Free Ad-Supported TV Channels (FAST) Market Insights:

The global FAST (free ad-supported tv) channels market was valued at $6.9 billion in 2022 and is projected to reach $28 billion by 2032, growing at a CAGR of 15.4% from 2023 to 2032.

FAST (Free Ad-Supported TV) channels refer to streaming platforms or services that offer free content to viewers, supported by advertising. These channels have become increasingly popular as an alternative to conventional cable and satellite TV subscriptions. They offer non-subscription access to a selection of on-demand films, TV series, and live channels. Furthermore, FAST channels operate on an advertising revenue model. Content from studios, networks and independent producers is licensed and made available to viewers for free. To offset the costs of content acquisition and streaming programs, these channels incorporate advertising into their services. The platform is funded by the money earned from the commercials that advertisers pay for their advertisements to be shown to viewers.

FAST channels' cost advantage over conventional pay-TV services is one of the main factors promoting the free ad-supported TV channels market growth. Many consumers are looking for affordable alternatives to expensive cable or satellite TV. FAST channels offer free access to a variety of content including movies, TV shows, news, and sports, attracting audiences, which appeals to cost-conscious viewers. Furthermore, FAST channels provide a wide variety of content from many genres, such as films, TV shows, documentaries, news, and live sporting events. Viewers can access content from both traditional broadcasters and digital-native creators, providing a broader selection compared to traditional TV channels. This variety of options attracts viewers with different interests, increasing engagement and driving growth in the market.

In addition, content partnership and aggregation accelerated the growth of the free ad-supported TV channels market. FAST channels aggregate content from various sources, including traditional broadcasters, studios, and digital creators. They can offer a wide variety of programs by working with content suppliers to bring in more viewers. Through ad-supported distribution, these collaborations also give content owners the opportunity to monetize their holdings. However, limited content offerings, monetization challenges, and bandwidth and infrastructure limitations are significant barriers to FAST (Free Ad-Supported TV) channels market growth.

On the contrary, increasing demand for streaming content has played a crucial role in providing lucrative growth opportunities for the FAST (Free Ad-Supported TV) channels market. Further, connected TV (CTV) devices, such as smart TVs, streaming boxes, and sticks, have become mainstream, allowing viewers to access streaming content directly on their television screens. This trend has created new opportunities for FAST channels as they can reach a larger audience through these devices.

The report focuses on growth prospects, restraints, and trends of the FAST (Free Ad-Supported TV) channels market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the free ad-supported TV channels market outlook.

Segment Review:

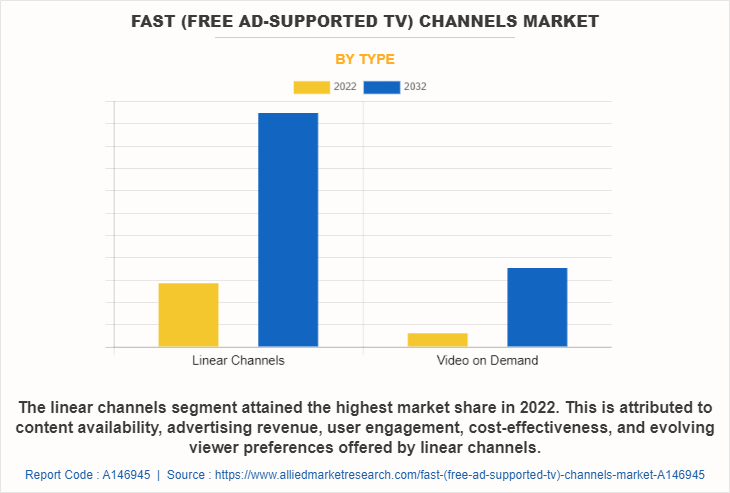

The FAST (Free Ad-Supported TV) channels market is segmented into type, content type, distribution platform, and region. By type, the market is differentiated into linear channels and video on demand. Depending on content type, it is fragmented into movies, music and entertainment, news, sports, and others. The distribution platform segment is divided into mobile applications and web-based channels. Region wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

By type, the linear channels segment acquired a major share in 2022 and is attributed to be the fastest-growing segment during the forecast period. This is attributed to content availability, cost-effectiveness, and evolving viewer preferences. Linear channels offer a curated programming schedule, similar to traditional TV channels. This format provides viewers with a familiar and convenient way to consume content. The availability of linear channels in the FAST market offers viewers a diverse range of programming options, including news, sports, entertainment, and lifestyle channels, thereby attracting a wider audience.

Region wise, North America dominated the free ad-supported TV channels market share in 2022 and is considered to be the fastest-growing region during the forecast period. This was attributed to the popularity of streaming services, increasing demand for free streaming content, increasing number of connected TV devices, shifting of ad budgets towards digital platforms in the region. Streaming services have gained immense popularity in North America, with platforms such as Netflix, Amazon Prime Video, and Hulu leading the way. These factors have created a favorable environment for ad-supported streaming platforms and contributed to the free ad-supported TV channels market forecast.

Key Market Players

The key players operating in the free ad-supported TV channels market include Roku, Inc., Pluto TV, Tubi TV, Crackle, Xumo, Inc., Sling TV, Vudu, Plex, Peacock TV LLC, and Amazon.com, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the FAST channels industry.

Top Impacting Factors

Platform Expansion and Accessibility

FAST Channel have increased their audience by receiving free ad-supported services across platforms and devices. They provide customers with quick and convenient ways to access their favorite content through smart TVs, mobile devices, gaming consoles and mobile devices.

For instance, in June 2021, XUMO, a leading FAST channel, launched its app on Apple TV to attract consumers and increase their audience base. The free ad-supported streaming service offers over 200 digital channels across 12 genres, including sports, news, kids and family entertainment, live events, movies, and others. Therefore, this strategy drives the growth of the free ad-supported TV channels market.

Cost Advantage and Variety of Content

FAST channels' cost advantage over conventional pay-TV services is one of the main factors promoting its growth. Many consumers are seeking affordable alternatives to expensive cable or satellite TV subscriptions. Free content on FAST channels such as sports, news and TV shows attracts viewers who are concerned about spending their money.

In addition, various FAST channels offer a variety of content from a variety of genres including movies, TV shows, documentaries, news and live sports. Viewers can access these content from both traditional broadcasters and digital native producers, offering a broader selection compared to traditional TV channels. This variety attracts viewers with different interests, increasing engagement and driving growth in the free ad-supported TV channels market.

Content Partnership and Aggregation

FAST channels aggregate content from various sources, including traditional broadcasters, studios, and digital creators. By partnering with content providers, they can offer a diverse range of programming to attract a larger audience. These partnerships also enable content owners to monetize their libraries through ad-supported distribution.

For instance, in December 2021, Pluto TV, the free ad-supported streaming television (FAST) service, extended its content partnership with Channel 5 in a move that brings three new channels to the streaming service in the UK. Furthermore, in November 2020, AVOD operator, Chicken Soup for the Soul Entertainment partnered with Crackle Plus and Amagi to power the linear channel experience for Crackle, Popcornflix, and other channels on its growing list of Free Ad-Supported TV (FAST) platforms. Therefore, these key strategies adopted by the key market players are the major growth factor for the free ad-supported TV channels (FAST) market size.

Increasing Demand for Streaming Content

The widespread availability of smartphones, greater internet access, and shifting viewer preferences have all contributed to an increase in demand for streaming content. Consumers are increasingly turning to streaming services as a simple and flexible method to get their favourite TV series, films, and other types of digital entertainment.

For instance, in June 2023, Comcast’s NBC Universal inked agreements with its joint venture, Xumo Play, and Amazon’s streaming platform Freevee, which offers the distribution of dozens of free, ad-supported streaming channels. These factors are expected to provide major lucrative opportunities for the free ad-supported TV channels market growth in the upcoming years.

Country Specific Statistics & Information

Advertisers are increasingly investing their money towards digital advertising, including video advertising on streaming platforms. As a result of the loss in traditional TV viewership and the rise of ad-supported streaming services, advertisers see an opportunity to reach an extensive and interested audience through FAST channels. Recognizing this trend, major media companies and broadcasters are investing in free ad-supported TV channels industry. For instance, in May 2023, Amazon introduced Fire TV Channels, its new, free, and ad-supported (FAST) video experience for Fire TV devices. Though Fire TV had previously offered FAST content, Fire TV Channels now be continuously updated throughout the day and integrated into several areas across the Fire TV interface, including on Home Screen rows, within Fire TV’s “Free” tab, and in category-specific pages devoted to certain genres.

In addition, established broadcasters in Europe have recognized the potential of FAST channels and launched their own ad-supported streaming platforms. For instance, ITV in the UK launched its streaming service ITV Hub+, which offers a free ad-supported tier alongside a subscription-based ad-free option. This expansion by traditional broadcasters into the streaming market contributes toward the growth of the free ad-supported TV channels market in Europe.

Furthermore, a large number of consumers are updating their traditional cable or satellite TV subscriptions in favour of more convenient and affordable streaming solutions. This "cord-cutting" trend has increased the desire for free streaming services that provide a variety of content without paying for a subscription. FAST channels industry cater to this audience by providing free, ad-supported content, making them an attractive alternative to traditional TV.

There was a significant increase in streaming consumption as consumers turned to these platforms for entertainment, news, and information during the COVID-19 pandemic, with people spending more time at home due to lockdowns and restrictions. As a result, the free ad-supported TV channels industry experienced a surge in viewership as more people turned to these platforms for entertainment. Furthermore, the economic impact of the pandemic led to financial uncertainties for many individuals. This increased the demand for free content, and FAST channels provided an attractive option as they offered free streaming with ad-supported content. Moreover, the pandemic brought about significant changes in consumer behavior, including a shift towards digital viewership. As more people adopted streaming services and cord-cutting, the demand for FAST channels increased, contributing to the growth of the FAST channels industry.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the free ad-supported TV channels market analysis from 2022 to 2032 to identify the prevailing market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the free ad-supported TV channels (FAST) market segmentation assists to determine the prevailing free ad-supported TV channels market opportunities.

Major countries in each region are mapped according to their revenue contribution to the free ad-supported TV channels (FAST) market market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as free ad-supported TV channels market trends, key players, market segments, application areas, and market growth strategies.

FAST (Free Ad-Supported TV) Channels Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 28 billion |

| Growth Rate | CAGR of 15.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 245 |

| By Type |

|

| By Content Type |

|

| By Distribution Platform |

|

| By Region |

|

| Key Market Players | Plex, Pluto TV, Peacock TV LLC, Sling TV, Vudu, Roku, Inc., Tubi TV, Crackle, Xumo, Inc., Amazon.com, Inc. |

Analyst Review

FAST channels offer opportunities for content creators and media companies to monetize their content through ad revenue sharing models. This has encouraged more content providers to distribute their programming through FAST channels, leading to an increase in available content. By offering a revenue-sharing model, FAST channels encourage manufacturers to participate in their platforms, further driving market growth. Furthermore, the widespread availability of streaming devices such as Roku, Amazon Fire TV, and Apple TV, along with the integration of smart TV capabilities in newer television models, has made it easier for consumers to access streaming content on their TVs. This accessibility has helped drive the adoption of FAST channels as consumers can easily access them through these devices and platforms.

In addition, FAST channels have formed partnerships with content providers, including both established studios and independent production companies. For instance, in December 2021, Pluto TV, the free ad-supported streaming television (FAST) service, extended its content partnership with Channel 5 in a move that brings three new channels to the streaming service in the UK.

The COVID-19 outbreak has had a positive impact on the FAST (Free Ad-Supported TV) channels market. The pandemic accelerated the adoption of streaming services, with many people turning to platforms such as Roku, Inc., Pluto TV, and Amazon Freevee for entertainment during lockdowns. Furthermore, people spent more time at home due to lockdowns, restrictions, and social distancing measures. This led to a surge in media consumption, including FAST channels. As people sought entertainment and news sources, the viewership of FAST channels increased significantly. This trend resulted in a larger audience base for these channels.

The FAST (Free Ad-Supported TV) channels market is fragmented with the presence of regional vendors such as Roku, Inc., Pluto TV, Tubi TV, Crackle, Xumo, Inc., Sling TV, Vudu, Plex, Peacock TV LLC, and Amazon.com, Inc. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With the increase in awareness & demand for FAST (Free Ad-Supported TV) channels across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

By the end of 2032, the market value of FAST (Free Ad-Supported TV) Channels Market will be $28 billion.

The FAST (Free Ad-Supported TV) Channels Market will expand at 15.4% CAGR from 2023 - 2032.

The leading key players of FAST (Free Ad-Supported TV) Channels market are Roku, Inc., Pluto TV, Tubi TV, Crackle, Xumo, Inc., Sling TV, Vudu, Plex, Peacock TV LLC, and Amazon.com, Inc.

The FAST (Free Ad-Supported TV) channels market is segmented into type, content type, distribution platform, and region. By type, the market is differentiated into linear channels and video on demand. Depending on content type, it is fragmented into movies, music and entertainment, news, sports, and others. The distribution platform segment is divided into mobile and desktop applications and web-based channels. Region wise, the FAST (Free Ad-Supported TV) channels market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Growth in advertising opportunities, Content partnership and aggregation, Platform expansion and accessibility & Cost advantage and variety of content

Loading Table Of Content...

Loading Research Methodology...