent, and pH-regulating agent.

The citric acid cycle is also known as the cycle of Krebs or the TCA cycle, is a crucial component in the respiration process of cells, which is the procedure by which carbohydrates, lipids, and protein are turned into energy. The compound citric acid is utilized in drugs, cosmetics, industrial operations, cleaning goods, and pH-regulating items, in addition to food.

Market Dynamics

Citric acid is cited as the most significant organic acid manufactured through microbial activities as more than 90% of citric acid production worldwide is produced through fermentation.

During the period of COVID-19, the government of different countries has been dividing different industries into categories of essentials and non-essentials. Operations of a few food additive companies were declared "essentials" by the US government, permitting operations at their facilities and continuing sales in accordance with those requirements. In Mexico, business operations were classified as "non-essential" for a period of time during the pandemic. Their clients were impacted since they were unable to purchase an item during the government-mandated shutdown, negatively impacting customer demand for the products.

The market for cosmetics and personal care is experiencing growth owing to change in consumer preferences, innovations in technology, and a surge in recognition of personal hygiene routines. The requirement in the citric acid market has surged due to its high requirement in different industries around the world. Citric acid is a very common ingredient used in beauty products as it possess exfoliating properties, which helps the consumer in getting rid of cellular debris and improve the overall look. Citric acid also has the ability to modify pH level, and plays an essential part in maintaining the right pH balance of the beauty and skincare products. The industry is witnessing an increase in demand for items containing citric acid as customers move towards products with clean and natural labels. Citric acid has several opportunities to be incorporated into novel formulations due to the rise in demand for functional and specialty cosmetics, which is driven by variables including anti-aging, skin brightening, and hydration advantages.

Flavoring essence is a major ingredient that is used in flavoring soft drinks and sodas. The increase in usage of synthetic flavoring essence is limiting the growth of the soft drink business as it has been related to dental issues in consumers as a result of long-term consumption. According to the American Dental Association, synthetic flavoring essences such as citric acid affect the teeth and lead to erosion.

The prolonged consumption of sodas dissolves away the layer of enamel and affects structural integrity. The damage further leads to hypersensitivity, increases chances of formation of cavities, and tooth erosion. On the other hand, synthetic flavor essence hampers the balance of the pH level of water, and it tends to keep it lower than the neutral pH level limit. The pH balance of a beverage is the most important factor in determining its ability to affect the teeth. A pH of less than four is regarded to be harmful to oral health. Overall, consumers are becoming more aware of the importance of maintaining good dental health, which is preventing them from drinking flavored sodas containing synthetic flavor essences. Therefore, beverage firms are forced to explore alternatives to citric acid, to carry out the production process of carbonated beverages.

Citric acid has become a widely used and efficient component in cleaning products as a result of growing environmental sustainability consciousness and a move towards eco-friendly cleaning solutions. Due to its inherent acidity, it is a fantastic choice for removing oil and dirt, removing stains, and dissolving mineral deposits. Citric acid's biodegradable and toxic-free properties place it as an appealing solution for environmentally conscious families as customers search for alternatives to harsh chemicals. Citric acid's combination with other natural components, which enables the production of all-purpose cleansers, surface disinfecting agents, and even household laundry detergents, highlights the market's potential opportunities. Citric acid's acceptance is being boosted by its credibility as a reliable and secure cleaning agent as the government also promotes the need for more environment-friendly and safer cleaning products. This increase in demand is creating citric acid market opportunity for growth as well as the larger movement toward healthier and environment-friendly lifestyles, which encourages a constructive cycle of development and innovation.

Segmental Overview

The citric acid market is segmented into form, application, grade, end use, and region. By form, the market is classified into powder and liquid. By application, it is segregated into acidulant, cleaning agent, binding agent, preservatives, and others. By grade, it is classified into food, industrial, and pharmaceuticals. By end use, it is divided into food & beverages, cleaning & sanitation, animal feed, personal care, and pharmaceuticals. Region-wise, it is studied across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, Russia, Spain, Netherlands, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, Thailand, Indonesia, Kazakhstan, Uzbekistan, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, Saudi Arabia, UAE, Turkey, and rest of LAMEA).

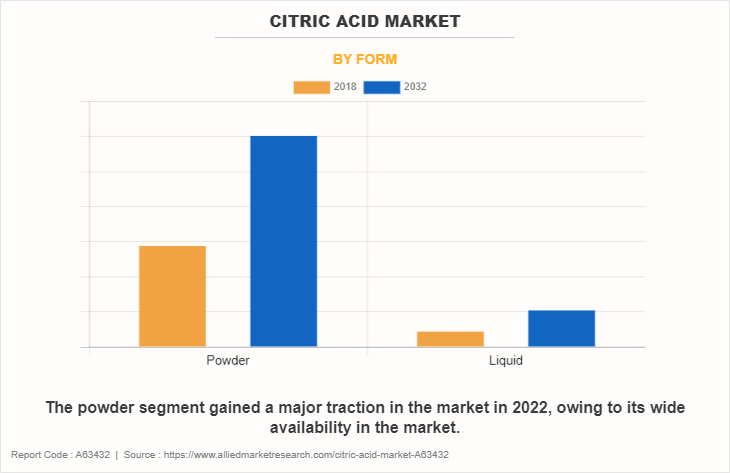

By Form

By form, the powder segment dominated the citric acid market in 2018 and is expected to remain dominant during the forecast period. Powder citric acid is widely available in the market, and as it is dry, it may be readily moved from one place to another. Powder citric acid is extremely soluble in water, making it suitable for usage in food and beverage items.

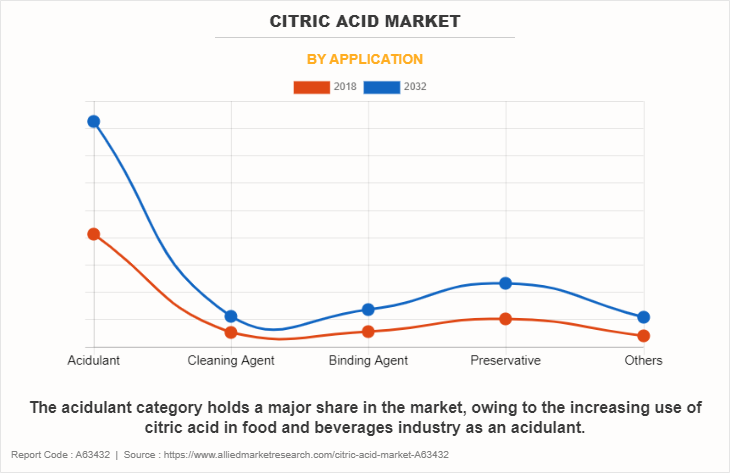

By Application

By application, the acidulant segment dominated the citric acid market in 2018 and is expected to sustain its market share during the forecast period. Citric acid is in high demand in the form of an acidulant in the food and beverage sectors owing to changes in consumer preferences and demands from the industry. Citric acid's function as a naturally derived flavor enhancer presents it as an appealing option for ingredient combinations as customers seek natural and clean-label food additives.

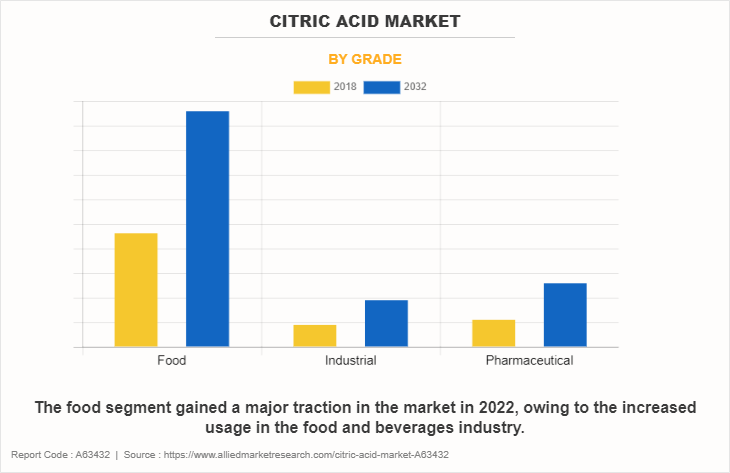

By Grade

By grade, the food segment dominated the citric acid market in 2018 and is expected to sustain its market share during the citric acid market forecast period. The increasing pace of lifestyle and work in the life of global consumers drives market demand for quick-service food options. Companies of food and beverage companies are working to improve the nutritional value and longevity of their products in recognition of consumer demand. The food and beverage sector is using more and more citric acid, which is driving up consumer demand for excellent quality citric acid and driving up sales of culinary-grade citric acid.

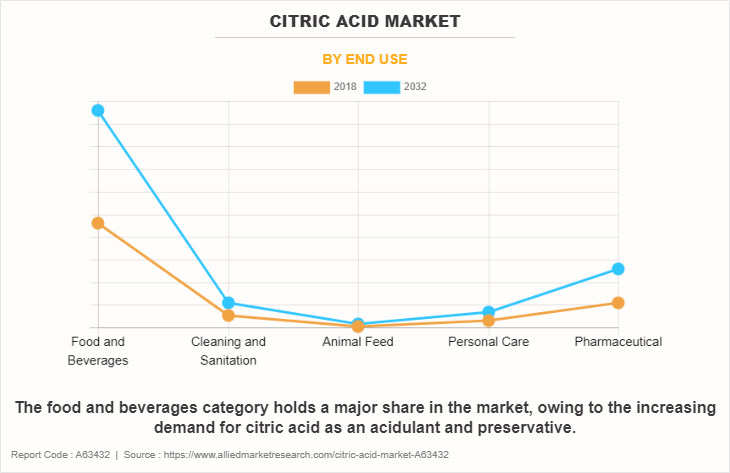

By End Use

According to citric acid market demand, on the basis of end use, the food and beverages segment dominated the market in 2018 and is expected to sustain its market share during the forecast period. The need for quality food-grade citric acid is high in the food and beverages industry as consumers are aware and conscious of maintaining proper health condition and seek food and beverage products made from good quality ingredients. The increasing use of citric acid is contributing to the citric acid market growth.

By Region

By region, Asia-Pacific dominated the citric acid market in 2018 and is expected to be dominant during the forecast period. Asia-Pacific has one of the world's major food and beverage markets. The food and beverage business in this part of the world is quickly developing as a consequence of higher standards of living and increased customer disposable income. Convenience food and drinks are popular among Asia-Pacific consumers because they reduce time and satisfy hunger. As a result, the demand for citric acid as a preservation agent and acidulant is strong in the beverage and food industry, particularly for enhancing the lifespan of goods, which is growing citric acid sales in the Asia-Pacific region.

Competition Landscape

Players operating in the global citric acid industry have adopted various developmental strategies to expand their citric acid market share, increase profitability, and remain competitive in the market. Key players profiled in citric acid market report include Foodchem International Corporation, BASF SE, Jungbunzlauer Suisse AG, Shandong Juxian Hongde Citric Acid Co. Ltd., Tate & Lyle PLC, Cargill, Incorporated, Citribel NV, Sucroal S.A., Gadot Biochemical Industries Ltd., Archer-Daniels-Midland Company, F.B.C Industries, Inc., Shandong Ensign Industry Co.,Ltd., Koninklijke DSM N.V., RZBC Group Co., Ltd., and Huangshi Xinghua Biochemical Co, Ltd.

Recent Developments in the Market

Expansion in the Global Market

- In June 2023, Archer-Daniels-Midland Company opened a new customer creation and innovation center (CCIC) in Manchester, UK to expand its presence in the UK.

- In June 2023, Tate & Lyle PLC opened its new customer innovation and collaboration center in Jakarta, Indonesia to expand its presence in the Asia Pacific region, specifically in Indonesia.

Partnership in the Global Market

- In March 2023, Tate & Lyle PLC partnered with IMCD. Through this partnership, it will distribute its ingredients in Brazil.

- In October 2021, Tate & Lyle PLC partnered with IMCD to distribute its products in Italy, this will increase consumer base in Italy.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the citric acid market analysis from 2018 to 2032 to identify the prevailing citric acid market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the citric acid market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global citric acid market trends, key players, market segments, application areas, and market growth strategies.

Citric Acid Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2018 - 2032 |

| Report Pages | 584 |

| By Grade |

|

| By End Use |

|

| By Form |

|

| By Application |

|

| By Region |

|

| Key Market Players | Cargill, Incorporated, Sucroal S.A., Foodchem International Corporation, Huangshi Xinghua Biochemical Co, Ltd., BASF SE, Tate & Lyle PLC, Archer-Daniels-Midland Company, Citribel NV, Shandong Ensign Industry Co.,Ltd., F.B.C Industries, Inc., Shandong Juxian Hongde Citric Acid Co. Ltd., Jungbunzlauer Suisse AG, Gadot Biochemical Industries Ltd., RZBC Group Co., Ltd., Koninklijke DSM N.V. |

Analyst Review

Citric acid is a vital ingredient used in beverages and food products. It is expected to witness notable demand in the future, owing to its wide application as a preservative, flavoring agent, taste enhancer, or taste modifier in meats, confectionery, sauces, condiments, and dressings. Moreover, growth in demand for fast food, cold drinks, and other food and beverages supplements the market growth.

The impact of these drivers is expected to increase significantly, owing to a rise in awareness about the benefits of citric acid. However, overconsumption of citric acid leads to health issues such as diarrhea, nausea, and vomiting, thus hindering the citric acid market growth. The cost of citric acid is expected to reduce in the future with advancements in technology.

According to CXOs, the introduction of a new production process for citric acid is expected to close down the demand and supply gap, as every year the demand for food-grade citric acid rises by 5%. Fungus Aspergillus niger is a fungus used in the production of citric acid by the process of fermentation. The fermentation industry contributes more than 90% of citric acid production, posing enormous challenges for conventional industrial recovery methods and processes.

There are several recovery technologies available, such as precipitation, extraction, adsorption, and membrane. The introduction of new technologies in the conventional production process offers a new perspective where calcium citrate compressed with water and carbon dioxide will produce citric acid without the use of any living organism.

The global citric acid market size was valued at $3.3 billion in 2018, and is projected to reach $7 billion by 2032

The global Citric Acid market is projected to grow at a compound annual growth rate of 5.6% from 2023 to 2032 $7 billion by 2032

Key players profiled in citric acid market report include Foodchem International Corporation, BASF SE, Jungbunzlauer Suisse AG, Shandong Juxian Hongde Citric Acid Co. Ltd., Tate & Lyle PLC, Cargill, Incorporated, Citribel NV, Sucroal S.A., Gadot Biochemical Industries Ltd., Archer-Daniels-Midland Company, F.B.C Industries, Inc., Shandong Ensign Industry Co.,Ltd., Koninklijke DSM N.V., RZBC Group Co., Ltd., and Huangshi Xinghua Biochemical Co, Ltd.

By region, Asia-Pacific dominated the citric acid market in 2018 and is expected to be dominant during the forecast period

Increase in demand for packaged food and beverages products, Rise in demand for organic food additives, Growth and expansion of personal care and cosmetics industry

Loading Table Of Content...

Loading Research Methodology...