Cosmetics Market Summary, 2032

The global cosmetics market size was valued at $429.2 billion in 2022, and is projected to reach $864.6 billion by 2032, growing at a CAGR of 7.1% from 2023 to 2032.Cosmetics have become an essential part of people's daily lifestyles. There is an increase in the number of social media users owing to the rise in internet penetration. Thus, most key players in the market strategize on promoting their products and services on these social media platforms.

Social media marketing is one of the major strategies adopted by various companies and industries to impart awareness about their product offerings among target customers. Thus, through the social media marketing strategy, the global cosmetics market witnesses a critical opportunity to gain traction and increase its customer reach among its target segments.

The rise in working women's participation creates an opportunity for countries to increase the size of their workforce and achieve additional economic growth. In addition, a rise in the number of working women leads to the growth of cosmetics sales in the market.

Market Dynamics

Manufacturers are changing their product branding and advertising strategies to accelerate their sales across various countries. Innovative strategies such as new product launches with natural ingredients and appealing packaging have been adopted by manufacturing companies to increase sales of their cosmetics products. As cosmetics have become an integral part of individuals’ lives, consumers, especially women, prefer to use cosmetics products, which are handy and easy to use while traveling or attending social meetings.

Moreover, the use of natural ingredients for manufacturing cosmetics products, which do not have any adverse effect on the skin, is a popular strategy of manufacturers to attract more customers. This also helps in increasing the revenue of companies operating in this industry. All strategies adopted by manufacturers drive the global market. However, chemicals used in the manufacturing of cosmetic products can harm an individual’s skin or other parts of the body. However, the application of cosmetic products on a daily basis could be dangerous for the skin.

Chemicals used as ingredients in cosmetic products can have many adverse side effects on the skin. Long-term and extensive use of chemical-rich shampoos, serums, and conditioners leads to heavy hair fall problems. Moreover, extensive use of color cosmetic products for eyes and lips can also cause skin diseases and consequential health hazards. Therefore, an increase in awareness of probable side effects of cosmetics and skin concerns among customers is an important factor that limits the growth of the market.

Innovation and technological developments are major drivers of the cosmetics sector. New and enhanced products are manufactured by ongoing R&D initiatives. Technology improvements in packaging, application methods, and formulation have had a great impact on the market. For instance, the creation of long-wearing makeup formulae, cosmetic 3D printing, and augmented reality (AR) beauty apps for virtual try-ons have had a significant impact on the business.

The cosmetics industry has seen tremendous globalization, with brands and products crossing international borders. International companies are expanding into emerging markets, which helps the market grow. As the supply chain for materials, packaging, and production spans several nations, the global cosmetics sector benefits from international trade. This globalization encourages diversity in product offerings and accessibility to a wide spectrum of consumers globally.

The cosmetics market operates under a set of laws that differ from nation to nation. Product safety, labeling, and ingredient limitations are all covered by these standards. Modifications to regulatory requirements may influence product development, production, and marketing. The cosmetics market demand for ingredient disclosure and stronger rules from consumers have contributed to the growth of clean and natural beauty products.

The market has changed as a result of the growth of e-commerce. Convenience, a large product selection, and individualized purchasing experiences are provided by online platforms. Brands are spending more money on influencer partnerships and interacting with consumers through interactive content and virtual try-ons.

The market is increasingly focused on sustainability and ethical issues. The environmental impact of consumer beauty products is a growing concern. Thus, companies are switching to eco-friendly packaging, lowering waste production, and sourcing sustainable products. In addition, new approaches to product creation and testing have emerged in response to consumer demand for vegan and cruelty-free goods.

Economic considerations, such as consumer disposable income, have a positive impact on the cosmetics market. Consumer spending on luxuries such as cosmetics may decline in times of economic difficulty. However, people could be more inclined to spend money on premium goods and higher-end cosmetics during times of economic boom.

The cosmetics market is highly influenced by cultural and social elements including ideas and beliefs of beauty and fashion. By region and demographic, these variables change. For instance, there are variances between Asian and Western consumers' preferences for makeup, and these variations have an effect on the range of products available and the marketing tactics used.

Segmental Overview

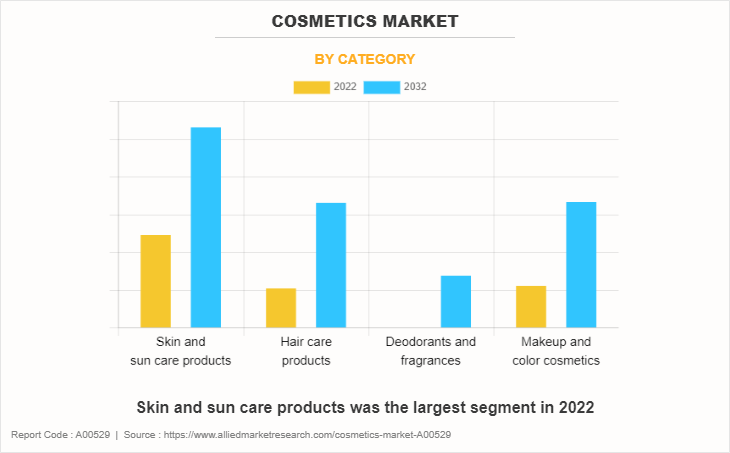

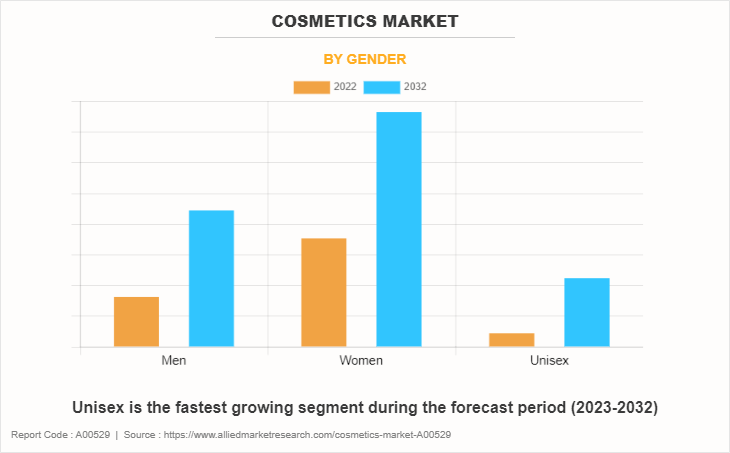

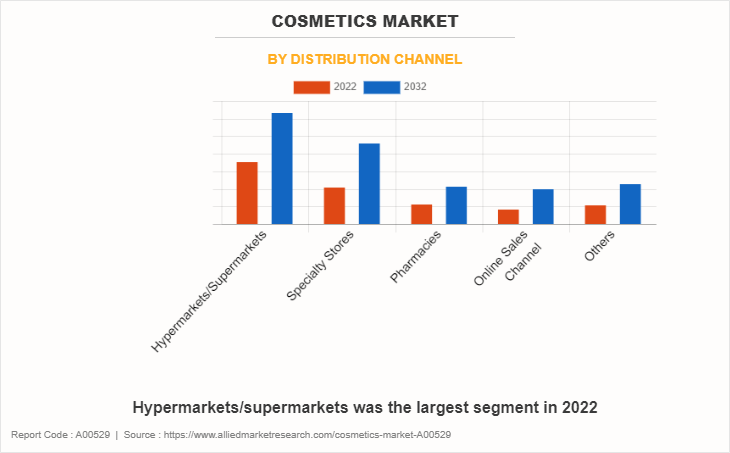

The cosmetics market is analyzed on the basis of category, gender, distribution channel, and region. By category, the market is divided into skin & sun care products, hair care products, deodorants & fragrances, and makeup & color cosmetics. By gender, the market is segmented into men, women, and unisex.

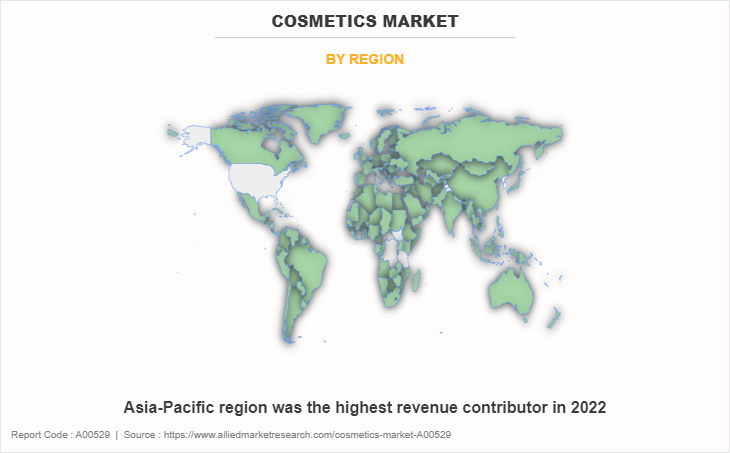

Depending on distribution channel, it is classified into hypermarkets/supermarkets, specialty stores, pharmacies, online sales channel, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Russia, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia & New Zealand, South Korea, ASEAN, and the rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Turkey, Saudi Arabia, and the rest of LAMEA).

By Category

As per market statistics, by category, the skin and sun care products segment dominated the global market in 2022 and is anticipated to maintain its dominance during the cosmetics market forecast period. There are several important trends emerging in the market for skin and sun care products. Consumers are placing more focus on items made with pure, natural components and less toxic chemicals.

With an emphasis on broad-spectrum protection, long-lasting formulas, and non-greasy textures, innovation in sunscreen is on the rise. Due to growing urbanization and screen use, anti-pollution and blue light protection in skincare products are becoming more important. In addition, product lines are expanding to accommodate different skin types and tones as a result of inclusivity and diversity. Sustainability is a major trend, resulting in eco-friendly packaging and ethical ingredient sourcing to reflect customer preferences.

By Gender

By gender, the women segment dominated the global market in 2022. Women are choosing a wider range of makeup looks, from subtle, creative looks to strong, dramatic looks. Brands are becoming more aware of the need for inclusive product lines that emphasize all skin types and tones.

In addition, there is an increase in skincare items made specifically for women's issues, such as anti-aging, hormonal shifts, and certain skincare regimes. In line with their ethical and environmental ideals, women often look for sustainable and cruelty-free products. A more inclusive strategy is being adopted by the cosmetics businesses to meet the varied interests and demands of women.

By Distribution Channel

By distribution channel, the online sales channel segment is predicted to show the fastest global cosmetics market growth during the forecast period. The cosmetics market has seen an increase in the influence of online sales channels. The development of e-commerce platforms, the emergence of direct-to-consumer (DTC) companies, and improved personalization made possible by AI and AR technology are the key developments.

DTC brands provide a direct and smooth buying experience, encouraging customer loyalty and brand trust. Customers' online purchasing experiences are improved by AI and AR solutions that enable virtual product trials. In addition, e-commerce sites such as Amazon and Alibaba give both well-known and up-and-coming businesses a platform to connect with a global clientele. As a result, the distribution model for cosmetics is changing to become more digital and customer-focused.

By Region

Region-wise, Asia-Pacific is predicted to dominate the market with the largest cosmetics market share during the forecast period. The region is adopting K-beauty and J-beauty influences, putting an emphasis on innovative skincare products and minimal cosmetics. As more environmentally and health-conscious consumers, they are seeing an increase in the popularity of clean and natural beauty products. The retail scene is changing due to e-commerce and social media-driven marketing, which highlights influencer partnerships and online buying.

As more cosmetics are made for different skin types and tones, personalization and inclusion are becoming more popular. As a result of increased sustainability concerns, products are now being packaged more sustainably and are sourced ethically. These factors are driving the growth of the market in Asia-Pacific.

Competition Analysis

The major key players include Unilever PLC, Avon Products, Inc., Kao Corporation, Revlon, Inc., Shiseido Company, Limited, Skin Food Co., Ltd, The Estee Lauder Companies Inc., The Procter & Gamble Company, LOREAL S.A., and Oriflame Cosmetics Global SA.

Several well-known and up-and-coming brands are vying for market dominance in the fiercely competitive cosmetics industry. Smaller, niche firms have become more well-known for catering to particular consumer demands and tastes. Large conglomerates, however, still control the majority of the market and frequently buy creative startups to broaden their product lines.

Large multinational corporations with broad brand portfolios, global reach, and sizable marketing budgets, such as L'Oréal, Estée Lauder, and Procter & Gamble, dominate the market. They have the means to conduct considerable R&D and continual product development. With a focus on clean and sustainable products, niche brands such as Glossier and Fenty Beauty are gaining market dominance through targeted offers that address certain customer demands. For quick development, these brands work with influencers, social media, and digital marketing.

The direct-to-consumer (DTC) approach, made popular by companies such as Kylie Cosmetics and Huda Beauty, alters the market by avoiding conventional retail channels and enabling a direct relationship with customers. Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market.

While they provide more affordable options, they might have different recognition or range of products than well-known companies. An important competition component is innovation in formulations, ingredient sourcing, and sustainability policies. Brands that are able to change the tastes of their target market and align with their ethical and environmental values have an advantage over rivals.

Key Developments in The Market

In July 2022, Unilever PLC partnered with the InterContinental Hotels Group to supply the guest bathrooms in its hotels and resorts with larger packs of personal care products such as hand wash, body wash, shampoo, conditioner and body lotion to help the hotel group cut its single use plastics.

In August 2023, Kao Corporation announced that its wholly owned subsidiaries Kao Australia Pty. Limited and Kao USA Inc. to acquire the Bondi Sands brands via the acquisition of Bondi Sands Australia Pty Ltd and related Bondi Sands companies to offers a range of its sun care and skincare products.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cosmetics market analysis from 2022 to 2032 to identify the prevailing cosmetics market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the cosmetics market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global cosmetics market trends, key players, market segments, application areas, and market growth strategies.

Cosmetics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 864.6 billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Category |

|

| By Gender |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Skinfood Co., Ltd., The Estee Lauder Companies Inc., LOREAL S.A., Shiseido Company, Limited, Kao Corporation, Avon Products, Inc, Unilever PLC, Oriflame Cosmetics Global SA, The Procter & Gamble Company, Revlon, Inc. |

Analyst Review

The perspectives of the leading CXOs in the cosmetics industry are presented in this section. The growing interest in eco-friendly and sustainable beauty products is one of the significant trends for market growth. Brands are being driven to implement eco-friendly and cruelty-free methods as consumers' awareness of the substances in cosmetics grows. Recyclable packaging and natural and organic formulas have grown in popularity. The cosmetics industry has also seen a digital transition, with e-commerce being a key factor. Consumers can now acquire cosmetics more easily due to online sales channels, virtual try-ons, and consultations. Social media sites are developed into effective marketing tools that enable firms to interact directly with their target audience.

Another major trend is personalization, with brands recommending specific skincare routines and shades of cosmetics for different skin types and tones. The importance of inclusivity and diversity has increased, which has resulted in a wider selection of colors and products made to suit various skin tones and ethnicities. With changes in consumer interests, the COVID-19 pandemic had a profound impact on the cosmetics sector. While demand for skincare and hygiene products increased, sales of cosmetics decreased as a result of mask use and fewer social meetings. But as limitations relaxed, the cosmetics industry evolved by developing long-lasting and mask-friendly products. Thus, the cosmetics market is a dynamic sector defined by innovation, sustainability, and digital revolution. Cosmetics businesses must continue to be flexible and sensitive to new trends as consumer preferences change to survive in this competitive environment.

The rise in working women's participation creates an opportunity for countries to increase the size of their workforce and achieve additional economic growth. In addition, a rise in the number of working women leads to the growth of cosmetics sales in the market.

Region-wise, Asia-Pacific was the highest revenue contributor in 2022.

The top companies analyzed for the Cosmetics market report are Unilever PLC, Avon Products, Inc., Kao Corporation, Revlon, Inc., Shiseido Company, Limited, Skin Food Co., Ltd, The Estee Lauder Companies Inc., The Procter & Gamble Company, LOREAL S.A., and Oriflame Cosmetics Global SA.

The global cosmetics market to grow at a CAGR of 7.1% from 2023 to 2032

The global cosmetics market size was valued at $429.2 billion in 2022, and is projected to reach $864.6 billion by 2032, growing at a CAGR of 7.1% from 2023 to 2032

Loading Table Of Content...

Loading Research Methodology...