Disposable Cutlery Market Summary, 2035

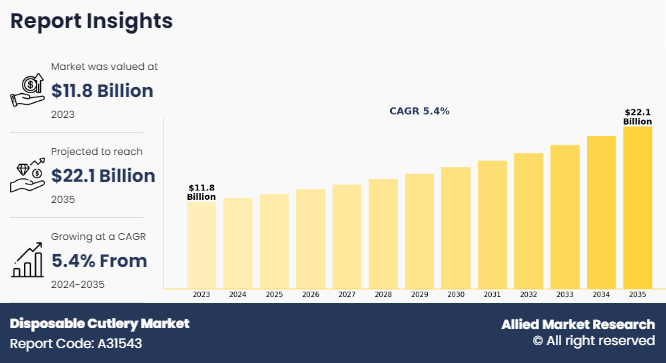

The global disposable cutlery market was valued at $11.8 billion in 2023, and is projected to reach $22.1 billion by 2035, growing at a CAGR of 5.4% from 2024 to 2035. The growth of the market is driven by factors such as an increase in demand for convenient dining solutions in fast-paced lifestyles, rise of takeaway & delivery services, and expansion of the food service industry.

Disposable cutlery is a kind of eating utensil that is mostly used once and then discarded. It comes in different sizes, shapes, and materials‐“mostly wood and plastic. Disposable cutlery includes spoons, forks and knives and is produced lightweight for easy handling both by households and commercial users.

MARKET DYNAMICS

The rise in the popularity of takeaway culture has significantly boosted the disposable cutlery market demand for disposable cutlery. According to the U.S. Department of Agriculture, in 2022, food spending in the U.S. totaled to $2.39 trillion after a pandemic-induced dip in 2020, with food-away-from-home expenditures reaching $1.34 trillion. As more consumers opt for the convenience of ordering food on the go, the need for practical and efficient dining solutions has increased.

Disposable cutlery provides a hassle-free option for both consumers and businesses, as it eliminates the need for washing and returning utensils. The ease of using disposable cutlery aligns perfectly with the fast-paced lifestyle of urban population, where convenience and time saving are top priorities. Thus, shift in dining preferences has led to a higher consumption of single-use cutlery, driving disposable cutlery market growth.

In addition, the expansion of food delivery services and quick-service restaurants has further fueled the demand for disposable cutlery. These businesses rely heavily on disposable products to ensure customer satisfaction and maintain hygiene standards. The COVID-19 pandemic has played a significant role in accelerating the trend of using disposables, as increased awareness of sanitation and safety has made disposable cutlery a convenient option. With more consumers ordering meals for home consumption, the reliance on disposable cutlery has become a key component of the modern dining experience, contributing to the increase in disposable cutlery market size.

However, the rise in environmental awareness has acted as a significant restraint to the market demand for disposable cutlery. As consumers become more conscious of the environmental impact of single-use plastics, there has been a growing reluctance to use disposable utensils. Individuals have increasingly opted for reusable alternatives such as stainless steel or bamboo cutlery, viewing them as more sustainable options that reduce plastic waste. The shift in consumer behavior has led to a decline in the demand for disposable cutlery, particularly among environmentally conscious demographics.

Moreover, increased awareness about plastic pollution and its detrimental effects on marine life and ecosystems has sparked advocacy campaigns and initiatives aimed at reducing single-use plastics. For instance, beach clean-up movements, social media campaigns, and environmental education programs have raised public awareness about the importance of reducing plastic consumption. In addition, regulatory measures and bans on single-use plastics in various regions further restrict the market demand for disposable cutlery.

The bans imposed by the European Union, India, and Canada, along with California's stringent regulations in the U.S., are anticipated to significantly impact the plastic disposable cutlery market. With restrictions on plastic use, manufacturers are expected to face a shrinking demand for traditional plastic cutlery that negatively impacts the market growth.

Furthermore, the rise in preference for eco-friendly cutlery items among consumers has led to the creation of numerous market growth opportunities for disposable cutlery manufacturers. The shift toward ecofriendly products has led to a surge in demand for disposable cutlery made from biodegradable, compostable, and recyclable materials. Products made from plant-based plastics, bamboo, and other eco-friendly materials have gained immense popularity, as they offer a guilt-free alternative to traditional plastic cutlery.

Manufacturers have responded to the demand for eco-friendly products by innovating and expanding their range of environmentally friendly disposable cutlery. In April 2023, Eco-Products, a brand under Novolex, introduced a new line of sustainable, compostable cutlery made from Forest Stewardship Council (FSC) certified birch wood to enhance their portfolio of eco-friendly and sustainable cutlery. Similarly, in June 5, 2021, Hotpack Packaging Industries LLC launched its eco stores in the UAE, which sell eco-friendly cutlery products to provide green food packaging alternatives in the region. In addition, companies have started investing in research and development to create products that meet functional needs of consumers and minimize environmental impact.

Furthermore, governments and regulatory bodies have played a crucial role by implementing policies and regulations that encourage the use of sustainable materials and penalize the use of non-recyclable plastics. These measures further drive the market demand for eco-friendly disposable cutlery. As a result, the market has experienced significant growth, with consumers and businesses prioritizing sustainability in their purchasing decisions, thereby contributing to the overall expansion of the disposable cutlery market.

SEGMENT OVERVIEW

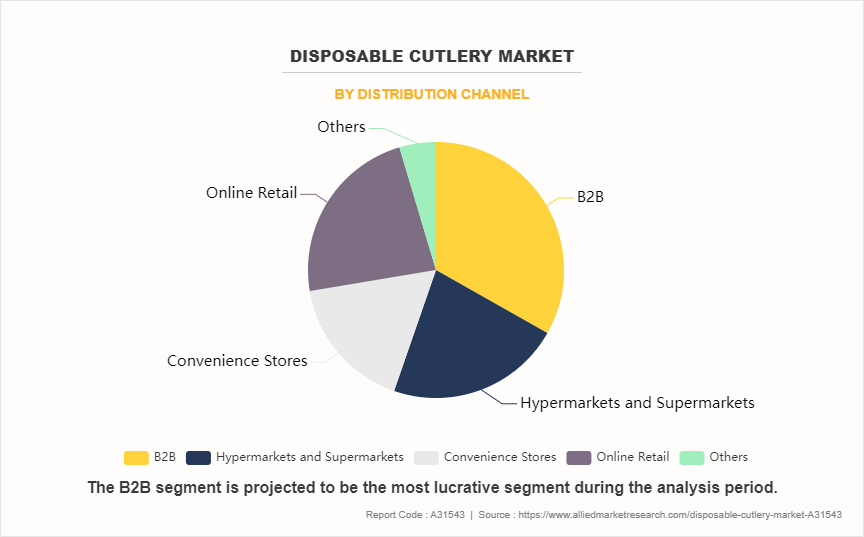

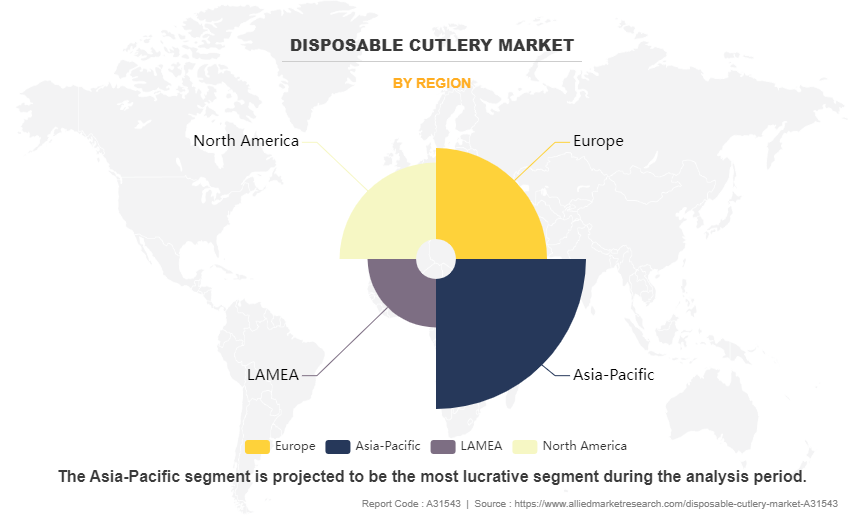

The disposable cutlery market is segmented into type, material, end use, distribution channel, and region. By type, the market is categorized into spoon, fork, and knife. By material, it is bifurcated into plastic and wood. By end use, it is classified into household and commercial. By distribution channel, the market is divided into B2B, supermarkets and hypermarkets, convenience stores, online retail, and others. By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, the UK, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Argentina, and rest of LAMEA).

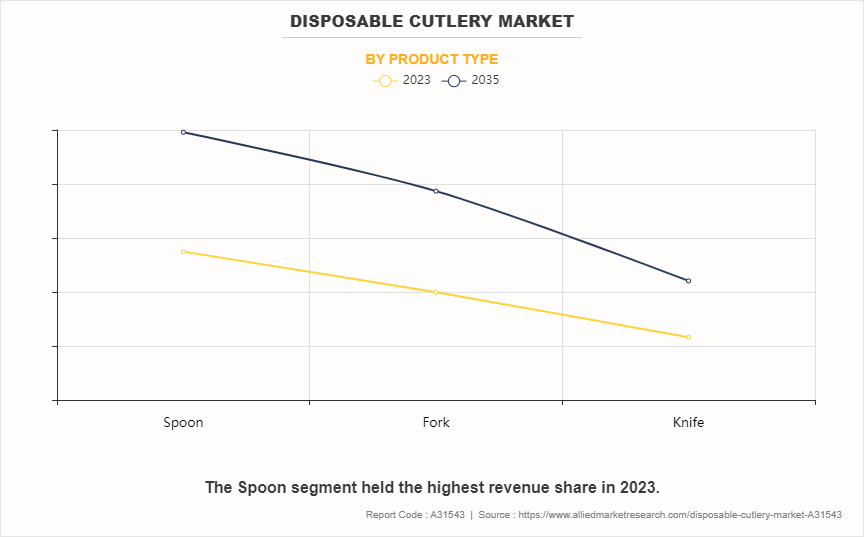

BY PRODUCT TYPE

By product type, the spoon segment dominated the global market in 2023 and is anticipated to maintain its dominance during the forecast period. Rise in preference for convenience-driven lifestyles has been witnessed in the last few years, where time-saving solutions are prioritized, which has made single-use utensils appealing for quick meals and on-the-go consumption. In addition, the rise of fast-food culture and the increase in frequency of outdoor events and gatherings have boosted the need for disposable cutlery. Hygiene concerns, particularly in food service and healthcare industries, contribute to the demand, as single-use items help prevent cross-contamination and the spread of pathogens.

Moreover, the affordability of plastic disposable cutlery compared to reusable alternatives makes it economically attractive for businesses and consumers. Furthermore, the lightweight and durable nature further enhances their popularity, facilitating easy transportation and usage in various settings, from restaurants to picnics and office lunches.

BY MATERIAL

By material, the plastic segment dominated the global market in 2023 and is anticipated to maintain its dominance during the forecast period due to sits cost-effectiveness and convenience. Plastic utensils are inexpensive to produce, making them an attractive option for businesses and consumers. They are lightweight and durable, which reduces shipping costs and the risk of breakage during transport. Plastic cutlery is also versatile, available in various shapes and sizes, and can be manufactured in large quantities to meet high demand. In addition, plastic cutlery is often perceived as more hygienic for single use, especially in settings like fast food restaurants, cafeterias, and events. Despite growing environmental concerns, these practical and economic advantages continue to drive the widespread use of plastic disposable cutlery over alternatives like wooden or biodegradable options, thus driving the growth of this segment.

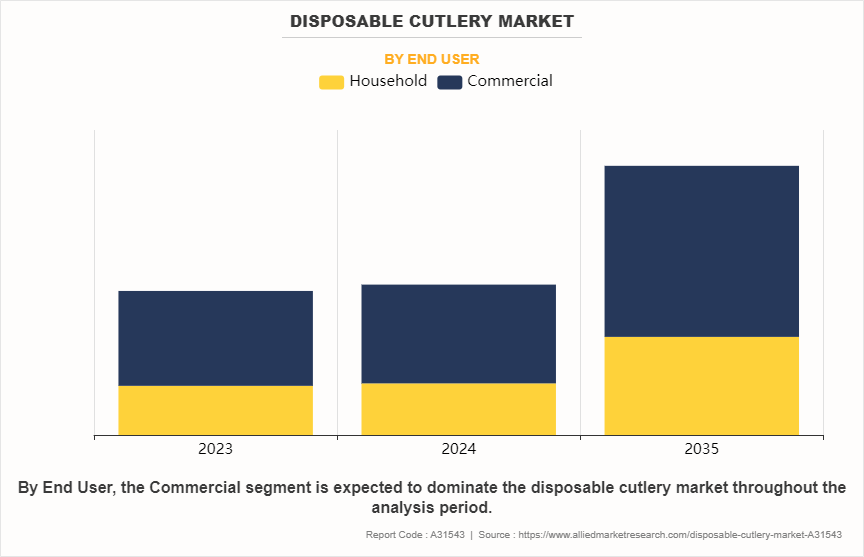

BY END USER

By end user, the commercial segment dominated the global market in 2023 and is anticipated to maintain its dominance during the disposable cutlery market forecast period. The fast-paced nature of the food service industry necessitates quick and efficient solutions for meal preparation and service. Disposable cutlery provides a convenient option, which eliminates the need for washing and sanitizing traditional utensils, thereby streamlining operations and reducing turnaround time. Hygiene is important in commercial settings, especially in restaurants, cafes, and catering businesses.

Disposable cutlery helps maintain strict hygiene standards by preventing cross-contamination and minimizing the risk of foodborne illnesses. The above requirements are particularly crucial in settings where large volumes of food are prepared and served to a diverse clientele.

In addition, the cost-effectiveness of disposable cutlery is a significant driving factor for businesses. Compared to investing in reusable utensils and the associated labor and water costs for cleaning, disposable cutlery offers a more economical solution. Moreover, disposable cutlery eliminates the risk of loss or theft associated with reusable options, further enhancing cost savings for commercial establishments. Thus, the convenience, hygiene benefits, and cost-effectiveness of disposable cutlery make it an indispensable choice for various commercial settings, driving its continued demand in the market.

BY DISTRIBUTION CHANNEL

By distribution channel, the B2B segment dominated the global market in 2023 and is anticipated to maintain its dominance during the forecast period. The B2B disposable cutlery ecosystem is comprised of multiple players, including manufacturers/suppliers, wholesalers/distributors, retailers, food service providers, food manufacturers, importers, and exporters. It consists of marketplaces where the vendor and the buyer of disposable cutlery make deals and transactions. The suppliers provide disposable cutlery direct from other businesses and go through a process where one business makes a transaction with another.

Moreover, the B2B distribution channel does not involve any intermediaries and has smooth monetary transactions without any fraud. The B2B e-commerce evolution has introduced the path to digital procurement in the disposable cutlery market. The adoption of digitalization in sales channels has made the work of manufacturers and vendors easy and smooth. In addition, the manufacturers display their products directly through digital marketing platforms Facebook, Instagram, Twitter, and Google. Therefore, manufacturers can expand their consumer base along with the improved perception of their brand.

BY REGION

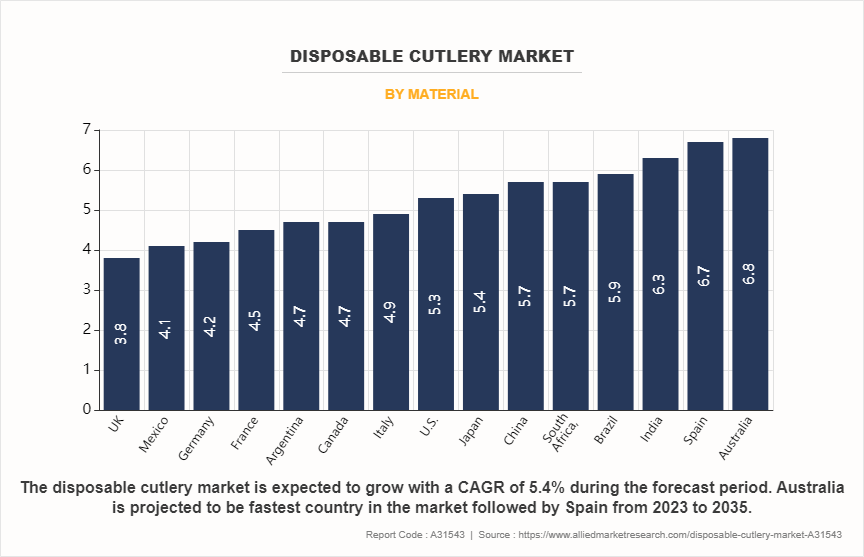

Region-wise, Asia-Pacific is anticipated to dominate the global disposable cutlery market with the largest disposable cutlery market share during the forecast period. The disposable cutlery market for Asia-Pacific is expected to grow as the population takes interest in various types of food offered by restaurants, and food-chains and others in the market. The disposable cutlery manufacturers are using sustainable raw materials in their products to attract consumers into using the product to earn the trust of conscious consumers.

Furthermore, customers look for products that are sturdy in nature, and are inexpensive. The trend has created new growth opportunities for the main players of the disposable cutlery market. In terms of geographical demand for the disposable cutlery, China dominates the market, followed by India, Japan, Australia, South Korea, and the rest of Asia-Pacific. The market is predicted to grow due to a rise in disposable income and increased government initiatives.

COMPETITION ANALYSIS

The key players operating in the disposable cutlery industry include Anchor Packaging Pty Ltd., BioPak, D&W Fine Pack LLC, Dart Container Corporation, Gold Plast SPA, Hotpack Packaging Industries LLC, Huhtamaki, Novolex, Pactiv Evergreen Inc., and Vegware Ltd. Several well-known and upcoming brands are vying for market dominance in the expanding disposable cutlery industry. Smaller, niche firms are more well-known for catering to consumer demands and preferences. Large conglomerates, however, control most of the market and often buy innovative start-ups to broaden their product lines.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the disposable cutlery market analysis from 2023 to 2035 to identify the prevailing disposable cutlery market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the disposable cutlery market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global disposable cutlery market trends, key players, market segments, application areas, and market growth strategies.

Disposable Cutlery Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 22.1 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2023 - 2035 |

| Report Pages | 250 |

| By Material |

|

| By End User |

|

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | D&W Fine Pack LLC, Anchor Packaging Pty Ltd., Vegware Ltd, Pactiv Evergreen Inc., Gold Plast SPA, Novolex, Dart Container Corporation, BioPak, Huhtamaki, Hotpack Packaging Industries LLC |

Analyst Review

As per the perspective of top-level CXOs, the global disposable cutlery market is expected to offer various business opportunities in developing economies. The CXOs stated that the continued rise of the food delivery and takeout industry, fueled by the increasing demand for convenience and on-the-go dining, has created a growing need for disposable cutlery. As more people opt for delivered meals and takeout options, the demand for single-use utensils will continue to surge.

Moreover, the global shift toward sustainable and eco-friendly products has reshaped the disposable cutlery market. Top leaders anticipate a substantial increase in demand for cutlery made from biodegradable and compostable materials, such as bamboo, plant-based plastics, and paper. In addition, the convenience factor associated with disposable cutlery is expected to fuel its adoption across various sectors, including food service, catering, and hospitality. The ability to serve large crowds efficiently while minimizing waste and reducing labor costs associated with washing reusable utensils makes disposable cutlery an attractive option for businesses.

However, top leaders also acknowledge the potential challenges posed by regulatory changes and public concerns about plastic pollution. They emphasize the importance of embracing sustainable alternatives and investing in innovative solutions to meet the growing demand while minimizing environmental impact. Overall, the disposable cutlery market is anticipated to experience substantial growth in the coming years, driven by convenience, sustainability trends, and the ever-expanding food service industry.

The global disposable cutlery market was valued at $11,807.5 million in 2023, and is projected to reach $22,063.5 million by 2035, registering a CAGR of 5.4% from 2024 to 2035.

The forecast period in the disposable cutlery market report is 2023 to 2035.

The base year calculated in the disposable cutlery market report is 2023.

The top companies analyzed for global disposable cutlery market report are Anchor Packaging Pty Ltd., BioPak, D&W Fine Pack LLC, Dart Container Corporation, Gold Plast SPA, Hotpack Packaging Industries LLC, Huhtamaki, Novolex, Pactiv Evergreen Inc., and Vegware Ltd.

The spoon segment is the most influential segment in the disposable cutlery market report.

Asia-Pacific holds the maximum market share of the disposable cutlery market.

The company profile has been selected on the basis of key developments such as partnership, product launch, merger and acquisition.

The market value of the disposable cutlery market in 2023 was $11,807.5 million.

Loading Table Of Content...

Loading Research Methodology...