Fig Ingredient Market Research, 2034

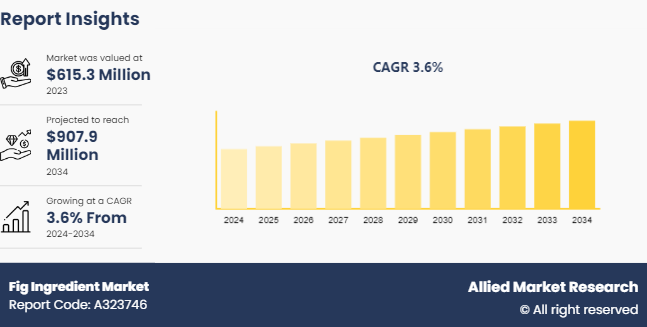

The global fig ingredient market was valued at $615.3 million in 2023, and is projected to reach $907.9 Million by 2034, growing at a CAGR of 3.6% from 2024 to 2034.

Market Introduction and Definition

Fig ingredient market refer to various components derived from the fig fruit, including fig extracts, powders, purees, and concentrates. Renowned for their sweet and earthy flavor profile, fig ingredients are prized for their versatility and nutritional benefits. Rich in dietary fiber, vitamins, and minerals, figs offer digestive health support, aid in weight management, and contribute to overall well-being. These fig ingredient industry find extensive use in the food and beverage industry, where they add natural sweetness, texture, and flavor to a wide range of products such as bakery items, snacks, confectionery, sauces, spreads, and beverages. Beyond culinary applications, fig ingredients are also utilized in cosmetics, skincare products, and pharmaceutical formulations for their antioxidant properties and potential health benefits.The fig ingredient market is experiencing several key trends that are shaping its growth and development. One notable trend is the increasing popularity of functional foods and beverages.

Key Takeaways

The fig ingredient market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2035.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major fig ingredients industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

The rise of plant-based and vegan trends is composed to significantly drive the fig ingredient market size. Figs, inherently vegan, offer a versatile and flavorful option for plant-based recipes, appealing to consumers seeking meat-free alternatives. Their natural sweetness and rich texture make them ideal ingredients for plant-based dishes like salads, desserts, and snacks, catering to a growing segment of health-conscious and environmentally aware consumers. Additionally, figs pair well with other plant-based ingredients such as nuts, seeds, and plant-based cheeses, further enhancing their appeal in vegan cuisine. As the demand for plant-based foods continues to surge, fig ingredients stand to benefit from their alignment with these dietary preferences, fueling innovation and expansion in the plant-based food market.

However, limited geographic production of figs presents a significant restraint for the fig ingredient market share. Figs thrive in specific climates, primarily Mediterranean and Middle Eastern regions, limiting their cultivation to these areas. This geographic constraint creates challenges in ensuring consistent and reliable supply chains for fig ingredients, particularly in regions where figs are not locally grown. Importing figs from distant regions adds logistical complexities, such as transportation costs and risks of spoilage. Furthermore, reliance on a few key producing regions makes the market vulnerable to disruptions caused by factors like adverse weather conditions or crop diseases. The limited geographic production thus restricts the availability and accessibility of fig ingredients, potentially hindering market growth and innovation in fig-based products.

Moreover, the premiumization and gourmet market present lucrative opportunities for the fig ingredient market growth. Figs are often associated with luxury and sophistication in culinary circles, making them demanding ingredients for gourmet chefs and discerning consumers. By emphasizing the high quality, unique flavor profiles, and artisanal production methods of fig ingredients, suppliers can cater to the demand for premium products in upscale restaurants, specialty food stores, and gourmet food products. Additionally, there is an opportunity to develop premium fig-based products such as fig preserves, fig-infused oils, and fig-based condiments, targeting consumers willing to pay a premium for indulgent, gourmet experiences. Capitalizing on the premiumization trend allows fig ingredient market opportunities for suppliers to tap into a profitable market segment and differentiate their products based on exclusivity, quality, and culinary sophistication.

Demographic trend and statistics

The global demand for fig ingredients has witnessed a steady rise, fueled by the increasing popularity of Mediterranean and Middle Eastern cuisines, the growing interest in plant-based and healthy eating, and the versatility of figs in various food products. Turkey, the world's largest producer, accounts for around 28% of global fig production, followed by Egypt, Morocco, Iran, Algeria, and the United States. Global fig production reached over 1.2 million tons in 2019 (FAO, 2019) . The European Union is the largest consumer of figs, with countries like Spain, France, and Italy having significant fig consumption. The Middle East and North Africa region also have a high demand due to cultural and culinary traditions. North America has seen a notable increase in fig consumption, driven by the health food trend and Mediterranean cuisine's popularity. Turkey is the leading exporter, accounting for approximately 60% of global fig exports (FAO, 2019) .

Consumer trends and dynamics

Consumer trends and dynamics for fig ingredients encompass various factors shaping their demand and usage.

Health and Wellness: Consumers are increasingly drawn to fig ingredients due to their perceived health benefits. Figs are rich in fiber, vitamins, and minerals, appealing to health-conscious individuals seeking nutritious food options.

Natural and Clean Label: The trend towards natural and clean label products has boosted the demand for fig ingredients. Consumers prefer ingredients with minimal processing and additives, making figs an attractive choice.

Plant-Based Diets: The rise of plant-based diets has led to a surge in demand for fig ingredients as alternatives to animal-derived products. Figs serve as versatile plant-based ingredients suitable for a variety of culinary applications.

Gourmet and Exotic Flavors: Fig ingredients offer a unique and exotic flavor profile, appealing to consumers seeking gourmet culinary experiences. Their distinctive taste adds depth and complexity to a wide range of dishes and beverages.

Convenience: Fig ingredients in various forms, such as dried figs, powders, and extracts, provide convenience for consumers. They can be easily incorporated into recipes, snacks, and beverages, catering to busy lifestyles.

Market Segmentation

The fig ingredients market is segmented into type, application, distribution channel and region. On the basis of type, the market is divided into fig powder and other. As per application, the market is segregated into food and beverage, cosmetic & personal care, dietary supplements, dairy products, confectionary and other. On the basis of distribution channel, the market is divided into pharmacies/drugstores, hypermarket/supermarket, direct selling, online. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The Middle East and Africa (MEA) region stands out as a significant player in the global fig ingredients market, playing a crucial role both as a producer and consumer. This region has an extensive history and cultural significance associated with figs, which have been an integral part of the local cuisine and dietary habits for centuries. Turkey, a country spanning both the Middle East and Europe, is the undisputed leader in fig production, accounting for a staggering 28% of the global output (FAO, 2019) . Other prominent fig producers in the MENA region include Iran, Morocco, Algeria, and Egypt, contributing substantially to the global supply chain.

The domestic fig ingredient market forecast within the MEA region is remarkably high, driven by the deep-rooted culinary traditions and the cultural importance attached to figs. The widespread use of fresh figs, dried figs, fig paste, and fig concentrate in various traditional and modern food preparations has created a thriving domestic market. Furthermore, the region's unique climatic conditions and long-standing agricultural practices have fostered an environment conducive to high-quality fig cultivation, enabling the production of premium fig ingredients.

In addition to meeting domestic demand, the MEA region plays a crucial role in global fig trade. Turkey, leveraging its strategic location and abundant production, is the world's leading exporter of figs, accounting for approximately 60% of global fig exports (FAO, 2019) . Other MENA countries, such as Iran and Morocco, have also established themselves as significant fig exporters, catering to the growing international demand for fig ingredients across various sectors, including the food processing industry, bakeries, confectioneries, and dairy products.

Industry Trends

According to the National Agricultural Statistics Service, the United States is both an importer and exporter of figs. While the country produces figs, over 80% of the figs produced in the United States go into processing industries due to the demand for dried figs. This is because dried figs have a longer shelf life and can be used in a variety of products, including baked goods, snacks, and breakfast cereals. As a result, the rising inclusion of figs in the processed industry will likely accelerate the demand for figs over the forecast period.

According to FAO, Turkey is the major producing country of figs, followed by Egypt, Iran, Morocco, Algeria, Iran, Syria, the USA, and Spain. In 2021, Turkey ranked first with approximately 300, 000 tons of production and about 30% of World Wet fig production. The world's annual fig production was about 1, 121, 000 tons in 2021; dried fig production accounted for one-quarter of the fig production, with around 105.000 tons.

Competitive Landscape

The major players operating in the fig ingredients market include Go Figa, Diptyque, Tuscan Fig, Pixi Beauty, The Body Shop, Marc Jacobs, Table Top Garden, Rutherford Meyer, Stonewall Kitchen, Newmans Own, Dairy Farmers, Rosebud Preserves Ltd, and Gippsland Dairy.

Recent Key Strategies and Developments

In October 2022, FruitLips created whole green figs in syrup for use on cheese platters or sliced on a pizza with blue cheese. There are no artificial flavors, colorants, or preservatives in the product.

In February 2023, Meurens Natural S.A. has introduced Natu-Figs, which are Kosher and Halal certified. The liquid produce can be utilized as a sweetener, fruit flavor, and natural dark color.

Key Sources Referred

Food and Agriculture Organization of the United Nations

Britannica

World Atlas

Libertyprim

Helgi Library

CABI

Tridge

Fig Valley Growers

National Library of Medicine

Nutra Fig

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fig ingredient market analysis to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the fig ingredient market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global fig ingredient market trends, key players, market segments, application areas, and market growth strategies.

Fig Ingredient Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 907.9 Million |

| Growth Rate | CAGR of 3.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 200 |

| By Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Rutherford Meyer, Marc Jacobs, Newmans Own, Inc., Tuscan Fig, Go Figa, TABLE TOP GARDEN, Pixi Beauty, The Body Shop, Stonewall Kitchen, LLC, Diptyque |

The global fig ingredient market was valued at $615.3 million in 2023, and is projected to reach $907.9 Million by 2034

The global Fig Ingredient market is projected to grow at a compound annual growth rate of 3.6% from 2024 to 2034 $907.9 Million by 2034

The major players operating in the fig ingredients market include Go Figa, Diptyque, Tuscan Fig, Pixi Beauty, The Body Shop, Marc Jacobs, Table Top Garden, Rutherford Meyer, Stonewall Kitchen, Newmans Own, Dairy Farmers, Rosebud Preserves Ltd, and Gippsland Dairy.

The Middle East and Africa (MEA) region stands out as a significant player in the global fig ingredients market, playing a crucial role both as a producer and consumer.

Health and Wellness, Natural and Clean Label, Plant-Based Diets, Gourmet and Exotic Flavors

Loading Table Of Content...