Dry Wine Yeast Market Research, 2032

The global dry wine yeast market size was valued at $2 billion in 2022, and is projected to reach $3.3 billion by 2032, growing at a CAGR of 5% from 2023 to 2032.

Dry wine yeast is a type of dehydrated yeast employed in winemaking to aid in the fermentation process. Yeasts are microorganisms that digest grape juice sugars and convert them to alcohol and carbon dioxide. Winemakers opt for dry yeast because it offers long shelf life and consistently performs well than liquid wine yeasts. Dry wine yeast is frequently packaged in sachets or vacuum-sealed packages. Given that they are inactive and dehydrated, the yeast cells can survive for a prolonged period. When the yeast cells are rehydrated, the sugars in grape juice may be fermented to create alcohol and carbon dioxide.

Market Overview

Manufacturers carefully choose and nurture certain yeast strains such as Lalvin EC-1118 and Prise de Mousse to guarantee desired fermentation properties, such as tolerance to alcohol concentrations, temperature ranges, and the development of specific flavor profiles. By performing this, winemakers may have greater influence over the procedure of fermentation and produce wines with the appropriate fragrance, flavor, and quality.

The effects of the COVID-19 pandemic on the dry wine yeast industry have been conflicting. Government lockdowns, limitations on travel, and the closing of hospitality businesses such as pubs and restaurants initially hampered the wine sector. These actions reduced wine output and consumption, which had an impact on consumer demand for dry wine yeast. However, as the COVID cases increased at an alarming rate, purchasing habits shifted toward domestic consumption and internet shopping. Dry wine yeast gained high traction among home winemakers as home winemaking became more popular as a recreational pastime.

Wine consumption around the world has been continuously rising owing to changing taste preferences among consumers, increasing disposable incomes, and growing wine culture globally. Wine production must keep up with demand as more people choose it as an appealing drinking option. Dry wine yeast plays a crucial role in the creation of wine by fermenting sugars into alcohol. Wine is created with dry wine yeast, which ensures consistent fermentation, improved flavor creation, and the desired attributes. Given the rising demand for wine, brewers are relying progressively more on dry wine yeast to produce wine that meets quality and is consistent.

Dry yeast is a favored option for winemakers as it exhibits extended shelf life and the capacity to be preserved for a prolonged duration periods without losing viability, which enable them to create more wine and meet the expanding market demand. Globally, the need for dry wine yeast is anticipated to rise as wine consumption increases, thus propelling the market expansion and providing possibilities for yeast producers and suppliers to meet the demands of the growing wine industry.

Furthermore, manufacturers are focusing on improving performance and qualities of dry wine yeast strains. These developments are meant to enhance the efficiency of fermentation, taste development, fragrance profiles, and general winemaking results. Scientists and yeast producers can develop new and better yeast strains that are tailored to particular winemaking needs by utilizing cutting-edge techniques, including genetic engineering, yeast propagation, and fermentation control. To make wines with desired qualities, such as improved varietal expression, higher complexity, or distinctive taste profiles, specialized yeast strains are created.

The improvement of yeast manufacturing procedures via the use of technology further contributes to the uniformity, purity, and vitality of dry wine yeast products. Moreover, improvements in packaging and preservation methods aid in keeping dry yeast viable during storage and delivery. These technical advancements make dry wine yeast more dependable for winemakers, encouraging further industry usage. The market for dry wine yeast is anticipated to witness notable growth as winemakers become more aware of the advantages and performance enhancements. The availability of solutions that improve the attributes of dry wine yeast and meet the changing demands and preferences of winemakers is expected to create lucrative opportunities for dry wine yeast market growth.

Home winemaking has been increasingly popular over time due to interest in hands-on experience, search for distinctive flavors, and rise in popularity of craft drinks. As more people experiment with winemaking as an extracurricular activity or small business, this development creates an enormous potential for the dry wine yeast market. In addition, home winemakers are seeking different yeast strains to create distinctive aromatic profiles, such as increased fruitiness, complexity, or particular regional styles.

Moreover, home wine producers are selective about the consistency and quality of the final product. They are seeking dry wine yeast solutions that regularly produce the best results for fermentation, guaranteeing the creation of wines of the highest caliber. Manufacturers with yeast strains that work consistently and to high standards will have an edge in the market. For many customers, environmental awareness and sustainability are crucial factors, which has fostered the need for dry wine yeast made using organic and ecological practices such as Fermivin Organic, which is a certified organic dry yeast suitable for organic winemaking practices.

Segmental Overview

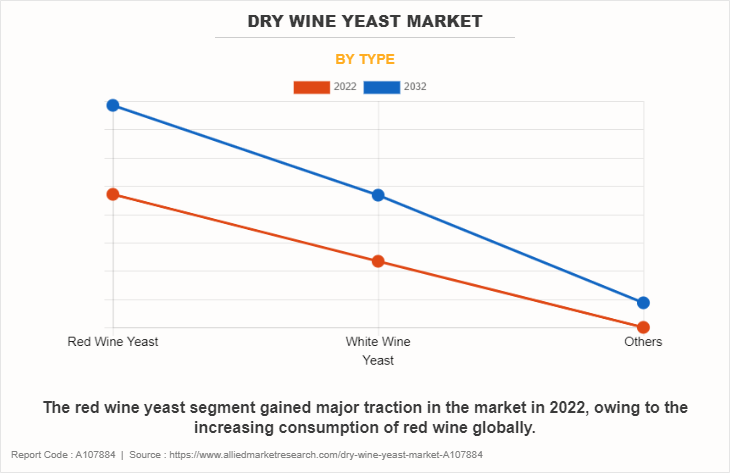

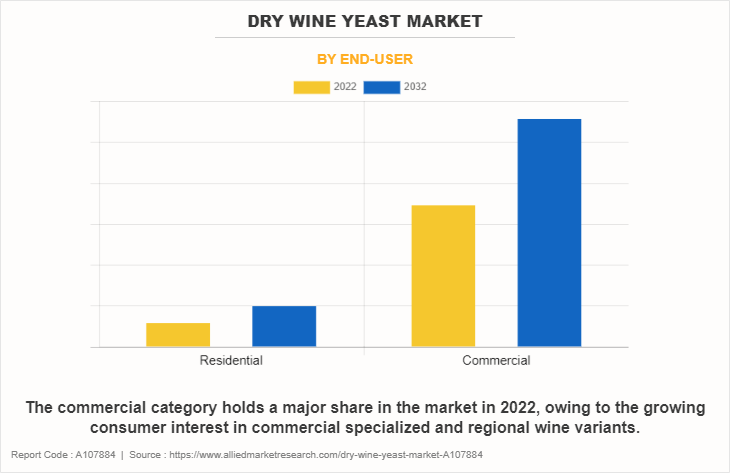

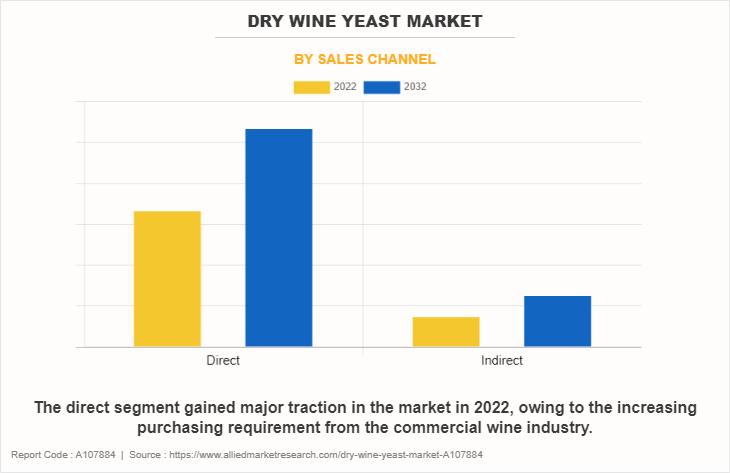

The dry wine yeast market is segmented into type, end user, sales channel, and region. By type, the market is classified into red wine yeast, white wine yeast, and upright. On the basis of end user, it is segregated into household and commercial. Depending on sales channel, it is bifurcated into direct and indirect. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and the rest of Asia-Pacific), and LAMEA (Brazil, UAE, South Africa, and the rest of LAMEA).

By Type

On the basis of type, the red wine yeast segment dominated the market in 2022 and is expected to maintain this trend during the forecast period. This is attributed to the fact that red wine dry yeast sales are increasing due to the rising red wine consumption, which, in turn, has increased both the demand for and supply of premium yeast strains suitable for the fermentation of red wine.

By End User

On the basis of end user, the commercial segment dominated the market in 2022 and is expected to sustain its market share during the forecast period. Growing consumer interest in specialized and regional wine types is being observed in the wine business. This current trend gives producers of dry wine yeast the chance to market yeast strains created specially to highlight the distinctive qualities and flavors of these particular wine genres. Commercial wineries looking to stand out and attract customers may be interested in customized yeast solutions that target certain regional or specialized markets. More wineries and winemakers are searching for dry wine yeast alternatives that are made with organic or sustainable procedures.

By Sales Channel

According to the dry wine yeast market demand, on the basis of sales channel, the direct segment dominated the market in 2022 and is expected to sustain its market share during the dry wine yeast market forecast period. Direct communication between yeast suppliers and winemakers is being emphasized. This is attributed to the fact that direct connections provide improved communication, awareness of the requirements of winemakers, and the provision of specialized solutions. Manufacturers of yeast can provide individualized customer care, technical help, and prompt product delivery, which promote long-lasting relationships.

By Region

According to the region, Europe dominated the dry wine yeast market in 2022 and is expected to be dominant during the forecast period. The production of several wine varieties, including well-known red wines, crisp white wines, and sparkling wines such as Champagne and Prosecco, is a specialty of the European market. Due to the wide range of wine styles, there are chances for yeast producers to develop specialized varieties of yeast that are matched to each style's requirements, including geographical differences and grape varietals.

Competition Landscape

Players operating in the global dry wine yeast market have adopted various developmental strategies to expand their dry wine yeast market share, increase profitability, and remain competitive in the market. Key players profiled in this report include Lallemand, Inc., Red Star Yeast, AEB Group, Angel Yeast Co., Ltd., White Labs, AB Biotek, Oenobrands SAS, Lesaffre Et Compagnie, Enartis, Laffort SAS., Anchor Yeast, Chr. Hansen Holding A/S, DSM Food Specialties, Scott Laboratories, Renaissance Yeast Inc., Institut Œnologique de Champagne, Vason Group, Erbslöh Geisenheim AG, ATP Group, BSG CraftBrewing, Biorigin, Kerry Group, SurePure Inc., and Diamond V

Examples of Acquisition in the Global Dry Wine Yeast Market

- In September 2022, Lesaffre Et Compagnie acquired Recombia Biosciences which is a biotechnology company specialized in high-throughput genome editing and synthetic biology.

- In August 2021, Angel Yeast Co., Ltd. through its joint venture announced to acquire Shandong Bio Sunkeen Co, Ltd ("Bio Sunkeen") in order to expand its portfolio.

Examples of Investment in the Global Dry Wine Yeast Market

- In April 2021, Angel Yeast Co., Ltd. planned to invest 434 million yuan in expansion of yeast extracts.

Examples of Expansion in the Global Dry Wine Yeast Market

- In November 2021, Lesaffre Et Compagnie inaugurated its brand-new Baking Center in Dubai in order of expansion strategy to support customers in the United Arab Emirates.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dry wine yeast market analysis from 2022 to 2032 to identify the prevailing dry wine yeast market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dry wine yeast market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dry wine yeast market trends, key players, market segments, application areas, and market growth strategies.

Dry Wine Yeast Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.3 billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 252 |

| By Type |

|

| By End-user |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Oenobrands Sas, Red Star Yeast, Laffort S.A.S., Lallemand Inc., White Labs, Enartis, AEB Group S.p.A., Lesaffre Et Compagnie, AB Biotek, Angel Yeast Co., Ltd. |

Analyst Review

According to the insights of the CXOs, wine is an integral part of European culture, and this cultural trend is increasingly gaining popularity among the European population as Italy, Spain, and France are the top 3 countries that contribute to the majority share of wine consumption. Other than Europe, the popularity of wine is increasing in the Asia-Pacific countries as the young and working-class people in these regions are including wine in their diet, house parties, and occasional drinks. These consumer trends are expected to fuel the market growth during the forecast period. In addition, to cater to the market demand and run the manufacturing process smoothly, wine producers are looking for quality wine yeast to fulfill their requirements.

According to a study published in May 2020 and supported by the European Association of Wine Economists and the Chaire Vins et Spiritueux de INSEEC U., wine consumption has significantly increased during the confinement phase of the coronavirus outbreak in Spain and the rest of Europe.

The dry wine yeast market was valued at $2,012.5 million in 2022 and is projected to reach $3,273.2 million by 2032, growing at a CAGR of 5.0% from 2023 to 2032.

The global dry wine yeast market registered a CAGR of 5.0% from 2023 to 2032.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the dry wine yeast market report is from 2023 to 2032.

The top companies that hold the market share in the dry wine yeast market include Lallemand, Inc., Red Star Yeast, AEB Group, Fermentis, White Labs, and others.

The dry wine yeast market report has 3 segments. The segments are type, end user, and sales channel.

The emerging countries in the dry wine yeast market are likely to grow at a CAGR of more than 8.8% from 2023 to 2032.

Post-COVID-19, the dry wine yeast market is witnessing new heights of growth and is expected to recover its losses in the next 1-2 years. The change in consumer consumption patterns of red and white wines has increased the demand for dry wine yeast in the market.

Europe will dominate the dry wine yeast market by the end of 2032.

Loading Table Of Content...

Loading Research Methodology...