Corporate Event Market Research, 2035

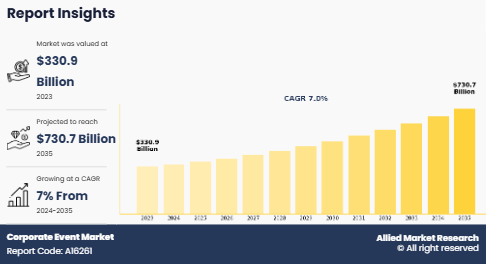

The global corporate event market was valued at $330.9 billion in 2023, and is projected to reach $730.7 billion by 2035, growing at a CAGR of 7% from 2024 to 2035.Corporate events are organized gatherings or functions designed to achieve specific business objectives, such as enhancing brand awareness, fostering collaboration, motivating employees, launching products, or cultivating relationships with clients, partners, and stakeholders. These events range from large-scale conferences, trade shows, and product launches to smaller, more intimate settings such as seminars, workshops, company meetings, team-building activities, and appreciation dinners. Corporate events are often tailored to address the unique needs of an organization, providing a platform for knowledge sharing, networking, and strategic planning. They serve as essential tools for improving internal communication, promoting company culture, and generating business growth. Corporate events create opportunities for professional development, leadership engagement, and business expansion by bringing together employees, industry experts, clients, and investors in a formal or informal setting. Corporate events play a crucial role in modern business strategies by driving innovation, collaboration, and organizational success whether in-person, virtual, or hybrid.

Market Dynamics

The demand for innovative events such as secrecy-based events, silent conferences, lunch clubbing, and project-based events, as well as the significance of various components included in a corporate event, are expected to propel the corporate event market growth during the forecast period. Moreover, increased competition in the market for event services as a result of the presence of a large number of market competitors notably contributes toward the market growth. Global economies have been approaching youngsters for entrepreneurship and start-up businesses for the last few decades. A variety of events and programs, including seminars, conferences, and entrepreneurial programs are being arranged to provide direction and solutions for the youth. Various initiatives are organized and funded internationally to see if students can take advantage of unexplored commercial opportunities. Youth have been able to turn their original company ideas into workable plans due to an increase in the audience attending business seminars and a rise in demand for effective counseling programs. As a result, youngsters are becoming increasingly interested in attending conferences, seminars, and career-related events, which is anticipated to increase corporate event market demand globally, thereby fueling the expansion of the corporate event market size.

Technological progress plays an important role in the corporate event industry. Conference/seminar events have been transformed with the introduction of the latest technology. Presently, wireless connectivity has become imperative for the growth and productivity of organizations across the globe. Moreover, LCD projectors, video conferencing, and fast notebooks are the new standard requirements in the corporate event industry. Strong economic growth in Asia-Pacific is one of the major factors that boosts the growth of the corporate event market. In addition, the rapid development of the business travel sector in recent decades has positioned North America to be the largest market across the world. The growth of the corporate event market is further driven by liberalization to access trade licenses and government initiatives to encourage private investment & foreign direct investments. Moreover, initiatives to develop the corporate event segment have fueled the frequency of business travel across the globe.

Ease of visa restrictions, rise in investments for infrastructural development, and surge in number of travelers in commercial aviation across the globe are some of the other factors that fuel the growth of the corporate event market. Moreover, the surge in penetration of the internet & technology in densely populated states augments the growth of the market. Therefore, developments in the corporate event market majorly drive economic growth and intellectual development.

Economic uncertainty is a significant factor hindering the growth of the corporate event market, as businesses often adopt a cautious approach to spending during periods of financial instability. When market conditions are unpredictable, companies tend to tighten their budgets and prioritize essential expenditures, which can lead to cutbacks on non-essential activities like corporate events. Organizations may postpone or scale down conferences, seminars, incentive trips, and other large gatherings to reduce costs, opting for smaller, in-house meetings or virtual alternatives that are more cost-effective. Additionally, economic instability can affect sponsorship opportunities, as companies may be reluctant to invest in event sponsorships or marketing activities that do not guarantee immediate returns. Uncertainty in the global economy also influences travel budgets, limiting the ability of attendees to participate in international events or exhibitions, thereby reducing the scale and reach of these events.

Segmental Overview

The corporate event market is segmented into event type, industry, platform, event location, and region. By event type, the market is categorized into conferences/seminars, trade shows/exhibitions, incentive programs, company meetings, and others. As per industry, it is divided into financial services, information technology, real estate & infrastructure, automotive, direct selling or MLM industry and others. The financial services segment is further categorized into banking and insurance. According to platform, it is fragmented into a physical event, virtual event, and hybrid event. According to event location, it is fragmented into a tier 1 cities, tier 2 cities, and tier 3 cities. By audience, the market is bifurcated into International and audience. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia, and the rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, ASEAN, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Saudi Arabia, South Africa, United Arab Emirates, Chile, and rest of LAMEA).

By event type

By event type, the conference/seminars segment dominated the market in 2023, garnering the highest corporate event market share, due to ongoing development in the quantity and size of conference and seminar events. Meetings and conferences account for roughly 15-18% of the total time spent by a business. It is further anticipated that the growing number of businesses and regular conferences and seminars they hold will significantly contribute toward the market growth during the corporate event market forecast period.

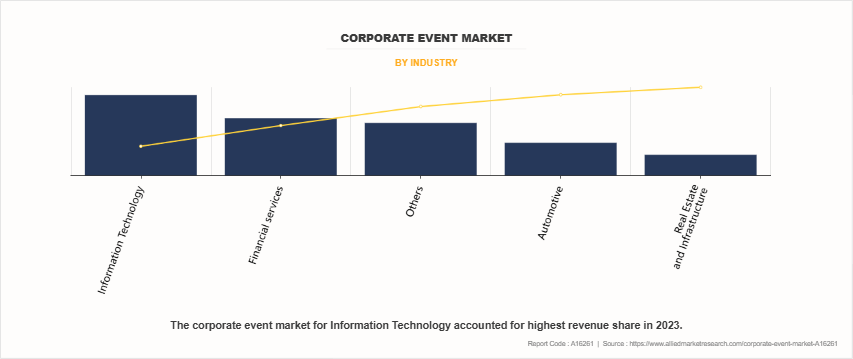

By industry

Depending on industry, the information technology segment dominated the market in 2023, garnering the highest market share. The market growth for corporate events is positively impacted by the quick expansion of the information technology sector. Corporate events are becoming increasingly popular with businesses and organizations in the broadcasting, data processing, publishing, telecommunication, and sound recording industries. Over the past 10 years, the IT industry's contribution of global GDP scaled 1.5 times to 6.5%, the biggest percentage gain of any industry during this time. Moreover, IT companies conduct events to increase market penetration of their businesses by promoting their brands and services through different events.

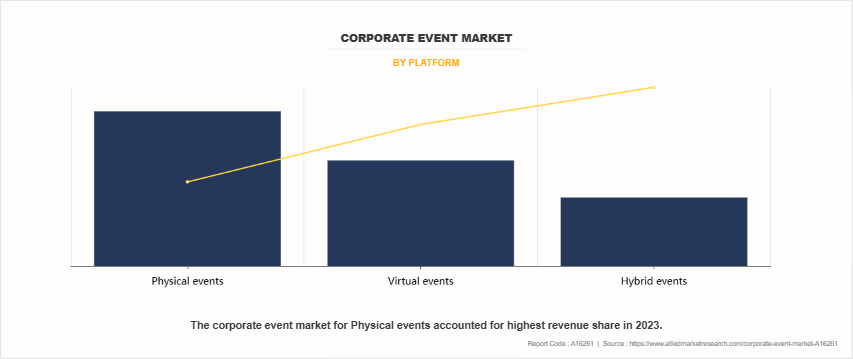

By platform

By platform, the physical event segment dominated the market in 2023, holding the highest market share. This is attributed to the significant presence of small and medium-sized businesses and the rise in the number of corporate events held by them. Large corporations further hosted quarterly & annual meetings, conferences, and training sessions, which contributed to the expansion of the physical events segment. Physical events are the most often held events since there is already a large body of methodology and procedures for doing them. These gatherings are crucial for activities, including exchanges between teams, business networking, team development, and team strengthening exercises. Physical events require the use of lighting, sound, video, and decorations to accommodate a larger audience without causing informational gaps or interactional difficulties. In addition, physical presence of people at events aids in giving organizers physical clues on how to proceed with a gathering and aids in giving them real-time feedback.

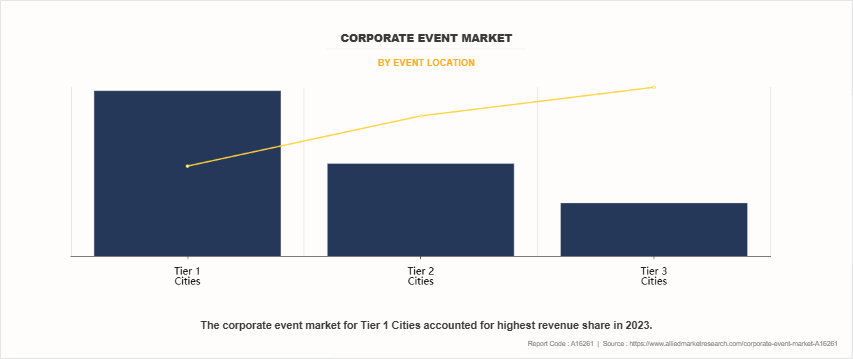

By event location

By event location, the tier 1 cities segment dominated the market in 2023, holding the highest market share. This is attributed to their advanced infrastructure, connectivity, and concentration of business hubs. Cities like New York, London, Tokyo, and Singapore are home to major multinational corporations, financial institutions, and key industry players, making them prime locations for high-profile conferences, trade shows, and product launches. Their well-developed transportation networks, state-of-the-art event venues, and availability of luxury accommodations create an ideal environment for hosting large-scale corporate gatherings. In addition, these cities have a thriving ecosystem of service providers, such as event management companies, technology vendors, and catering services, further reinforcing their position as the top choices for corporate events.

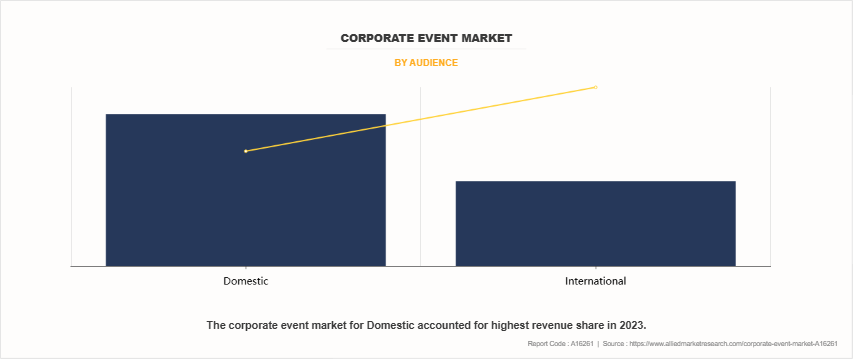

By audience

By audience, the domestic segment dominated the market in 2023, holding the highest market share. The domestic segment led the corporate events market, capturing the highest market share due to a combination of economic, logistical, and strategic factors. As companies resumed in-person engagement post-pandemic, many prioritized domestic events for their cost-effectiveness, faster execution timelines, and lower risk compared to international travel. Ongoing global uncertainties such as geopolitical tensions, fluctuating exchange rates, and travel disruptions has prompted organizations to focus on local engagement to ensure continuity and control. Moreover, domestic events has been observed as more agile and reliable, particularly for internal training, leadership meetings, regional product launches, and client relationship-building.

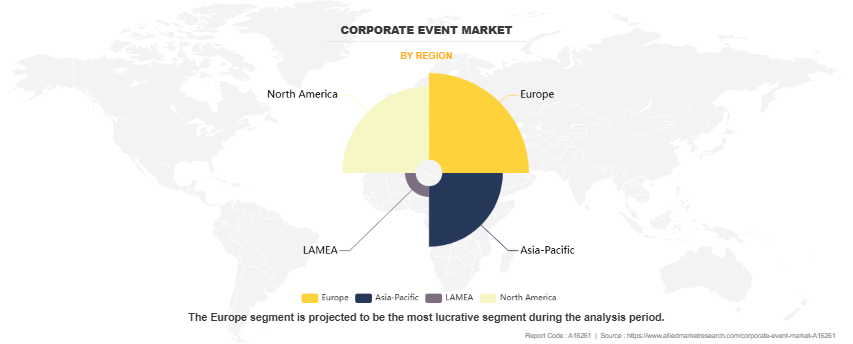

By region

Region wise, Europe dominated the market in 2023, holding the highest market share. Europe is driven by its well-established infrastructure, diverse cultural landscape, and strategic geographical location. Major cities like London, Paris, Berlin, and Amsterdam serve as key business hubs, attracting multinational corporations and industry leaders looking to host international conferences, trade shows, and exhibitions. The advanced transportation networks, high-quality event venues, and strong focus on innovation and technology in the region make it an ideal destination for large-scale corporate gatherings. Europe also benefits from its reputation for hosting world-class events that blend business with cultural experiences, enhancing networking opportunities and attendee engagement.

Competition Analysis

The major players profiled in the report include 360 Destination Group, Access Destination Services, LLC, BCD Travel Services B.V., BI Worldwide, CWT, Flight Centre Travel Group (FCM), Creative Group, Inc., ITA Group, Maritz Holdings, Inc., and Reed Exhibitions Ltd.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the corporate event market analysis from 2023 to 2035 to identify the prevailing corporate event market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the corporate event market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global corporate event market trends, key players, market segments, application areas, and market growth strategies.

Corporate Event Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 730.7 billion |

| Growth Rate | CAGR of 7% |

| Forecast period | 2023 - 2035 |

| Report Pages | 255 |

| By Platform |

|

| By Event location |

|

| By Audience |

|

| By Event Type |

|

| By Industry |

|

| By Region |

|

| Key Market Players | BI WORLDWIDE, BCD Travel Services B.V., Maritz Holdings, Inc., Reed Exhibitions Ltd., 360 Destination Group, CWT, Creative Group, Inc., ITA Group, Flight Centre Travel Group (FCM), Access Destination Services, LLC |

Analyst Review

According to the insights of top-level CXOs, the corporate event market is growing at a significant pace and is anticipated to continue this trend in the future. Events play a vital role in revenue generation and brand equations for corporates and associations. It is observed that events conducted presently are interesting compared to those conducted in the past decade, driving the shift in consumers' choices and pressuring event planners and owners. Corporate events are becoming a key attraction for SMEs and MNCs. as they help to engage and entertain the audience. In addition, a broad market and inexpensive manufacturing costs make it simple to gain a competitive edge in the market. In addition, the countries such as Germany, France, Italy, and Spain that have liberalized market entry methods encourage commercial organizations to increase the size of their markets. One of the key elements driving the expansion of corporate events globally is the increased need to operate such businesses, which has resulted in a rise in activities such as geocentric or cross-cultural employee training and global marketing.

The CXOs have further added that the industry is witnessing new and independent players leveraging technology to gain a competitive advantage in the present consolidated environment. However, companies are facing challenges in this industry to manage live inventory for simple and small events. Conversely, the focus of companies is to enhance the attendee experience and witness the successful completion of an event without any hindrance. Furthermore, lighting, visuals, and audio elements are crucial in the corporate event market as they keep the audience engaged through the use of lighting, sound, and visual effects. U.S. is the center of the world's business as majority of the corporations are headquartered in the country, and many big international players operate there. As a result, more corporate events such as conferences/seminars and company meetings are being held in the U.S, which is expected to drive the growth of the corporate event market globally.

The corporate event market was valued at $330.9 billion in 2023 and is estimated to reach $730.7 billion by 2035, exhibiting a CAGR of 7.0% from 2024 to 2035.

The major players profiled in the report include 360 Destination Group, Access Destination Services, LLC, BCD Travel Services B.V., BI Worldwide, CWT, Flight Centre Travel Group (FCM), Creative Group, Inc., ITA Group, Maritz Holdings, Inc., and Reed Exhibitions Ltd.

The global corporate event market is evolving rapidly due to technological advancements, changing workforce dynamics, and growing emphasis on sustainability and ROI-driven experiences.

North America is the largest regional market for Corporate Event

The leading application of the corporate event market is conferences and seminars.

Loading Table Of Content...

Loading Research Methodology...