Flavor Enhancer Market Research, 2032

The global flavor enhancer market size was valued at $11.4 billion in 2022, and is projected to reach $20.4 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032.

Food and beverage manufacturers often add flavor enhancers to improve or heighten the taste, smell, and overall sensory experience of their products. They function by amplifying certain flavors, activating the tongue's taste receptors, or developing a more harmonious and pleasant flavor profile.

MARKET DYNAMICS

Customers are increasingly looking for products with clear labels that contain natural and recognized ingredients. In addition to a need for clear and transparent labeling, this trend has resulted in an increase in demand for natural taste enhancers made from plant-based sources. The flavor enhancer market has been impacted by increased health and wellness awareness. With lower sodium, sugar, and artificial additive levels, consumers are looking for healthier substitutes. Manufacturers of flavor enhancers are addressing this trend by creating healthier formulations and providing low-sodium or reduced-sugar choices.

The flavor enhancers market is expanding due to the global expansion of the food processing sector. The demand for flavor enhancers is driven by the rising output of processed meals, snacks, sauces, and spices because manufacturers want to produce uniform and palatable flavors throughout their product lines. Technology advances and the creation of new formulas make it possible to produce taste enhancers that are more potent and efficient. As the needs of the food sector change, manufacturers now provide flavor enhancers with greater functions, improved taste profiles, and cleaner production methods.

For artificial or synthetic flavor enhancers, the trend toward using natural components as flavor enhancers might be difficult to overcome. Some food producers are looking for all-natural alternatives to enhance flavors in their products, such as herbs, spices, and substances derived from fermentation. The shift away from conventional flavor enhancers influences demand. Regarding flavor enhancers, certain cultures and geographical areas have particular sensitivities or preferences. Specific markets' culinary customs or taste preferences are not compatible with certain flavor enhancers, which limits those markets' ability to use and accept them.

A market for flavor enhancers that enable customization exists as consumers seek out more and more unique taste experiences. A more customized and delightful dining experience is provided by manufacturers who provide flavor enhancer items that let consumers change the intensity or flavor profile in accordance with their personal preferences. Manufacturers of flavor enhancers now have the chance to develop foods that are tailored to the distinctive flavor profiles found in different cuisines thanks to the rising popularity of ethnic and international cuisines. It is possible to fill a niche market and satisfy the desire for a variety of flavors by creating flavor enhancers that reproduce or improve the genuine flavors of various cuisines.

Regional and ethnic flavors are becoming more popular in the market for flavor enhancers as a result of increased global interest in different cuisines and flavors. To meet the need for globally inspired and ethnically inspired flavor experiences, manufacturers are creating flavor enhancers that mimic or improve the actual flavors of certain cuisines. Asia-Pacific and Latin America are rising markets where the flavor enhancer business has been growing. There is now a greater demand for processed and convenience foods in these areas as a result of rapid urbanization, shifting lifestyles, and rising disposable incomes, opening up new markets for flavor enhancer producers.

SEGMENTS OVERVIEW

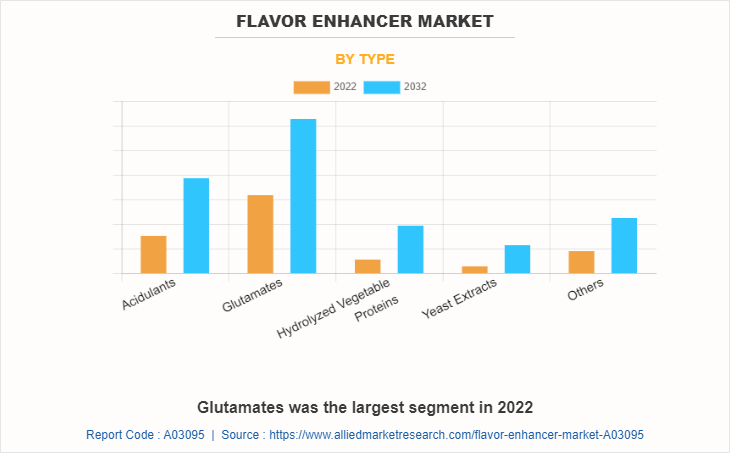

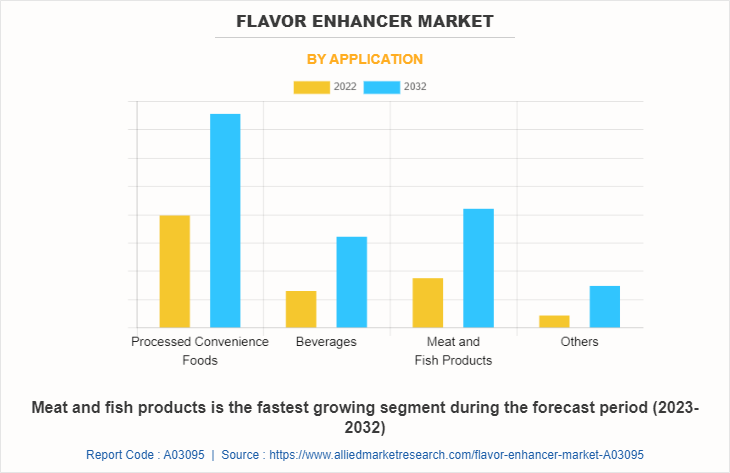

The flavor enhancer market is analyzed on the basis of type, application, and region. By type, the market is divided into acidulants, glutamates, hydrolyzed vegetable proteins, yeast extracts, and others. By application, it is classified into processed convenience foods, beverages, meat and fish products, and others. Region wise, the flavor enhancer market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

BY TYPE

The glutamates segment, as per type, dominated the global flavor enhancer market in 2022 and is anticipated to maintain its dominance throughout the flavor enhancer market forecast period. To develop flavor profiles that are both complex and well-balanced, glutamates are frequently combined with other flavor enhancers. Further enhancing umami flavor is the synergistic interaction of glutamates with nucleotides like inosine monophosphate (IMP) and guanosine monophosphate (GMP). This trend enables the creation of distinctive and enhanced flavors in food products. For consumers who are concerned about their health, sodium reduction is a major concern. In response to this pattern, producers now provide glutamate-containing flavor enhancers in reduced-sodium varieties. These products with less sodium offer customers healthier substitutes while still delivering increased taste experiences.

BY APPLICATION

According to flavor enhancer market demand, on the basis of application, the processed convenience foods segment dominates the global flavor enhancer market. The natural flavors of ingredients used in processed convenience foods are enhanced with flavor enhancers. They enhance the flavor of meats, vegetables, and other ingredients, resulting in a more pleasing flavor profile. Certain components or processing techniques in processed foods have the potential to introduce off-tastes or notes. Flavor enhancers are used to cover up or balance out these off-notes, giving consumers a more enjoyable taste experience.

BY REGION

Region wise, Asia-Pacific dominated the flavor enhancer market size with the largest share during the forecast period. In the Asia-Pacific region, especially in nations like China and India, there is a significant and growing population. Consumption of processed and convenient foods has expanded in these nations due to urbanization and the rise of the middle class, which has raised the demand for flavor enhancers. Consumption patterns are shifting toward processed and convenience foods as pays to grow and lifestyles become busier. A favorable market for flavor enhancers has been created in the Asia-Pacific region as consumers strive for quick and simple meals.

COMPETITION ANALYSIS

The major players analyzed for the flavor enhancer industry are Ajinomoto Co., Inc., DSM nutritional products, DuPont de Nemours, Inc., Firmenich SA, International Flavors & Fragrances Inc., Kerry Group plc, Givaudan SA, Angel Yeast Co., Ltd., Lesaffre Et Compagnie, and Fufeng Group Company Limited. Key players operating in the flavor enhancer market have adopted product launch and business expansion as key strategies to expand their flavor enhancer market share, increase profitability, and remain competitive in the flavor enhancer industry.

Monosodium glutamate (MSG) is one of the flavor enhancers that Ajinomoto produces in large quantities. The company provides a comprehensive selection of flavor enhancer products for use in a variety of food, beverage, and processed food applications. The development of flavor enhancers based on amino acids is a specialty of Fufeng Group, a significant player in the flavor enhancer market. The company serves the food and beverage industries by providing products including monosodium glutamate (MSG) and nucleotides.

A well-known supplier of specialist food ingredients, such as flavor enhancers, is Tate & Lyle. For usage in diverse food applications, the company provides a variety of flavor-enhancing ingredients, including monosodium glutamate (MSG), yeast extracts, and hydrolyzed vegetable proteins. The company Senomyx Inc. specializes in creating and selling flavor modulators and enhancers. In order to serve the food, beverage, and flavor industries, the company focuses on identifying innovative flavor compounds using its own taste receptor-based technology.

A top provider of flavors and fragrances, Givaudan provides flavor-enhancer options for a range of food and beverage applications. To create innovative flavor enhancer products, the company draws on its knowledge of flavor science and market preferences. For the food and beverage business, flavor enhancer products are offered by Kerry Group, a global taste and nutrition provider. In addition to natural extracts, yeast extracts, and savory components, the company offers a wide variety of flavor enhancer products.

The opportunity to produce novel products results from working with food manufacturers. Companies that produce flavor enhancers better serve the needs of food manufacturers by collaborating with them to develop unique flavor profiles, customize their products for culinary applications, and offer technical support. The expansion of e-commerce platforms and direct-to-consumer channels gives flavor enhancer producers a chance to connect with a larger audience of customers. Online platforms provide accessibility and visibility for producers, enabling them to promote their flavor enhancer products to consumers directly.

SOME EXAMPLES OF EXPANSION IN THE MARKET

- In October 2022, Firmenich SA opened a new campus in Geneva, Switzerland. This new campus will focus on development, innovation, and bringing overall improvement in the operational excellence of the company.

- In August 2022, International Flavors & Fragrances Inc., opened a new nourish innovation lab in New Jersey. This new lab focuses on the development of products for food and beverage markets through the incorporation of technologies and ingredients expertise.

- In November 2021, Fugeng USA, part of Fufeng Group Company Limited., announced plans to expand its business operation by opening a new production plant in Grand Forks, U.S, and will further strengthen its business presence in the country and its corn-based production in the country.

SOME EXAMPLES OF PRODUCT LAUNCH IN THE MARKET

- In February 2022, Givaudan SA launched PrimeLock+, which is natural, vegan-friendly, and which provides flavor, and taste solutions to plant-based products. This launch expanded its product offering.

- In May 2022, Givaudan SA launched NaNino+, which is a plant-based flavoring that is marketed as a replacement for nitrite in processed meat. With this launch, it has expanded its product offering.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the flavor enhancer market analysis from 2022 to 2032 to identify the prevailing flavor enhancer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the flavor enhancer market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global flavor enhancer market trends, key players, market segments, application areas, and flavor enhancer market growth strategies.

Flavor Enhancer Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 20.4 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Ajinomoto Co., Inc., DSM-Firmenich AG, Lesaffre Et Compagnie, International Flavors & Fragrances Inc., Tate & Lyle PLC, Meihua Holdings Group Co., Ltd., Kerry Group plc, Givaudan SA, Fufeng Group Company Limited, Angel Yeast Co., Ltd. |

Analyst Review

The perspectives of the leading CXOs in the flavor enhancer market are presented in this section. Food and beverage flavor intensifiers provide food and beverages with a new dimension by enhancing their flavors. The nutritional value in terms of energy, proteins, lipids, carbohydrates, vitamins, and minerals should not be discussed because flavor enhancers are only utilized in very little amounts. However, alcohol evaporates when alcoholic beverages are added to spicy sauces and other foods, so the nutritional value is never in doubt. For instance, processed foods like soups, sauces, and sausages often contain the additive monosodium glutamate (MSG).

The CXOs further added food additives and flavors are crucial in the food industry since human requirements and preferences are growing, and they also help to keep food from going bad. There are various advantages to employing additives, including the ability to obtain any foodstuffs at least during the off-season, and the ability to obtain the desired flavors in food by adding flavor. The benefit will be an expansion of industries, which is directly correlated with an expansion of the national economy, as the consumer wants food to expand globally. The greatest advantages come from being able to stop food from degrading due to microorganisms and other factors as well as from undesirable losses that could affect human health. Food testing organizations are involved in meeting the requirements to make the food standard by analyzing food nutrients and the presence of food additives or flavors. This is because an increase in the concentration of any food additives or flavors is directly proportional to diseases in people.

The global flavor enhancer market size was valued at $11.4 billion in 2022, and is projected to reach $20.4 billion by 2032

The global Food Enhancer market is projected to grow at a compound annual growth rate of 5.7% from 2023 to 2032

The major players analyzed for the flavor enhancer industry are Ajinomoto Co., Inc., DSM nutritional products, DuPont de Nemours, Inc., Firmenich SA, International Flavors & Fragrances Inc., Kerry Group plc, Givaudan SA, Angel Yeast Co., Ltd., Lesaffre Et Compagnie, and Fufeng Group Company Limited.

Region wise, Asia-Pacific dominated the flavor enhancer market size with the largest share during the forecast period.

Increasing demand for packaged and processed foods and functional foods, Technological advancements

Loading Table Of Content...

Loading Research Methodology...