Connected Rail Market Insights, 2033

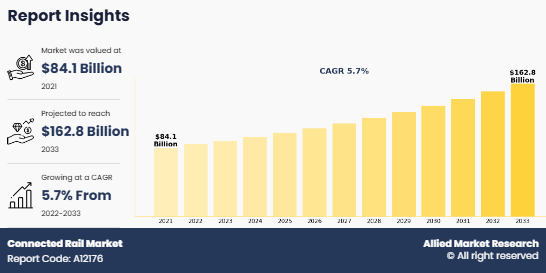

The global connected rail market size was valued at USD 84.1 billion in 2021, and is projected to reach USD 162.8 billion by 2033, growing at a CAGR of 5.7% from 2022 to 2033.

Connected rail can be defined as an advanced approach to efficiently manage railway operations through sharing railway data across rail infrastructure components, such as passengers, control centers, ticketing department, and freight. Connected rails are effective integration of the latest technologies such as Internet of Things (IoT), big data, cloud, analytics, artificial intelligence (AI), global positioning system (GPS), and machine learning (ML) to improve efficiency and accuracy of rail operations. Growth of the global connected rail market is driven by rise in penetration of digital infrastructure and increase in demand for automated & autonomous rail operations. Majority of railways are operated by government authorities, and procurement and installation of such smart technologies are done through contracts and agreements, which are key strategies adopted by market players in the global market.

Key Takeaways

- The global Connected Rail Market Size has been analyzed in terms of value ($billion). The analysis in the report is provided on the basis of system type, source, capacity, end use, 4 major regions, and more than 15 countries.

- The global pour point depressants market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the pour point depressants market includeAlstom, Cisco Systems Inc., Hitachi Ltd., Huawei Technologies Co., Ltd., IBM (International Business Machines) Corporation, Nokia, ROBERT BOSCH GmbH, Siemens AG, Wabtec Corporation, and Trimble, Inc.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., Canada, Germany, and Brazil hold a significant Connected Rail Market Share.

In addition, factors such as growth in integration of the Internet of Things (IoT) in the railway industry, along with increase in Connected Rail Market Demand for safety and compliance in rail transit, passenger, and freight capacity are expected to drive the connected rail market growth. However, lack of technological infrastructure and consistency in developing countries and infrastructure changes in existing systems are expected to hamper market growth. Furthermore, technological advancements in autonomous rail & green transportation and an increase in reliance on computing systems are anticipated to offer remunerative opportunities for the market expansion during the Connected Rail Market Forecast period.

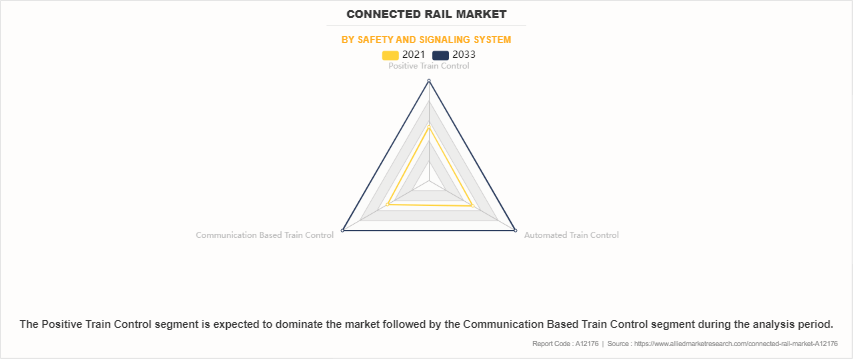

The connected rail market is segmented on the basis of service, rolling stock, safety & signaling system, and region. By service, the market is divided into passenger information system, train tracking & monitoring, automated fare collection system, passenger mobility, and predictive maintenance. By rolling stock, it is classified into freight wagons, passenger wagons, diesel locomotive, electric locomotive, and light rail & trams. By safety & signaling system, it is classified into positive train control, communication-based train control, and automated train control. Region wise, the connected rail industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Increase in adoption of the Internet of Things (IoT) in the railway sector

Use of IoT in railways is increasing as it improves infrastructure reliability and safety in trains. IoT sensors generates data that supports analysis and understanding of conditions that were not possible in past. A large quantity of data can be utilized to enhance train schedules and maintenance of equipment, with the help of IoT. In addition, the IoT has the potential to improve work productivity of railway operations. It also fills gaps in communication and control systems by connecting networks to cloud-based applications.

Furthermore, railways of many countries are adopting IoT to improve their productivity and enhancement services. For instance, in 2021, the UK network rail started the use of IoT, AI, and deep learning to improve its railway system. Similarly, in 2019, the network rail launched Intelligent Infrastructure (II) program to try data into intelligent information that can effectively deliver improved services for passenger and freight customers. The program uses data captured by its sensors, high-definition aerial imagery & 3D LiDAR, footage from inspection trains, information from the train operators, additional video from drones & helicopters, and other sources. Data consolidated by workstreams on Network Rail’s cloud platform is uploaded to Microsoft’s Azure Cloud, where AI algorithms turn information into actionable predictive maintenance schedules. Through this program, the UK network rail solved many problems such as monitoring of assets, analysis of the previous task, efficiency of workers, and up-gradation in services which is likely to bring myraid Connected Rail Market Opportunity.

Moreover, railway operators are collaborating with connected rail companies to enhance network connectivity. For instance, in March 2022, Alstom, signed a contract with Santiago, Chile to provide its Urbalis CBTC signaling system for 20 years of maintenance and 37 Metropolis trains. Therefore, increase in use of IoT in railways drive the connected rail industry growth for diversity in digital railway solutions and telecommunication technology.

Growth in demand for safety and compliance in rail transit

Growth in demand for safety and compliance in rail transit, such as theft protection and hygienic stations has increased significantly in recent years. This has led to rise in demand for safety and compliance in rail transit, which provides better infrastructure for railway. For instance, in June 2022, the Federal Railroad Administration (FRA) announced over $368 million in Consolidated Rail Infrastructure and Safety Improvements (CRISI) grant program funds to 46 projects in 32 states and the District of Columbia. These investments are expected to play a crucial role in modernizing rail infrastructure and supply chains in the region, helping to reduce crowding and getting people and goods where they need to go quickly and more at a reasonable cost.

In addition, to improve infrastructure of railway, governments of various countries are collaborating with connected rail companies to increase connectivity and expansion of railway transit including overhaul, deployment of cloud-based applications, automatic vending machines, and monitoring of trains. For instance, in November 2021, Alstom signed an agreement with Metrolinx to overhaul 94 BiLevel commuter rail cars for GO Transit, a regional public transit service for Greater Toronto and Hamilton Area (GTHA) in Ontario, Canada. Through this agreement, Metrolinx expanded its rail service and reduced crowding on its stations. Therefore, rise in demand for safety and compliance in rail transit is expected to support growth of the connected rail market.

Segmental Overview

The connected rail market is segmented based on service, rolling stock, safety & signaling system, and region. By service, the market is divided into passenger information system, train tracking & monitoring, automated fare collection system, passenger mobility, and predictive maintenance. By rolling stock, it is classified into freight wagons, passenger wagons, diesel locomotive, electric locomotive, and light rail & trams. By safety & signaling system, it is categorized into positive train control, communication-based train control, and automated train control. Region wise, the connected rail industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Service

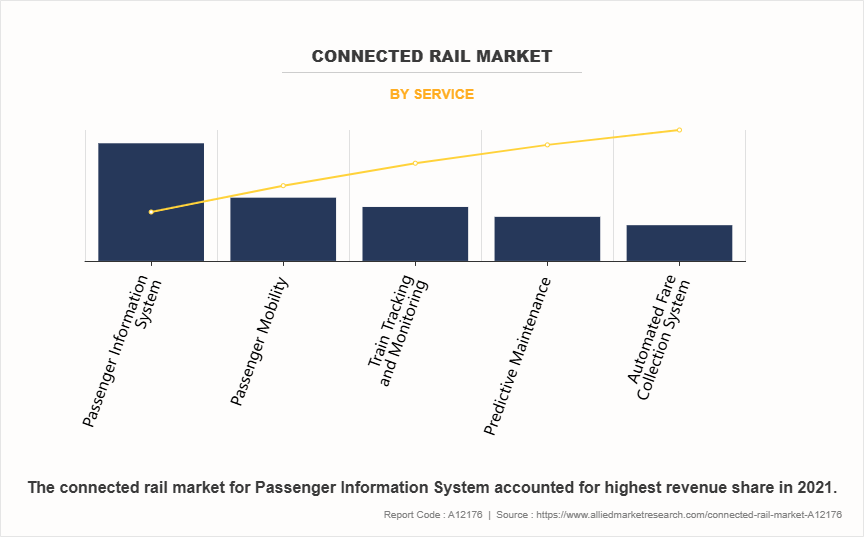

By service, the Passenger Information System segment dominated the global connected rail market in 2021, in terms of revenue. This is attributed to the growing demand for real-time updates, route information, and travel schedules among passengers, which enhances convenience and overall travel experience. The integration of digital technologies, such as mobile applications and onboard displays, has further boosted the adoption of passenger information systems, making them a critical component of connected rail solutions.

By Rolling Stock

By rolling stock, the Freight Wagons segment is expected to register significant growth, registering a CAGR of 7.0% during the forecast period.This is attributed to the increasing need for efficient logistics and transportation solutions to support growing global trade. Freight wagons benefit from connected rail technologies through improved tracking, load management, and operational efficiency, which are essential for optimizing supply chain operations and meeting industry demands.

By Positive Train Control system

By Positive Train Control system, the communication-based train control segment is expected to register significant growth, registering a CAGR of 6.1% during the forecast period. This is attributed to the emphasis on enhancing safety and minimizing human errors in rail operations. Positive Train Control systems help prevent accidents caused by speeding, collisions, or misaligned switches by providing automated control and monitoring, making them a preferred choice in modern rail signaling.

By Region

By region, Europe dominated the global connected rail market in 2021 in terms of market share. This is attributed to the region’s well-established rail infrastructure, strong focus on sustainability, and high investments in rail modernization projects. Europe leads in adopting advanced rail technologies, supported by government initiatives and stringent safety regulations, positioning it as a dominant player in the connected rail industry.

The prominent players profiled in connected rail market include Alstom, Cisco Systems Inc., Hitachi Ltd., Huawei Technologies Co., Ltd., IBM (International Business Machines) Corporation, Nokia, ROBERT BOSCH GmbH, Siemens AG, Wabtec Corporation, and Trimble, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the connected rail market analysis from 2021 to 2033 to identify the prevailing connected rail market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the connected rail market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global connected rail market trends, key players, market segments, application areas, and market growth strategies.

Connected Rail Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 162.8 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2021 - 2033 |

| Report Pages | 297 |

| By Service |

|

| By Rolling Stock |

|

| By Safety and Signaling System |

|

| By Region |

|

| Key Market Players | Huawei Technologies Co., Ltd., Nokia, Trimble Inc., Robert Bosch GmbH, IBM Corporation, Siemens, Wabtec Corporation, Cisco Systems Inc., Hitachi, Ltd., ALSTOM SA |

Analyst Review

The global connected rail market has a promising future for existing market players. Factors such as rise in use of the Internet of Things (IoT) in the railway industry and increase in demand for safety and compliance in rail transit are expected to drive growth of the market. Major market players have developed and launched new connected rail solutions to cater to a wider customer base globally. Furthermore, increase in number of rail passengers from various countries such as the U.S., Russia, India, Japan, the UK, and Germany as a result of growth in demand for autonomous trains is expected to develop new applications during the forecast period. Moreover, incorporation of newly launched technologies such as autonomous trains, electric trains, and communication-based train control (CBCT) technologies is anticipated to provide lucrative growth opportunities for the market.

Furthermore, the connected rail market is projected to witness considerable growth, especially in Europe, owing to presence of sophisticated infrastructure to undertake various projects and earliest & highest adoption of connected rail solutions across various industries. Commercial and government rail operators are adopting various innovative techniques to provide customers with advanced and innovative offers. Furthermore, increase in adoption of artificial intelligence (AI), machine learning (ML), and cloud computing in the railway sector and rise in use of rail data in development of trains and passenger services are major factors expected to offer lucrative opportunities for the market growth.

Region wise, North America is the highest revenue contributor, followed by Europe, Asia-Pacific, and LAMEA. Europe is expected to maintain its lead during the forecast period, owing to increase in funding for conducting connected rail projects in the region and presence of big market players, such as Alstom, Robert Bosch GmbH, and Siemens that have a global presence.

The global connected rail market was valued at $84,122.3 million in 2021, and is projected to reach $162,817.5 million by 2033, registering a CAGR of 5.7% from 2022 to 2033.

The Connected Rail market is product type, and region. 2024-2033 would be the forecast period in the market report.

The Passenger Information System segment held the largest market share in 2023 and is expected to grow at the fastest rate during the forecast period. The global Connected Rail market was valued at 84,122.3 million in 2023.

The Connected Rail market is analyzed across North America, Europe, Asia-Pacific, LAMEA. 2023 is the base year calculated in the Connected Rail market report.

The top companies that hold the market share are Alstom, Cisco Systems Inc., Hitachi Ltd., Huawei Technologies Co., Ltd., IBM (International Business Machines) Corporation, Nokia, ROBERT BOSCH GmbH, Siemens AG, Wabtec Corporation, and Trimble, Inc.

Loading Table Of Content...

Loading Research Methodology...