Enterprise Quantum Computing Market Overview

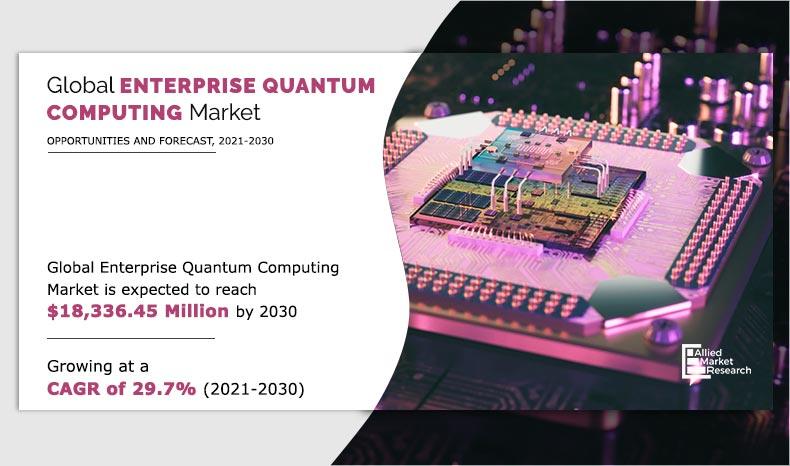

The global enterprise quantum computing market size was valued at USD 1,370.82 Million in 2020 and is projected to reach USD 8,336.45 Million by 2030, growing at a CAGR of 29.7% from 2021 to 2030. The factors such as rise in investments in quantum computing technology, increase in demand for high performance computing, and growth in demand from medical research and financial markets are expected to boost the market growth.

Key Market Insights

By technology, the Quantum dot segment is expected to grow the most, and this trend is expected to continue during the forecast period.

By deployment mode, the cloud segment is expected to witness highest growth in the upcoming years.

By region, Asia-Pacific is expected to witness significant growth in the coming years.

Market Size & Forecast

- 2030 Projected Market Size: USD 8,336.45 Million

- 2020 Market Size: USD 1,370.82 Million

- Compound Annual Growth Rate (CAGR) (2021-2030): 29.7%

Quantum computer is fundamentally different than conventional & supercomputers and uses the technology based on quantum phenomena. Unlike classical computers, it uses quantum bits (qubits) to process the data. In addition, quantum computing performs complex calculations proficiently when compared with classical computers and this factor majorly fuels the growth of the enterprise quantum computing market.

Furthermore, it finds its application in aerospace & defense, BFSI, healthcare & life science, energy & utilities, manufacturing, IT & telecom, and other industries. For instance, the UK-based quantum computing company Cambridge Quantum Computing merged with the U.S.-based Honeywell Quantum Solutions to create the leading quantum computing company in the world.

Enterprise Quantum Computing Market Segment Review

The global enterprise quantum computing market analysis is segmented on the basis of component, deployment, technology, application, industry vertical, and region. Based on component, the market is classified into hardware, software, and services. As per deployment, the market is bifurcated into on-premise and cloud. In terms of technology, the market is divided into quantum annealing, superconducting, trapped ion, quantum dot, and others. Based on application, the market is categorized into machine learning/deep learning/AI, optimization, simulation & data modelling, cyber security, and others. Based on industry vertical, the market is categorized into, healthcare & life sciences, IT and telecom, manufacturing, BFSI, energy & utilities, aerospace & defense, and others. Based on region, market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of technology, the superconducting segment dominated the overall enterprise quantum computing industry in 2020, and is expected to continue this trend throughout the forecast period. This is due to an increase in the adoption of enterprise quantum computing by enterprises to gain strategic and competitive advantage over their competitors. Furthermore, many industry players are researching and developing qubits based on this technology to explore and overcome the limits of conventional computation methods, which fuels the market growth and is expected to provide major development opportunities for the enterprise quantum computing market growth in the near future.

By Technology

Quantum Dot segment is projected as one of the most lucrative segments.

However, the Quantum dot segment is expected to grow the most, and this trend is expected to continue during the forecast period. Quantum dots can be used for lowering the electron tunneling block when two qubits couple. This majorly fuels the growth of the market. In addition, due to the advanced microfabrication and semiconductor technology it is being appraised as one of the promising technologies for a solid-state qubit. This is further anticipated to boost the growth of the enterprise quantum computing market.

Depending on deployment mode, the Cloud segment garnered the largest share in 2020, and is expected to continue this trend during the forecast period. This is attributed to numerous benefits provided by this on-premise deployment such as high level of data security and safety. However, the cloud segment is expected to witness highest growth in the upcoming years. As cloud deployment does not need any investment in IT infrastructure as all data is stored on cloud server, which increases the demand for geospatial analytics software in small and medium scale organizations.

By Component

Service segment is projected as one of the most lucrative segments.

The report focuses on the growth prospects, restraints, and enterprise quantum computing market analysis. The study uses Porter’s five forces analysis of the enterprise quantum computing industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and bargaining power of buyers on the enterprise quantum computing market trends.

By Region

Asia-Pacific is projected as one of the most significant region.

Enterprise Quantum Computing market report provides a detailed profile of key players including Alibaba Group, D-Wave Systems Inc., Google, Huawei Technologies, IBM, ID Quantique, Intel Corporation, Microsoft, Rigetti & Co, Inc., and Toshiba Research Europe Ltd. It also covers market trends, analysis, and future forecasts to identify potential investment opportunities.

What are the Top Impacting Factors in Market

Rise in need for secure computing platforms and increase in use of simulation and modeling in quantum computing are also expected to drive the growth of the enterprise quantum computing market. However, operational challenges and stability & error correction issues associated with quantum computing are expected to hamper the growth of the market during the forecast period. Furthermore, emergence of on-premises quantum computers for businesses and technological advancements in quantum computing are expected to provide opportunities for the growth of the market.

Rise in investments in quantum computing technology

Increase in emergence of quantum technology and ongoing potential developments observed by major industries fuel the market growth. For instance, industry giants such as Lockheed Martin, NASA, Goldman Sachs Group., and other government organizations are investing in R&D of this technology. In addition, rise in investment by industry giants and government organizations in startups working in this technology are the major factors that fuel the market growth. For instance, in October 2019, Google LLC partnered with NASA, and Oak Ridge National Laboratory to provide the best quantum computing service in the world, also other major industries are investing heavily in quantum computing startups, such as D-Wave systems for R&D.

Moreover, these companies are also leveraging the quantum computing platform provided by D-Wave. Furthermore, the U.S. Department of Energy’s Office of Science’s Advanced Scientific Computing Research Program is funding $42 million to Sandia National Laboratories. The project will be funded for four major developments in quantum computing technology, which is anticipated to drive the enterprise quantum computing market growth. In addition, China has also invested in this emerging technology, as it is building National Laboratory for Quantum Information Sciences in Hefei worth $10 Million, which opened in 2020.

Moreover, industrial giants who are already involved in the development of quantum computing technology are also supporting the universities, researchers, and startups by investing and providing funds for further R&D of the technology. For instance, Microsoft partnered with 14 different quantum computing software startups, which is anticipated to play a major role in adoption of quantum computing technology. Also, the partnership will provide an existing relationship of Microsoft’s collaboration with various universities and government labs to startups.

What are the Key Benefits for Stakeholders:

The study provides an in-depth analysis of the market along with the current trends and future estimations to elucidate the imminent investment pockets.

Information about key drivers, restraints, and opportunities and their impact analysis on the enterprise quantum computing market size is provided.

Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the enterprise quantum computing market.

The quantitative analysis of the enterprise quantum computing industry from 2020 to 2030 is provided to determine the enterprise quantum computing market potential.

Enterprise Quantum Computing Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Mode |

|

| By Technology |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| By Key Market Players |

|

| Key Market Players | Intel Corporation, ID Quantique, Toshiba Corporation, D-Wave Systems Inc., Rigetti & Co, Inc., Microsoft Corporation, Google (Alphabet Inc.), Alibaba Group, Huawei Technologies Co. Ltd., International Business Management Corporation (IBM) |

Analyst Review

According to the perspectives of the chief of the leading companies, the enterprise quantum computing market is expected to grow at a promising rate during the forecast period. Emergence of on-premises quantum computers for businesses and technological advancements in quantum computing are some of the factors expected to offer lucrative opportunities for the growth of the market during the forecast period. Moreover, early adoption of quantum computing within the defense & automotive sectors is one of the major factors that drive the market growth. Also, surge in investment by government entities within the market and rise in use of simulation and modeling are one of the major factors that boost the growth of the market and are expected to provide great opportunities for the market growth.

According to the CXOs, increase in research in the quantum computing field in Asia-Pacific nations, such as China, India, Japan, and rest of Asia-Pacific is expected to provide lucrative opportunities to the market. At present, North America dominates the market, and is anticipated to remain dominant during the forecast period. Emerging countries in Latin America are also projected to offer substantial growth opportunities. Also top key players in the market are adopting strategies which will help in the growth of market. For instance, in September 2021, leading IT consulting service provider company Accenture partnered with IonQ to accelerate quantum computing business experimentation in organizations globally and across industries. Accenture’s experience and skills in quantum, coupled with its ability to design and create customized industry solutions tailored to IonQ’s quantum computing technology, will help more companies innovate and become quantum ready.

The global enterprise quantum computing market size was valued at USD 1,370.82 Million in 2020 and is projected to reach USD 8,336.45 Million by 2030

The global enterprise quantum computing market is projected to grow at a compound annual growth rate of 57.2% from 2021-2030 to reach USD 21,954 million by 2030

Some key market players in the enterprise quantum computing market are Alibaba Group, D-Wave Systems Inc., Google, Huawei Technologies Co., Ltd., International Business Management Corporation (IBM), ID Quantique, Intel Corporation, Microsoft, Rigetti & Co, Inc., and Toshiba Research Europe Ltd.

North America is the largest regional market for enterprise quantum computing.

Key factors driving the enterprise quantum computing market include rising demand for advanced computing, optimization solutions, and complex problem-solving.

Loading Table Of Content...