Disposable Gloves Market Research, 2033

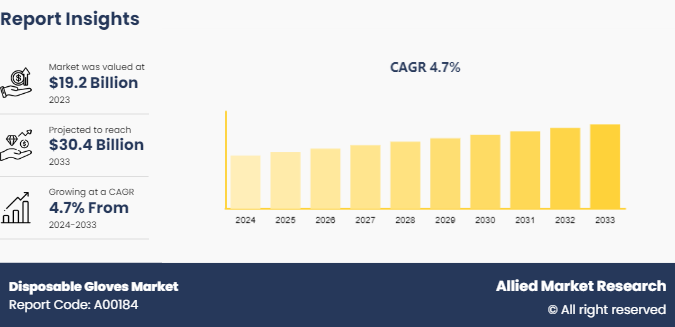

The global disposable gloves market size was valued at $19.2 billion in 2023, and is projected to reach $30.4 billion by 2033, growing at a CAGR of 4.7% from 2024 to 2033. The disposable gloves market is driven by the increasing focus on hygiene and safety across healthcare and food industries, rising awareness about infection control, and stringent regulations promoting the use of protective gear.

Market Introduction and Definition

Disposable gloves are protective hand coverings made from materials such as latex, nitrile, vinyl, or polyethylene, designed for single-use. They are employed in various settings, including medical, laboratory, and industrial environments, to safeguard hands from contaminants, chemicals, or infections. These gloves offer a barrier that helps prevent cross-contamination and ensures hygiene by being discarded after use. Their disposable nature makes them ideal for maintaining cleanliness and reducing the risk of spreading pathogens, as they eliminate the need for cleaning and reuse. Disposable gloves are essential for tasks requiring sterile conditions and protection.

Key Takeaways

- The disposable gloves market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major disposable gloves industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The disposable gloves market growth is driven by increasing awareness of hygiene and infection control across various sectors, particularly in healthcare, and industrial applications. In healthcare settings, the heightened focus on preventing healthcare-associated infections (HAIs) and ensuring sterile environments have significantly bolstered demand for disposable gloves. In industrial and laboratory environments, the need to protect workers from hazardous substances and chemicals contributes to market growth. In addition, rise in advancements in glove materials and manufacturing processes have also enhanced product quality, offering improved comfort, dexterity, and protection, which in turn drives the disposable gloves market size. Moreover, regulatory mandates and guidelines from health organizations and government bodies requiring the use of protective gloves in various settings further bolster growth during the disposable gloves market forecast period.

Moreover, the rise in disposable glove usage in emerging economies, driven by increasing awareness of occupational safety and rising healthcare infrastructure, adds to the market expansion. The availability of a diverse range of disposable gloves catering to different needs such as latex, nitrile, vinyl, and polyethylene gloves also supports market growth by providing options suited for various applications. Furthermore, the growth of e-commerce platforms has made disposable gloves more accessible to a broader audience, further contributing to their increased adoption. However, stricter health and safety regulations may require additional certifications and standards, increasing compliance costs for manufacturers thereby limiting the market growth. On the other hand, increasing consumer awareness about the importance of safety and hygiene in everyday life provides an disposable gloves market opportunity. Additionally, advancements in glove materials and technologies, such as enhanced durability and comfort, offer new opportunities for innovation. The growing trend of personal protective equipment (PPE) in various sectors also contributes to market expansion.

Parent Market Overview

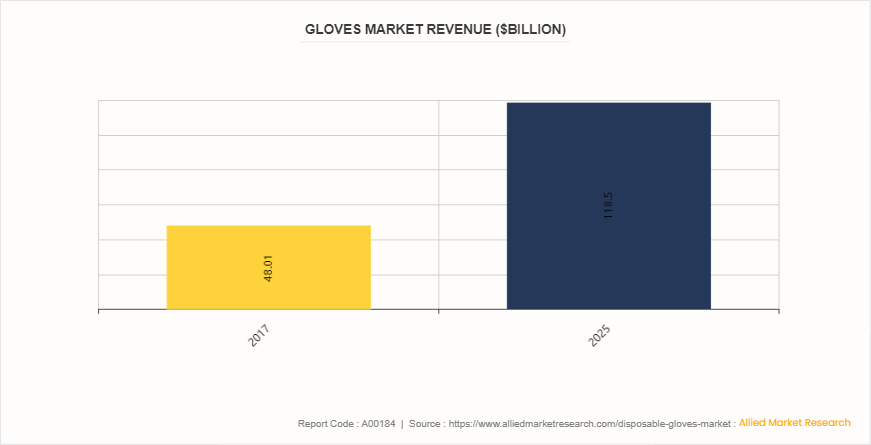

The gloves market is a parent market of disposable gloves market. According to Allied Market Research, the overall gloves market was valued at $48.01 billion in 2017 and is projected to reach $118.5 billion by 2025, reflecting CAGR of 8.6% during 2021-2025. This remarkable expansion can be attributed to the increasing demand for personal protective equipment (PPE) across various sectors, including healthcare, food processing, and industrial applications. The heightened awareness of hygiene and safety, especially in the wake of the COVID-19 pandemic, has further propelled the demand for disposable gloves. Innovations in glove materials and manufacturing processes are also contributing to market growth by enhancing product quality and performance. As a crucial component of the personal protective equipment market, the disposable gloves segment is expected to continue its upward trajectory, driven by stringent safety regulations and growing health concerns globally.

Market Segmentation

The disposable gloves market is segmented into type, application, form, and region. On the basis of the type, the market is segmented into natural rubber gloves, nitrile gloves, vinyl gloves, neoprene, polyethylene, and others. Each of these gloves are further segmented by size into small (S) , medium (M) , and large (L) . As per application, it is bifurcated into medical and non-medical applications. The medical segment is further divided into examination and surgical gloves. The non-medical application segment is sub-segmented into food service, clean room, and industrial. On the basis of form, the market is bifurcated into powdered and non-powdered form. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America has a disposable gloves market share during the forecast period, owing to a robust healthcare infrastructure, and a high focus on infection control and hygiene standards. The presence of major healthcare facilities and industries that require regular use of disposable gloves contributes to strong demand. In addition, increased awareness about the importance of personal protective equipment (PPE) and a growing emphasis on safety protocols further drive market growth in the region. The Asia-Pacific region offers immense potential due to expansion of healthcare infrastructure, coupled with rising health awareness, which boosts consumption in the medical field. Growing regulatory emphasis on hygiene and safety standards further fuels market growth. Additionally, emerging economies present untapped markets, contributing to the overall growth potential of the disposable gloves market.

Industry Trends

In Illinois, Governor J.B. Pritzker signed legislation banning latex gloves in healthcare and food service settings to protect individuals with latex allergies. The law took effect for food service establishments and EMS personnel on January 1, 2023 and on January 4, 2024 for health care facility personnel. This led to increasing the demand for alternative glove materials such as nitrile, vinyl, and synthetic options thereby supporting the market growth.

In 2023, the U.S. Customs and Border Protection (CBP) modified its Withhold Release Order against Supermax Corporation Bhd., allowing the importation of disposable gloves from the company after it successfully addressed indicators of forced labor in its supply chain. This action reflects ongoing efforts to ensure ethical manufacturing practices in the glove industry and to improve working conditions for laborers involved in production. Such action emphasize the importance of ethical manufacturing practices and improves industry standards, potentially increasing consumer trust and demand thereby propelling the market growth.

In December 2023, the Canadian government announced an investment in Manikheir Canada Inc., which will become the country's only medical-grade nitrile glove manufacturer. This initiative supports the government's commitment to enhancing domestic production capabilities for personal protective equipment, including gloves, thereby reducing reliance on imports and bolstering local industry. This initiative aims to enhance Canada's self-sufficiency in producing personal protective equipment (PPE) , reducing reliance on imports and strengthening local industry capabilities which supports market growth.

Competitive Landscape

The major players operating in the disposable gloves market include?Top Glove Corporation Bhd, Semperit AG Holding, Sri Trang Agro Industry PCL (Sri Trang Gloves (Thailand) Public Company) , Kossan Rubber Industries Bhd, Rubberex Corporation (M) Berhad, Ansell Limited, Cardinal Health Inc., Adventa Berhad (Sun Healthcare) , Hartalega Holdings Berhad, and Dynarex Corporation.

Recent Key Strategies and Developments in Disposable Gloves Industry

- In January 2021, Ansell Limited announced that it completed the acquisition of the Primus brand and related assets that constitute the Life Science business belonging to Primus Gloves and Sanrea Healthcare Products (“Primus”) , and also have entered into a long-term supply partnership.

- In November 2021, Sri Trang Gloves (Thailand) Public Company Limited (STGT) announced that it is expanding the rubber glove market in the Asian region to support its business expansion plan by setting up a subsidiary in Vietnam for the distribution of rubber gloves.

- In September 2021, Sri Trang Gloves (Thailand) Public Company Limited (STGT) announced the launch of natural rubber gloves (powder-free) Model "Spectrum" (Spectrum) in a variety of colors.

Key Sources Referred

- National Center for Biotechnology and Information (NCBI)

- Centers for Medicare & Medicaid Services (CMS)

- National Health Service (NHS)

- Australian Government Department of Health and Aged Care

- Government of Canada's Health and Wellness

- Ministry of Health and Family Welfare (MoHFW)

- National Health Mission (NHM)

- Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- World Health Organization (WHO)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the disposable gloves market analysis from 2024 to 2033 to identify the prevailing disposable gloves market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the disposable gloves market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global disposable gloves market trends, key players, market segments, application areas, and market growth strategies.

Disposable Gloves Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 30.4 Billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 225 |

| By Type |

|

| By Application |

|

| By Form |

|

| By Region |

|

| Key Market Players | Cardinal Health., Top Glove Corporation Bhd, ANSELL LTD., Sri Trang Agro Industry PCL (Sri Trang Gloves (Thailand) Public Company), Kossan Rubber Industries Bhd, Semperit AG Holding, Hartalega Holdings Berhad, Adventa Healthcare, Dynarex Corporation, Rubberex Corporation (M) Berhad |

Analyst Review

The utilization of disposable gloves is projected to witness a significant increase, owing to high incidence of diseases across the globe as well as the utilization of gloves in non-medical sectors. The market is largely fragmented, and several manufacturers have focused on offering advanced and novel disposable gloves, which aid in curbing latex-associated allergies and hospital acquired infections. In addition, market players have successfully manufactured gloves with different properties such as higher resistance against chemicals, superior anti-tear properties and gloves with limited thickness thereby not affecting the wearing and removing process, which is anticipated to create lucrative opportunities for the growth of disposable gloves industry.

Disposable gloves are primarily used across health care and food industry, as a protective tool that avoids cross- infection between caregivers and patients or the users. Over time, numerous variants of disposable gloves have been developed such as natural rubber, nitrile, vinyl and neoprene. Latex rubber, as a material is the major component used in disposable gloves' manufacturing; however, this trend is shifting from latex gloves to nitrile or vinyl due to the increase in cases of infection from the latex gloves. Each of these variants render unique benefits over conventional gloves; this also paves way for a wide application spanning range of industries such as food service, clean room, and industrial application among others. For instance, nitrile gloves are more puncture resistant and friction less with a long shelf life as compared to latex gloves.

Increasing incidences of pandemic diseases such as swine flu (H1N1 pandemic) and a resultant need for infection prevention/control aids, such as ‘disposable gloves’, (economically, can be used) drive the growth of global disposable gloves' market volume (billion gloves). Moreover, polyethylene-based disposable gloves are in high demand in the industry, due to their cost effectiveness and ease of availability. Furthermore, increase in demand for food safety across the world supplements the adoption of polyethylene gloves. The use of non-powder gloves aids in supplementing the market growth, as these gloves do not develop adhesion and granulomas, thereby reducing the risk of post-operative wound infection as well as latex allergens sensitizations, and hypersensitivity.

The total market value of disposable gloves market was $19.2 billion in 2023.

The market value of disposable gloves market is projected to reach $30.4 billion by 2033.

The forecast period for disposable gloves market is 2024 to 2033.

The base year is 2023 in disposable gloves market.

Key drivers include increased awareness of hygiene and safety, the rise of healthcare services globally, and stringent regulatory requirements for personal protective equipment (PPE).

Disposable gloves are used in various sectors, including healthcare, food processing, industrial applications, and personal care, to protect against contamination, chemicals, and other hazardous materials.

Loading Table Of Content...