Flavonoid Market Research, 2032

The global flavonoid market was valued at $1.7 billion in 2022, and is projected to reach $2.9 billion by 2032, growing at a CAGR of 5.8% from 2023 to 2032.

Market Dynamics

Flavonoid is one of the categories of plant polyphenols which has antioxidant properties. They are majorly responsible for the pigments or colors in vegetables, fruits, and flowers. In plants, these colors protect the plants from environmental stress as flavonoids are potent with antioxidants. Flavonoids are also industrially manufactured, mainly by product types including isoflavones, anthocyanin, and others.

Flavonoid is largely used in the nutraceuticals industry. This is attributed to the high consumption and demand for nutraceutical supplements containing flavonoids such as isoflavones and anthocyanidins, which in turn is driving the flavonoid market growth. In addition, flavonoid in the pharmaceutical industry is used for its polyphenolic structure, for different pharmacological activities. This in turn is also propelling the growth of the market. However, lack of consumer awareness regarding availability of flavonoid as a dietary supplement is restricting the growth of the market. Nevertheless, an upsurge in the usage of flavonoids in the food & beverages industry is expected to offer huge opportunities for the growth of the market during the flavonoid market forecast period.

Sustainable sourcing practices, such as eco-friendly farming and responsible harvesting, are gaining importance among environmentally conscious consumers. As the demand for ethically and sustainably sourced ingredients rises, flavonoid producers that prioritize these practices can capitalize on this trend. This leads to increased consumer trust and a surge in demand for flavonoid-rich products, ultimately boosting the flavonoid market. Genetic testing and advanced technology enable consumers to identify specific dietary needs, increasing demand for flavonoid supplements that address individual health concerns, and such factors surge the flavonoid market size.

Increasing health consciousness drives the demand for flavonoids as consumers actively seek natural and health-promoting solutions. Flavonoids' well-documented antioxidant and anti-inflammatory properties make them attractive additions to diets and supplements, spurring market growth as individuals prioritize wellness through flavonoid-rich products. Functional food and beverages fortified with flavonoids are in high demand as consumers seek healthier dietary choices. These products offer convenience and a tasty way to incorporate flavonoid benefits such as antioxidants into daily routines. The market responds with innovative flavonoid-fortified options, boosting the overall demand for flavonoid-rich ingredients.

The introduction of dietary supplements containing flavonoids into previously untapped markets amplifies the demand for the flavonoid market. As consumers increasingly seek wellness-oriented products, these supplements offer a convenient way to access the health benefits of flavonoids, fueling market growth and expanding its reach to new consumer segments and regions. Genetic testing and advanced technology enable consumers to identify specific dietary needs, increasing demand for flavonoid supplements that address individual health concerns. This trend fosters a deeper connection between consumers and flavonoid-rich products, driving market expansion.

Segmental Overview

The global flavonoid industry is segmented on the basis of product type, form, application, and region. By product type, it is classified into isoflavones, anthocyanin, and others. By form, the market is bifurcated into powder and liquid. By application, it is divided into pharmaceuticals, nutraceuticals, food & beverages, and cosmetics. Region-wise, the market is analyzed across North America (the U.S., Canada and Mexico), Europe (France, Germany, Italy, Spain, U.K., Netherland, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, Argentina and Rest of LAMEA).

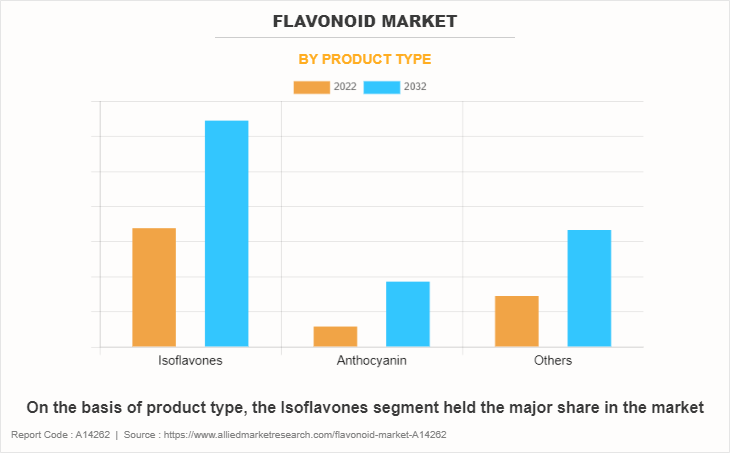

By Product Type

The isoflavones segment accounted for the highest flavonoid market share in 2022. Isoflavones are a type of organic compound and are one of the types of flavonoids. They are used in the production of cosmetics and various skin care products such as moisturizers and face creams. Moreover, isoflavones are also widely used in the pharmaceutical industry to treat a variety of diseases. This in turn has driven the growth of the overall flavonoid market. However, the anthocyanin segment in the flavonoid market is expected to be the fastest-growing segment during the forecast period in terms of value sales.

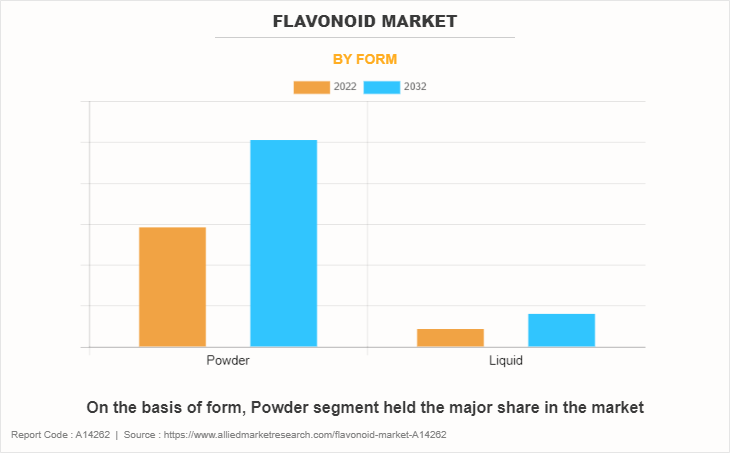

By Form

The powder segment accounted for the highest market share in the global flavonoid market in 2022 and is also expected to retain its dominance during the forecast period. The flavonoids available in powdered formats are majorly used in the pharmaceuticals industry, are also used in functional food and are available as phytoestrogen supplements, which are contributing to driving the growth of the market. However, a liquid segment in the flavonoid market is expected to be the fastest-growing segment during the forecast period in terms of value sales.

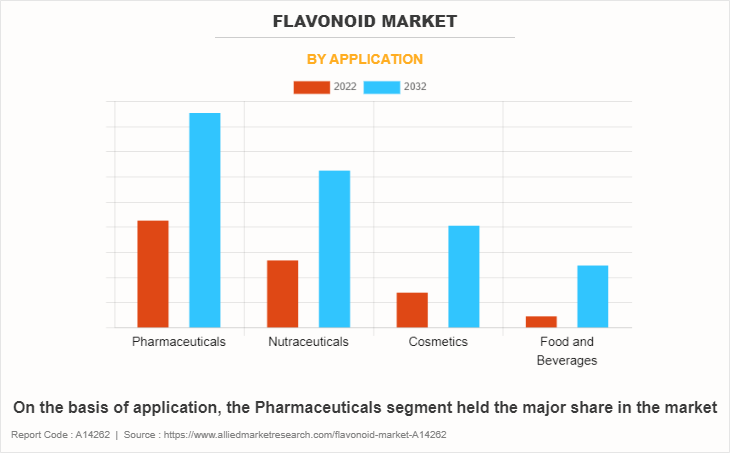

By Application

The pharmaceuticals segment accounted for the highest market share in the global flavonoid market in 2022 and is also expected to retain its dominance during the forecast period. This is mainly because flavonoid is an immunity-boosting enzyme that reduces the possibility of cancer, cardiovascular disease, and others. Thus, this has driven the demand for flavonoids used in the pharmaceuticals industry. However, the food & beverages segment in the flavonoid market is expected to be the fastest-growing segment during the forecast period in terms of value sales.

By Region

North America accounted for the highest market share in 2022, owing to the consumption of flavonoid as a supplement increasing among the consumers in this region. This is mainly due to high incidences of diseases, such as high cholesterol, high blood pressure, coronary heart diseases, atherosclerosis, and congestive heart failure. Flavonoid helps protect the heart and blood vessels from getting damaged. Therefore, North America has created a prolific flavonoid market demand over a period. However, Asia-Pacific is expected to be the fastest-growing market during the market forecast period.

Competition Analysis

Companies can operate their business in a highly competitive market by launching new products or updated versions of existing products. Agreement with key stakeholders is expected to be a key strategy to sustain the market. In recent years, many leading players opted for partnership as its key strategy to strengthen their foothold in the market. To understand the key flavonoid market trends, the strategies of leading players are analyzed in the report. Some of the key players in the flavonoid market analysis include BASF SE, Ingredients By Nature, Foodchem International Corporation, Conagen, Inc., Bordas S.A., Cayman Chemical Company, Biosynth AG, Santa Cruz Biotechnology, Inc., Archer-Daniels-Midland Company, and Givaudan SA

Recent Developments in the Flavonoid Market

- In 2023, Archer-Daniels-Midland Company opened a new customer creation and innovation center (CCIC) in Manchester, UK in order to expand its presence in the UK.

- In 2023, Givaudan SA acquired a major cosmetic ingredients portfolio from Amyris, Inc., which is a is a leading biotechnology company, in order to strengthen its leadership in biotechnology.

- In 2022, Conagen, Inc., launched a flaovonoid namely, kaempferol, which is an antioxidant produced by precision fermentation.

- In 2021, Biosynth AG (Biosynth Carbosynth) and Jinan Shengquan Group Share-Holding Co., Ltd., acquired the raw material factory of Kexing Biopharmaceutical Co., Ltd. in Jinan, China in order to expand the production capacities of their joint venture Carbotang.

- In 2021,BASF SE opened a new additive manufacturing technical center (AMTC) in Shanghai, China as a technical hub to boost innovation for the Asia-Pacific customers.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the flavonoid market analysis from 2022 to 2032 to identify the prevailing flavonoid market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the flavonoid market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global flavonoid market trends, key players, market segments, application areas, and market growth strategies.

Flavonoid Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.9 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Product Type |

|

| By Form |

|

| By Application |

|

| By Region |

|

| Key Market Players | Conagen, Inc., Bordas S.A., Cayman Chemical Company, BASF SE, Santa Cruz Biotechnology, Inc., Foodchem International Corporation, Ingredients By Nature, Archer-Daniels-Midland Company, Biosynth AG, Givaudan SA |

Analyst Review

The market players have adopted key developmental strategies such as agreement and partnership to fuel the growth of the flavonoid market in terms of value sales. They also emphasize on continuous improvement in their product to keep a strong foothold in the market and to boost the demand for flavonoid in other industries including the nutraceuticals industry, pharmaceutical industry, food & beverages industry, and cosmetic industry.

According to the key market players, changes in lifestyles and a rise in concern regarding health and beauty are encouraging consumers to seek non-invasive and effective solutions. Therefore, the manufacturers are investing in R&D activities and making continuous efforts to launch new and improved ingredients for nutraceutical producers to help them in meeting the rising global demand of consumers for improved nutritional supplements. Thus, this factor promotes the use of flavonoids in the nutraceuticals industry.

The key market players in this market adopted new strategies such as improvement in the product launch, partnership, agreement, and others as their key developmental strategies to fulfill the rise in demand for final product manufacturers.

However, the lack of consumer awareness regarding the availability of flavonoid as a dietary supplement, especially in developing regions along with the health benefits associated with the consumption of flavonoid is expected to hamper the growth of the flavonoid market in the future.

The global flavonoid market was valued at $1.7 billion in 2022, and is projected to reach $2.9 billion by 2032

The global Flavonoid market is projected to grow at a compound annual growth rate of 5.8% from 2023 to 2032 $2.9 billion by 2032

Some of the key players in the flavonoid market analysis include BASF SE, Ingredients By Nature, Foodchem International Corporation, Conagen, Inc., Bordas S.A., Cayman Chemical Company, Biosynth AG, Santa Cruz Biotechnology, Inc., Archer-Daniels-Midland Company, and Givaudan SA

North America accounted for the highest market share in 2022, owing to the consumption of flavonoid as a supplement increasing among the consumers in this region.

Rise in adoption of flavonoids in nutraceuticals industry, Rise in usage of flavonoid in pharmaceutical industry, Growth in usage of flavonoid in cosmetic industry

Loading Table Of Content...

Loading Research Methodology...