Cloud DLP Market Insights:

The global cloud DLP market size was valued at USD 2.4 billion in 2021 and is projected to reach USD 27.5 billion by 2031, growing at a CAGR of 28% from 2022 to 2031.

Regulatory, compliance & enforcement and rapidly increasing cloud adoption are driving the growth of the market. In addition, the increasing employee mobility and bring your own device (BYOD) culture is fueling the cloud DLP market growth. However, lack of awareness & education and enterprise budgetary constraints limit the growth of this market. Conversely, growing data sprawl is anticipated to provide numerous opportunities for the expansion of the market during the forecast period.

Data loss prevention (DLP) solutions safeguard sensitive data from being stored, used, or transmitted insecurely. By safeguarding the data, it reduces the probability of data theft or unauthorized exposure. Cloud DLP solutions precisely protect enterprises that have adopted cloud storage by safeguarding sensitive data from entering the cloud before being encrypted. After encryption, it allows the data to be shared with authorized cloud applications. Most of these solutions alter or remove sensitive data before being shared on the cloud for ensuring data protection while in transit as well as cloud storage.

Segment Review:

The global Cloud DLP market is segmented into component, enterprise size, industry verticals, and region. Depending on the component, the market is divided into software and services. Based on enterprise size, it is categorized into large enterprises and SMEs. Based on industry verticals, it is bifurcated into banking, financial services, and insurance (BFSI), retail and consumer goods, healthcare and life sciences, manufacturing, IT and telecommunications, government and public sector, education, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global Cloud DLP industry is dominated by key players such as Broadcom Inc, Check Point Software Technologies LTD., Cisco Systems, Inc., Forcepoint, Help/Systems, LLC, Lookout, Inc., McAfee, LLC, Netskope, Zecurion and Zscaler, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the cloud DLP industry.

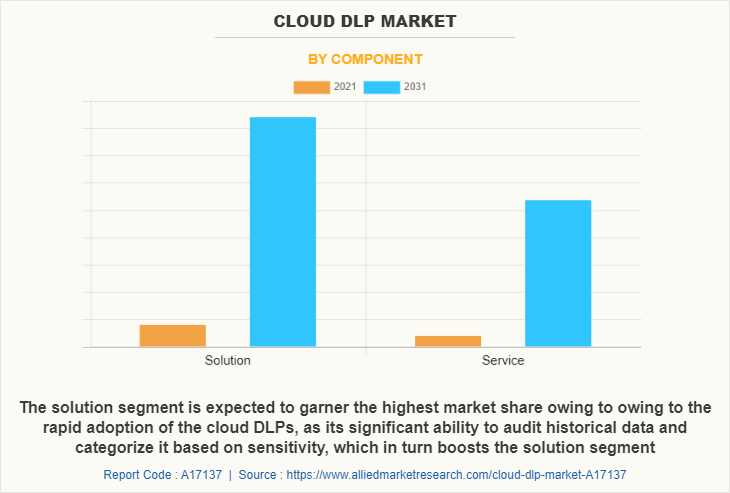

Depending on the component, the solution segment dominated the cloud DLP market share in 2022 and is expected to continue this trend during the forecast period, owing to the rapid adoption of the cloud DLPs, to audit historical data and categorize it based on sensitivity. However, the service segment is expected to witness the highest growth in the upcoming years, owing to the rise in the adoption of cloud-based solutions by the business in order to sustain itself in the market and remain productive.

Region wise, the cloud DLP market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the increasing activities of data breaches in various sectors. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to the emerging digital transformation and the adoption of new technologies due to the increasing competition among market players in this region.

The report focuses on growth prospects, restraints, and analysis of the global cloud DLP market trend. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global cloud DLP market share.

Top Impacting Factors:

Regulatory compliance and enforcement

Cloud compliance is the type of regulations and policies designed to protect individuals and companies from the impact of data loss. Compliance is driving the cloud DLP market as it offers solutions focused on the type of data collected and stored by a business and the regulatory frameworks that apply to data protection. Compliance tools and cloud services help enterprises with compliance are becoming widely available driving the growth of the market. For example, AWS Lake Formation provides a data catalog that automatically discovers, tags, and catalogs data across the AWS cloud environment. It provides an easy way to centrally define and manage security, governance, and auditing policies all in one place.

Furthermore, Cloud security regulatory compliance also requires action-oriented cloud security policies that are updated regularly to reflect changes in the business and new online threats, which in turn is driving the growth of the market. Moreover, Compliance regimes like GDPR, CCPA, HIPAA, and PCI DSS require effective management & protection of customer data to keep consumers safe. Nightfall is a DLP platform that helps to discover and classify sensitive customer data like PII, PHI, and PCI that many compliance regimes identify as data that must be protected. The tool also provides a quick way to remediate issues by taking actions like notifying admins and quarantining or deleting data. This reduces the risk of losing or exposing sensitive customer data which is drive the demand for the cloud DLP market globally.

Rapidly increasing cloud adoption

Cloud-computing adoption has been increasing rapidly, with cloud-specific spending expected to grow at more than six times the rate of general IT spending through 2020 as the growing market trend which is driving the cloud DLP market. In addition, Cloud providers are offering strong native optimization capabilities to help organizations select the most cost-effective architecture that can deliver the required performance. This is also driving the growth of the market.

Furthermore, several market players are acquiring to boost cloud adoption. For instance, In June 2020, IBM Corporation signed a definitive agreement to acquire Spanugo, a US-based provider of cloud cybersecurity posture management solutions. To further meet the security demands of its clients in highly regulated industries, IBM will integrate Spanugo software into its public cloud. this acquisition of Spanugo software will help accelerate the availability of a security control center that will enable IBM clients to define compliance profiles, manage controls, and in continuous real-time, monitor compliance across their organization.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the cloud DLP market forecast, current trends, estimations, and dynamics of the cloud dlp market analysis from 2021 to 2031 to identify the prevailing cloud dlp market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cloud dlp market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cloud dlp market trends, key players, market segments, application areas, and market growth strategies.

Cloud DLP Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | CHECK POINT SOFTWARE TECHNOLOGIES LTD., McAfee, LLC, Lookout, Inc., CISCO SYSTEMS, INC., Netskope, Forcepoint, Help/Systems, LLC, Broadcom Inc, Zscaler, Inc., Zecurion |

Analyst Review

The rapidly increasing instances of data breaches, along with other factors, such as DLP-as-a-service, DLP functionalities extending into the cloud, and advanced threat protection, have significantly increased the focus on data loss protection solutions across the world. As the demand for digital assets increased, there has been a massive growth in the amount of both structured and unstructured data, which is driving the need for data protection services with a strategic focus on data-centric organizations. Multiple large enterprises in the fortune global 500 have been investing in the DLP market for more than a decade. Currently, the market studied has been emerging as a critical security strategy within reach of mid-sized enterprises.

Key providers in the cloud DLP market are Broadcom, Check Point Software Technologies Ltd., and Cisco System, Inc. With the growth in demand for cloud DLP, various companies have established acquisitions to increase their solutions offerings. For instance, in February 2022, Check Point Software Technologies Ltd. acquired Spectral, an Israeli startup and key innovator in developer-first security tools designed by developers for developers. This acquisition helps Check Point extend its cloud solution, Check Point CloudGuard, with a developer-first security platform, and provided the widest range of cloud application security use cases including Infrastructure as Code (IaC) scanning and hardcoded secrets detection.

In addition, with the surge in demand for cloud-based DLP solutions, various companies have expanded their current services to continue with the rising demand in the market. For instance, in July 2021, Broadcom Inc. launched Adaptive Protection, an advanced capability as part of the Symantec endpoint security solution. Adaptive Protection delivered enhanced security that is automated and customized for each customer’s environment while ensuring zero impact on productivity. Adaptive Protection effectively enabled enterprises to stay ahead of cyber-attacks and stop breaches before they happen. Moreover, for instance, in June 2022, Cisco unveiled its new strategic vision of a unified platform for end-to-end security across hybrid multi-cloud environments. The company is designing the Cisco Security Cloud to be the most open security platform with no public cloud lock-in. this strategic launch and collaboration is expected to drive the market growth.

Regulatory, compliance & enforcement and rapidly increasing cloud adoption are driving the growth of the market. In addition, the increasing employee mobility and bring your own device (BYOD) culture is fueling the growth of the cloud DLP market.

Region wise, the cloud DLP market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the increasing activities of data breaches in various sectors.

The global cloud DLP market size was valued at $ 2.35 billion in 2021, and is projected to reach $27.54 billion by 2031, growing at a CAGR of 28.0% from 2022 to 2031.

The global Cloud DLP market is dominated by key players such as Broadcom Inc, Check Point Software Technologies LTD., Cisco Systems, Inc., Forcepoint, Help/Systems, LLC, Lookout, Inc., McAfee, LLC, Netskope, Zecurion and Zscaler, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...