Cyber Security in Energy Sector Market Overview

The global cyber security in energy sector market size was valued at USD 8.6 billion in 2022 and is projected to reach USD 25 billion by 2032, growing at a CAGR of 11.7% from 2023 to 2032.

Cybersecurity incorporates a comprehensive range of tools, practices, and techniques interrelated closely to operational and information technology security. This method uses protective and responsive methods to defend networks and information from being attacked and compromised. Therefore, cyber security finds a considerable application in the field of energy security that provides power, heat, and fuel to modern societies. The energy sector is often susceptible to cyber threats, due to its heavy reliance on interconnected computer systems, and industrial control systems, and the potential for large-scale disruptions if these systems are lacking in security measures.

Moreover, cyber security in energy utilizes legacy malware protection, web filtering, and advanced threat defense to protect users from internet-borne threats and to aid enterprises enforce internet policy compliance. Numerous cybersecurity solutions and services are further used to deliver security services to prevent threats and improve the overall effectiveness of the energy supply chain. The cyber security in energy sector market has grown as a result of shifting trends, expectations, and behavior in the energy market owing to the numerous advantages provided by the digitalization of energy services. Furthermore, the rise in need and requirement to keep information, data, and devices secured in the energy sector fuels the market.

In addition, the surge in risks of cyber-attacks on the energy industry for the execution of mass operations boosts the growth of cyber security in the energy market. However, high acquisition costs and complexities of cyber security hinder the growth of market. On the contrary, technological advancements in cyber security in energy, such as the inclusion of artificial intelligence (AI) and automation, are expected to fuel the growth of cyber security in energy sector market in upcoming years. Moreover, the rise in adoption of digital practices for various operations in the energy sector is expected to provide lucrative opportunities for the market growth in upcoming years.

The report focuses on growth prospects, restraints, and analysis of the global cyber security in energy sector market trends. The study provides Porter five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global cyber security in energy sector market share.

Segment Overview

The cyber security in energy sector market is segmented on the basis of component, deployment model, enterprise size, end user, and region. Depending on component, the market is bifurcated into solutions and services. By solution, the market is fragmented into network security, endpoint security, application security, data security, others. By services, the market is segmented into vulnerability assessment, digital risk and threat monitoring, business continuity services, disaster recovery, digital forensics, penetration testing, threat intelligence, security information and event management, implementation and integration services, training and education services, and others. By deployment model, the market is bifurcated into cloud and on-premise. By enterprise size, it is segregated into small and medium-sized enterprises (SMEs) and large enterprises. As per end user, it is classified into industrial, commercial, and residential. By industrial, the market is categorized into oil & gas industry, transmission & distribution, power plants, natural gas plants. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

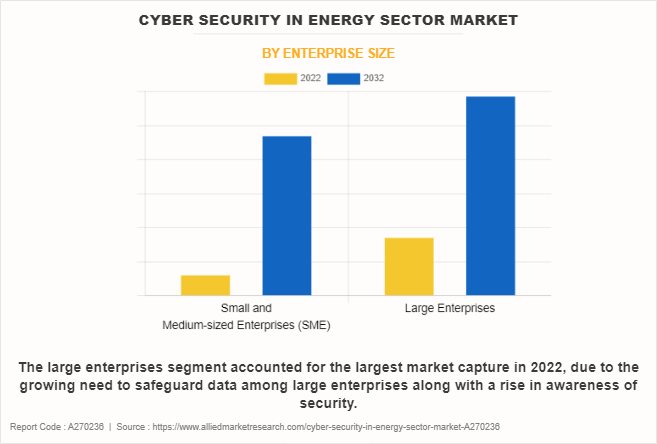

Depending on the enterprise size segment, the large enterprises segment dominated the cyber security in energy sector market share in 2022 and is expected to continue this trend during the forecast period, owing to the rise in need to safeguard data along with the rise in awareness of security events. However, the small and medium-sized enterprises (SMEs) segment is expected to witness the highest growth in the upcoming years, owing to the increase in number of cyber threats among SMEs, along with the growing awareness of cyber security among small businesses.

Region-wise, the cyber security in energy sector market was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to an increase in demand for cloud-enabled activities in the energy and power sector, along with the increasing government mandates for cybersecurity practices further contributing to the market growth within the region.

However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the rise in need to support secure enterprise mobility practices within organizations coupled with the surge in the number of targeted cyberattacks in the energy sector due to the use of outdated security systems within this region. The report focuses on growth prospects, restraints, and analysis of the global cyber security in energy sector market trends.

Top Impacting Factors

Surge in Demand for Cloud-based Cybersecurity Solutions in the Energy Sector

The rise in demand for cloud-based cybersecurity solutions in the energy sector is a reflection of the industry's increasing dependence on digital technologies and the need to protect critical infrastructure from progressing cyber threats. Further, the growing need for remote monitoring has resulted in the growing use of cloud technology in security infrastructure. These aforementioned factors are projected to strengthen the demand for internet security in energy sector market.

Furthermore, the cloud computing model is widely adopted in the energy sector due to its inherent benefits, such as centralized data security and flexible infrastructure. Many organizations in the energy industry have shifted their preference toward cloud solutions to simplify the storage of data, as this technology provides remote server access on the internet, which further allows access to unlimited computing power. Moreover, the implementation of a cloud-based model empowers organizations to manage all the applications, as it provides exceptionally challenging analytics that run in the background.

In addition, the increasing awareness towards data security through the use of cloud solutions increases the installation of cloud-based cyber security platforms, which directly drives the growth of internet security in energy sector market.

Complexities of Device Security

Ensuring robust cybersecurity and device security in the energy sector is particularly complex on account of the implementation of numerous interconnected systems, critical infrastructure, and the potential concerns of cyber threats. These interconnected devices may include everything from smart meters to power plant control systems. Each device has its security vulnerabilities, which can make it complicated to develop and adopt a comprehensive security strategy, which is the key reason for halting the growth of the cyber security in energy sector market.

Furthermore, many devices and systems in the energy sector are designed as legacy systems that typically lack security features, resulting in complexities to update and patch, which makes them more susceptible to cyberattacks. Hence, this factor is also expected to restrain the growth of cyber security in energy sector industry.

Moreover, security is essential in wireless communications & other systems, and security issues are projected to become increasingly important and widespread in many devices. Various issues in designing security solutions include price, power, performance, and consistency. With varying security requirements of device manufacturers, a standard security design remains a challenge for most vendors.

In addition, solution providers require content from both security engineers and embedded system designers, which further increases the complexity of the process. Besides, the facility of providing cryptographic keys to mobile devices during manufacturing poses as a significant risk for mobile device chipmakers. Furthermore, lack of highly skilled workforce in cybersecurity field across small- & medium-scale enterprises is further impeding the growth of the global cyber security in energy sector industry.

Key Market Players

The global cyber security in energy sector market is dominated by key players such as Accenture, IBM Corporation, General Electric, Hitachi Energy Ltd., Schneider Electric, ABB, Schweitzer Engineering Laboratories, Inc., Siemens, AT&T, and Eaton Corporation Plc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Key Industry Development

Recent Partnerships in the Market

- On April 2023, Accenture and Google partnered to help businesses better protect critical assets and strengthen security against persistent cyber threats. Together, they are providing the technology, trusted infrastructure, and security expertise organizations need to build resilient security programs and maintain confidence in their readiness.

- In November 2022, Hitachi Energy proclaimed the partnership with Anlyz, an innovative SOCaaS platform provider company, expanding the managed services offerings. This strategic development further helped in identifying, responding, and remediating complex cyber risks.

Recent Product launches in the Market

- In April 2021, Siemen Energy introduced the world's first power transmission solution, SensSolution, which is integrated with universal cloud connectivity and web application suite. This allows the secured transmission of substation data to the cloud, enabling valuable real-time analyses and monitoring.

- In November 2021, Hitachi Energy unveiled IdentiQ, a digital twin solution for high-voltage direct current (HVDC) and power quality solutions, which helps to advance the global energy systems to be more flexible and sustainable. Also, this solution is secured in compliance with industry-leading cybersecurity standards and protects all asset data and information.

Key Benefits for Stakeholders:

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cyber security in energy sector market analysis from 2022 to 2032 to identify the prevailing cyber security in energy sector market forecast.

The cyber security in energy sectormarket research is offered along with information related to key drivers, restraints, and cyber security in energy sector market opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the cyber security in energy sector market growth assists in determining the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global cyber security in energy sector market share, key players, market segments, application areas, and market growth strategies.

Cyber Security in Energy Sector Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 25 billion |

| Growth Rate | CAGR of 11.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 1084 |

| By Deployment Model |

|

| By Enterprise Size |

|

| By End User |

|

| By Component |

|

| By Region |

|

| Key Market Players | Hitachi Energy Ltd., Schweitzer Engineering Laboratories, Inc., Siemens, Schneider Electric, ABB, Accenture, General Electric, AT&T, Eaton Corporation plc, IBM Corporation |

Analyst Review

The global cyber security in energy sector market is witnessing reasonable growth, due to the increasing number of cybersecurity solution providers and the favorable government policies & mandates for improving security in critical infrastructure.

In accordance with several interviews conducted by the top level CXO executives, the adoption of cybersecurity in energy has increased in the last few years, due to the rise in awareness among organizations of all sizes in the energy sector when it comes to protecting their information, along with the increase in ransomware attacks on small businesses, nonprofits, and government agencies. Thus, organizations are observing increased investment by the majority of the companies to protect their sensitive and crucial data. Furthermore, the surge in adoption of cloud-based security solutions in energy management processes is expected to drive the growth of the market.

Additionally, key players in the cyber security in energy sector market such as Eaton, Siemens, ABB, and General Electric, account for a significant share of the market, followed by some other top vendors in the local and regional markets. With larger requirements for security services, companies introduced various strategies to launch new products in the energy market for cyber security is expected to increase the adoption rate among the end users. For instance, in September 2022, ABB unveiled a new cyber security solution, ABB Ability Cyber Security Workplace, to simplify and enhance the protection of industrial infrastructure by consolidating both ABB and third-party security solutions into one simple, all-embracing digital platform. This solution seeks to address the current skills gap in cyber security literacy and protect critical industry assets. Such strategic initiatives by the market players are expected to contribute to significant growth of the cyber security in energy sector market across the globe.

Moreover, market players have aimed to expand their business operations and geographical footprint, which in turn, propel the growth of cyber security in energy sector market. For instance, in February 2023, Siemens Energy introduced its cyber security operations center (CSOC) in Selangor, Malaysia, which aimed at offering operational technology (OT) cyber security services to customers across the region and beyond. This facility helps to monitor, detect, and ease cyber threats on critical infrastructure such as energy and utilities. Also, it helps to build a more mature energy value chain in the Asia-Pacific region.

The rise in need and requirement to keep information, data, and devices secured in the energy, along with the surge in risks of cyber-attacks on the energy industry for the execution of mass operations boosts the growth of cyber security in energy sector market.

Depending on the enterprise size segment, the large enterprises segment dominated the cyber security in energy sector market share in 2022 and is expected to continue this trend during the forecast period, owing to the rise in need to safeguard data along with the rise in awareness of security events.

Region-wise, the cyber security in energy sector market was dominated by North America in 2022 and is expected to retain its position during the forecast period.

The global cyber security in energy sector market size was valued at $8,573.94 million in 2022, and is projected to reach $25,036.84 million by 2032, growing at a CAGR of 11.7% from 2023 to 2032.

The global cyber security in energy sector market is dominated by key players such as Accenture, IBM Corporation, General Electric, Hitachi Energy Ltd., Schneider Electric, ABB, Schweitzer Engineering Laboratories, Inc., Siemens, AT&T, and Eaton Corporation Plc.

Loading Table Of Content...

Loading Research Methodology...